[ecis2016.org] The official website of the Bhavnagar Municipal Corporation, commonly known as BMC Bhavnagar, offers many citizen-centric services like property tax payments and marriage registration

The Bhavnagar Municipal Corporation, known as BMC Bhavnagar, is a government body to carry out basic development projects in the city, in Gujarat. Established under the provisions of the Gujarat Provincial Municipal Corporation Act, 1949, the BMC Bhavnagar offers several citizen-centric services online.

You are reading: Bhavnagar Municipal Corporation: All you need to know about BMC Bhavnagar

Read also : BDA e auction: All about Bangalore Development Authority ongoing e-auctions for various sites

Services available on BMC Bhavnagar website

The following facilities are available on BMC Bhavnagar portal:

- Details of allocations made under the Pradhan Mantri Awas Yojana (PMAY)

- Details of allocations made under the Mukhyamantri Gruh Yojna.

- Property tax payment.

- Professional tax payment.

- Quick response cell.

- Details about tenders.

- Download birth/death certificates.

- Marriage registration.

- Development works.

- Vehicle tax payment.

- Application for online shop license.

- Application for fire NOC.

- Waste collecting vehicle tracking.

- Recruitment.

- Swachhata Survekshan details.

[ecis2016.org] How to check Gujarat Jantri rate online?

Read also : BDA e auction: All about Bangalore Development Authority ongoing e-auctions for various sites

Bhavnagar Municipal Corporation: How to pay property tax online?

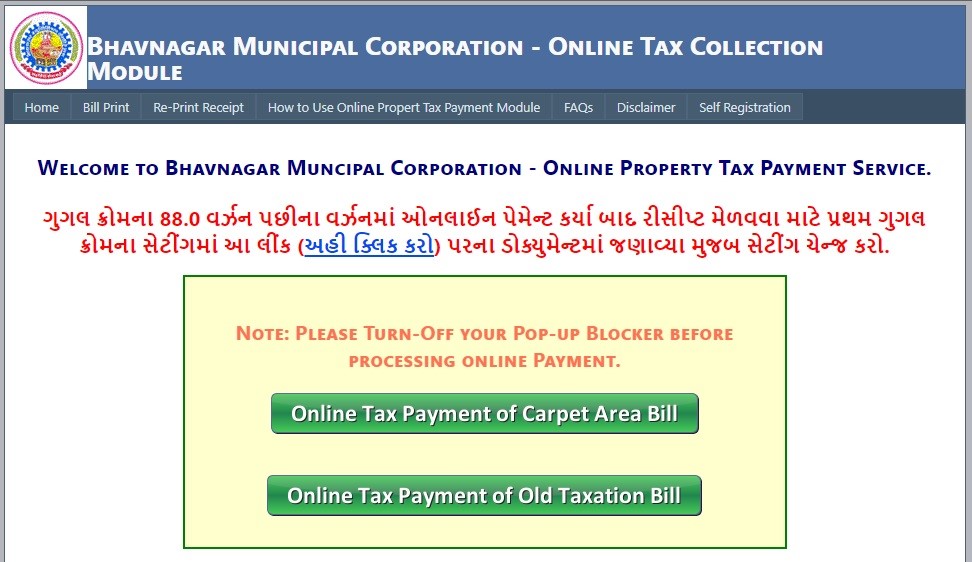

Step 1: Go to Bhavnagar Municipal Corporation’s official website.

Read also : BDA e auction: All about Bangalore Development Authority ongoing e-auctions for various sites

Step 2: On the home page, click on the ‘Online Property Tax Payment’ option on the top.

Step 3: Now, you need to select one of the two options:

(1) Online Tax Payment for Carpet Area Bill

Read also : BDA e auction: All about Bangalore Development Authority ongoing e-auctions for various sites

(2) Online Tax Payment for Old Taxation Bill

Read also : All you need to know about Tripura RERA

Read also : BDA e auction: All about Bangalore Development Authority ongoing e-auctions for various sites

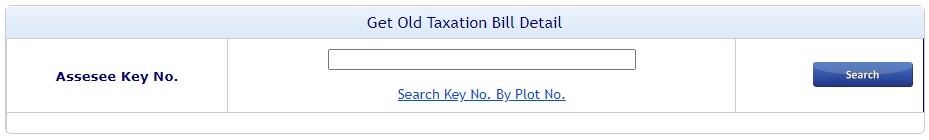

Step 4: In either case, all details of your outstanding bill will be shown after you enter the asset key number or form number and click on ‘Show Details’.

Step 5: For security verification, enter the Captcha. If you want to get feedback via an SMS, enter your mobile number in the field for SMS next to it.

[ecis2016.org] All about Bhu Naksha Gujarat

Step 6: On the online property tax amount visible on screen, you need to make the full payment using your debit, credit cards or net-banking.

Step 7: After the successful bill payment, the receipt will appear on the screen. You will also receive a confirmation via SMS. Your property tax payment receipt can also be reprinted at the later stage by clicking on ‘Re-Print Receipt’ given in the menu bar, by clicking on the tax system applicable to you (carpet area or old taxation) and entering your asset key number/form number.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle