[ecis2016.org] Here is a step-wise process to download your ICICI Bank home loan statement

Those who have taken a loan from private lender ICICI Bank, will need ICICI home loan statement for a variety of reasons. Apart from the fact that this ICICI Bank home loan statement is required to claim tax deductions on home loan, it is also instrumental in understanding the progress a borrower is making, in repaying his ICICI home loan EMI. Here is how to check ICICI home loan statement online.

You are reading: How to get ICICI home loan statement online?

[ecis2016.org] All about RBI guidelines for home loan

Download ICICI home loan statement online

To download your ICICI Bank home loan statement online, you will have to activate your net banking, using your user ID and password.

Here is a step-wise process to download your ICICI Bank home loan statement:

Steps to check ICICI Bank home loan statement

Step 1:

Log on to ICICI Bank net banking website: https://www.icicibank.com/Personal-Banking/insta-banking/internet-banking/index.page

Step 2:

Login using your net banking user ID and password.

Step 3:

Read also : Axis Bank login: Your guide to Axis Bank internet banking

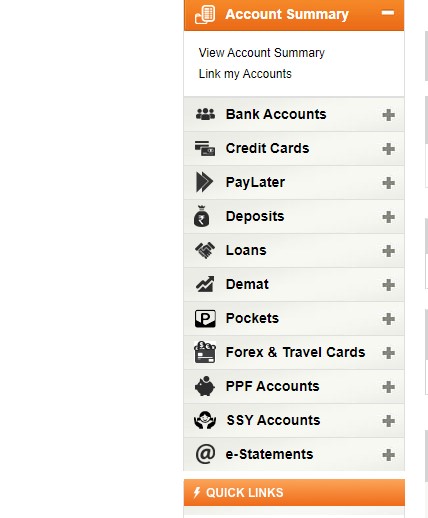

On the screen that appears, click on ‘E-statement’.

Step 4:

Among the multiple account numbers that might appear in the drop-down, you have to select the account number and the period for which you need the statement.

Step 5:

Now click on ‘PDF’ to generate the home loan statement.

[ecis2016.org] What is legal and technical verification of property in home loan?

When do you require your ICICI Bank home loan statement?

- You will require the document to prove your investments, in order to claim tax deductions.

- You will need to submit this document, if you are applying for another loan.

- This document also provides you with a clear understanding, of how the bank is recovering the interest and the principal component from your home loan, how much money you have already paid and how much money you still owe to the bank.

[ecis2016.org] All about CERSAI

How to track ICICI home loan application status?

Those who have applied for a home loan with ICICI Bank, will also be able to track the status of their application by following certain easy steps.

With form number or reference number: Go to the official website of the bank. In the personal banking section, under products, you will find the home loan tab. Click on it to arrive at the ‘Track My Status’ option. Key in your form number or reference number, to get the status of your application.

Read also : All you need to know about Standard Chartered credit card net banking

In case you forget the reference number: In this case you will have to provide several personal details, such as name, date of birth, PAN, loan amount and type, etc. and answer certain security questions, to track the status of your application.

[ecis2016.org] All about Section 80EEA

ICICI Bank home loan in 2022

With the Reserve Bank of India (RBI) increasing the repo rate, at which the banking regulator lends credit to scheduled banks in the country, to 4.40%, banks are expected to increase their lending rates. However, so far, home loans at ICICI Bank are available at 6.70%-7.55% per annum. The bank also offers construction loans to buyers, who are interested in building their own property with the help of housing finance. ICICI Bank currently lends home construction loans at 7.20% to 8.20% annual interest, apart from charging 0.50% of the loan amount as processing fee.

Among the many other benefits that the bank offers to its customers is ease of doing business.

As the public lender has launched an array of digital initiatives, it hopes to source 75% of its new home loans digitally, in the next few years. As it is, ICICI Bank’s mortgage loan portfolio has crossed Rs 2 trillion. While nearly one-third of the new home loans are sourced digitally, the bank expects this number to reach three-fourths of new home loans in the next few years. The bank has made significant investments, to to simplify the online processing for one of the most complex financial products, i.e., home loans.

[ecis2016.org] Know about SBI CIBIL score

For instance, those who have taken a home loan from ICICI Bank do not have to visit the bank’s branch, to get a home loan statement or interest certificate. While you can visit any ICICI Bank branch and request for a copy of your home loan statement, the document can also be downloaded through net banking.

Also see: How to check ICICI Bank home loan status

It is important to note here that home loan borrowers have to submit their home loan interest certificate to their employer, to claim deductions under Section 80C, Section 24(b), Section 80EE and Section 80EEA.

[ecis2016]: Best banks to get your home loan in 2022

FAQs

Can I download my ICICI Bank home loan statement online?

Yes, you can download your ICICI Bank home loan statement online using net banking.

How can I get my ICICI Bank home loan statement offline?

You can visit any ICICI Bank branch and request for a copy of the home loan statement.

When do I need a home loan interest certificate?

Banks will demand to see this certificate, if you are applying for another loan to gauge your loan-to-value ratio. You will also have to submit the home loan statement, in order to claim tax benefits while filing income tax returns.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Must Knows