[ecis2016.org] In real estate sector, types of leases can be primarily divided into four categories – absolute net lease, triple net lease, modified gross lease and full-service lease.

Tenants in India need to sign a lease deed with their landlords before entering a flat. While leave and licence agreements are common in the residential real estate space, tenants need to sign a lease in case of commercial renting space. These leases could be of various types, as far as the real estate sector is concerned.

You are reading: Types of leases tenants and landlords should know about

[ecis2016.org] What is a leave and license agreement?

Types of leases

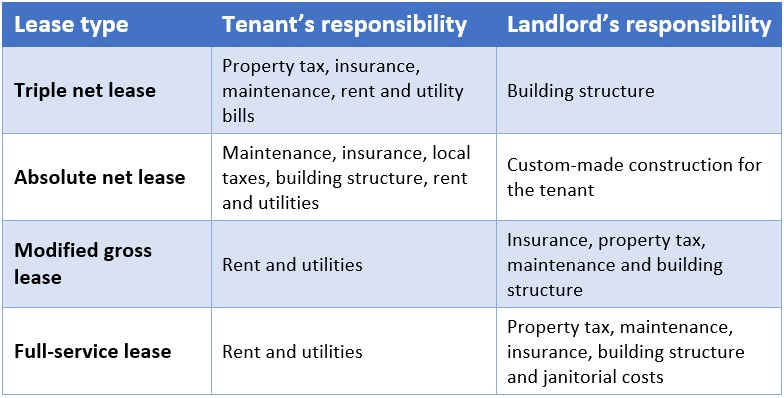

In the real estate sector, types of leases can be broadly put into the following four categories, depending on its structure: absolute net lease, triple net lease, modified gross lease and full-service lease.

Read also : Historical property documents not liable for stamp duty at current rates

[ecis2016.org] Lease vs rent: Key differences

Types of leases: Triple net lease

Common in the commercial renting space, a triple net lease demands a tenant to pay the main expenses of the property (such as property tax, insurance and maintenance), apart from paying rent and utility bills. A steady and predictable income stream for landlords, triple net lease is also known as the NNN lease. (In case of single net lease, a tenant needs to pay property tax; in a double net lease, he would pay property tax and insurance; in a triple net lease, he would pay property tax, insurance and maintenance.)

Also used for freestanding commercial buildings, the triple net lease is usually for a single tenant.

Know all about HRA exemption on rent paid

Types of leases: Absolute net lease

An absolute net lease puts the responsibility of paying maintenance, insurance and local taxes on tenants while also making them responsible for the building structure. An absolute net lease, sometimes known as bondable lease, makes a landlord free from all financial obligations. A tenant gets benefits in the form of lower monthly rental in such case. An absolute net lease is drafted when a landlord constructs a custom-made commercial renting space for a single tenant, keeping in view every need of his tenant. Usually, large businesses enter into such kind of lease deeds.

An absolute net lease is a variation of the NNN lease.

Read also : All about Aadhaar update form

[ecis2016.org] Police verification for rent agreement: is it must?

Types of leases: Modified gross lease

In a modified gross lease, a landlord shoulders the burden of insurance, property tax and maintenance while a tenant pays utility bills. The roof and other structural aspects of a building are the owner’s responsibility. In this case, the monthly rental is higher compared to an absolute net lease or NNN lease. Modified gross lease is common in office space leasing where the number of tenants is high.

[ecis2016.org] Society maintenance charges that residents need to be aware of

Types of leases: Full-service lease

A lease agreement that requires a landlord to pay all operating costs – property tax, maintenance, insurance, and janitorial costs – is known as a full-service lease, also referred as a gross lease. However, tenants might be asked to pay for certain utility bills like telephone and internet bills. Common in large multi-tenant commercial units, full-service leases require a tenant to pay high rents.

Also read how to claims tax deduction under 80GG is HRA is not part of your salary.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Must Knows