[ecis2016.org] In Chennai, you can pay your ‘sotthu vari’ or property tax Chennai online and offline. The due date for payment of property tax Chennai is September 31 and March 31 every year. Read on, to find how to use property tax calculator Chennai, Chennai Corporation property tax status and how to pay property tax online

Residents of Chennai can easily pay their ‘sotthu vari’ or Property tax Chennai online. They also have the option to make the payment of Chennai property tax offline. The due date for Property tax Chennai payment is September 31 and March 31 every year. In case of any defaults with respect to Property tax Chennai payment there is a 1% penalty every month.

You are reading: All about property tax in Chennai

With respect to General Revision of Property Tax, then Chennai Municipal Corporation clarified that Property Tax Chennai for the current half-year (1/2022-23) according to the present demand should be paid before April 15, 2022. New demand as per General Revision for the current half year (1/2022-23), will be generated after the General Revision is notified by Greater Chennai Corporation. Assessees can pay the balance amount of property tax Chennai later.

In this article, we look at the step-by-step process for payment of Property tax Chennai in Tamil Nadu, an annual levy that property owners have to pay, apart from paying income tax on house property when filing their taxes for the financial year.

[ecis2016.org] All about PCMC property tax

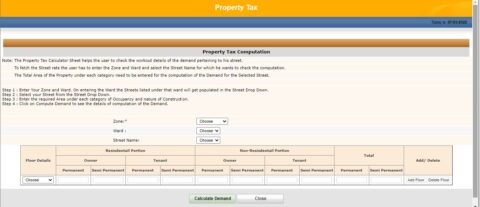

Property tax calculator Chennai

Property tax calculator Chennai is an important tool that helps in calculating property tax Chennai. You can access the property tax calculator Chennai provided on the property tax Chennai online portal (click here). You will need to enter the type of building for which you have to pay the Chennai corporation property tax and other details such as the area, location, street, type of occupancy and the floor details. While you can use this Chennai property tax calculator or the Tamil Nadu property tax calculator, the website mentions that this Chennai property tax calculator is for test purposes only.

[ecis2016.org] All about the property tax calculator Delhi

Another way to ascertain the exact amount of property tax Chennai is by following property tax calculator formula:

Assuming the following,

| Plinth Area x Basic Rate per sq ft (say 1,000 sq ft x Re 1) | Monthly rental value = Rs 1,000 per month. |

| Annual rental value = Rs 1,000 x (12 months) – 10% for land. Annual value for building only | Rs 12,000 – Rs 1,200 = Rs 10,800. |

| Less 10% depreciation for the building (repairs / maintenance) | Rs 1,080 (which is 10% of Rs 10,800). |

| Depreciated value of the building | Rs 10,800 – Rs 1,080 = Rs 9,720. |

| Add 10% of the land value | Rs 1,200 (which is 10% of Rs 12,000). |

| Annual value for land and building | Rs 9,720 + Rs 1,200 = Rs 10,920. |

[ecis2016.org] All about Kerala building tax online payment

You can see that 10.92 is the common factor that can be used to calculate the annual value of all buildings while proceeding with calculating Greater Chennai Corporation property tax. Multiply the annual rental value with 10.92 to arrive at the annual value for any building.

[ecis2016.org] Everything about property tax calculator Bangalore

Method of fixing annual value for land on lease or rent

The property tax Chennai website offers the following explanation:

Monthly rental value (as per agreement between lessor and lessee) x 12 = Annual Value

No depreciation is allowed for vacant land: Rent per 2,400 sq ft (one ground) = Rs 8.00 per month.

Annual value (Rs 8.00 x 12) = Rs 96 per month.

Method of fixing annual value for the super structure only (land being separate): Annual rental value – 10% x (MRV x 12).

[ecis2016.org] All about GVMC property tax

So, how property tax is calculated in Chennai? The half-yearly Chennai property tax for any property is calculated as a percentage of its annual rental value, as per this table:

| Annual Value | Half year tax (as a percentage of annual value) | |||

| General Tax | Education Tax | Total | Lib. (less) | |

| Re 1 to Rs 500 | 3.75% | 2.50% | 6.25% | 0.37% |

| Rs 501 to Rs 1,000 | 6.75% | 2.50% | 9.25% | 0.67% |

| Rs 1,001 to Rs 5,000 | 7.75% | 2.50% | 10.25% | 0.77% |

| Rs 5,001 and above | 9.00% | 2.50% | 11.50% | 0.90% |

[ecis2016.org] All about the MCGM property tax

Property tax calculator Chennai: Property tax Chennai rates

In case of residential properties, basic property tax rate ranges between Rs 0.60 per sq ft and Rs 2.40 per sq ft. For non-residential projects, the property tax Chennai rate is between Rs 4 per sq ft and Rs 12 per sq ft.

[ecis2016.org] All about Chennai metro

Property tax Chennai: Zone number for property tax

| Zone number for property tax | Name of the Zone | Ward number |

| I | Thiruvotriyur | 1-14 |

| II | Manali | 15-21 |

| III | Madhavaram | 22-33 |

| IV | Tondiarpet | 34-48 |

| V | Royapuram | 49-63 |

| VI | Thiruvikanagar | 64-78 |

| VII | Ambattur | 79-93 |

| VIII | Anna Nagar | 94-108 |

| IX | Teynampet | 109-126 |

| X | Kodambakkam | 127-142 |

| XI | Valasaravakkam | 143-155 |

| XII | Alandur | 156-167 |

| XIII | Adyar | 170-182 |

| XIV | Perungudi | 168, 169, 183-191 |

| XV | Sholinganallur | 192-200 |

[ecis2016.org] All about GVMC water tax

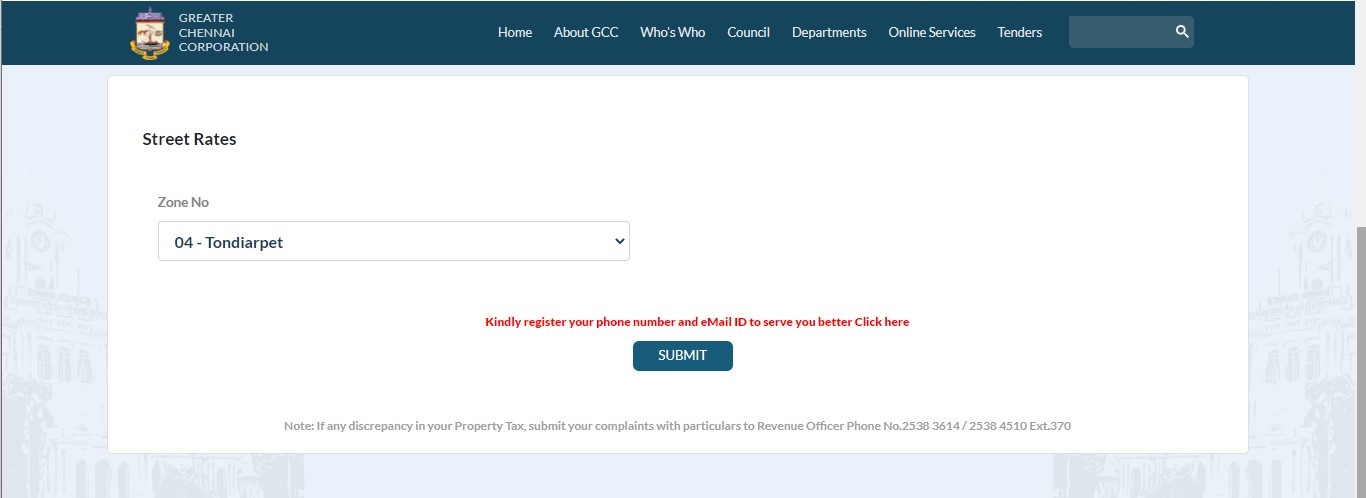

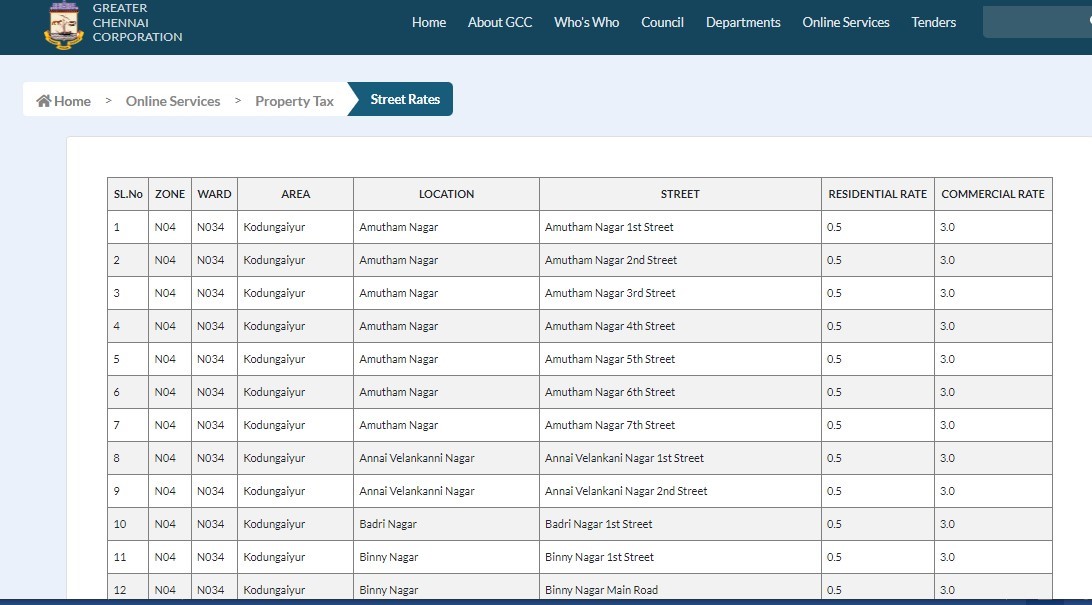

Property tax Chennai: Street rates

To know the street rates of property tax Chennai, visit https://chennaicorporation.gov.in/gcc/online-services/online-payment/property-tax/street-rates/ and select the street name from drop down box and submit.

You will see the entire list

Property tax Chennai: What constitutes residential, non-residential property?

Individual houses, flats and apartments that have not been rented out for commercial/ business purposes, are treated as residential for property tax Chennai purposes. On the other hand, shops, offices, malls, movie theatres and party or marriage halls, are considered non-residential for Chennai property tax purposes.

Check out property price trends in Chennai

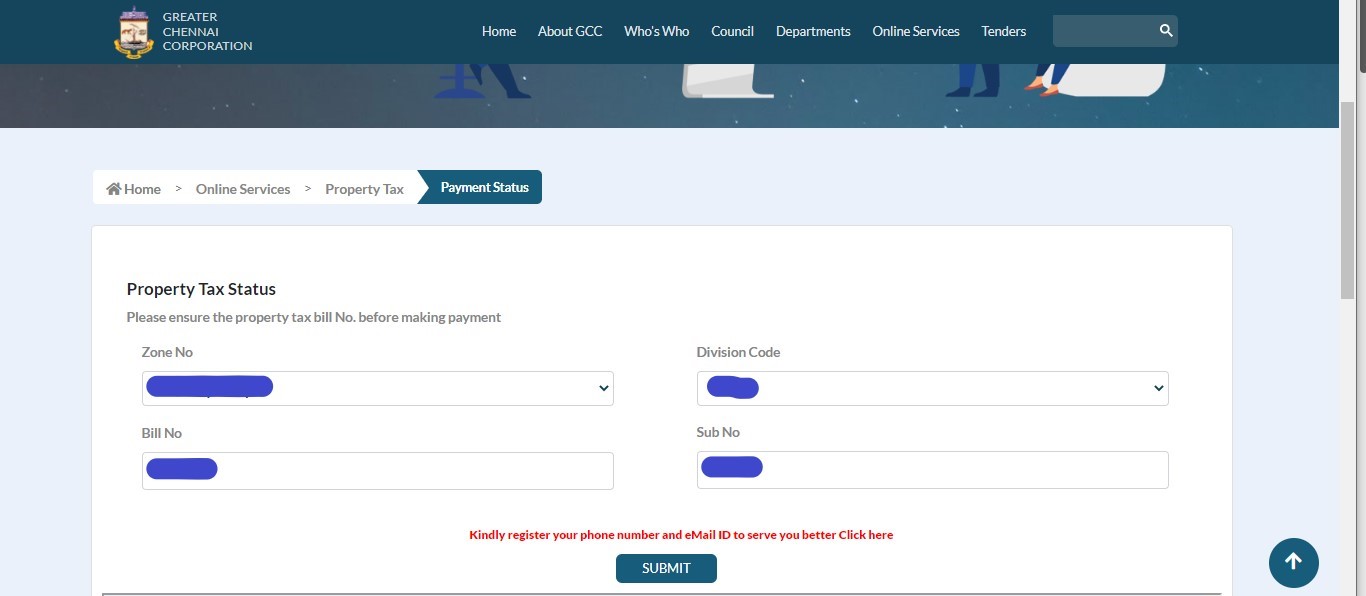

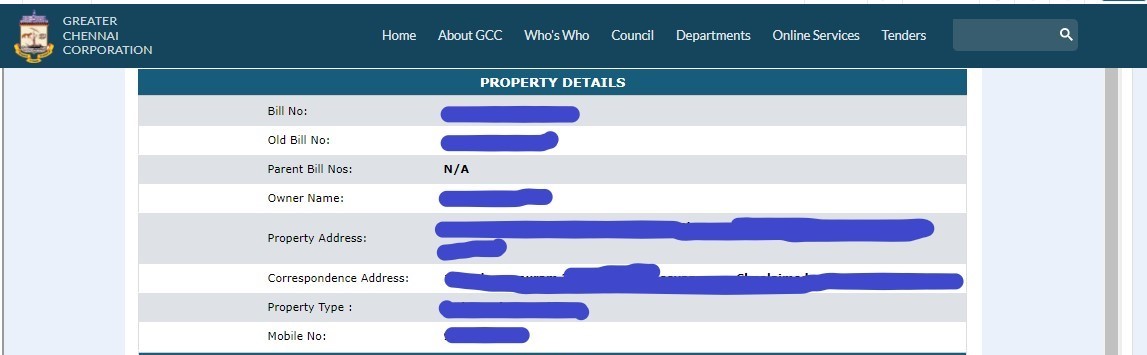

Property tax Chennai: Chennai corporation property tax status

To check the Chennai corporation property tax status, click on

https://chennaicorporation.gov.in/gcc/online-services/online-payment/property-tax/property-tax-payment-status/

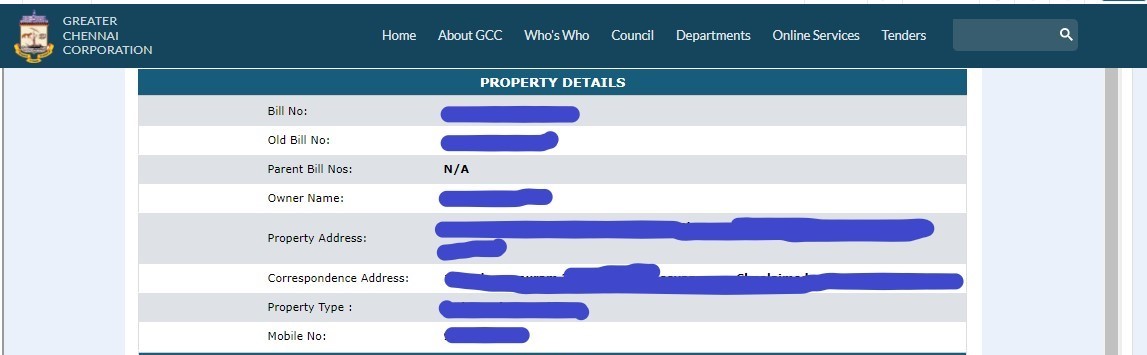

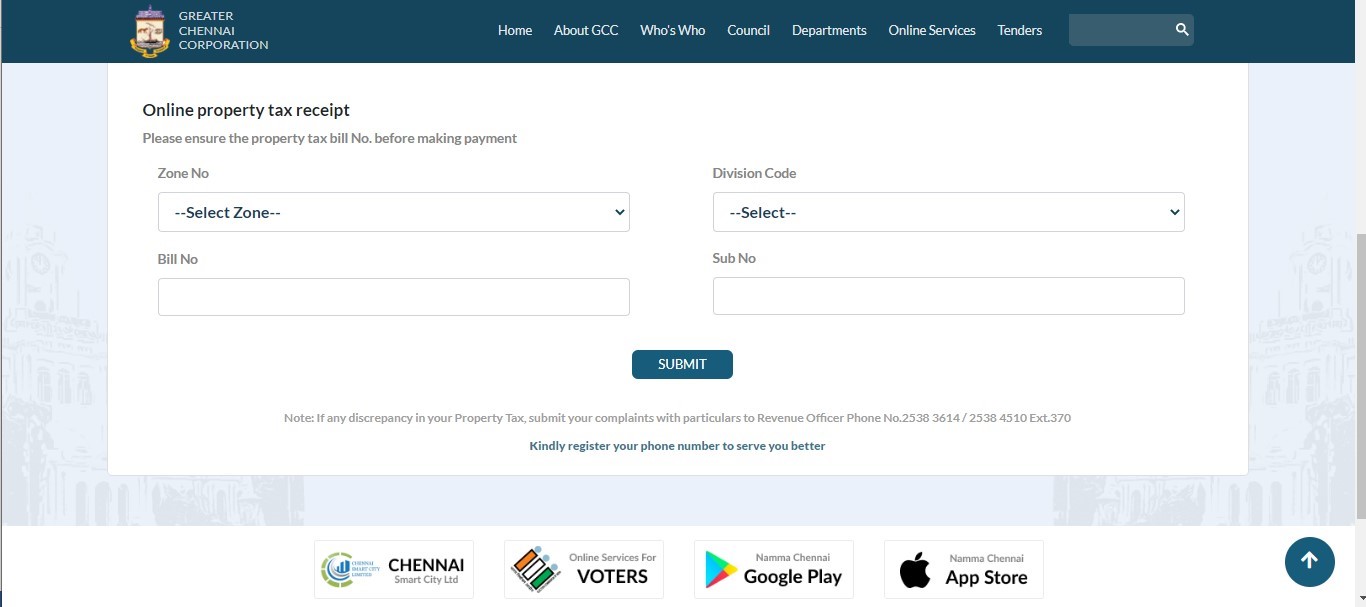

To know the Chennai corporation property tax status, enter the zone no, division code, bill no and sub no and press on submit.

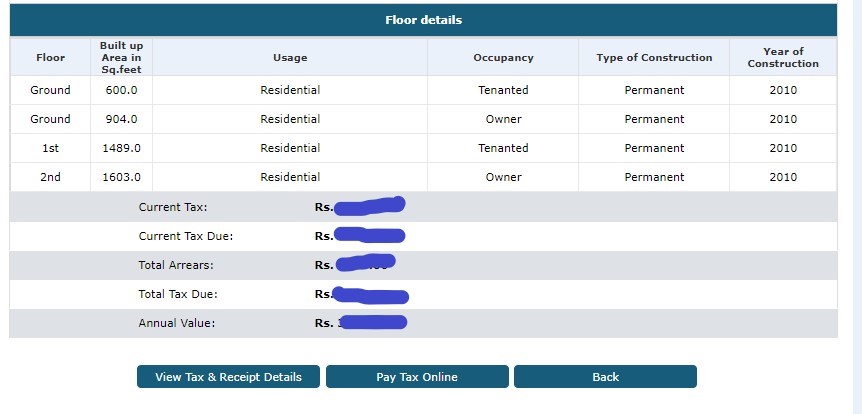

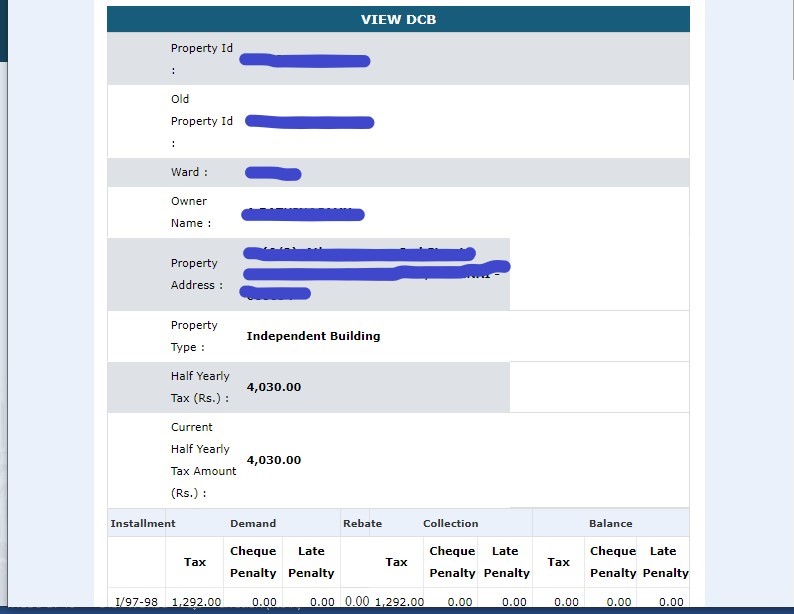

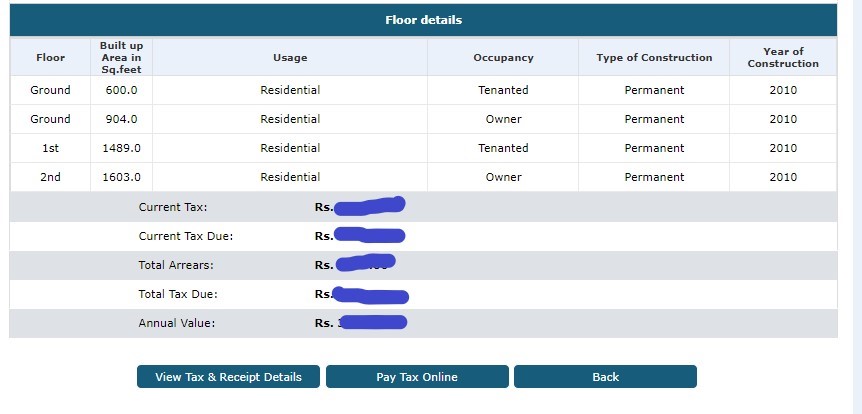

You will see the Chennai corporation property tax status below where you can see all details like bill no., old bill no., owner name, property address, correspondence type, property type, mobile number. The floor details segment in the chennai corporation property tax status includes floor, built up area, usage, occupancy, type of construction, year of construction, current tax, current tax due, total arrears, total tax due, annual value.

To know your Chennai Corporation property tax status Click on ‘View Tax and receipt details’ to see the Chennai property tax receipt details

Property tax Chennai: How to make property tax online payment Chennai?

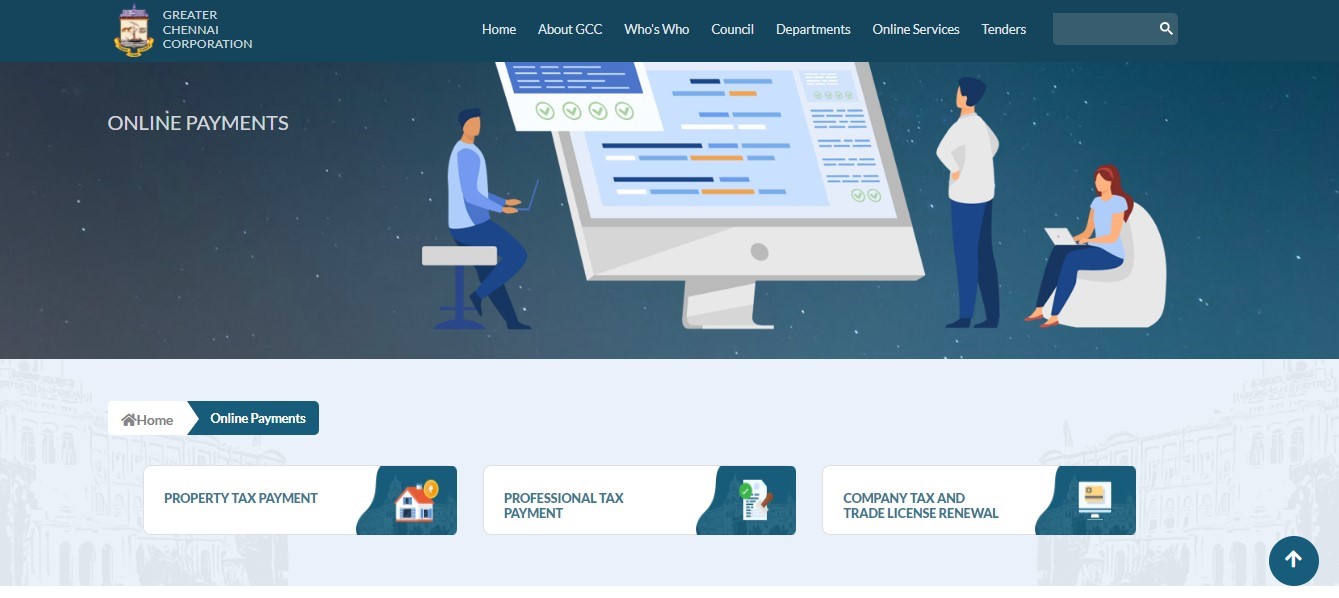

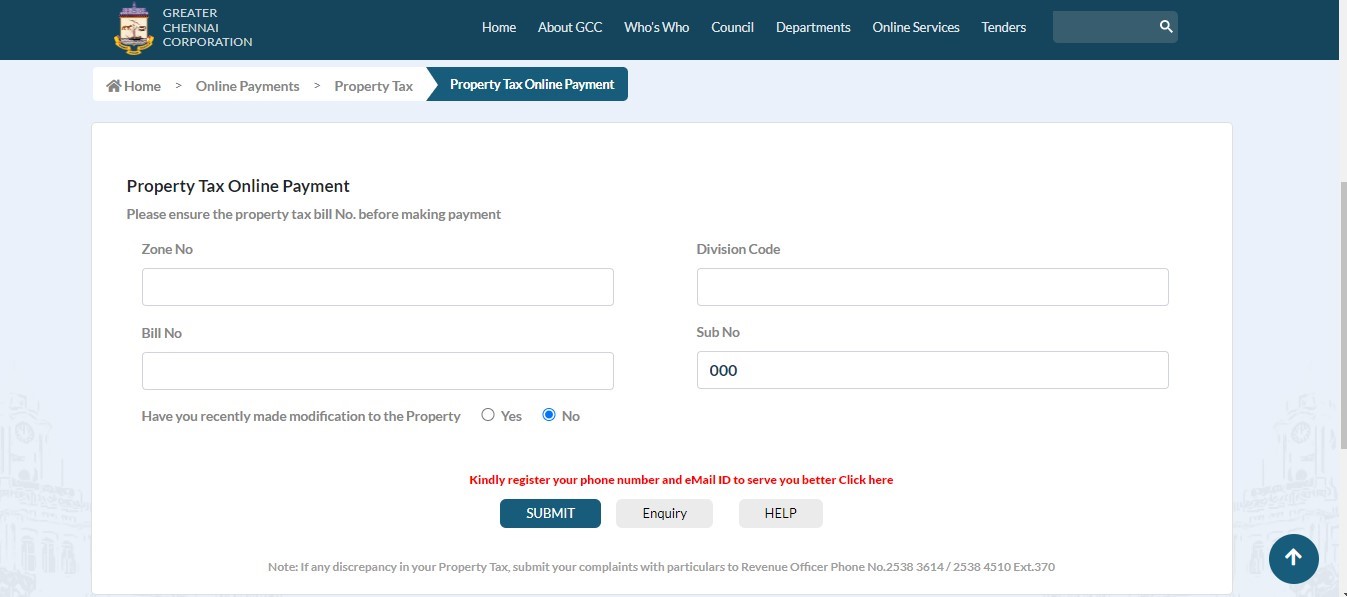

Step 1: First visit the Chennai corporation website on https://chennaicorporation.gov.in/gcc/. On the Chennai corporation property tax website, click on Online Payments tab. You will reach https://chennaicorporation.gov.in/gcc/online-payment/ where you have to click on property tax payment.

You will reach

Read also : All about Hyderabad’s Durgam Cheruvu bridge

On entering details and pressing submit on the property tax Chennai website, you will get the following information. Then, click on ‘Pay Tax online’.

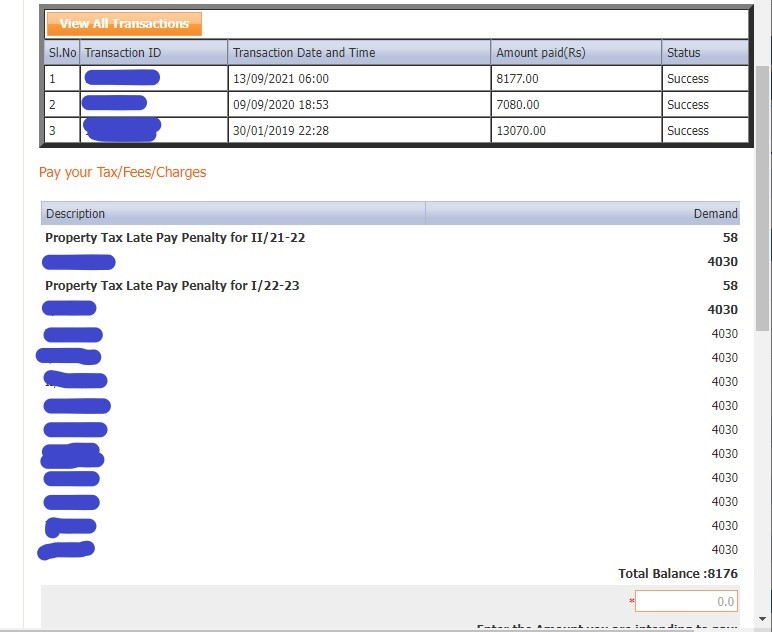

You will see a pop up page that shows your previous transactions with respect to Chennai corporation property tax.

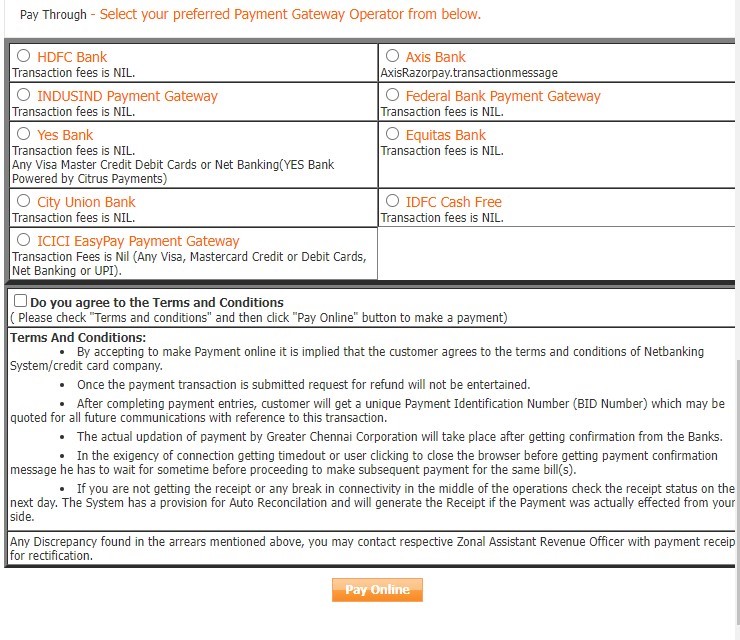

See the balance to be paid as property tax Chennai, enter the amount you intend to pay and select your preferred payment gateway and proceed with the online payment.

Chennai property tax: Offline payment

If you choose to pay Chennai property tax offline, you can issue the cheque or demand draft that will be addressed to ‘The Revenue Officer, Corporation of Chennai’. The Chennai property tax payments can be submitted to authorised banks, tax collectors, e-seva centers and Tamil Nadu Arasu Cable Television Corporation (TACTC) in Taluk Offices. Mentioned are list of authorised banks that can receive the Chennai property tax payments are

- City Union bank

- Canara bank

- HDFC

- IDBI

- Indian Overseas Bank

- Indian Bank

- Indusland Bank

- Karur Vysya bank

- Kotak Mahindra Bank

- Lakshmi vilas Bank

- Punjab National Bank

- State Bank Of India

- Tamilnadu Mercantile Bank

- Yes Bank

Property tax Chennai: Assessment

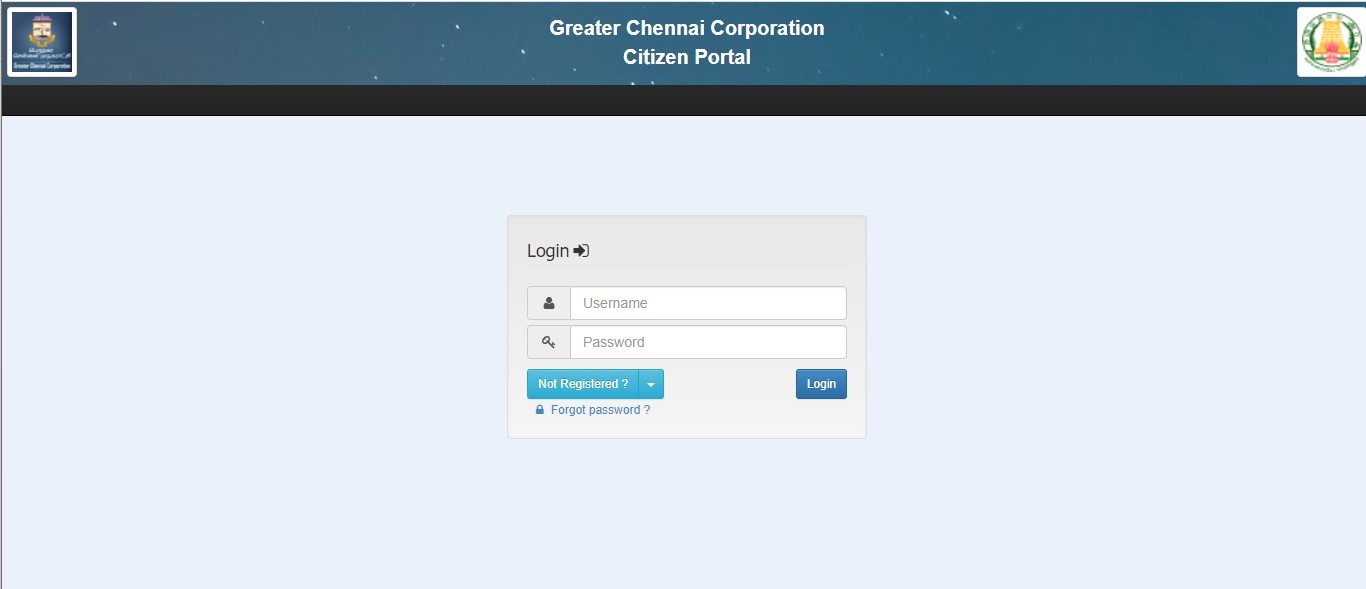

Online assessment

Citizens can submit a request for property tax Chennai online assessment through the Chennai property tax portal. Login to the Chennai property tax online citizen portal and enter details like

- Division

- Name of the assessee

- Location of property

- Area

- Location

- Street name

- Door number

- Contact number and proceed with the assessment.

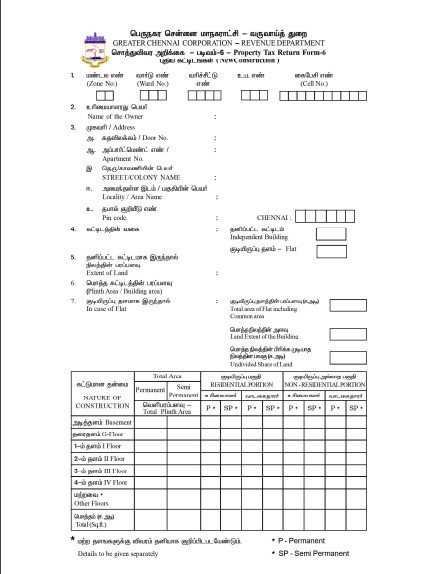

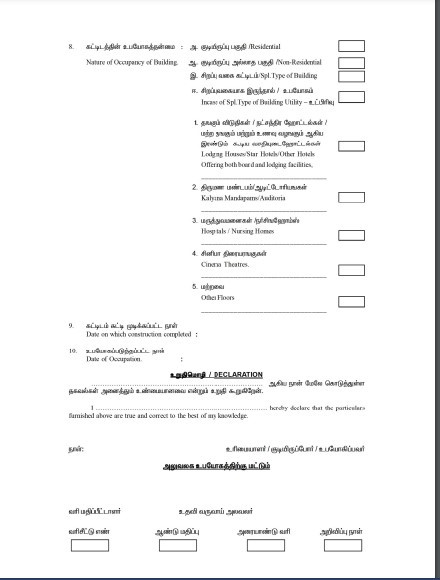

Note that the assessee should submit the hard copy of registered documents in his/her favour, filled application form and last property tax Chennai paid receipt

Offline assessment

At one of the TACTV counters present at Chennai Municipal Corporation please give

- Letter of request that has the address and contact details

- Copies of the registered documents in his/her favour

- Filled in Form-6 application form

- Copy of the property tax Chennai paid receipt

Once these are submitted, applicant will get acknowledgement through SMS.

Assessment request at concerned zonal offices/ headquarters

Also, the Chennai citizen can submit a request at concerned zonal offices/ headquarters with

- Letter of request that has the address and contact details

- Copies of the registered documents in his/her favour

- Filled in Form-6 application form

- Copy of the property tax Chennai paid receipt

Once application for assessment is submitted, it will be verified by the assessor. He will measure the newly constructed building and submit proposal to the concerned officer. Post field verification, proposal will be sent to the assessment committee. After the approval of the assessment committee, the new assessment order will be issued to the assesse and he will be informed through SMS.

Property tax Chennai: Modification

Online modification

Citizens can submit a request for online modification of property tax Chennai through the Chennai property tax portal. Login to the Chennai property tax online citizen portal and enter details like

- Division

- Name of the Assessee

- Location of Property

- Area

- Location

- Street Name

- Door Number

- Contact Number

Note that the assessee should submit the hard copy of registered documents in his/her favour, filled application form and last tax paid receipt.

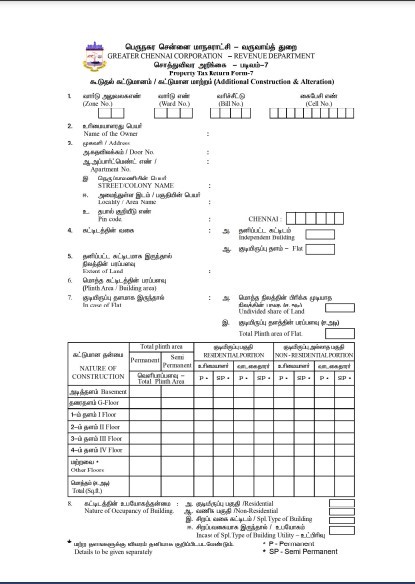

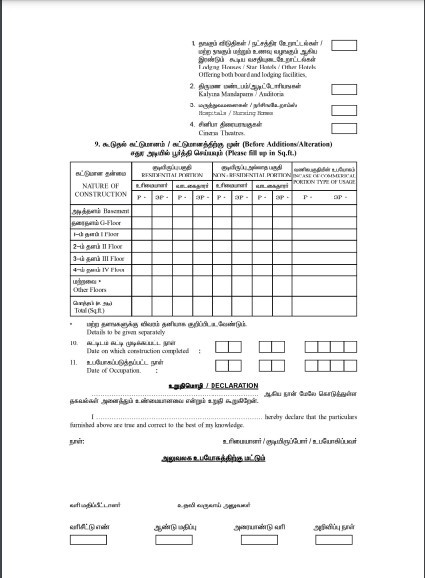

Offline modification

At anyone of the TACTV counters located in Greater Chennai Corporation premises, a citizen has to submit the following:

- Letter of request with address details and contact number

- Copies of the registered documents in his/her favour

- Filled Form -7 application form

- Copy of the property or vacant land tax paid receipt

Once submitted, acknowledgement of property tax Chennai service will be sent to the citizen through SMS.

Request at concerned zonal offices/ headquarters

Applicant can write to the concerned zonal offices/ headquarters with a

- Letter of request with address details and contact number

- Copies of the registered documents in his/her favour

- Filled Form -7 application form

- Copy of the property or vacant land tax paid receipt

On submission of the request for modification of property tax, the assessor will check the application submitted and after informing him will measure the building. A proposal will then be submitted to the assessment committee which will check correctness of the proposal and approve it. Once approved, the new assessment order-Notice 6 will be sent to the assesse and he will also be informed through SMS.

Property tax Chennai: Appeal for property tax assessment

Online appeal

Citizens can submit a request for online appeal for appeal for property tax Chennai through the Chennai property tax portal. Login to the Chennai property tax online citizen portal and enter details like

- Division

- Name of the Assessee

- Location of Property

- Area

- Location

- Street Name

- Door Number

- Contact Number

Note that the assessee should submit the hard copy of registered documents in his/her favour, filled application form and last property tax paid receipt.

Offline modification

At anyone of the TACTV counters located in Greater Chennai Corporation premises, a citizen has to submit the following:

- Letter of request with address details and contact number

- Copies of the registered documents in his/her favour

- Filled Form -6 application form

- Copy of the property or vacant land tax paid receipt

Once submitted, acknowledgement of the property tax Chennai service will be sent to the citizen through SMS.

Request at concerned zonal offices/ headquarters

Applicant can write to the concerned zonal offices/ headquarters with a

- Letter of request with address details and contact number

- Copies of the registered documents in his/her favour

- Filled Form -6 application form

- Copy of the property or vacant land tax property tax Chennai paid receipt

On submission of the request for appeal of property tax, the assessor will check the application submitted and after informing him will measure the building. A proposal will then be submitted to the concerned officer and a Zonal Assistant Revenue officer will approve it. Once approved, the new assessment order-Notice 10 will be sent to the assesse and he will also be informed through SMS.

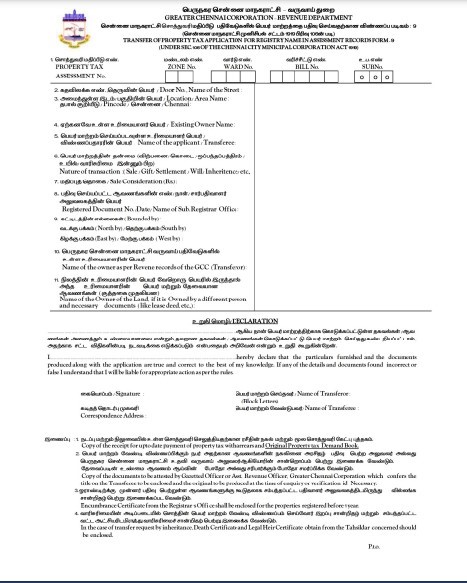

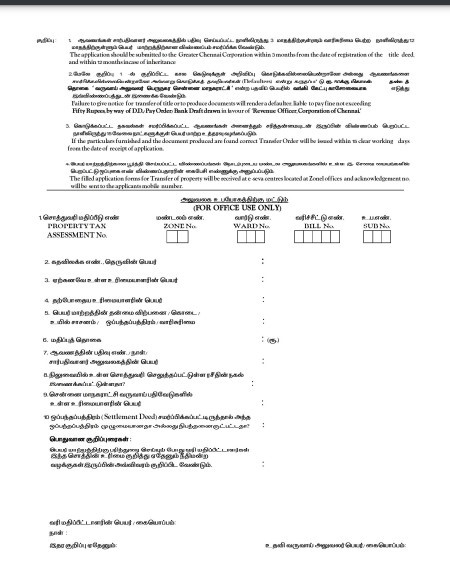

Transfer of property tax Chennai

Online application

Citizens can submit a request for online appeal for transfer of property tax Chennai through the Chennai property tax portal. Login to the Chennai property tax online citizen portal and enter details like

- Division

- Name of the Assessee

- Location of Property

- Area

- Location

- Street Name

- Door Number

- Contact Number

Read also : All you need to know about the MMRDA

Note that the assessee should submit the hard copy of registered documents in his/her favour, filled application form and last property tax Chennai paid receipt.

Offline application

At any one of the TACTV counters located in Greater Chennai Corporation premises, a citizen has to submit the following:

- Letter of request with address details and contact number

- Copies of the registered documents in his/her favour

- Filled Form -6 application form

- Copy of the property or vacant land tax paid receipt

Once submitted, acknowledgement will be sent to the citizen through SMS.

Request at concerned zonal offices/ headquarters

Applicant can write to the concerned zonal offices/ headquarters with a

- Letter of request with address details and contact number

- Copies of the registered documents in his/her favour

- Filled Form -6 application form

- Copy of the property or vacant land tax paid receipt

On submission of the request for appeal of property tax, the assessor will check the application submitted and after informing him will measure the building. A proposal will then be submitted to the concerned officer and a Zonal Assistant Revenue officer will approve it. Once approved, the name transfer order (Notice 9) will be issued to the assesse and he will also be informed through SMS.

Property tax Chennai: Correction of property tax assessment

Online appeal

Citizens can submit a request for correction of property tax assessment through the Chennai property tax portal. Login to the Chennai property tax online citizen portal and enter details like

- Division

- Name of the Assessee

- Location of Property

- Area

- Location

- Street Name

- Door Number

- Contact Number

Read also : All you need to know about the MMRDA

Note that the assessee should submit the hard copy of registered documents in his/her favour, filled application form and last property tax Chennai paid receipt.

Offline appeal

At any one of the TACTV counters located in Greater Chennai Corporation premises, a citizen has to submit the following:

- Letter of request with address details and contact number

- Copies of the registered documents in his/her favour

- Filled Form -6 application form

- Copy of the property or vacant land tax paid receipt

Once submitted, acknowledgement will be sent to the citizen through SMS.

Request at concerned zonal offices/ headquarters

Applicant can write to the concerned zonal offices/ headquarters with a

- Letter of request with address details and contact number

- Copies of the registered documents in his/her favour

- Filled Form -6 application form

- Copy of the property or vacant land tax paid receipt

On submission of the request for Correction of property tax assessment, the assessor will check the application submitted and will do a field visit if required. He will then send a proposal to the Zonal Assistant Revenue officer. Once he approves it, the correction in property will be done.

[ecis2016.org] How to apply for TNEB new connection?

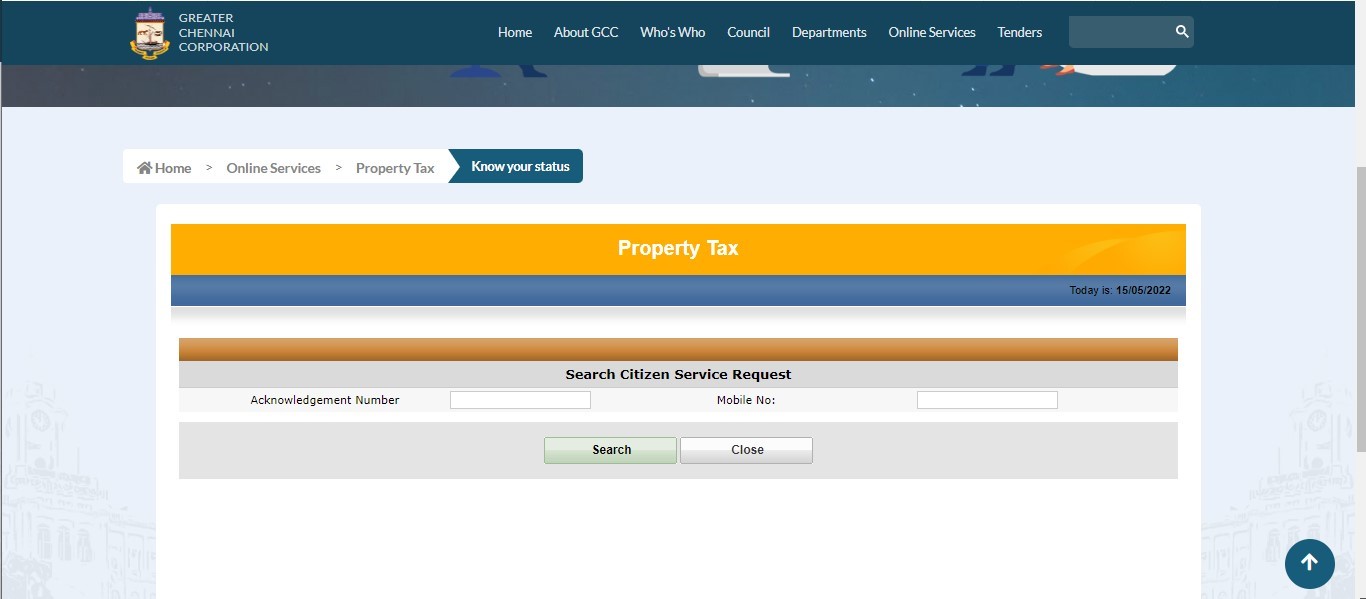

Property tax Chennai: Know your status

Visit https://chennaicorporation.gov.in/gcc/online-payment/online-tax-payment/know-your-status.jsp and click on Know your status. Enter the acknowledgement number and mobile no. and press search to know the status of your request.

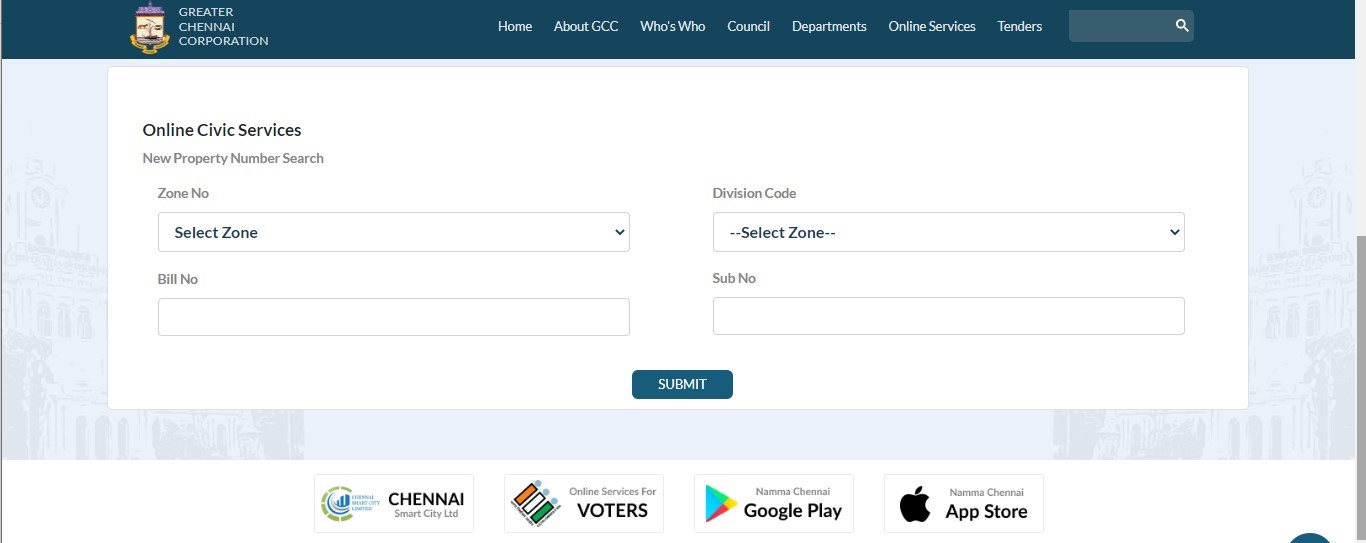

Property tax Chennai: New bill number search

Visit https://chennaicorporation.gov.in/gcc/online-services/online-payment/property-tax/ and click on ‘New bill number search’.

Enter zone no, division code, bill no, sub no and press submit. You will get the details you are looking for on property tax Chennai page.

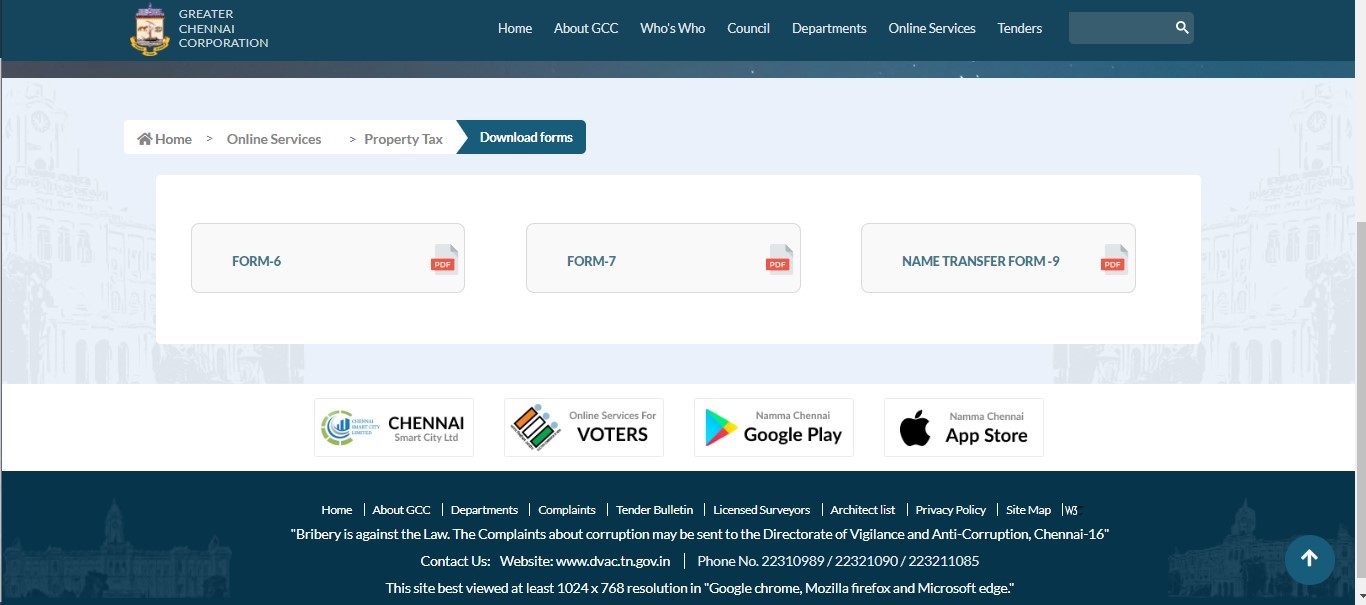

Property tax Chennai: Download forms

To download forms related to property tax Chennai, visit https://chennaicorporation.gov.in/gcc/online-services/online-payment/property-tax/download-forms/

To download form 6 from the property tax Chennai page, click on the Form 6 and a PDF will be downloaded on your computer.

To download form 7 from the property tax Chennai page, click on the Form 7 and a PDF will be downloaded on your computer.

To download form 9 from the property tax Chennai page, click on the Form 9 and a PDF will be downloaded on your computer.

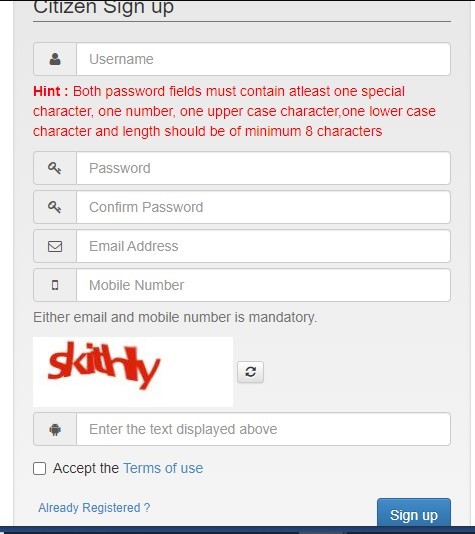

Property tax Chennai: Name transfer

Visit https://chennaicorporation.gov.in/gcc/online-services/online-payment/property-tax/ and click on ‘Name transfer’. You will reach the citizen portal page where you need to login using your username and password and then proceed with the name transfer process.

If you don’t have an account, click on ‘Not registered’ and first register.

Similarly, you have to login with username and password for going through the process of Objection, Sub-division, New Assessment and Amalgamation by clicking on these tabs on the property tax page and logging to the property tax Chennai citizen portal with the username and password.

Chennai property tax: Concessions allowed

- 10% library cess is calculated from the general tax of Chennai property tax.

- Tiled, thatched and other structures except those with terrace roofing, get a 20% rebate over the monthly rental value in Chennai property tax.

- Owner-occupied residential structures get a 25% rebate in monthly rental value in Chennai property tax.

- There is a 10% rebate over monthly rental value, for those commercial structures that are owned by the owner in Chennai property tax.

- A depreciation of 1% in Chennai property tax is given for every year for every building that is over four years old. However, there is a maximum limit of 25%.

Chennai property tax: What happens if you do not pay on time?

In case of not paying the Chennai property tax on time, the corporation penalises defaulters at the rate of 2% and it is charged automatically with the assessed value, after a grace period of 15 days. In case you wish to make changes to the property or its name, a no-dues Chennai property tax is mandatory.

Chennai property tax: How to get the property tax payment receipt?

On the official Chennai property tax online website, click on the option ‘Online property tax Receipt’. Then choose the zone number in property tax, division code for property tax Chennai, bill number and sub no. and press submit to get the Chennai property tax online receipt.

Then, click on ‘View Tax and Receipt’ details.

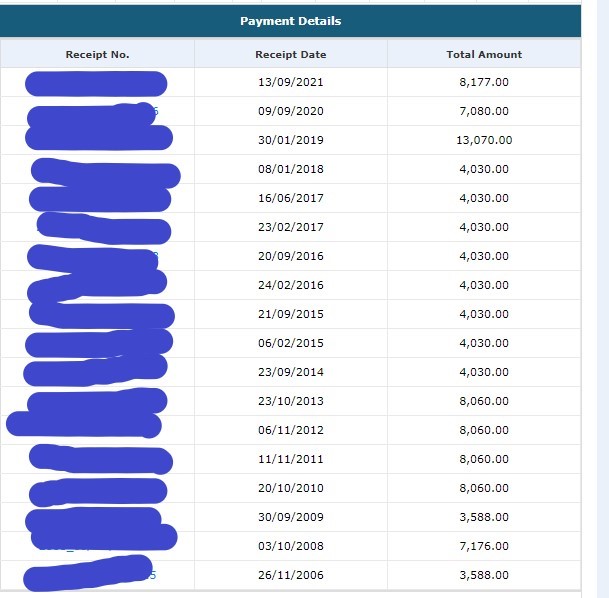

Scroll down to see the payment details which show all transactions over the years.

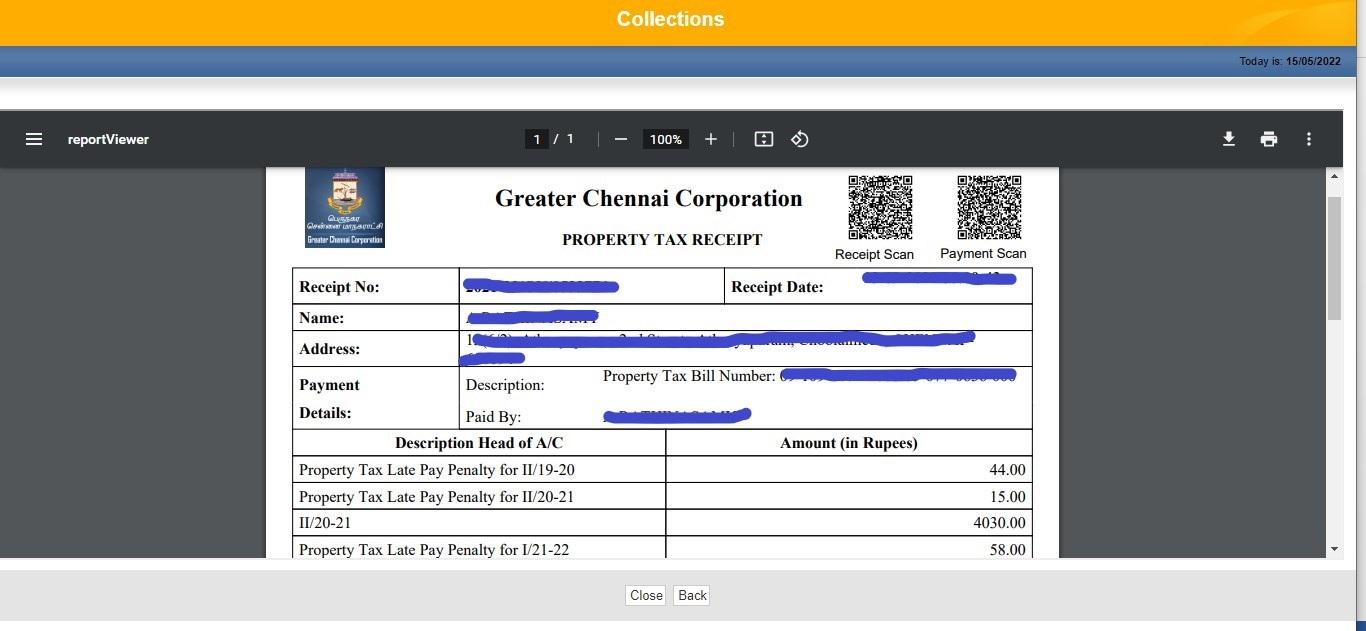

If you click on any particular receipt no. you will see the property tax Chennai receipt of that transaction.

Chennai property tax: What is vacancy remission?

The Chennai City Municipal Corporation (CMCC) Act, 1919 in Section 105 says that if any building which is either owned by self or rented happens to lie vacant for over 30 days in half-year, the Commissioner can remit so much not exceeding one-half of such portion of the Chennai property tax as relates to the building. In the case of FY 2020-21, the second half term is till October 15, 2020.

Chennai property tax: Mobile app

You can also pay Chennai property tax using the Namma Chennai app that can be downloaded from Google play store.

Chennai property tax: How to register your complaints?

The online medium not only makes your work easier but also keeps it transparent. You could pay your Chennai property tax online without having to meet the officials. However, in case you have had to make this Chennai property tax payment offline and you are asked for a bribe or if you witness any form of corruption, the Chennai Corporation mandates that you inform the Directorate of Vigilance and Anti-Corruption and get in touch with them on any of the following numbers: 24615989 / 24615929 / 24615949.

FAQs

Are there any extra charges for paying property tax in Chennai online?

If you are using a credit card or net banking, there are nominal charges that could vary from time to time while paying the Chennai property tax online.

What if I face problems while paying my Chennai property tax online?

You can contact the revenue department and apprise them. You can also call on 044- 25619258 for Chennai property tax online payment-related complaints.

Where can I pay the Chennai property tax if I am unable to do it online?

You can do so by visiting the walk-in counters of select banks. Chennai property tax collection through offline medium is done by Electronic Clearing Scheme (ECS).

I purchased a new flat and paid the property tax but lost the receipt. How do I find the Chennai property tax number?

Please check your property deed and other documents when you purchased the house to know about the Chennai property tax number.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle