[ecis2016.org] Here’s all you need to know about Varanasi Nagar Nigam and the online procedure to pay Varanasi property tax and water tax.

Located in the state of Uttar Pradesh, Varanasi Nagar Nigam serves as the city’s administrative authority. It is the authority that oversees all operations relating to collection of property tax, water tax, and sewerage tax in Varanasi. The municipality utilises the tax revenue to support important civic infrastructure and services.

You are reading: Varanasi Nagar Nigam: How to pay Varanasi property tax and water tax online?

[ecis2016.org] All about Kanpur house tax

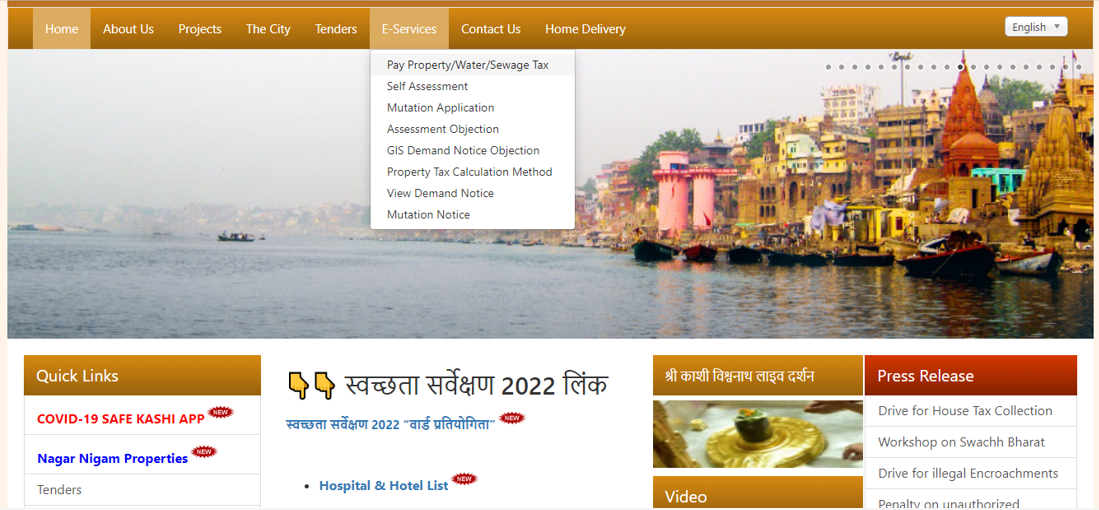

Varanasi Nagar Nigam e-services

Citizens can obtain birth and death certificates from the Varanasi Nagar Nigam’s official website and pay Municipal Corporation taxes such as property taxes, house taxes, water bills, and parking fees. The following is the list of e-services provided by Varanasi Nagar Nigam:

- Property/ Water/Sewage Tax

- Self Assessment

- Mutation Application

- Assessment Objection

- GIS Demand Notice Objection

- Property Tax Calculation Method

- View Demand Notice

- Mutation Notice

[ecis2016.org] Know process to pay Lucknow house tax

Varanasi Nagar Nigam property tax

The Assessment and Collection of Property Tax procedures have been streamlined and made more transparent by the Varanasi Nagar Nigam. It has been given the authority to regulate the growth and reduction in house tax to a specific level, as well as to allow individuals to determine their own property tax liability.

How to apply for Varanasi Nagar Nigam house tax bill online?

Use the following steps to pay your Varanasi Nigam house tax bill:

Step 1: Go to the official website of Varanasi Nagar Nigam.

Step 2: Move the cursor to E-services and select Pay Property Tax.

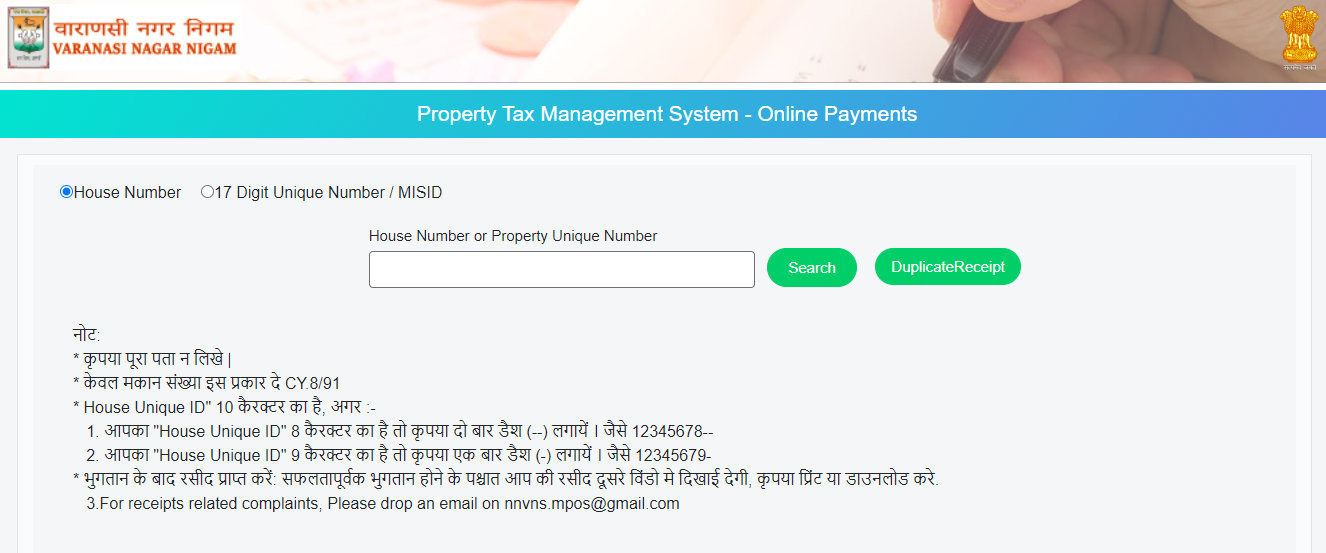

Step 3: A form will be displayed on your screen, which you must fill out using the information (Home Number or Property Unique Number) provided on your house tax slip.

Step 4: When you click on the see details button, a page will display on your screen, showing you the exact details of your home tax bill, including how much you owe.

Step 5: Scroll down to discover the amount due, which is your home tax.

Step 6: To complete the transaction, you must choose ‘continue to pay online’. Type in your phone number and bank name, then click on the “continue to pay online” option from the list of banks available.

Step 7: A new tab will appear asking for payment confirmation and your bank account credentials.

Step 8: Enter the Captcha, and then click on the Pay Now button.

Read also : AP stamps and registration deed details for land, property: Documents, process explained

Step 9: You will get an OTP on your registered number. Fill in the OTP and click on Pay now. Your screen will show a payment successful notification confirming your home tax payment.

- What is a farmhouse?

- Land measurement in South India

- GST on real estate: All about GST on flat purchase, rates in 2022 and impact on home buyers

- Best ways to pay rent using credit cards: Step by step guide to ecis2016.org Pay Rent platform

- Dharitree Assam: How to view Assam land record on ILRMS Assam?

Also read about property tax Indore and Indore Municipal Corporation citizen services

How to calculate Varanasi Nagar Nigam property tax?

The formula to figure out your property tax bill is:

property tax = built-up area × Age factor × base value × type of building × category of use × floor factor

Built-Up Area

It is the square footage of your property (Length x Breadth).

Age Factor

The age factor is less for older structures and greater for newer/recently built buildings under 30 years old. The property’s worth is determined by the amount of time it has been put to use. If you don’t use or occupy any portion of the property, the full value of the property is not included in the tax computation, resulting in a smaller overall tax

Base Value

When determining a property’s base value, Varanasi Nagar Nigam takes the property’s location, construction area, and building type into account.

Building Type

Property tax will depend on the type of building in use, such as residential. Commercial or industrial.

Category Of Use:

The sort of building you have determines the category of use for your property. In comparison to those who use it for commercial reasons, those who use it for residential purposes will be required to pay less property tax.

Floor Factor

The price for each level of a high-rise building that has been inhabited or owned is determined individually since the rate per square foot is different for each floor.

How to pay the Varanasi Nagar Nigam water tax online?

Read also : What is India’s Global Housing Technology Challenge?

You can pay the Varanasi Nagar Nigam water tax through an online method, or you can pay in person at the bank, post office, or VNN’s authorised branches.

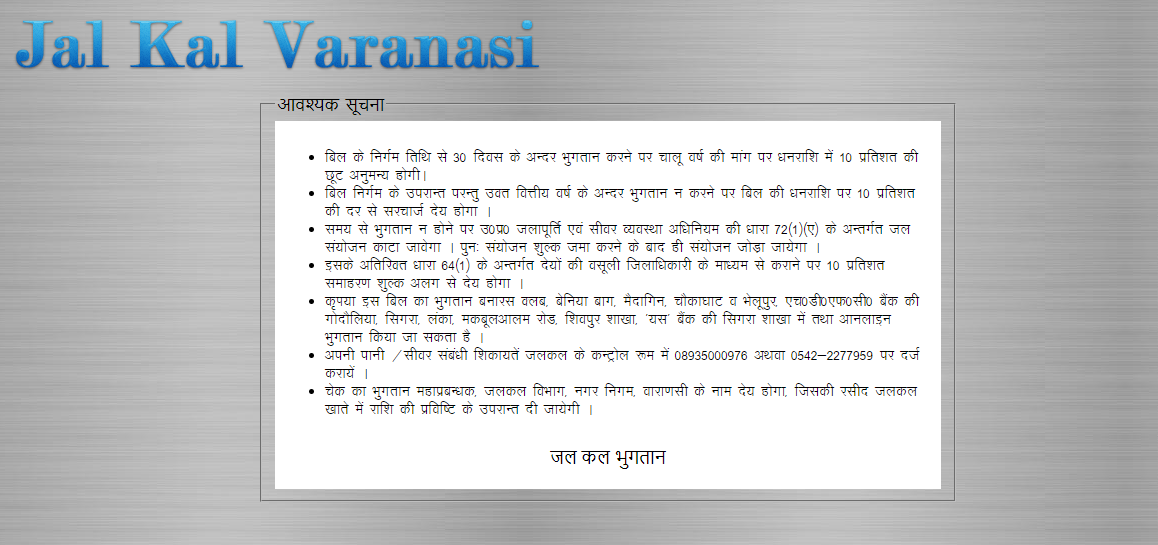

Step 1: Log in to the authority’s Jal Kal Varanasi website

Step 2: Move your cursor to Pay Online Water Tax, and click on ‘More Info’.

Step 3: You’ll be sent to a new page where you’ll need to click the Jal Kal Bhuktan link.

Step 4: Please enter your ward and house number in the space provided.

Step 5: You’ll now be sent to a page where you can enter your payment information.

Step 6: You can find out how much tax you have to pay on that page.

Step 7 : Make a payment using any method you like.

Additional note

- If you pay your bill within 30 days of when it was produced, you’ll save an extra 10%.

- The bill amount will be increased by 10% if payment is delayed for more than 30 days.

- Failure to pay your water bill on time may result in its removal from service.

- Water tax and water bill payments are subject to a late charge as well.

Contact information

Address: Jal Kal Vibhag, B20193, Bhelupur, Varanasi

Contact: 0542-2276339

Email: infor@jalkalvaranasai.org

What is Varanasi Nagar Nigam sewerage tax?

Users of Varanasi city’s sewage system pay a tax to Varanasi Nagar Nigam, which is used to maintain and improve the sewer system. Those who reside in homes or buildings with an underground drainage system or an open drainage system are required to pay this fee. In certain cases, unique reductions for various categories of individuals may be advertised on a notice board outside the VNN office, which is where the tax is collected.

Varanasi Nagar Nigam Contact Information

Address: Nagar Nigam Sigra, 221010

Contact: +0542-2221999

Email: nagarnigamvns@gmail.com

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle