[ecis2016.org] Based on the years of occupancy, a tax payer in Lucknow can enjoy certain rebates on his/her property tax liability

While deciding its interim annual budget for 2022-23, on May 4, 2022, the Lucknow Municipal Corporation decided to not increase Lucknow house tax. However it has raised the target of Lucknow house tax collection from Rs 300 crores to Rs 330 crores.

You are reading: Lucknow house tax: All you need to know about Lucknow Nagar Nigam house tax

What is Lucknow House Tax?

As you may be well aware, just like all other cities, property owners the state capital of UP have to pay Lucknow house tax, more commonly known as property tax. Those living in the urban limits of the city pay Lucknow house tax to the Lucknow Nagar Nigam or Lucknow Municipal Corporation. In this article, we will discuss all aspects of Lucknow house tax, also called the Lucknow Nagar Nigam house tax.

Lucknow house tax payment online

Residents of Lucknow do not have to visit the city’s municipal office to pay their property tax, thanks to the presence of an online facility. The Lucknow Nagar Nigam or the Lucknow Municipal Corporation (LMC) has been collecting house tax online, since 2005. Official records indicate that there are around 5.6 lakh taxable properties in the Uttar Pradesh capital. The Lucknow Nagar Nigam house tax payment website has a user-friendly interface, where conducting business is easy and hassle-free.

[ecis2016.org] All about Kanpur house tax

Lucknow Nagar Nigam house tax rate

| General tax: 15% of the annual value of the property. |

| Water tax: 12.5% of the annual value of the property. |

| Sewer tax: 3% of the annual value of the property. |

Note: Property tax is a percentage of the annual rental value of the property.

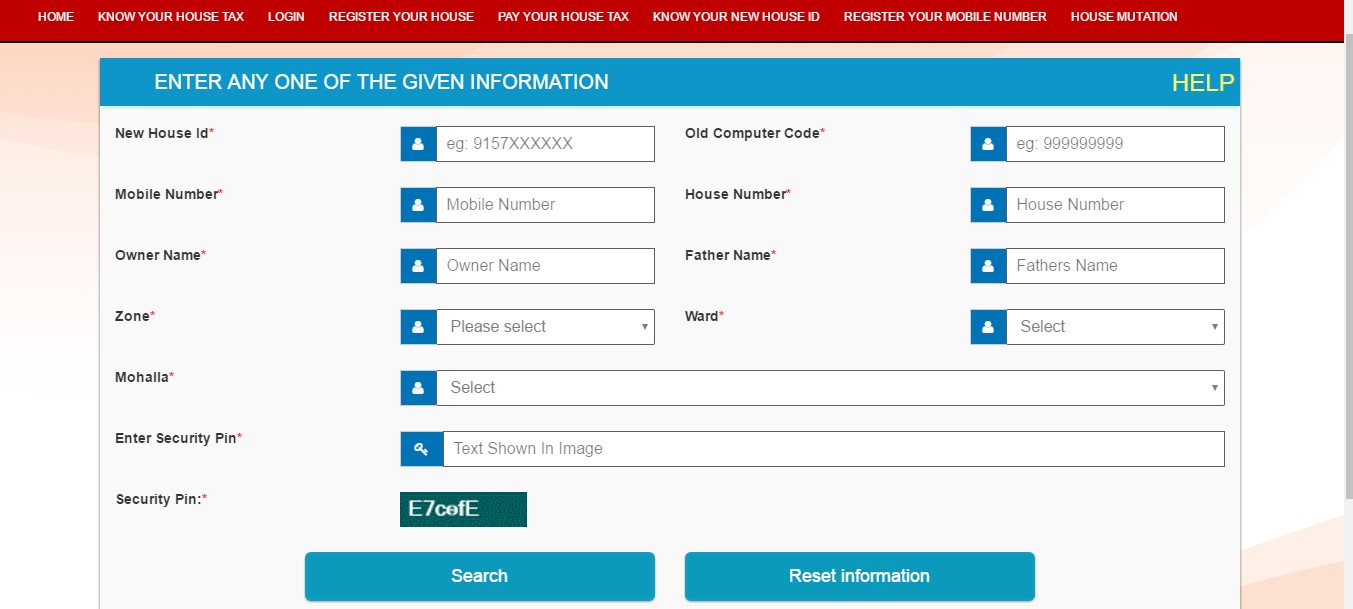

Lucknow house tax: How to check your house ID on LMC website

Users who do not know their house ID have to log in to the official LMC website (https://lmc.up.nic.in/internet/searchnewhouseid.aspx) and click on the ‘Know your new house ID’ tab at the top of the page. Enter specific details on the page that now appears to get the new house ID.

A similar page opens on clicking the ‘Know your house tax’ tab. Key in the information to find out your house tax amount.

Lucknow house tax: How to register on LMC portal?

For successful online payment, the user has to first register himself and his house.

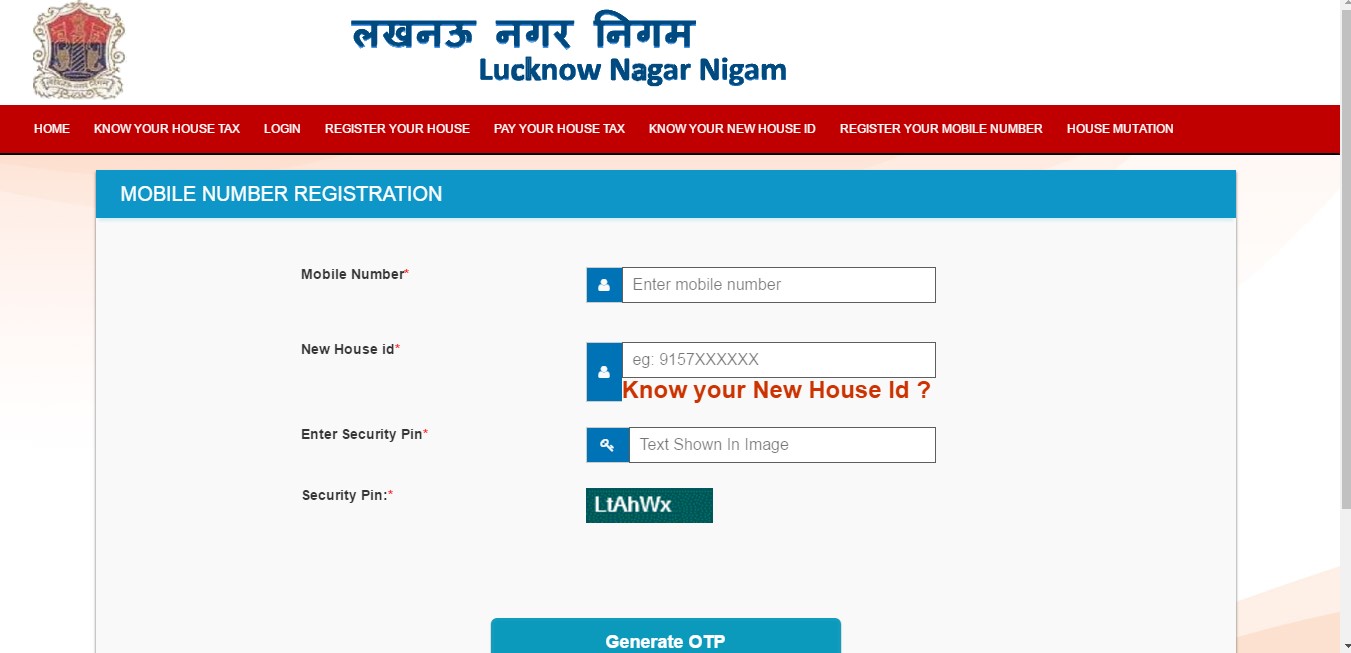

How to register your mobile number

To register your mobile number, log on to the LMC website and click on the ‘Register Your Mobile’ tab among the options.

Read also : Property rights of a Hindu daughter under the Hindu Succession Act 2005

Provide your mobile number along with your new house ID, to generate an OTP and proceed.

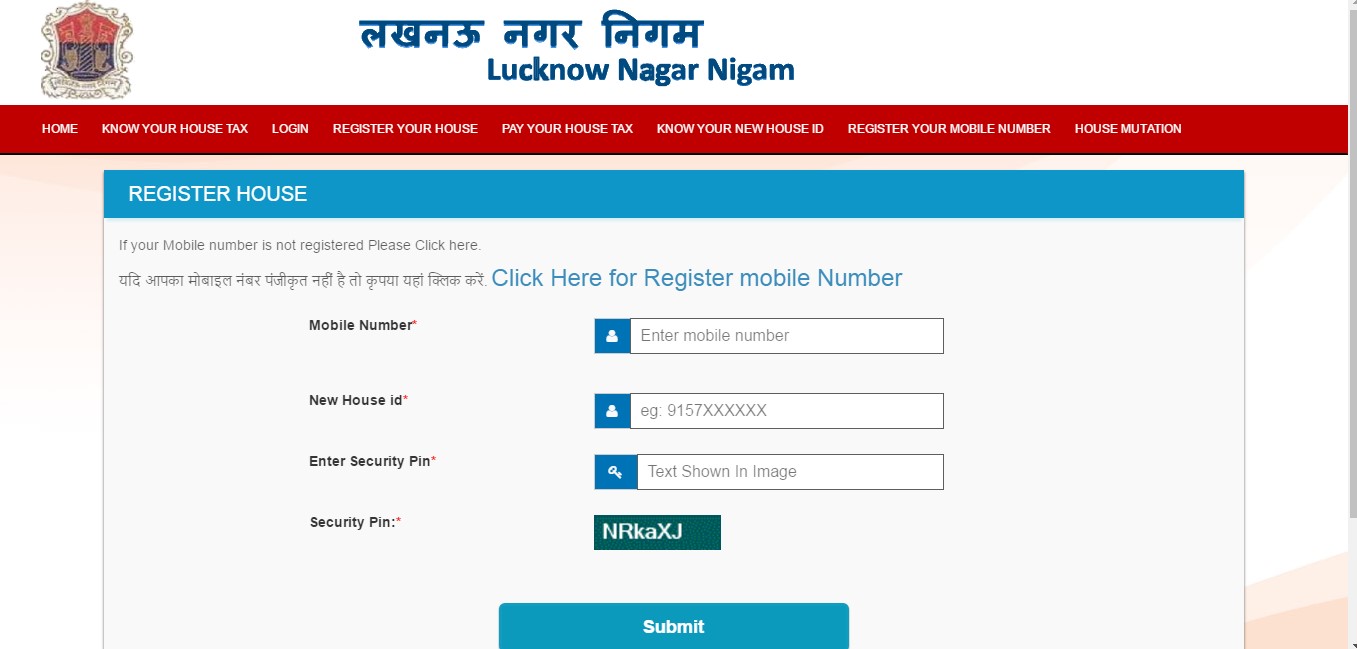

How to register your house?

Step 1: To register your house, log on to the LMC website and click on the ‘Register You House’ tab among the options given on top.

Step 2: Enter your mobile number, new house ID, etc. and submit.

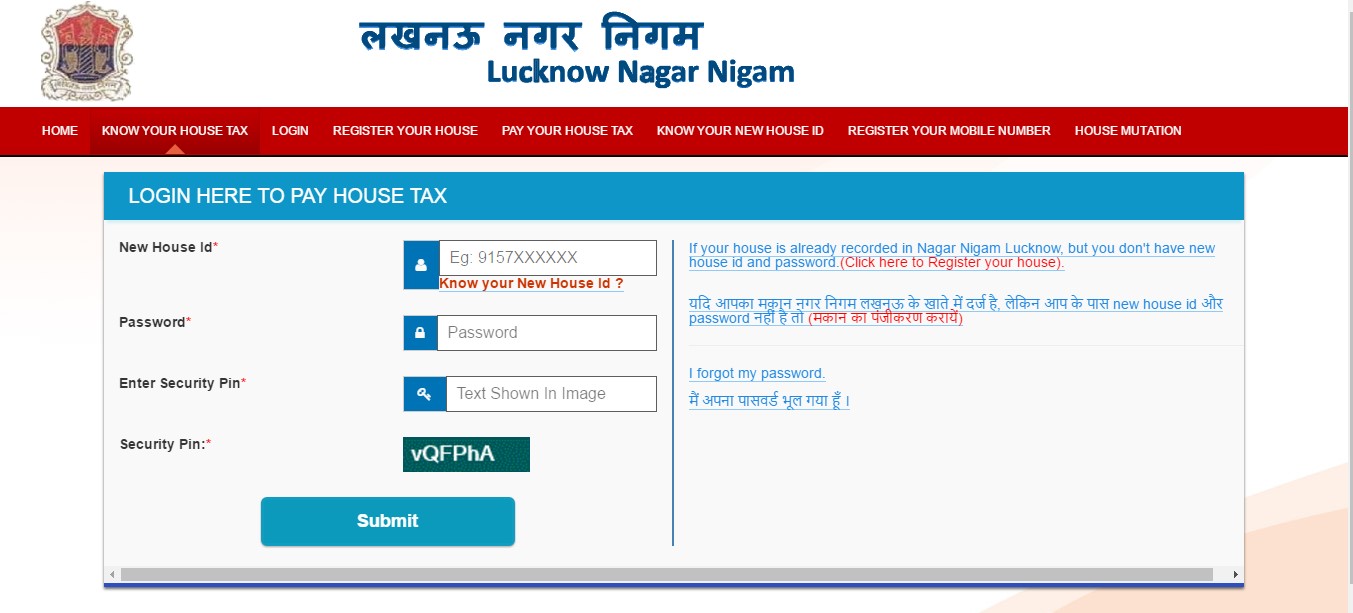

Lucknow house tax online payment process

To pay your house tax, log on to the LMC website and click on ‘Pay your house tax’ tab.

- Jhatpat Electricity Scheme: Know about the Online UPPCL Jhatpat Connection Scheme Application Procedure

- Income tax: Your complete guide to income tax laws in India

- What is bill of entry and how does it work?

- MoU: Understanding the legality of memorandum of understanding

- Noida police verification for tenants: All you should know

Enter the new house ID, password, security code, etc., to proceed. The new page that appears, displays your property tax and payment options.

Lucknow house tax: How to find out property tax rate in Lucknow?

On the LMC website, click on the option ‘Monthly rates for AV calculation’. This leads you to a notification that mentions monthly rates for various wards in the city in per sq ft values.

For calculation of the property tax, the following factors are considered:

- Location

- Zone

- Ward

- Mohalla

- Age of property

- Type of construction

- Position of land

- Width of the road

Read also : PF withdrawal: Everything you want to know about EPF withdrawal

In case you misreport your house tax liability over self-assessment, the LMC could impose a penalty, based on the area of the property.

How to pay Lucknow house tax offline?

Property tax can be paid offline by visiting the Lucknow Municipal Corporation office at the Triloknath Road, Lalbagh, Lucknow.

LMC house tax rebate

Based on the years of occupancy, a tax payer in Lucknow can enjoy certain rebates on his/her property tax liability.

20% rebate: If you have been occupying the property for 10 years.

32.5% rebate: If you have been occupying the property for 11-20 years.

40% rebate: If you have been occupying the property for more than 20 years.

Lucknow house tax: Lucknow-One app

Relaunched by the LMC in October 2020, the Lucknow-One app helps citizens to avail of services, including quick payment options for property tax and vehicle registration. Apart from offering assistance for any sort of emergency, the app also helps one to locate nearby services through the ‘Find What’s Near Me’ option. One can also register complaints related to roads, sanitation, street lighting, drinking water, etc., using the Lucknow-One app.

Lucknow house tax facts

What is house tax?

While buyers have to pay a one-time amount to become the owner of a property, they have to consistently pay smaller amounts in the form of house tax, to maintain their ownership over this asset. House tax is a direct tax imposed on property ownership by local authorities of cities in India.

Income tax on property vs house tax

Note here that house tax is not the same as the tax you pay against property ownership on your annual income. The property tax payment is over and above the tax the government imposes on holding of immovable assets. The property tax is charged by the local municipal body. The income tax you pay every year on your property ownership under various tax laws in India is collected by the centre on the other hand.

FAQs

How to register house in Lucknow Nagar Nigam?

To register your house in Lucknow Nagar Nigam, visit the url: https://lmc.up.nic.in/internet/newregister.aspx

What is house ID in Lucknow Nagar Nigam?

To know the house ID, log in to the LMC and click on ‘Know your new house ID’. Enter the necessary details, to get the new house ID.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Must Knows