[ecis2016.org] Businesses dealing in sales and supply of goods and services have to complete GST registration under the rules prescribed by the goods and services tax regime.

Businesses dealing in sales and supply of goods and services must complete GST registration under the rules prescribed by the Goods and Services Tax (GST) regime. Carrying out businesses without GST registration is considered an offence in specific cases and could attract a significant monetary penalty.

You are reading: GST registration: What is it and how to conduct GST registration online?

After GST registration, a 15-digit Goods and Service Tax Identification Number (GSTIN) is issued, acting as your identification number for all business operations, based on which GST will be levied and collected.

When is GST registration mandatory?

Any business in India whose aggregate turnover exceeds the threshold limit is liable to get registered. However, certain categories of businesses mentioned in Schedule-III of the MGL are liable to get registered, irrespective of the threshold. A farmer is not considered a taxable person and is not liable for GST registration.

For companies involved in the supply of services, GST registration is mandatory if their annual turnover exceeds Rs 20 lakhs. For businesses dealing in the supply or sales of goods, GST registration is mandatory in case their annual turnover exceeds Rs 40 lakhs.

GST registration threshold is Rs 10 lakhs if you have a place of business in Arunachal Pradesh, Assam, Himachal Pradesh, Jammu & Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura or Uttarakhand.

GST registration is mandatory, irrespective of the turnover, in the case of:

- Inter-state supplies

- Supply of goods through an e-commerce portal

- Service provider

- Agent for registered principal

- Liable to pay the reverse charge

- Non-resident taxable person

- Casual taxable person

- Input service distributor

- TDS/TCS deductor

- E-commerce operator

- An online data access and retrieval service provider

Also read all about the process of GST search and GST number check

GST registration: Benefits

- You are legally recognised as a supplier of goods or services.

- Proper accounting of taxes.

- Facility to pass on the credit of the taxes to purchasers or recipients.

- Authorises you to collect tax on behalf of the government.

Documents needed for GST registration

- PAN card

- Aadhaar card

- Photograph

- Address proof

- Details of business

- Digital signature

The following documents can act as proof of address:

- Passport

- Voter ID

- Aadhaar card

- Ration Card

- Telephone or electricity bill

- Driving licence

- Bank statement

The following documents can act as proof of identity:

- PAN card

- Aadhaar card

- Voter ID

- Passport

[ecis2016.org] A guide to the government’s GST portal login and online services

GST registration online process

Step 1: Go to the official GST website. Under ‘Services’ click on ‘Registration’. You will get the option of ‘New Registration’. Using the same tab, you can later ‘Track Application Status’.

Step 2: Fill in all the required details in the form.

Step 3: You will receive OTPs on your email ID and mobile number. Input them both and click and ‘Continue’.

Step 4: The page will now display your temporary reference number. Save it for future use and click ‘Proceed’.

Step 5: Return to ‘Service’ on the homepage. Under ‘New Registration’ select ‘Temporary Reference Number (TRN)’ and input the TRN and the Captcha. Click on ‘Proceed’.

[ecis2016.org] How to make GST payment online and offline?

Read also : GST on cement and its impact on the cement industry

Step 6: Enter the OPT received on your mobile or email to proceed.

Step 7: The dashboard will show ‘My Saved Application’. Click on the ‘Edit’ icon under ‘Action’.

Step 8: The Registration Application form with 10 tabs will appear on the screen. Click on each tab to enter your details.

Step 9: Select Yes/No to opt-in or out of the Composition Scheme under ‘Option for Composition’.

Step 10: Select Yes/No for type of registration as a casual taxable person. If ‘Yes’, generate the challan by entering the details for advance tax payment.

Step 11: For ‘Reason to obtain registration’, select ‘Input Service Distributor’.

Step 12: Input the remaining details. Click on ‘Save & Continue’.

Once the business section filing is complete that tile will turn blue.

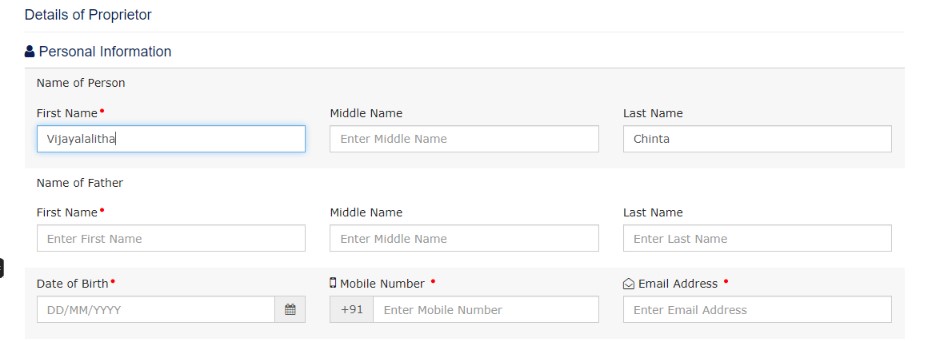

Step 13: Now enter promoter details and save and continue.

Step 14: Fill in the details of the authorised signatory and save and continue.

Read also : Dos and don’ts for tenants sub-letting their apartments

Step 15: Fill in the details regarding the principal place of business and save and continue.

Step 16: Now add the additional place of business, if any.

Step 17: Next is the GST tab.

Step 18: Next is the ‘State Specific Information’ tab.

Step 19: Next, you will get the Aadhaar Authentication tab.

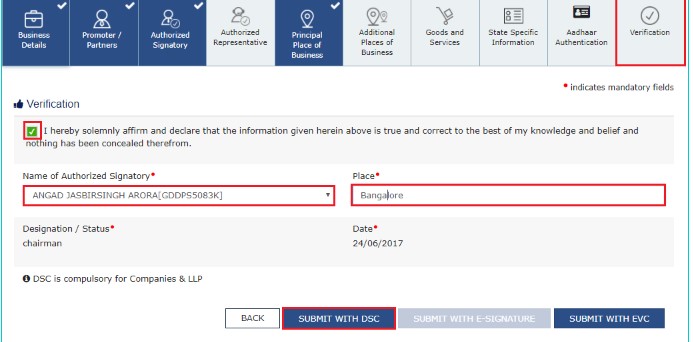

Step 20: Last comes the Verification tab.

Step 21: Once all the details are submitted successfully, the following message will appear on your screen.

FAQs

Is GST registration permanent?

Yes, GST registration is permanent unless the GST Registration Certificate is surrendered/cancelled/suspended/revoked.

How can I apply for GST registration?

You can apply for GST registration online on the GST web portal. Alternatively, you may use the offline utility provided on the GST website.

What are the prerequisites for GST registration?

To apply for a GST registration, you ought to have the following details/documents: 1. PAN card; 2. Details of your business; 3. Valid and accessible e-mail ID and mobile number; 4. Documentary proof of the constitution of your business; 5. Documentary proof of promoters/partners; 6. Documentary proof of principal place of business; 7. Details of additional places of business, if applicable; 8. Details of authorised signatories, including photographs and proof of appointment; 9. Details of primary authorised signatory; 10.Business bank account details along with bank statement or first page of bank passbook; 11. Valid Class-II or Class-III DSC of authorised signatory in case of companies and LLPs; 12. Valid Class-II or Class-III DSC or Aadhaar (for e-sign option) in case of other entities.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Must Knows