[ecis2016.org] Here is how you can claim deductions on tax liability under income from house property using provisions under Section 24 of the Income Tax Act.

Section 24 of Income Tax (I-T) Act is among many provisions that help taxpayers in India to save taxes. Section 24 is meant specifically to cut down on tax imposed under ‘Income from House Property’.

You are reading: Section 24 of Income Tax Act: Tax deduction against home loan interest payment

Sec 24: What is income from house property?

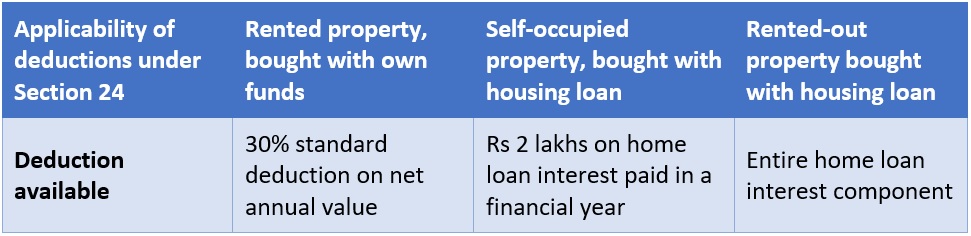

While Section 24 of the I-T Act provides for levying tax on rental income from the property belonging to owners under income from house property, its sub- sections – Section 24A and Section 24B – talk about deductions they can claim in two different scenarios.

Applicability of Section 24A: Standard deduction

Section 24A provides a flat 30% deduction on net annual value of the rented property, in case the property has been bought using the owner’s own money. So, if Ram bought a house and gave it on rent for an annual rent of Rs 1,00,000, then, he can claim tax deduction of Rs 30,000. However, claiming deduction under Section 24A will not be possible if Ram uses the said property, a condition known as self-occupied. However, Section24B gives you a window to claim deduction in case of self-occupied properties too, provided housing loan is involved. Let us understand how.

Applicability of Section 24A of I-T Act on rented property: Deduction against home loan interest payment

| Particulars | Amount |

| Gross annual value (GAV) | Rs 10.20 lakhs |

| Deduct from GAV the municipal tax to arrive at net annual value (NAV) | Rs 20,000 |

| NAV | Rs 10 lakhs |

| Exemptions available | |

| Standard deduction of 30% on NAV under Section 24(A) | Rs 3 lakhs |

| Deduction of up to Rs 2 lakhs on home loan interest paid | NIL |

| Total deduction | Rs 3 lakhs |

Applicability of Sec 24B

In case of self-occupied property, its annual value is considered as ‘nil’. This would, in fact, result in loss for the property. In such case, the borrower can claim tax deduction of up to Rs 2 lakhs on home loan interest paid in a financial year under Section 24B. In case the property is generating rental income, the entire home loan interest component is allowed as deduction.

Applicability of Section 24 of I-T Act on self-occupied house property

| Particulars | Amount |

| Gross annual value (GAV) | Nil |

| Deduct from GAV the municipal tax to arrive at net annual value (NAV) | Nil |

| NAV | Nil |

| Exemptions available | |

| Standard deduction of 30% on NAV under Section 24(A) | Nil |

| Deduction of up to Rs 2 lakhs on home loan interest paid | Rs 2 lakhs |

| Loss from house property | Rs 2 lakhs |

Read also : How to be legally secure when buying an under-construction property

Note, this deduction would be restricted to Rs 30,000 only, in case:

- The home loan was taken before April 1, 1991.

- The loan is used for repairs, renewal, or reconstruction, even though it was borrowed after April 1, 1991

- The loan was taken on April 1, 1991, or after that, but house construction was not completed in five years. So, if the loan was taken on April 1, 2022, the house must be completed by March 31, 2027. In such case, the deduction amount is reduced to flat Rs 30,000.

Also note, this deduction will not be allowed unless you provide a certificate about the home loan interest payment from your lender.

“No deduction shall be made … unless the assessee furnishes a certificate, from the person to whom any interest is payable on the capital borrowed, specifying the amount of interest payable by the assessee for the purpose of such acquisition or construction of the property, or conversion of the whole or any part of the capital borrowed which remains to be repaid as a new loan,” reads Section 24.

Applicability of Sec 24 in case of rented property purchased using home loan

In case you have taken a home loan to buy a property and have now given it on rent, the entire amount paid as the home loan interest component can be claimed as deduction under Section 24.

Read also : All about Delhi e-District portal registration

Sec 24: Various scenarios

| Property type | GAV | Deduction for property tax | NAV | Standard deduction | Exemption on home loan interest |

| Self-occupied/vacant | Nil | Nil | Nil | Nil | Rs 2 lakhs |

| Rented | The rent earned or the expected rent, whichever is higher | The amount paid during the year | The amount after subtracting property tax | 30% of NAV | Entire amount paid during the year |

Sec 24: How is it different from 80C?

Unlike Section 80C, which offers tax deduction on home loan principal component on a ‘payment basis’, Section 24 allows deductions on an ‘accrual basis’. Basically, interest payment would be calculated for each year separately and deductions can be claimed, even if no actual payment has been made.

[ecis2016.org] All about Section 80EEA

FAQs

How much interest on housing loan can be claimed as deduction under Section 24?

When computing income chargeable to tax under ‘income from house property’ in case of a rented property, there is no limit on the quantum of interest which can be claimed as deduction. However, in case of a self-occupied property, the limit is Rs 2 lakh or Rs 30,000 if certain conditions are not fulfilled.

What is the maximum deduction limit under Section 24?

The maximum deduction limit under Section 24 could either be 30% of GAV of the rented property, or Rs 2 lakh-deduction against home loan interest payment of self-occupied property, or The entire home loan interest payment in case of rented properties.

When it comes to home loan, what is the difference between Section 80C and Section 24?

Section 80C allows deduction of up to Rs 1.50 lakhs against home loan principal amount payment. Section 24 allows tax deduction of up to Rs 2 lakhs in the year against home loan interest component payment.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Must Knows