[ecis2016.org] Here is a step-by-step guide on Kanpur Nagar Nigam house tax payment online.

The Kanpur Municipal Corporation consists of 110 wards that occupy a total area of 403 km square, making it the second-largest city in Uttar Pradesh. The Kanpur Municipal Corporation, also known as the Kanpur Nagar Nigam, collects property tax from the property owners in the city. Residents may make payments using the department’s digital site, which is available 24X7. Residential and commercial properties are subject to different taxation.

You are reading: Kanpur Nagar Nigam house tax: Steps to pay property tax online

Kanpur used to collect home tax from its people using the ARV (annual rental value) method till a few years ago. House tax payments in Kanpur can now be made on the Kanpur Municipal Corporation’s official website. Property owners in Kanpur need to go to the municipal corporation’s website. To make an electronic tax payment.

[ecis2016.org] All about Kanpur metro route and Kanpure metro map

Who needs to pay the Kanpur Nagar Nigam House Tax?

Kanpur Nagar Nigam House Tax must be paid annually to the municipal office if you are a Kanpur resident and own property in the city. The government collects the house tax, also known as the property tax, to cover the costs of building roads, managing public spaces, and providing utilities like water, sewage removal, and waste removal. The amount you must pay varies greatly depending on your location, the size of your land, and the property you possess.

[ecis2016.org] All about BBMP property tax calculator

Steps to pay the Kanpur Nagar Nigam House Tax

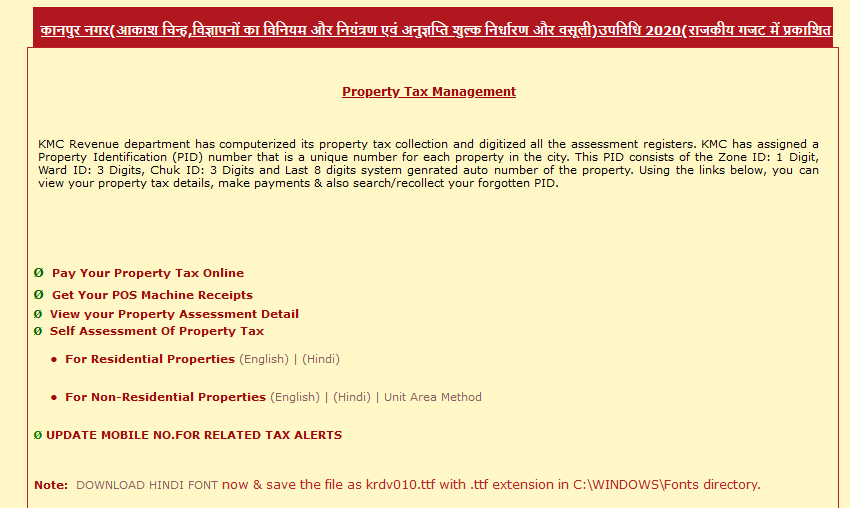

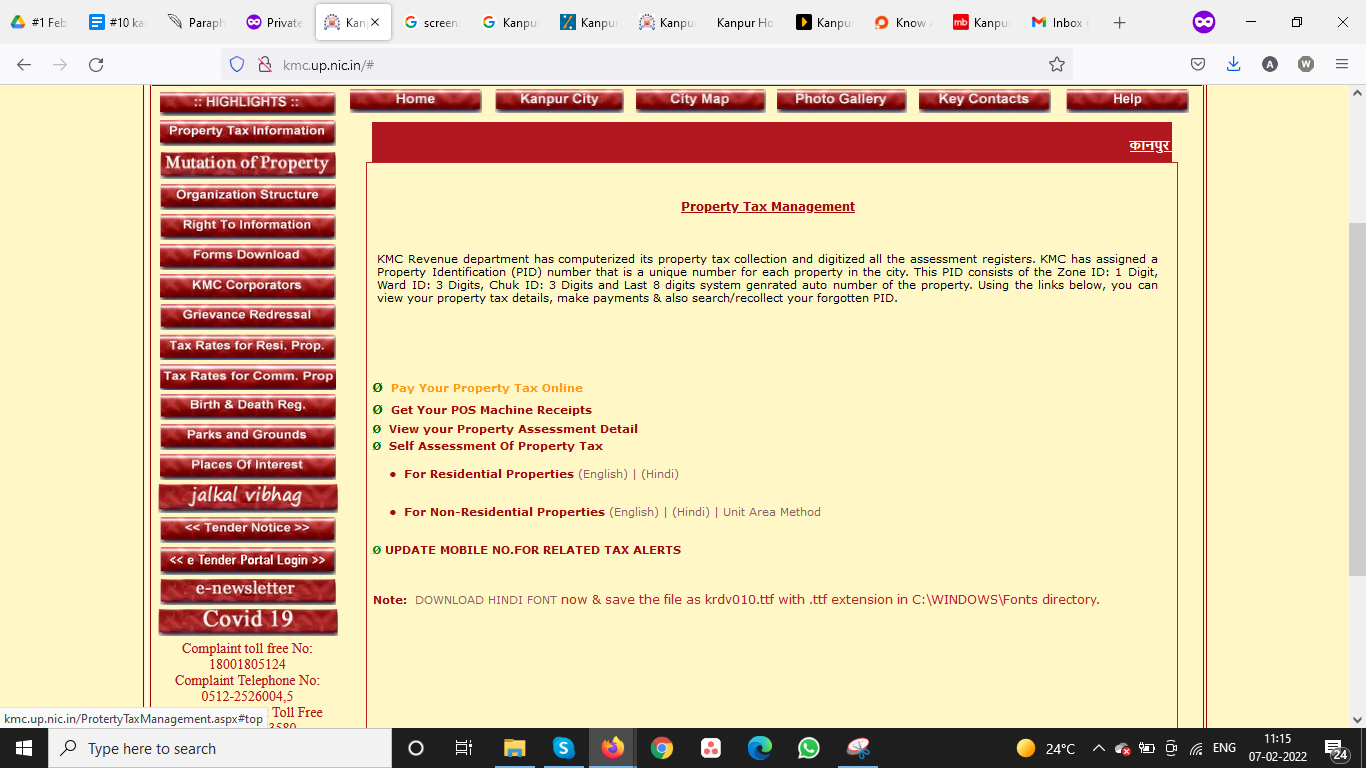

Step 1: Go to the official website.

Step 2: Navigate to the ‘Property Tax Information link on the left sidebar.

Read also : How to check CIBIL Score for free online using PAN number

Step 3: The landing page will provide you with a wide range of property tax links.

Step 4: Select ‘Pay Your Property Tax Online’ option

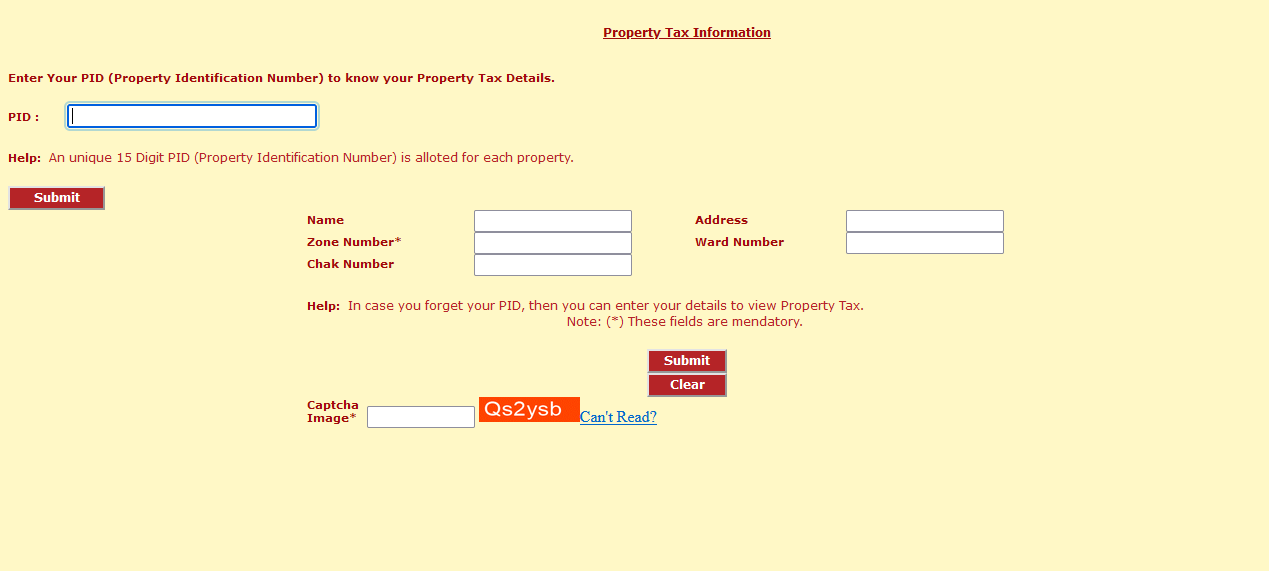

Step 5: Enter your personal identification number (PID) in the appropriate field. (If you’ve lost your PID, you may create a new one by entering your name, address, zone number, and ward number.)

[ecis2016.org] How to find property UID number in Raipur to pay property tax

Step 6: Select ‘Continue.’

Read also : Passport renewal process in India

Step 7: The initial page will contain the amount of tax due, including overdue, adjustments, and interest on repayments. You are responsible for verifying these facts and ensuring that the submitted information is accurate and up to date. Proceed to the online payment procedure for Kanpur house tax.

Step 8: To pay your Kanpur property tax online, choose a payment method by clicking on ‘Continue’.

[ecis2016.org] Know process to pay Lucknow house tax

Calculating Kanpur Nagar Nigam house tax

You will find a link to property tax information on the Kanpur Municipal Corporation’s homepage page. You may view the Kanpur property tax calculator by clicking on the link. This online calculator may be used to determine the amount of tax due on your residential property.

[ecis2016.org] All about property tax Ludhiana

Determining house tax requires the following information:

- Details of the landlord or owner

- Details of the tenant or occupants

- Address

- Plot number

- Year/age of construction

- Concerned ward or zone

- Rental or self-occupied

- Area/square footage total

[ecis2016.org] All about property tax Mumbai

Tax refunds and penalties from the Kanpur municipal corporation

- A special rebate is given to public work buildings and benevolent institutions and educational institutions, graveyards, and historic buildings. No tax is assessed against these structures.

- For some property regions, such as balconies, garages, and corridors, the Kanpur Municipal Corporation offers refunds or lower prices.

- In addition to receiving a tax refund, disabled people also get a portion of their taxes waived off.

- The amount of penalty for late payment of taxes is determined by the size of the property and may vary from Rs 100 to Rs 25,000 per day.

[ecis2016.org] All about stamp duty in UP

Property tax exemptions in Kanpur Nagar Nigam house tax

Tax exemptions are available for buildings used for burial or cremation services, buildings used for charitable purposes or public worship, schools and intermediate academic institutions, historic buildings, properties with a value of less than Rs 360 and which are the only property owned by the individual.

[ecis2016.org] All about the NMC property tax Nagpur online

Kanpur Nagar Nigam house tax FAQs

Can I pay Kanpur Nagar Nigam house tax online?

Yes, you can pay your Kanpur Nagar Nigam house tax online.

Where to pay Kanpur Nagar Nigam house tax online?

You can pay your Kanpur Nagar Nigam house tax online on kmc.up.nic.in.

What kind of services can you find on the Kanpur municipal corporation’s website?

You can avail various services, including online property tax payment, property tax calculation, birth registration, and death registration.

Is it possible to get notifications about property taxes on my mobile phone?

Yes, you can get notifications about property taxes on your mobile phone. Go to the KMC’s official website and click on the page that says ‘property tax information’. Next, click on the ‘Update Mobile No. for Related Tax Alerts’ link and follow the on-screen instructions.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Must Knows