[Ecis2023]

For a map and guide, and information on where to find books in Holly Hedges or where are the books in Sweaty Sands, please read the following. Continue reading to find the complete guide from Penn Book.

You are reading: Where Are The Books In Sweaty Sands? Best Full Guide [ecis2023]

Flexibility is a key factor in Fortnite’s success. It is updated every week, a testimony to the concept of online video gaming as a service. This allows for new game modes, customizable items, and special events.

The best known feature of Fortnite is its 100 player Battle Royale mode. This online free for all pits a single player against another person or teams against other players in a survival match. The battle royale mode was inspired by PlayerUnknown’s Battlegrounds, also known as PUBG.

Now it’s time for some research. Ragnarok is our Viking warrior from Fortnite Season 5. He has a notion about the Chuggus and wants us to find some old, convenient glowing books to discover what’s happening. This is one of our most difficult object hunts in a while. These objects glow with a slight blue tint, but they are small and hidden in corners. I am here to help.

Table of Contents

- 1 Where to collect books from Holly Hedges

- 2 Where Are The Books In Sweaty Sands?

- 3 Fortnite Book Locations in Holly Hedges and Sweaty Sands for Week 7 Challenges

- 3.1 Fortnite book locations in Holly Hedges and Sweaty Sands

- 3.2 Fortnite Week 7 Challenges

- 4 FAQs

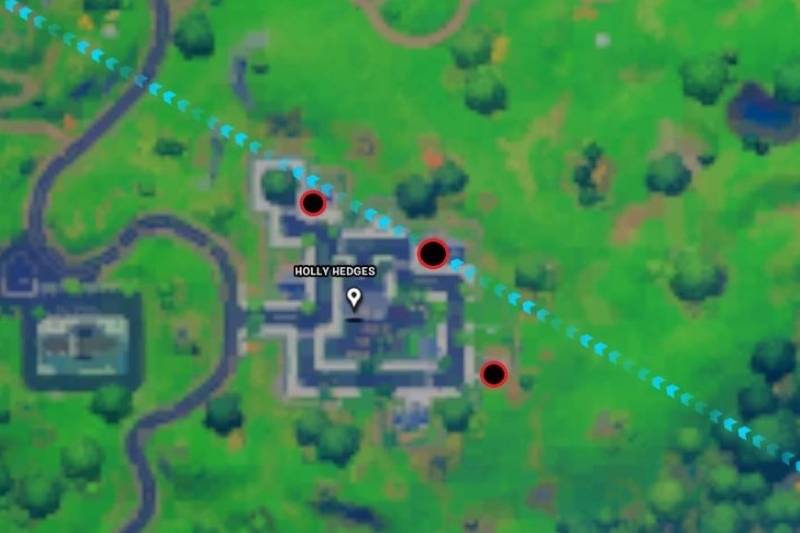

Where to collect books from Holly Hedges

Holly Hedges: It is best to tackle each one individually. From what I know, there are three books at each location. You can miss one but still complete the challenge. Let’s get to the map.

These three are:

The tall yellow Victorian on the East Side of Town. After you enter, find the fireplace to your left.

The house with the two garage doors facing the northeast, the middle one on the map. Near a window, in the corner of one of the rooms to the rear of the house.

As soon as you enter the yellow house, there is a bookcase.

Where Are The Books In Sweaty Sands?

Sweaty Sands – It’d be hard to do all of this in one match. It would be possible to get a vehicle or just a circle that goes close to your next location. This is the map.

Read also : Why Is My Motherboard HDMI Not Working? How Do I Fix It 2022

These three are from East to West:

- The multicolored house is located in the southern middle. It’s green, yellow, stone, brown and stone. The book is located next to the kitchen counter.

- The big apartment building to the East. The book can be found right in front of the desk, on a bookshelf with a mailroom behind it.

- This is the small house that lies across from the apartment building. The book can be found near a bookshelf.

This will suffice: it took me two matches to complete the task, but if the stars align, it should be possible for you to do it one. Continue your search to find out what Chuggus is doing. Ragnarok says that the books weren’t very helpful.

Fortnite Book Locations in Holly Hedges and Sweaty Sands for Week 7 Challenges

Fortnite Week 7 Challenges have officially gone live. The most difficult task is to collect books from Holly Hedges or Sweaty Sands. This guide will show you six book locations that can be used to complete this challenge quickly and easily. You need a quick 20,000 XP to get your Season 5 Battle Pass. We can help you!

Fortnite book locations in Holly Hedges and Sweaty Sands

The Week 7 Challenge isn’t any different from any other Fortnite based objective over the years. To complete the challenge, all you have to do is to approach the locations we describe. We haven’t included the books in our screenshots as we are making this guide ahead of time, but they should be there for you.

Holly Hedges

Book location 1: This is the first book you will need to collect. It can be found in the northwest corner, near the large tree. The yellow house is located to the right of this tree.

You’ll find a tall bookcase when you walk in the door. You should find a book next to it.

Book location 2: This is the location that you are looking for. It’s a large brown house just east of a crosswalk.

Take a left and go into the back room. The book is located on the ground next to these windows.

Book location 3: This is the third location. It’s located at a large greenhouse in the southeast. The large deck at the back makes it easy to recognize.

You will find a room with a fireplace if you go inside. The fireplace is next to a book.

Sweaty Sands

Book Location 4: This is the first place to collect Sweaty Sands books. It is located directly across from the trailer park. The metal frame surrounds the entrance.

The bedroom is large and has a book next to it.

Book Location 5: Get out of that house and walk straight ahead to the blue-brick house.

You will see a bookcase beside a set of steps as soon as you walk in. You can also find another book on the ground.

Book Location 6: This is the final book location. It’s located a bit further east, at the next house. It is a brick house with a porch and a sign indicating private property at the front.

Read also : How To Screenshot On Toshiba Laptop? Top Full Guide 2022

Enter the room, and go through the door to the left. You’ll find a bedroom with a bookcase. The last book you need to collect is the one right next to it, just like the rest. You can collect books from any five of the six locations and get XP.

Fortnite Week 7 Challenges

One of the seven Epic quests making their Fortnite debut on Thursday is collecting books from Holly Hedges or Sweaty Sands. However, the rest of the objectives are mainly focused on shields and the Slurpy Swamp area. Below is the complete list of Week 7 Challenges, including the Legendary Quest.

Slurpy Swamp houses can be visited in just one match (or three).

- Collect Books from Holly Hedges & Sweaty Sands (5).

- Consume three Shield Potions

- Destroy Slurp Barrels (10).

- Slurpy Swamp Search Chests (seven)

- Maximize your shields in one match

- Eliminations with one shield (zero)

- Inflict damage on opponents (500) (1,000), (1,500) (2,000), (2,500) [Legendary Quest]

This is all you need to know about Fortnite’s collection of books from Holly Hedges or Sweaty Sands.

FAQs

How many books are in sweaty sands?

Fortnite Season 5 will require players to find books. Two locations include holly hedges and sweaty sands. Holly Hedges. Each location has three books, so players can still complete the challenge even if they miss one.

Where are the gnomes in Fort crumpet?

Fortnite Gnomes can be found in Fort Crumpet or Pleasant Park. The north side of Fort Crumpet is located northwest of Sweaty Sands. In the southeast corner. In front of the house with the red brick fronted and grey wooden sides at the northeast corner of Pleasant Park.

Where can I find the five Fortnite books?

Fortnite loopers who are looking for a way to get Fortnite players involved in Fortnite can find the following books within Holly Hedges:

- Brown house, Northeastern corner.

- Yellow house, Northwest corner.

- Greenhouse, Southeastern corner, next to the soccer field.

- Another brown house, Southern side.

- Blue house, Western side.

How do I collect gnomes from Fort crumpet?

Under the stairs is the second gnome of Fort Crumpet. Head straight in from the entrance and then go through the archways to the building. At the first sign of the building’s entrance, turn left, and you will see a set of stairs. They are where the gnome hides.

Read more:

- Best Comparison Between Game Of Thrones Books Vs Show

- Video Games Vs Books: Which is Best [2022]

- Top 30 Best Video Game Books of All Time Review 2022

Source: ecis2016.org

Copyright belongs to: ecis2016.org

Please do not copy without the permission of the author

Source: https://ecis2016.org

Category: Blog

![How To Send Books To Inmates From Amazon? Best Guide [ecis2023] 3 How To Find Kindle Unlimited Audiobooks Top Full Guide 300x200 1](https://ecis2016.org/wp-content/uploads/2022/06/How-To-Find-Kindle-Unlimited-Audiobooks-Top-Full-Guide-300x200-1.jpg)