[ecis2016.org] The HSN code is a globally standardised nomenclature for goods, to classify each internationally-traded item

Since more than 98% of the goods traded internationally are classified by an HSN code, it becomes crucial for traders across the world to understand what this code means.

You are reading: HSN code: All about the Harmonized System of Nomenclature for goods

What is an HSN code?

The HSN code is a globally standardised tariff nomenclature for goods, issued by the World Customs Organization (WCO). Unique to each traded product, an HSN code is organised by economic activity or component material. The HSN code enables 200 members of the WCO to maintain a global database of goods. The WCO, an independent inter-governmental organisation, periodically updates the HSN codes according to the changing nature of global trade.

Classifying and regulating global trade since 1988, HSN codes are changed at regular intervals to broaden their scope. HSN 2022, for example, will capture trade in a range of new fields. HSN 2022 is the seventh edition and has become effective since January 1, 2022.

HSN code full form

HSN is the abbreviation for Harmonized System of Nomenclature. HSN Code or the Harmonized Commodity Description and Coding System provide codes to classify each internationally-traded item.

[ecis2016.org] All about services provided by IP India portal

HSN code structure

HSN codes are organized into:

- 21 sections

- 97 chapters

- 1,244 headings

- 5,224 subheadings

For example, In India, the HSN code for pan-masala containing tobacco (Gutkha) is 24039990.

Here, 24 is the chapter number, 03 is the heading, 99 is the sub-heading and 90 is for a clearer classification of the tariff item.

Digits in the HSN code

A detailed HSN code can have 12 digits.

The first six digits are universally accepted while the last six digits are added based on source country, tariff and statistical requirements. In the digits added by the source country:

* The first two digits designate the HSN chapter

* The next two digits designate the HSN heading

* The last two digits designate the HSN subheading

However, a lot of developed countries have 10-digit HSN codes while India has 8-digit HSN codes.

[ecis2016.org] All about UIDAI and Aadhaar

GST HSN code

Under the Goods and Services Tax (GST) regime in India, all goods and services are classified under the Services and Accounting Code, better known as the SAC codes. Based on the HSN codes, SAC codes classify goods and services for clearer recognition, measurement and taxation under the GST.

[ecis2016.org] All about GST on flat purchase

HSN code search in India

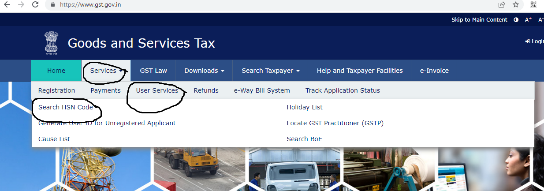

Step 1: Go to the official GST web portal. Under the ‘Services’ tab, select the ‘User Service’ option and then the ‘Search HSN Code’ option.

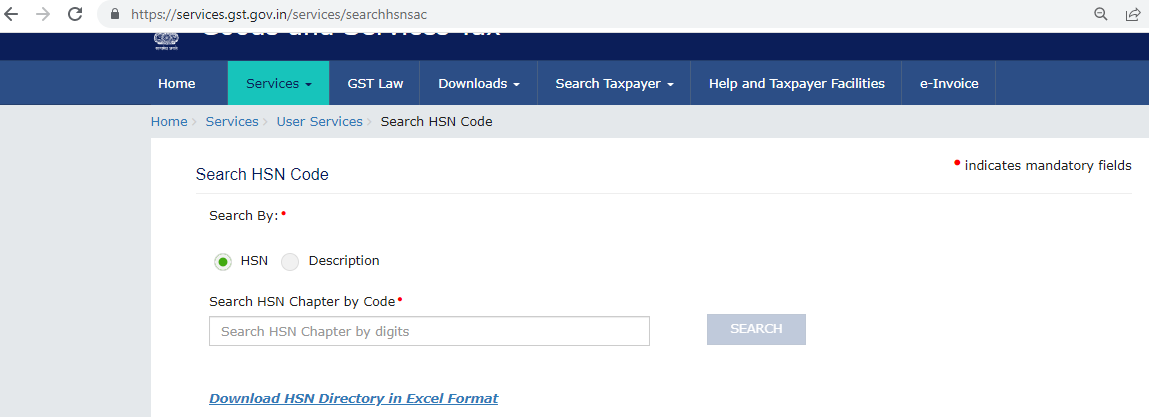

Step 2: You can search the HSN code by providing the chapter number or the product description.

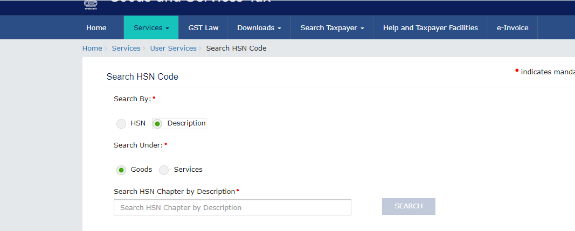

Step 3: In case you are not sure of the HSN chapter number, select ‘Description’ and then either ‘goods’ or ‘services’.

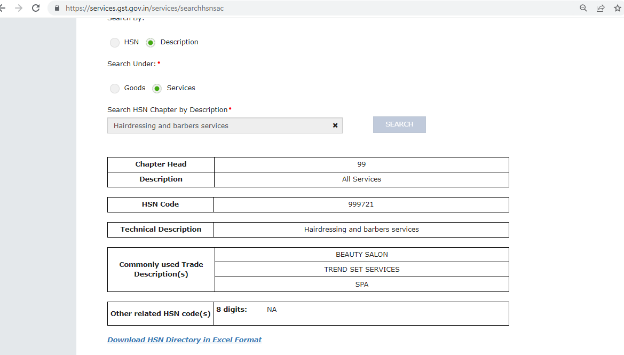

Step 4: Select your description. The HSN code will appear on the screen. You can download it in an excel sheet.

Read also : Maharashtra self-redevelopment scheme: All you need to know about it

HSN code list

Over 10,000 separate categories of products are coded under the HSN system. The HSN codes are organised in sections, which are divided into chapters, headings and sub-headings.

HSN code: Section 1

Live animals and animal products

Section notes: 0100-2022E

| 0101-2022E | Live animals |

| 0102-2022E | Meat and edible meat offal |

| 0103-2022E | Fish, crustaceans, molluscs and other aquatic invertebrates |

| 0104-2022E | Birds’ eggs, dairy produce, natural honey, edible products of animal origin, not elsewhere specified or included |

| 0105-2022E | Products of animal origin that are not elsewhere included or specified |

HSN code: Section 2

Vegetable products

Section notes: 0200-2022E

| 0206-2022E | Live trees and other plants, roots, bulbs and the like, cut flowers and ornamental foliage |

| 0207-2022E | Edible vegetables and certain tubers and roots |

| 0208-2022E | Edible fruits and nuts, citrus fruit or melon peels |

| 0209-2022E | Coffee, tea, maté and spices |

| 0210-2022E | Cereals |

| 0211-2022E | Products of the milling industry, malt, wheat, starches, inulin, gluten |

| 0212-2022E | Oilseeds and oleaginous fruits, miscellaneous grains, seeds and fruit, industrial or medicinal plants, straw and fodder |

| 0213-2022E | Gums, lac, resins and other vegetable saps and extracts |

| 0214-2022E | Vegetable plaiting materials and vegetable products that are not elsewhere included or specified |

HSN code: Section 3

Animal, vegetable or microbial fats and oil and their cleavage products, prepared edible fats, animal or vegetable waxes

| 0315-2022E | Vegetable, animal, or microbial oils and fats and their cleavage products, prepared edible fats, vegetable or animal waxes |

HSN code: Section 4

Prepared foods stuff, beverages, spirits, vinegar, tobacco and manufactured tobacco substitutes, products whether or not containing nicotine intended for inhalation without combustion, other nicotine or nicotine-containing products intended for the intake of nicotine in the human body

Section notes: 0400-2022E

| 0416-2022E | Preparations of meat, fish, crustaceans, molluscs or other aquatic invertebrates, or insects |

| 0417-2022E | Sugars and sugar confectionery |

| 0418-2022E | Cocoa and cocoa preparations |

| 0419-2022E | Preparations of cereals, starch, flour or milk, pastrycooks’ products |

| 0420-2022E | Preparations of fruits, vegetables, nuts or other parts of plants |

| 0421-2022E | Miscellaneous edible preparations |

| 0422-2022E | Beverages, spirits and vinegar |

| 0423-2022E | Waste and residue from the food industries, prepared animal fodder |

| 0424-2022E | Tobacco and manufactured tobacco substitutes, products, whether or not containing nicotine, intended for inhalation without combustion, and other nicotine-containing products intended for the intake of nicotine into the human body |

HSN code: Section 5

Mineral products

| 0525-2022E | Salt, sulphur, earths and stone, lime and cement, plastering materials |

| 0526-2022E | Ores, slag and ash |

| 0527-2022E | Mineral oils and fuels, and products of their distillation, mineral waxes, bituminous substances |

HSN code: Section 6

Products of the chemical and allied industries

Section notes: 0600-2022E

| 0628-2022E | Inorganic chemicals, organic or inorganic compounds of rare-earth metals, of precious metals, of radioactive elements or of isotopes |

| 0629-2022E | Organic chemicals |

| 0630-2022E | Pharmaceutical products |

| 0631-2022E | Fertilisers |

| 0632-2022E | Tanning or dyeing extracts, tannins and their derivatives, pigments, dyes and other colouring matter, varnishes and paints, putty and other mastics, inks |

| 0633-2022E | Essential oils and resinoids, cosmetic or toilet preparations, perfumery |

| 0634-2022E | Soap, washing preparations, organic surface-active agents, lubricating preparations, artificial and prepared waxes, polishing or scouring preparations, candles and similar articles, modelling pastes, ‘dental waxes’ and dental preparations with a plaster basis |

| 0635-2022E | Albuminoidal substances, modified starches, glues, enzymes |

| 0636-2022E | Explosives, pyrotechnic products, matches, pyrophoric alloys, and certain combustible preparations |

| 0637-2022E | Photographic or cinematographic goods |

| 0638-2022E | Miscellaneous chemical products |

HSN code: Section 7

Plastics and articles thereof, rubber and articles thereof

Section notes: 0700-2022E

| 0739-2022E | Plastics and articles thereof |

| 0740-2022E | Rubber and articles thereof |

HSN code: Section 8

Raw hides and skins, leather, fur skin and articles thereof, harness and saddlery, travel goods, handbags and similar containers, articles of the animal gut other than silkworm gut

| 0841-2022E | Raw hides and skins (other than fur) and leather |

| 0842-2022E | Articles of leather, harness and saddlery, travel goods, handbags and similar containers, articles of animal gut (other than silkworm gut) |

| 0843-2022E | Fur skins and artificial fur, manufactures thereof |

HSN code: Section 9

Woods and articles of wood, wood charcoal, cork and articles of cork, manufactures of straw or esparto or other plaiting materials, basket ware and wickerwork

| 0844-2022E | Wood and articles of wood, wood charcoal |

| 0845-2022E | Cork and articles of cork |

| 0846-2022E | Manufactures of straw, of esparto or other plaiting materials, basket ware and wickerwork |

HSN code: Section 10

Pulp of wood or other fibrous cellulosic material, recovered paper or paperboard, paper or paperboard and articles thereof

| 0847-2022E | Pulp of wood or other fibrous cellulose material, recovered (scrap and waste) paper or paperboard |

| 0848-2022E | Paper and paperboard, articles of paper, paper pulp, or paperboard |

| 0849-2022E | Newspapers, printed books, pictures and other printing industry products, manuscripts, typescripts and plans |

HSN code: Section 11

Read also : Bangla Sahayata Kendra West Bengal (BSKWB): All You Need To Know

Textiles and textile articles

Section notes: 1100-2022E

| 1150-2022E | Silk |

| 1151-2022E | Wool, coarse or finr animal hair, horsehair yarn and woven fabric |

| 1152-2022E | Cotton |

| 1153-2022E | Other vegetable textile fibres, paper yarn and woven fabrics of paper yarn |

| 1154-2022E | Man-made filaments, strips and the like of man-made textile materials |

| 1155-2022E | Man-made staple fibres |

| 1156-2022E | Wadding, felt and nonwovens, twine, special yarns, cordage, ropes and cables and articles thereof |

| 1157-2022E | Carpets and other textile floor coverings |

| 1158-2022E | Special woven fabrics, tufted textile fabrics, tapestries, lace, trimmings, embroidery |

| 1159-2022E | Impregnated, coated, covered or laminated textile fabrics, textile articles of a kind suitable for industrial use |

| 1160-2022E | Knitted or crocheted fabrics |

| 1161-2022E | Articles of apparel and clothing accessories, crocheted or knitted |

| 1162-2022E | Articles of apparel and clothing accessories, not crocheted or knitted |

| 1163-2022E | Other made-up textile articles, sets, worn clothing and worn textile articles, rags |

HSN code: Section 12

Footwear, headgear, umbrellas, sun umbrellas, walking sticks, seat sticks, whips, riding-crops and parts thereof, prepared feathers and articles made thereof, artificial flower, articles of human hair

| 1264-2022E | Footwear, gaiters and the like, parts of such articles |

| 1265-2022E | Headgear and parts thereof |

| 1266-2022E | Umbrellas, sun umbrellas, walking sticks, seat-sticks, whips, riding-crops and parts thereof |

| 1267-2022E | Prepared feathers and down and articles made of feathers or down, artificial flowers, articles of human hair |

HSN code: Section 13

Articles of stone, plaster, cement, asbestos, mica or similar materials, ceramic products, glass and glassware

| 1368-2022E | Articles of stone, cement, plaster, asbestos, mica or similar materials |

| 1369-2022E | Ceramic products |

| 1370-2022E | Glass and glassware |

HSN code: Section 14

Natural or cultured pearls, precious or semi-precious stones, precious metals, metals clad with precious metals and articles thereof, imitation jewellery, coin

| 1471-2022E | Natural or cultured pearls, precious/semi-precious stones, precious metals, metals clad with precious metal and articles thereof, coins, imitation jewellery |

HSN code: Section 15

Base metals and articles of base metals

Section notes: 1500-2022E

| 1572-2022E | Iron and steel |

| 1573-2022E | Articles of iron or steel |

| 1574-2022E | Copper and articles thereof |

| 1575-2022E | Nickel and articles thereof |

| 1576-2022E | Aluminium and articles thereof |

| 1577-2022E | (Reserved for possible future use in the Harmonized System) |

| 1578-2022E | Lead and articles thereof |

| 1579-2022E | Zinc and articles thereof |

| 1580-2022E | Tin and articles thereof |

| 1581-2022E | Other base metals, cermet, articles thereof |

| 1582-2022E | Tools, implements, spoons, forks and cutlery, of base metal, parts thereof of base metal |

| 1583-2022E | Miscellaneous articles of base metal |

HSN code: Section 16

Machinery and mechanical appliances, electric equipment and part thereof, sound recorder and reproducers, television image and sound recorders and reproducers, and parts and accessories of such articles

Section notes: 1600-2022E

| 1684-2022E | Nuclear reactors, boilers, machinery and mechanical appliances, parts thereof |

| 1685-2022E | Electrical machinery and equipment and parts thereof, sound recorders and reproducers, television image and sound recorders and reproducers, and parts and accessories of such articles |

HSN code: Section 17

Vehicles, aircraft, vessels and associated transport equipment

Section notes: 1700-2022E

| 1786-2022E | Railway or tramway track fixtures and fittings and parts thereof, railway or tramway locomotives, rolling stock and parts thereof, mechanical and electro-mechanical) traffic signalling equipment of all kinds |

| 1787-2022E | Vehicles other than tramway or railway rolling stock, and parts and accessories thereof |

| 1788-2022E | Aircraft, spacecraft, and parts thereof |

| 1789-2022E | Ships, boats and floating structures |

[ecis2016.org] All about Eway bill login and generation process

HSN code: Section 18

Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus, clocks and watches, musical instruments

| 1890-2022E | Optical, cinematographic, photographic, measuring, checking, precision, surgical or medical instruments and apparatus, parts and accessories thereof |

| 1891-2022E | Clocks and watches and parts thereof |

| 1892-2022E | Musical instruments, parts and accessories of such articles |

HSN code: Section 19

Arms and ammunitions and parts and accessories thereof

| 1993-2022E | Arms and ammunition, parts and accessories thereof |

HSN code: Section 20

Miscellaneous manufacturing articles

| 2094-2022E | Furniture, mattresses, mattress supports, bedding, cushions and similar stuffed furnishings, lighting fittings and luminaires, not elsewhere specified or included, illuminated signs, name-plates and the like, prefabricated buildings |

| 2095-2022E | Toys, games and sports requisites, parts and accessories thereof |

| 2096-2022E | Miscellaneous manufactured articles |

HSN code: Section 21

Works of art, collectors’ pieces and antiques

| 2197-2022E | Works of art, collectors’ pieces and antiques. |

FAQ

What is the HSN full form?

HSN stands for Harmonized System of Nomenclature.

How many digits are there in the HSN codes in India?

An HSN code in India has 8 digits.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Must Knows