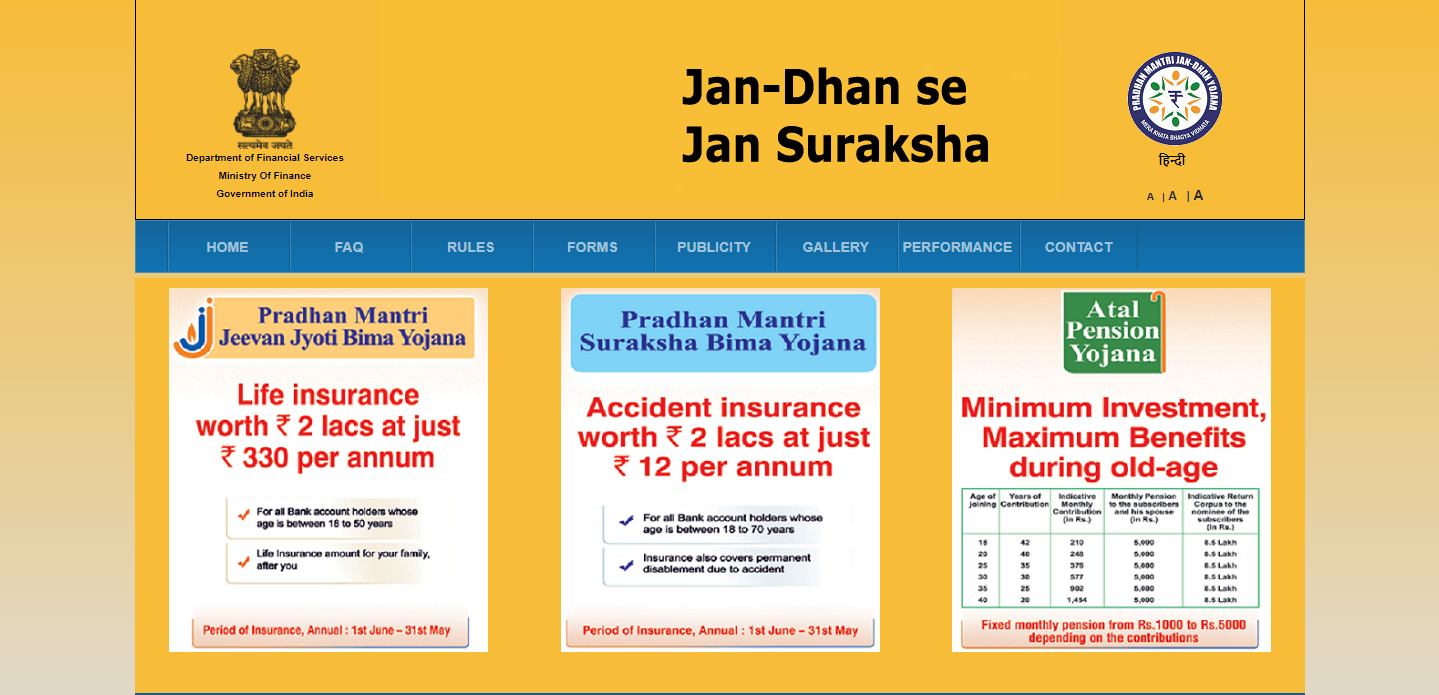

[ecis2016.org] The Pradhan Mantri Jeevan Jyoti Bima Yojana is an central government scheme that aims to benefit the citizens, especially the poor and underprivileged people, by providing life insurance coverage.

The Central Government of India inaugurated the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) on May 9, 2015. If a participant dies before the age of 55 for any reason, the government will provide a life insurance policy in the amount of rupees two lakh to their family nominee under the PMJJBY scheme. Life Insurance Corporation of India and other private insurance companies are offering the scheme through public and private sector banks.

You are reading: What is the PMJJBY? How to apply for it, and what are its benefits?

Pradhanmantri Jeevan Jyoti Bima Yojana 2022: Overview

The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is an insurance scheme that helps you secure your financial future. It is a one-year life cover that protects your family from financial loss if you die an untimely death. The PMJJBY policy comes with a government subsidy, which means lower premiums for you and allows for a free re-signing of the policy after one year if you choose to continue with it.

- Indian citizens must be at least 18 years old and no older than 50 years old to participate in policy planning.

- The Pradhan Mantri Jeevan Jyoti Bima Yojana is a very good initiative of the Government of India; the poor and underprivileged people will receive insurance and their children will also benefit significantly in the future.

The policyholder will be required to pay a yearly premium of Rs 330 under this plan, which will be deducted automatically from the policyholder’s savings account every year in May. This scheme provides an affordable rate of premium for all citizens, including EWS and BPL. Available insurance coverage under the Pradhanmantri Bima Yojana will begin on June 1 of this year and will last until May 31 of the following year. In order to purchase insurance in PMJJY, no medical examination is required.

- Insurance premium paid by the beneficiary to LIC/insurer – Rs 289/-

- Expense reimbursement for BC/Micro/Corporate/Agent – Rs.30/- per annum per member

- Reimbursement of Participating Bank Administrative Fee – Rs.11/- per member per year.

- Total Premium – Rs 330/-

PMJJBY: Coverage Amount

The scheme provides a life cover of Rs. 2 lakh to the policyholder’s beneficiary in the event of the policyholder’s death.

PMJJBY: Coverage Period

The scheme lasts for one year and can be renewed each year.

PMJJBY Highlights

| Scheme Name | Pradhan Mantri Jeevan Jyoti Bima Yojana |

| Started By | Central Government |

| Beneficiaries | Citizens of the Country |

| Objective | Providing Policy Insurance |

| Official Website | https://www.jansuraksha.gov.in/ |

Pradhan Mantri Jeevan Jyoti Bima Yojana: Purpose and objective

This scheme aims to benefit the citizens by ensuring financial security for their families. The Indian government will provide a sum of Rs 2 lakh to the policyholder’s family under the scheme. All Indian citizens can be covered by PMJJBY by applying for this scheme.

PM Jeevan Jyoti Bima Yojana advantages

- This scheme is available to citizens aged 18 to 50 in the country.

- Following the death of the policyholder, the family of the policyholder can renew PMJJBY under this scheme year after year. This plan’s members must pay an annual premium of Rs 330. A life insurance policy worth Rs 2 lakh will be provided.

- During each annual coverage period, the annual instalment under this plan is paid by May 31.

- If the annual instalment cannot be deposited by this date, the policy can be renewed by paying the entire annual premium in a lump sum payment and self-declaring good health at a later date.

- The PMJJBY offers a simple and painless claim submission process.

- The premium paid is deductible under section 80C of the Income Tax Act.

Some highlights of Prime Minister Narendra Modi’s Jeevan Jyoti Bima Yojana

- To apply for the Pradhan Mantri Jeevan Jyoti Bima Yojana, you do not need to undergo any type of medical examination.

- To purchase PM Jeevan Jyoti Bima Yojana, you must be between the ages of 18 and 50.

- PMJJBY reaches maturity at the age of 55.

- This plan must be renewed each year.

- The maximum sum insured under this scheme is $200,000.00.

- The Pradhan Mantri Jeevan Jyoti Bima Yojana enrollment period runs from June 1 to May 31.

- Cannot make a claim for 45 days after enrolling.

Pradhan Mantri Jeevan Jyoti Bima Yojana Eligibility

- Citizens taking out policies under this scheme must be between the ages of 18 and 50.

- The policyholder will have to pay a yearly premium of Rs 330.

- Under this scheme, the policyholder/applicant is required to have a bank account because the government will directly transfer the maturity funds to the beneficiary’s bank account under this scheme.

- The subscriber must keep the required balance in their bank account at the time of auto-debit on or before the 31st of May every year.

- The Aadhar card must be linked to the savings account.

- All joint account holders are eligible to participate in the scheme.

- An individual can only join the scheme through one bank account, even if they have multiple bank account

Documents of Jeevan Jyoti Bima Yojana

- Applicant’s Adhaar card

- Identity card

- Bank account passbook

- Mobile number

- Passport size photo

PMJJBY: Registration Process

A person can join the scheme by going to the bank where they have a savings account. LIC and other private life insurance organisations are in charge of the scheme. Enrollment is possible at any point during the year by paying the full annual cost. Those who have previously left the scheme can re-enter by paying the annual membership fee.

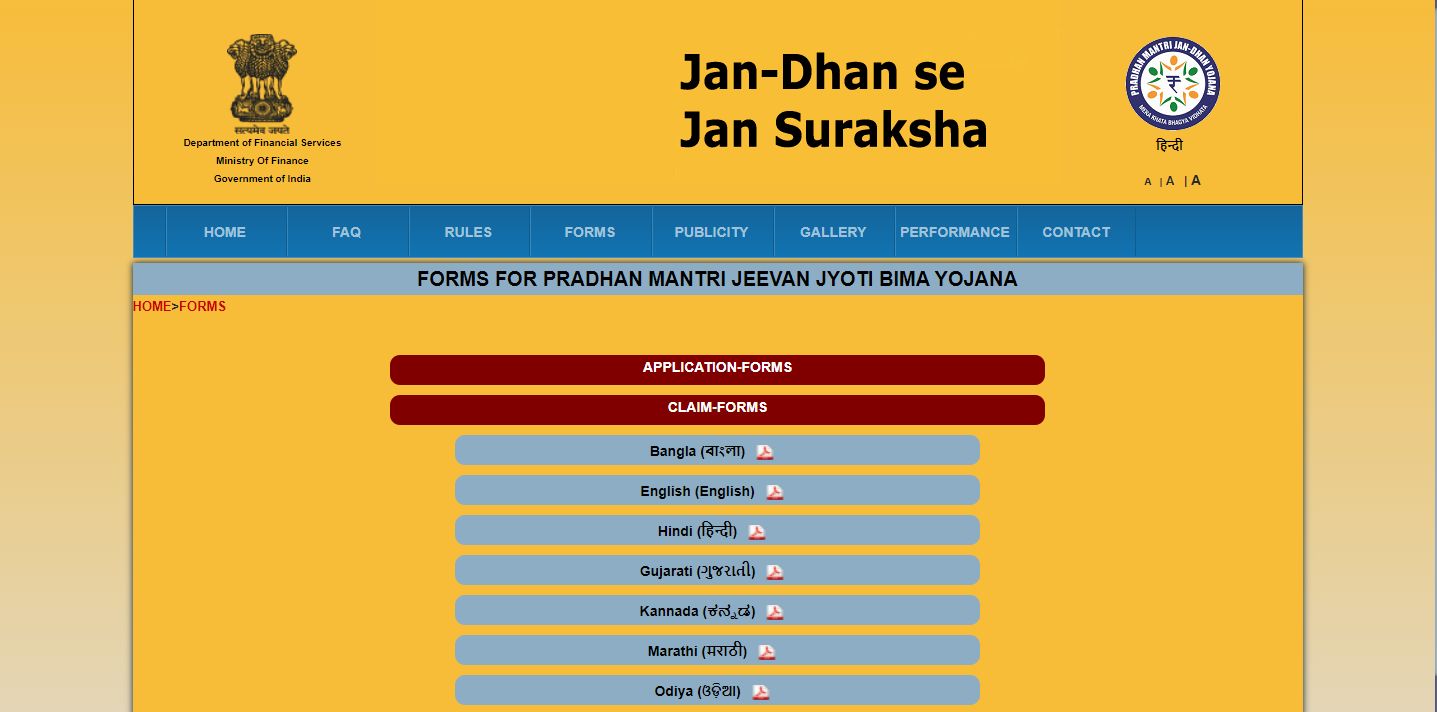

How do you apply for the Pradhan Mantri Jeevan Jyoti Bima Yojana?

Interested citizens of the country who want to apply for the Jeevan Jyoti Bima Yojana should follow the steps outlined below.

- Visit the official public safety website.

- Click on the forms option from the top menu bar on the official public safety website.

Read also : Section 24 of Income Tax Act: Tax deduction against home loan interest payment

- Next click on the Pradhanmantri Jeevan Jyoti Bima Yojana button to get the forms related to this scheme.

- After you have completed filling in all of the personal information, you must submit the form to the bank, where an active savings bank account will be opened for you in order to be eligible for this scheme.

This is the process on how you can download the application form for the pradhan mantri jeevan jyoti bima yojana pdf.

How to claim the Pradhan Mantri Jeevan Jyoti Bima Yojana?

The compensation will be settled by the relevant LIC Pensions and Groups Scheme (P&G) Office/Unit upon the policyholder’s death. The procedure for settling a claim is given below:

- If the insured person dies, his nominee may make a claim under the Pradhan Mantri Jeevan Jyoti Bima Yojana.

- Following that, the policyholder’s nominee should first contact the policyholder’s bank, which is part of the PMJJBY scheme.

- The nominee must then obtain the Pradhan Mantri Jeevan Jyoti Insurance Claim Form as well as the Discharge Receipt from the bank. The forms can be obtained from the bank or downloaded from the LIC, Bank, and Finance Ministry’s Jansuraksha websites.

- Then the nominee must submit the claim form and discharge receipt form, and photographs of the death certificate and cancelled cheque. If not, they must supply bank details for the policyholder’s linked PMJJBY savings account.

PMJJBY: Verification of claim

Through bank

- The bank professional will check if the policy is still active after receiving the claim.

- If the policy is still active, the bank will go over the nominee’s details and the claim form, filling in the relevant fields.

- The bank must next submit the following papers to the LIC’s designated P & G office: a) A completed claim form; b) A death certificate; c) A discharge receipt; and d) A photocopy of the nominee’s cancelled check (if available).

- The claim form should be sent to the authorised P&GS office of LIC within 30 days of the nominee’s receipt of the claim form.

Through a certified P&GS unit

- Check the claim form and any attachments for accuracy. If this is not the case, you should contact the appropriate bank.

- The member’s coverage will next be double-checked by the designated P&GS Unit to ensure that it is current and that no death claims have been paid for the individual through any other account. The nominee will be contacted if a claim has already been resolved, and a copy of the agreement will be forwarded to the bank.

- If this is the only claim settled, the funds will be sent to the nominee’s bank account or policyholder account, along with an acknowledgement and a copy to the bank.

- After receiving the claim from the bank, the insurance company has 30 days to settle it.

- To begin, go to the Pradhan Mantri Jeevan Jyoti Bima Yojana’s official website.

- The home page will now appear.

- Then, select the Publicity option.

- On this page, you must choose the publicity material.

- The relevant necessary information will be displayed on your computer screen.

PMJJBY forms downloading procedure

- To begin, go to the Pradhan Mantri Jeevan Jyoti Bima Yojana’s official website.

- All you need to know about Mukhyamantri Vridhjan Pension Yojana 2022

- How to register for TN labour schemes? All you need to know

- Finance Act 2016: Tax benefits for home purchase and rent paid

- Online E Aadhaar Card Download 2022: All you need to know

- Agreement for sale or final payment: What constitutes a transfer of property?

- On the home page, you must select the Forms option.

- Select the Pradhan Mantri Jeevan Jyoti Bima Yojana option on the next page.

- The options listed below will now appear on your screen.

- Claim Forms

- You must select the appropriate option.

- After that, you must download the form.

- You will be able to download the offline form in this manner.

PMJJBY viewing rules procedure

- To begin, go to the Pradhan Mantri Jeevan Jyoti Bima Yojana’s official website.

- After that, you must select the Rules option.

- Your screen will now display a list of all the rules.

- You must select an option from this list that meets your needs.

- The relevant necessary information will be displayed on your computer screen.

- Your screen will now display a list of all the rules.

- You must select an option from this list that meets your needs.

PMJJBY download state-specific toll-free numbers

- First, you must visit the official Public Safety website.

Read also : Plot loan: Check out the lowest land loan interest rates from the best banks

- The home page will now appear in front of you.

- You must click on the contact link on the home page.

- A new page will now appear before you, displaying the state-by-state toll-free number pdf.

- By downloading this PDF, you can find state-specific toll-free numbers.

In the fiscal year 2020-21, 2,50,351 death claims were received.

In the fiscal year 2020-21, this scheme received 2,50,351 death claims, of which 13100 were rejected, and another 2346 were being considered. The central government accepted 2,34,905 death claims under this scheme in the fiscal year 2020-21, which has resulted in a payment of Rs 4698.10 crore to the families of the deceased. This information was obtained through the Right to Information Act by Neemuch’s RTI activist Chandrashekhar Gond.

| PMJJBY Financial year | Cumulative no. of people enrolled in PMJJBY | Total no. of claims

received for PMJJBY |

Total no. of claims

disbursed for PMJJBY scheme |

| 2016-17 | 3.10 crore | 62,166 | 59,118 |

| 2017-18 | 5.33 crore | 98,163 | 89,708 |

| 2018-19 | 5.92 crore | 145,763 | 135,212 |

| 2019-20 | 6.96 crore | 190,175 | 178,189 |

| 2020-21 | 10.27 crore | 250,351 | 234,905 |

Claim settlement details of PMJJBY

| Year | PMJJBY Received death claims | PMJJBY Distributed amount |

| 2016-17 | 59,118 | Rs 1,182.36 crore |

| 2017-18 | 89,708 | Rs 1,794.16 crore |

| 2018-19 | 1,35,212 | Rs 2,704.24 crore |

| 2019-20 | 1,78,189 | Rs 3563,78 crore |

| 2020-21 | 2,34,905 | Rs 4698.10 crore |

Claim settlement for a total of 56716 citizens in 2020-21

The Pradhanmantri Bima Yojana can only be accessed through a bank account. If a person withdraws from this scheme, he can regain access to it by paying an annual premium and demonstrating a self-declaration of good health. In the fiscal year 2020-21, death claims totalling Rs 1134 crore were paid to 56716 citizens under the scheme. Coronavirus infection has resulted in an increase in the number of deaths. As a result, the claim payment under this scheme has also increased. Half of the claims have resulted from the death of a person as a result of coronavirus infection. This scheme is expected to enrol 102.7 million people by the end of the fiscal year 2021.

Learn why 330 has been deducted from your account

A debit of 330 was made from the accounts of citizens who registered for the Pradhan Mantri Jeevan Jyoti Bima Yojana in May. Every year on June 1, the scheme is renewed, and the renewal premium is debited by the banks in May.

If the policyholder has more than one account and the premium amount has been deducted from more than one account, you can request a refund from your bank. This scheme’s benefits are available for a period of one year.

- If the beneficiary wishes to continue receiving benefits from this scheme after one year, they must renew their membership.

- It will be necessary to implement the auto-debit feature in order to benefit from this scheme.

- Banks will occasionally send reminders via SMS or email. Because this scheme includes auto-debit renewal, it is the account holder’s responsibility to ensure that the sum of 330 is available in his account on time.

If death occurs as a result of covid infection, then take advantage of the scheme by meeting the conditions listed below

The PMJJBY policy/scheme (Pradhan Mantri Jeevan Jyoti Bima Yojana) is a life insurance plan. All citizens whose family members died due to Coronavirus infection or any other reason and were registered under this scheme are eligible to receive the sum insured up to $200,000.00. The advantage can be used only if the policyholder purchased this scheme in 2020-21.

Only after 45 days will risk coverage be available

Until the first 45 days of enrollment, all new buyers are ineligible to claim under this scheme. Only after the 45-day period has passed can a claim be made. The company will not settle any claims within the first 45 days. However, if the applicant’s death was caused by an accident, then, in this case, the applicant will be compensated even within the first 45 days.

In what circumstances will the benefits of this scheme be denied/terminated?

- If the beneficiary’s bank account is no longer active.

- In the event that the premium amount is not available in the bank account.

- If the citizen is 55.

FAQs

What is the full form of PMJJBY?

The full form of PMJJBY is Pradhanmantri Jeevan Jyoti Bima Yojana. It is a scheme introduced by the central government of India that works as a life insurance policy, paying a sum of two lakh rupees to the beneficiary’s family in case of their untimely demise before the age of 55.

When was PMJJBY introduced?

The PMJJBY scheme was first introduced in the year 2015. Since then, a large portion of the Indian population has enrolled on this scheme.

Can you apply online for the PMJJBY scheme?

No, you can’t apply online for the PMJJBY scheme. The application form needs to be downloaded/retrieved from the government’s official portal, printed, filled in by hand and submitted to your bank in order to complete the registration process.

What is the helpline number for the PMJJBY scheme?

The toll-free governmental helpline number for the PMJJBY scheme is 1800-180-1111 / 1800-110-001.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Must Knows