[ecis2016.org] There are various methods used to attach monetary value to a piece of land. Read on about some of the more widely used ones

The value of land in India, especially in urban regions, has grown exponentially over the past two decades, on the back of the terms like ‘land scarcity’ and ‘space crunch’. Such has been the demand for land that its values have continued to show appreciation, in spite of a multi-year slowdown in the real estate market in India, which has been aggravated by the Coronavirus pandemic and its fallout on human lives and the economy. In fact, the impact on value appreciation on new property has also been negligible as reflected in numbers below.

You are reading: How to calculate land value?

Annual property price growth: City-wise break-up

| City | Average price as on June 30, 2021 (in Rs per sq ft) | Annual growth in % |

| Ahmedabad | 3,251 | 5 |

| Bangalore | 5,495 | 4 |

| Chennai | 5,308 | 3 |

| Hyderabad | 5,790 | 5 |

| Kolkata | 4,251 | 2 |

| MMR | 9,475 | No change |

| NCR | 4,337 | 2 |

| Pune | 5,083 | 3 |

| National average | 6,234 | 3 |

Source: Real Insight: Q2 2021

Now, one may wonder why the worth of specific land parcels, typically in rural areas, remains largely unchanged while others, mostly in urban areas, witness huge appreciation in values over a year.

According to economist Ajay Shah, if one were to place 1.2 billion people in 1,000-sq ft homes meant for a family and two workers of the family into office/factory space of 400 sq ft, then, roughly 1% of India’s land area is required, assuming an FSI of 1. Hence, it is not the scarcity but the human tendency to stay close to one another that leads to value appreciation of land in certain parts of the country. This decisive factor is behind every popular method adopted to arrive land valuation in India.

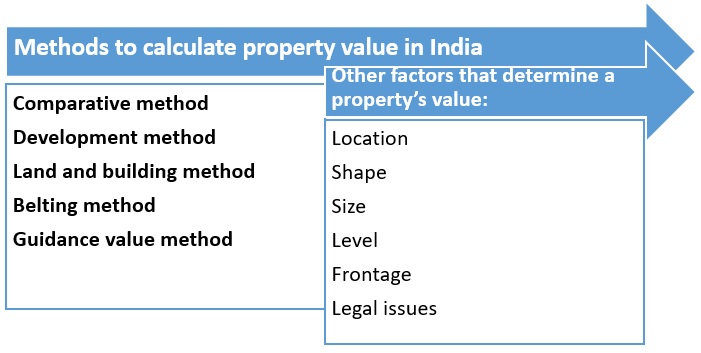

According to Harvard Law School professor Oliver Oldman, the key to developing an accurate land-value assessment, is the process of land-value mapping. With that as the guiding light, several land valuation systems have been developed, to arrive at the true value of land across the world. Based on their effectiveness, a handful of methods to arrive at the worth of land and fix its price, have been more popular globally. These are also quite commonly used in India. Discussed in this article are some key ones.

Comparative property valuation method of land valuation

At a time when apartment-based projects have become an inherent part of urban living, this method is often put in practice, to arrive at the worth of flats. Also known as the sales comparison approach, this method helps you arrive at the value of your property, by way of examining the value of similar properties in that very location.

Let us say two flats were recently sold in your housing society for Rs 1 crore each. If you were to sell your property in the near future, the same amount would be the asking price for your property.

This property valuation method works, because you are living in an active market where comparable data exists, to make the calculation. However, when you actually put your flat up for sale, you might find that buyers are not willing to pay you more than Rs 90 lakhs for your flat. This could be because of many reasons.

Location: Even within a housing society, location plays a major role in deciding a property’s worth. Flats that are closer to the main entry point, for example, will fetch a lower price, because of the continuous disturbance that the residents may be subjected to. Similarly, a park-facing flat is more lucrative for a buyer and hence worthier than a flat that is surrounded by other flats.

Shape: While nobody prefers a house with an irregular shape, the possibility of such homes getting as much as the asking price are further diminished with Vastu making a big comeback in India. Under the principles of Vastu, flats with irregular sizes hamper the owner’s personal, as well as professional growth.

Read also : Indian homebuyers are looking for ready-to-move-in (RTMI) properties: ecis2016.org and NAREDCO survey

Size: If your house is even slightly smaller than your neighbour’s, your property would never command the same monetary value as their’s.

Level: Depending on the city where you have your apartment, the level of your apartment would also decide the value of your property. In Mumbai, an upper-storey flat in a housing society costs more than an apartment at the ground floor, because of recurring flooding during the monsoons. The opposite is true in Delhi-National Capital Region (NCR) where ground floor homes command a premium.

Frontage: A corner flat or a corner plot, by virtue of having easier entry and egress points, would command a premium, as compared to other properties.

Legal issues: Suppose your property is jointly owned by your sibling who is not willing to sell his share in the property. Such a problem may not only stall the sale but also result in value depreciation.

[ecis2016.org] igrs.ap.gov.in market value in Andhra Pradesh (AP)

Development method of land valuation

This method is primarily used in deciding the worth of plots and apartments that are built on such plots. Also known as the residual land value method, this globally accepted approach helps one to gauge the potential of a land parcel.

- Best ways to pay rent using credit cards: Step by step guide to ecis2016.org Pay Rent platform

- Aurangabad Property Tax: Everything that you should know

- All you need to know about Madhya Pradesh property tax

- What is SGX Nifty and why is it important?

- Mumbai pips other metros in residential demand – records the highest growth in Q1 2022

At one point, the worth of the plot might be negligible but upcoming infrastructure development could increase its worth multifold.

In Jewar, for example, a bigha (27,000 sq ft) of land was being sold for Rs 4-5 lakhs in the past. After plans firmed up to build NCR’s second airport at Jewar, land rates have now touched Rs 20-25 lakhs a bigha. Consequently, values of apartments in housing societies in nearby Greater Noida locations have also increased, along with rentals.

The land and building method of land valuation

Under this method of land valuation, the value of land is separately assessed and the value of the building is added to the number, to arrive at the final value. using this method, one could arrive at land valuation as well as property valuation.

To reach the value of the building, reconstruction cost is first worked out and then, adjustments are made for depreciation. If the building could be reconstructed for Rs 25 lakhs, for instance, then, Rs 5 lakhs might be deducted from its value as depreciation, because of its age, method of construction, current condition, quality depreciation, etc. By this process, the cost of the building is only Rs 20 lakhs, in this case. Now, the rental capacity of any comparable property should be factored in, to reach its capitalised value by multiplying its net annual income (let us assume this is Rs 55 lakhs). The difference between the two figures, i.e., Rs 35 lakhs, is the land value.

The belting method of land valuation

To assess the worth of a large land parcel in urban areas, the belting method is most effective and generally used. For this purpose, the entire land parcel is divided among three belts, with the greatest weightage given to the part closest to the main road. Typically, the front belt could stretch up to 10 ft and the second belt up to 50 ft. The part thereafter would be the third belt. While 75% of the value of the first belt could be assigned to the second belt, half of its value could be assigned to the third belt. If belt 1 is worth Rs 10 lakhs, areas up to 150 ft would be worth Rs 7.50 lakhs. Areas beyond this would be worth Rs 5 lakhs, depending on how vast it is.

The guidance value method of property valuation

For some of us, the job becomes easy since authorities have carried out the onerous task and have allocated a specific guidance value — also known as circle rate, ready reckoner rate, etc. — to land. This is done by states in order to levy stamp duty and registration charges on transfer of properties. Gurugram’s district administration, for example, recently announced a hike in circle rate that is likely to make purchase of plot-based properties costlier. However, the government-specified rates could be higher and lower than the prevalent market value of the property. In case you are planning to sell your plot/flat, find out about the prevalent market rate.

Market value of land

Read also : IGRSUP: Stamp and registration department UP services explained

The market price of land and the market value of land are not one and the same thing. The market price of land is the money that the owner is willing to sell his land for, in the open market. The market value of the land is reflected in how much this land is worth, especially in the eyes of prospective buyers, as compared to its price.

Almost always, there is a value that an owner attaches to his property, based on several factors. However, when a prospective buyer starts to evaluate this same land, he may not assess this asset to be as worthy as estimated by the owner. This is indicative of the fact that buyers and sellers do not attach the same value to land.

The difference between market value of land and market price of land

The market price of a land parcel can be determined based on some key facts, without even physically visiting the property. The factors that determine the market price of land or property are supply and demand, the condition of the property and past transactions for similar properties.

You just have to do some data crunching and find out for the price at which similar land parcels in the same area are being sold currently. So, if a similar land plot sale fetched the owners, say, Rs 2,000 per sq ft, an agent would expect to get the same price for his client.

However, for the agent to fully understand the value of this land parcel, he would have to physically visit the site, since the market price of land is attached without adding the value component.

If the site is adjacent to the main road, for example, the plot has greater value than similar land parcels in the areas. If the plot is, say, adjacent to a cemetery, its value would be much less than other similar plots in the area.

Now, only after assessing all these factors, should an owner put a market price to his land parcel or property. This should be a price that the buyer should be willing to pay and the seller should be willing to accept.

The rate at which the transaction would finally take place, would be the market price of land, which will have an impact on the market value of properties in the area. Hence, both these things continue to impact each other immensely.

Key points to remember during land valuation

Location of the property: Location plays the biggest role, in determining the worth of land. The scale of development in a locality, decides its worth or the lack thereof. This is why a large land parcel in a developing locality would fetch much less money than a tiny piece of land in a well-developed area. The increase in land prices near the Jewar Airport, in Noida, is a fine example of this.

Quality of construction: Second in determining the value of land comes the quality of construction of the building standing on it. In the same locality, a building will cost much more if premium materials have been used to build it, as compared to a building constructed using average quality materials, even if there is no age difference between the two buildings. Do note that you have to hire technical experts to gauge the construction quality, as you may lack the expertise to do so on your own.

Age of the property: Age is another factor that impacts the worth of a property. An old construction would cost much less than a new construction in the same location.

Builder brand: In case of a building, the brand of the developer will also have an impact on the pricing. A project by a well-known developer will, for instance, cost more than a project by comparatively less-known developer.

FAQs

What is land value?

The cost attached to a property is known as its value.

What is guidance value?

Guidance value is the state-specified value allocated to land/property.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle