[ecis2016.org] Check out our income tax e-filing guide to know everything about filing ITR or income tax return online.

What is an ITR?

ITR or income tax return is a form, which all taxpayers in India need to fill and submit to the Income Tax (I-T) Department, to report their income and deductible tax and claim rebates.

You are reading: ITR: Everything you wanted to know about income tax return

Is filing an ITR necessary?

Filing an ITR is necessary in case any of the following conditions is applicable to you:

1. If your gross income is more than the basic exemption limit

Taxpayer basic exemption limit

| For individual taxpayers aged up to 60 years | Rs 2.50 lakhs |

| For individual taxpayers aged above 60 years | Rs 3 lakhs |

| For individual taxpayers aged above 80 years | Rs 5 lakhs |

[ecis2016.org] Income tax slab: Everything a taxpayer needs to know about old and new tax regime

However, individuals whose income is within the basic exemption limit will still have to file ITR if:

- Your electricity bill for the year is in the excess of Rs 1 lakhs.

- You have spent Rs 2 lakh or more on a foreign trip for yourself or anybody else.

- You have deposited money in the excess of Rs 1 crore in one or more current bank accounts.

2. If you want to claim refund from the I-T Department.

3. If you want to apply for any loan or visa.

4. If the loss under an income head needs to be carried forward.

5. If you have invested in foreign assets.

6. If you are a business in the form of a company or firm, irrespective of your profit or loss.

[ecis2016.org] All about loss from house property

Income tax e-filing

You have the facility of income tax e-filing, which is necessary in the following cases:

- In case your gross income exceeds Rs 5 lakhs.

- To claim refund of income tax.

- To file income tax returns using ITR 3, 4, 5, 6, 7.

Also know all about UAN login

Which ITR form should I file?

ITR form types

There are seven types of ITR forms. Taxpayers need to use one of these forms to file their I-T returns, depending on their category (individual, Hindu Undivided Family, company, etc.), amount and source of their incomes.

| ITR 1 | Also known as SAHAJ, it is for individuals with an annual income of up to Rs 50 lakhs, earned from salary/pension, one house property and other sources. |

| ITR 2 | For individuals with annual income of over Rs 50 lakhs, earned from salary/pension, other sources, foreign income, more than one house property, capital gains. |

| ITR 3 | Individuals who are partners in a firm and earning income in the form of interest, salary, bonus, commission, remuneration received by him from such firm. |

| ITR 4 | Also known as SUGAM, this form is for individuals who have income not exceeding Rs 50 lakhs during the FY, including income from business and profession computed on a presumptive basis u/s 44AD, 44ADA or 44AE, income from salary/pension, one house property, agricultural income (up to Rs 5,000), and other sources. |

| ITR 5 | For companies, LLPs, AOPs and BOIs. |

| ITR 6 | For companies not claiming deductions under Section 11. |

| ITR 7 | People and companies under sections 139 (4A), 139 (4B), 139 (4C), 139 (4D). |

Documents/details required to fill ITR form

- PAN

- Form 26AS

- Form 16A, 16B, 16C

- Salary slips

- Bank statements

- Interest certificates

- TDS certificate

- Proof of tax saving investments

Pre-requisites for income tax e-filing

- The user should be registered on the e-filing portal and have a valid user ID and password.

- Active PAN.

- PAN linked with Aadhaar.

- Pre-validated bank account.

- Valid mobile number for e-verification, linked with Aadhaar/e-filing portal/your bank/CDSL/NSDL

Income tax e-filing: How to file I-T return online?

Step 1: After you have made sure which category of income taxpayer you belong to and which ITR form you will fill, go to the official income tax e-filing portal. Login using your username and password.

As only registered users can file their I-T return online on the website of the I-T Department, new users will have to click on the ‘Register’ option at the top right side of the page.

Online registration process to file ITRSelect the user type as ‘Individual’ and click on ‘Continue’. Now, provide the following details: PAN, surname, first name and middle name, date of birth, residential status and click on ‘Continue’ Fill in the following mandatory details:

Click on ‘Submit’ after registration. For residents, a-six-digit OTP1 and OTP2 will be shared on your mobile and e-mail ID, specified at the time of registration. Enter the OTP to complete the registration process. You can now go back and follow the first step for income tax e-filing. |

Step 2: On the home page, click on the ‘File Income Tax Return’ option under the ‘e-file’ tab.

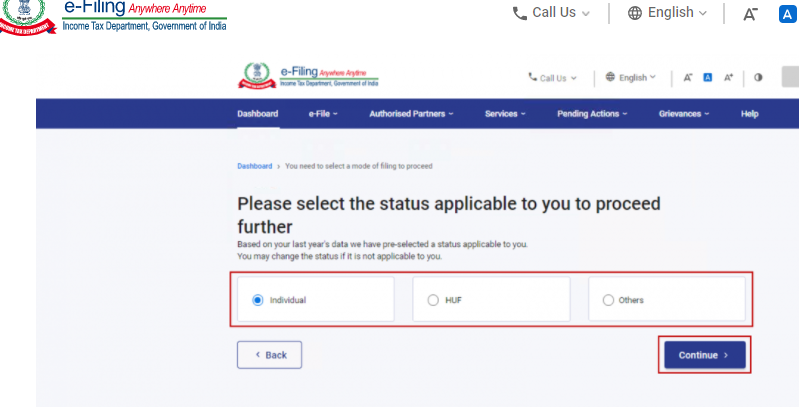

Step 3: Choose the category of income taxpayer – individual or Hindu Undivided Family, etc.

Step 4: Choose the ITR form applicable to you and enter the details of your bank account.

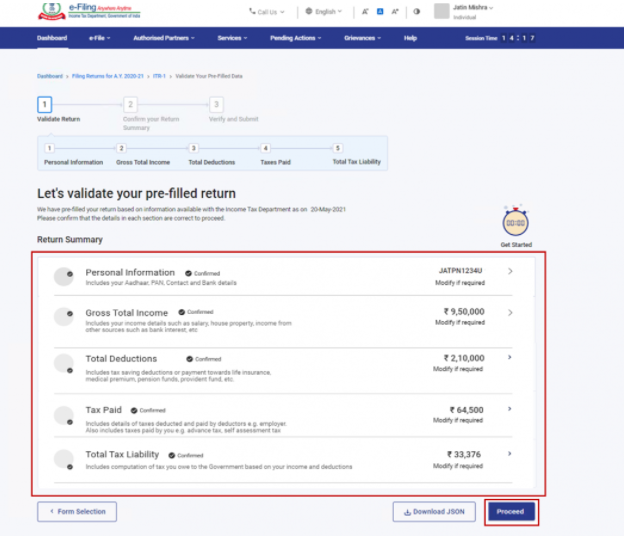

Step 5: You will be redirected to a new page, where the pre-filled details of your ITR will appear. These include your personal information, gross total income, total deductions, tax paid and total tax liability. Check these details and if you are sure that all the details provided in the form are correct, validate it.

Read also : Joint ownership in real estate: How two parties can jointly own a property

Step 6: Go back to your dashboard. From the e-File option select ‘Income Tax Returns’, then ‘File Income Tax Return’ option.

Step 7: Select the assessment year and click on continue.

Step 8: Select mode of filing as online and continue.

Step 9: If you have already filled the ITR and it is pending for submission, click on ‘Resume Filing’. If you wish to start afresh and discard the saved return, then, click on ‘Start New Filing’.

Step 10: Select mode of filing and ITR form and click on ‘Let’s Get Started’.

Step 11: Select the checkboxes applicable to you and click ‘Continue’.

Step 12: Review your pre-filled data and edit it, if needed. Enter the remaining data, if required and click on ‘Confirm’ at the end of each section.

Step 13: Enter your income and deduction details in different sections. After completing and confirming all sections of the form, click on ‘Proceed’.

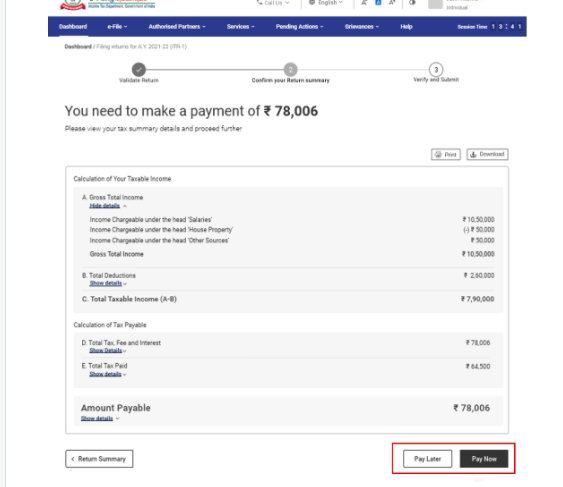

If there is any tax liability, you will be shown a summary of your income tax computation, on the basis of the details provided by you, along with the ‘Pay Now’ and ‘Pay Later’ options at the bottom of the page. It is recommended to choose ‘Pay Now’. Note the challan serial number and BSR code and enter the same in the details of payment.

Read also : Lucknow house tax: All you need to know about Lucknow Nagar Nigam house tax

Step 14: After paying the tax, click on ‘Preview Return’. If you have no tax liability, or if any refund is due to you, based on your tax computation, you will be taken to the ‘Preview and Submit Your Return’ page.

Step 15: On the ‘Preview and Submit Your Return’ page, enter the place, select the declaration checkbox and click ‘Proceed to Validation’.

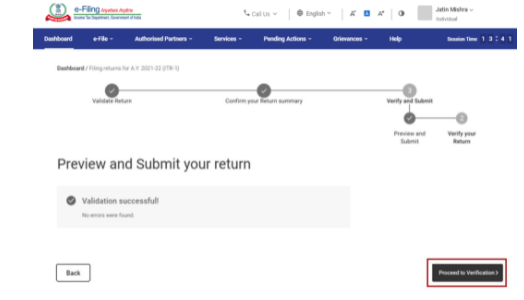

Step 16: Once validated, click ‘Proceed to Verification’. If a list of errors is displayed in your return, then, go back to the form to correct the errors. If there are no errors, click on ‘Proceed to Verification’ to e-verify your ITR.

Step 17: On ‘Complete Your Verification’ page, select your preferred option and click on ‘Continue’.

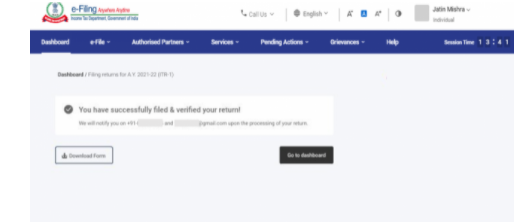

Step 18: On the e-verify page, select the option through which you want to e-verify the return and click ‘Continue’. Once you e-verify your return, a message is displayed with the acknowledgment number and transaction ID. You will also receive a confirmation message on your registered mobile number and e-mail ID.

Late filing of ITR

Taxpayers, who fail to file their ITRs within the last date, have been provided with a three-month window to file their delayed returns. However, belated ITRs attract a late filing fee under Section 234F of the I-T Act.

If your gross total taxable income during the financial year does not exceed Rs 5 lakhs, the penalty is Rs 1,000. In case the income exceeds Rs 5 lakhs, the penalty amount goes up to Rs 5,000. Additionally, a monthly interest of 1% is charged on the unpaid tax amount, under Section 234A. The interest will start from the date immediately after the due date.

[ecis2016.org] All about Section 80C Deduction

Things to be kept in mind while filing I-T return

*The taxpayer should identify the correct ITR form applicable in his case.

*Ensure that you file the ITR on or before the due date. The consequences of delay in filing I-T return on time are as follows:

- Losses cannot be carried forward.

- Levy of interest under Section 234A.

- Late filing fees under Section 234F is applicable on returns filed after the due date.

- Exemptions under Section 10A and Section 10B will not be available.

- Sections 80-IA, 80-IAB, 80-IB, 80-IC, 80-ID and 80-IE deductions will not be available.

- Sections 80IAC, 80IBA, 80JJA, 80JJAA, 80LA, 80P, 80PA, 80QQB and 80RRB deductions will not be available (from AY 2018-19).

*Download form 26AS and confirm actual TDS/TCS/tax paid. Make sure there are no discrepancies.

[ecis2016.org] All about TDS on sale of property

*Ensure that other details like PAN, address, bank account details, e-mail ID, etc., are correct.

Read all the details – passbook/bank statement, interest certificate, investment proof for deductions claimed, books of account and balance sheet, etc., carefully while filing the ITR.

*No documents are to be attached with the Return of Income.

*If the ITR is filed electronically without digital signature and without the electronic verification code, then, post the acknowledgement of filing the Return of Income to the CPC Bangalore, within 120 days of filing the ITR.

ITR FAQs

What is an ITR?

ITR or income tax return is a prescribed form through which the details of the income earned by a person in a financial year and the taxes paid on income, are communicated to the Income-Tax Department. It allows to carry forward loss and claim refund from the I-T Department. Different forms of income tax returns are prescribed, to file returns for various status and nature. These ITR forms can be downloaded from www.incometaxindia.gov.in.

Is my responsibility as per the Income Tax Act over once taxes are paid?

No, you are also responsible for ensuring that tax credits are available in your tax credit statement, you have received TDS/TCS certificates and full particulars of income and tax payment are submitted to the I-T Department in the form of Return of Income to be filed before the last date.

Am I liable for any criminal prosecution like arrest or imprisonment, if I don’t file my income tax return?

Non-payment of taxes may attract interests, penalty, and prosecution. The prosecution can lead to rigorous imprisonment for three months up to two years. If the tax evasion exceeds Rs 25 lakhs, the punishment could range from six months to seven years.

How to file return of income?

ITR or Return of Income can be filed in hard copy (only ITR 1/4 in specified cases) at a local office of the Income Tax Department or can be filed online at www.incometaxindiaefiling.gov.in.

Is there any e-filing helpdesk set up by the Income Tax Department?

In case of queries regarding e-filing of returns, a taxpayer can contact 1800 180 1961.

Can I file my Return of Income without quoting PAN?

With effect from September1, 2019, every person with a PAN, having linked his Aadhaar with PAN under Section 139AA, can furnish his Aadhaar in lieu of a PAN for all the transactions where quoting of a PAN is mandatory as per the Income Tax Act. Further, with effect from September 1, 2019, an assessee can file his Return of Income by quoting his Aadhaar instead of quoting his PAN. Note, it is mandatory to quote PAN on the Return of Income.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Must Knows