[ecis2016.org] Here’s a step-by-step guide on how to open an SBI account online.

The State Bank of India is one of the largest banks in the country, with about 9,000 branches across the nation. Customers can open a savings account with SBI very easily and enjoy the benefits that come along with it. SBI account opening can be done both online and offline.

You are reading: How to open an SBI Savings Account?

SBI online account opening: Eligibility

To be eligible for SBI new account opening, you must meet the following criteria:

- The applicant should be an Indian citizen.

- The individual should be at least 18 years of age.

- The parent or legal guardian can open the account for a minor.

- The applicant should have valid identity proof.

- The applicant should be able to make the initial deposit as per the account chosen.

SBI account opening: Documents required

Documents required for SBI bank account opening are:

- Proof of identity: Passport, Driving license, Voter ID, etc.

- Proof of residence: Passport. Driving license, Voter ID, etc.

- PAN Card

- Form 16 (If PAN card not available)

- Two latest passport-size photos

Read also : All you must know about Labour Card Odisha

Check out: Have info. regarding IFSC code of SBI bank

How to open an SBI account online?

For an SBI savings account opening online, follow these steps:

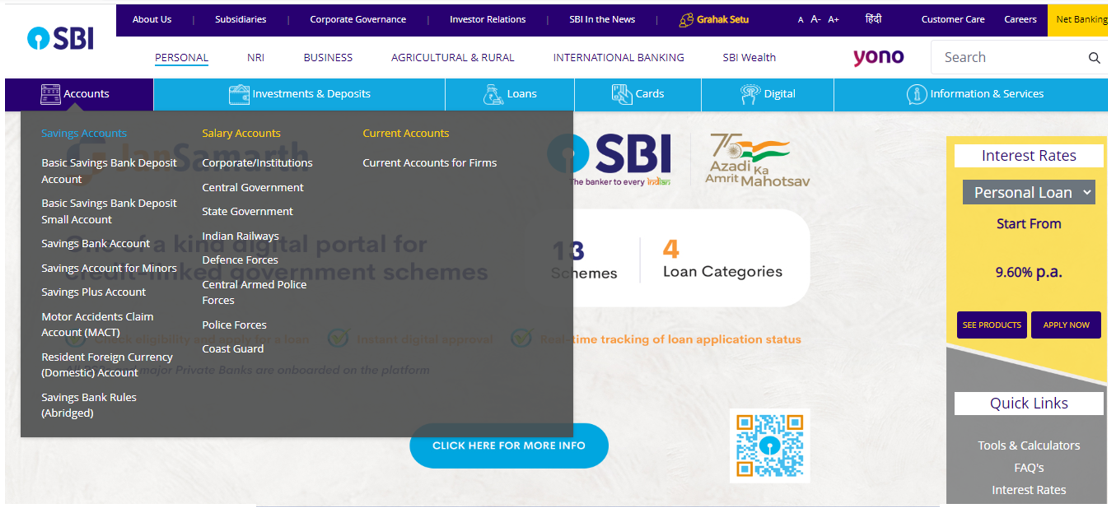

- Visit the official website of SBI.

- Click on Accounts and select Savings Account.

- Click on the SBI Savings account option and click Apply.

- In the application form, fill in the name, address, date of birth, and other details and click on submit.

- On the completion of this process, visit the branch with the required KYC documents.

- The verification process will be initiated and the account will be activated in 3 to 5 working days.

Steps to open SBI savings account offline

- Visit the SBI branch nearest to you.

- Request for an account opening form.

- Fill in the form as per the requirements. Fill in form 2 only if you do not have a PAN card.

- Ensure that all details are perfectly filled and as per the KYC documents submitted.

- Make an initial deposit of Rs. 1000.

- After the completion of the process, collect your free passbook and chequebook.

Nomination facility

After the mandate by the Government of India, all savings bank account customers are required to have a nominee who can operate the account on their behalf. When filling in the form, a nominee will have to be made by the applicant. In the case of a minor, they can operate the account themselves, only when they turn 18 years of age. A nominee can operate the account after the death of an account holder.

SBI Welcome Kit

Read also : Assam RERA: Everything you need to know

After approval for SBI online (or offline) account opening, the SBI provides a welcome kit to all its customers. The kit contains the following:

- SBI ATM debit card

- The PIN will be sent by a separate post

- SBI cheque book

- Pay in slips

Ensure that the kit is sealed on arrival.

Check out: Have knowledge about SBI IFSC code list

Helpline number

For any complaints or grievances, customers can contact the SBI customer helpline- 1800112211.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Must Knows