[ecis2016.org] Here’s a guide on how to check CIBIL score by using your PAN card number.

The credit report summarises all the credit activities you have undertaken since you first obtained credit up to the time you last paid your credit. A credit report is used by banks and non-bank financial institutions to assess the credit behaviour and creditworthiness of credit applicants.

You are reading: How to check CIBIL score using PAN card number?

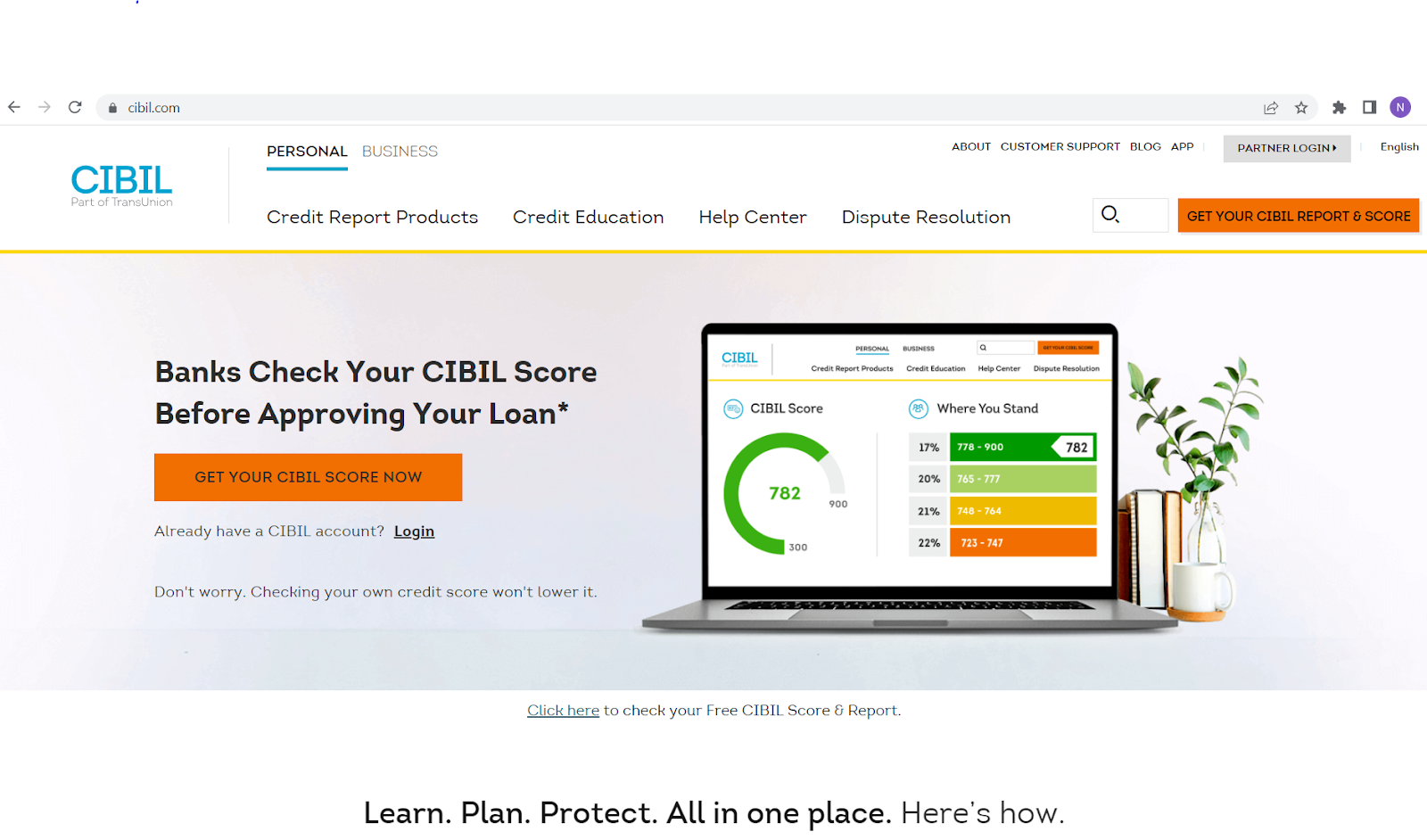

Credit scores provided by CIBIL are often considered by banks before making a loan offer. A credit score from CIBIL is composed of financial transactions over the past six months and ranges between 300 and 900, where 900 represents the best score. A person can follow the procedures given below to check CIBIL score by PAN card from the official CIBIL website. CIBIL generates a free report only once per year, after which the report is a fee-based service.

Check your CIBIL score using a PAN card

For CIBIL score check free online by PAN number, perform the steps given below:

- Visit https://www.cibil.com/freecibilscore

- Click the ‘Get Your Free CIBIL Score’ link.

- Provide information such as your birthdate, mobile number, and email address.

- Enter your PAN number after selecting ‘Income Tax Id (PAN)’ as the ID type.

- Now, choose the income type and monthly income.

- Next, enter your address, telephone number, and email address and click on ‘submit’.

- Once you submit the form, your CIBIL score will appear on the dashboard.

To check your CIBIL score using the subscription method, follow the steps given below:

- Visit the official CIBIL website at https://www.cibil.com/

- Click the ‘Get Your Credit Score’ link in the top right corner

- Select a subscription method

- Provide information such as your birthdate, mobile number, and email address

- Specify a password that will be used to login

- Enter your PAN number after selecting ‘Income Tax Id (PAN)’ as the ID type

- Click the ‘verify your identity’ option and provide accurate answers to the questions

- Proceed to the ‘make payment’ tab and complete the process

- Log in to your account by using your email or OTP

- Fill out the form that appears

- Once you submit the form, your CIBIL score will appear on the dashboard

Read also : Agricultural income: Taxation of income from agricultural land

[ecis2016.org] Read about Baroda Rajasthan Kshetriya gramin bank IFSC code

Why is PAN card information required to check the CIBIL score?

PAN Cards are documents that are used to identify an individual based on their unique PAN number. Furthermore, most individuals’ PANs are also linked to their bank accounts and financial accounts.

By adding your PAN, you make it easier for credit agencies to locate your information efficiently. When you enter your PAN card number to view your CIBIL score, it is used only to locate and authenticate the credit information associated with it.

It is still possible to obtain your CIBIL Score without a PAN card, using the identification proof number printed on your passport, voter ID, or driver’s licence instead.

Important factors that impact your CIBIL score

The following factors may affect your CIBIL score:

Past Payments: The ability of the borrower to pay off debts determines their credibility. Therefore, if a borrower defaults on a payment or fails to make payments on time, then the credibility of the person becomes damaged, which eventually leads to a low credit score.

Debt to income ratio: If an individual has taken out several loans, but their income is lower than his debts, this indicates that they have poor credit.

Read also : All about SSP Pre-Matric Scholarship, Karnataka

Type of enquiries made: When a borrower or lender makes a soft inquiry to learn about their credit history, it does not appear on their credit report. However, if several lenders check your score, then this can negatively impact your credit score.

Utilisation of credit cards: A high credit card utilisation rate and failure to pay credit card bills on time impact your credit score negatively as well.

What happens when your name is added to the defaulter list?

Having your name on the defaulters list can negatively impact your credit history. The loan application process may be impacted if your name appears on the defaulters list. Before applying for a loan, find out why your name is on the defaulters list and take the appropriate steps to resolve the issue.

How do you remove your name from the defaulter list?

To ensure that your name is not on the defaulter’s list, follow the below-mentioned steps.

- You should first obtain your free CIBIL Score and review it carefully.

- Identify the outstanding amounts and clear them all.

- Next, obtain a No Due Certificate from the respective bank.

- Submit the certification to the credit bureau and request that your name be struck off the defaulters list.

- Once this is done, submit all the supporting documents along with your loan application form.

- A confirmation message will be sent to you via email, which will include the status of your dispute application.

Contact the bank’s personnel immediately if you find any discrepancies with your information.

Check out: Have info. regarding Punjab bank IFSC code

FAQs

What factors determine your credit rating?

Your credit score is calculated based on information and details from your credit report. Several factors are taken into consideration, such as payment history, new credit, length of credit history, the amount owed, and types of credit used.

How does PAN change affect my CIBIL score?

If you lose or damage your PAN card and request a new one, your CIBIL will not change since your PAN number will remain the same.

What is a short-term credit rating?

A short-term credit rating is a reflection of your creditworthiness within a short timeframe. Your short-term credit rating indicates your likelihood of defaulting within one year.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Must Knows