[ecis2016.org] While the Coronavirus pandemic has adversely affected many people’s plans to buy their first homes, we look at how such prospective buyers can get their plan back on track, by following five simple steps

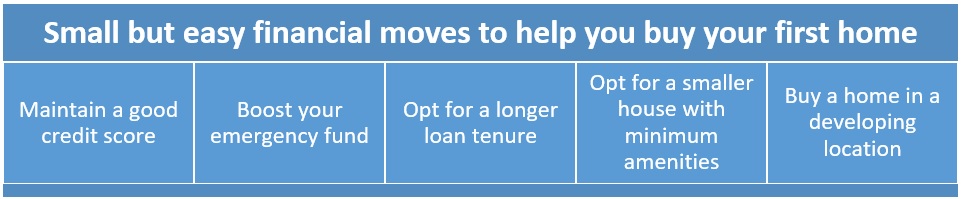

The Coronavirus pandemic and the series of lockdowns to contain its spread, have thrown the dreams of many home buyers into disarray. The government and the Reserve Bank of India (RBI) have announced several measures, to support the economy and existing and prospective home buyers, in this difficult situation. Nevertheless, constructions have stalled, with no clarity on the expected delays in project completion. People are no longer sure if they would be able to afford an EMI, as a large number of people have lost their jobs or suffered salary cuts. Does it mean the end of the road for first-time home buyers, who were planning to purchase a home in the near future? The answer is, no. You can still buy your first home, by making a few changes in your plan and following the five financial moves that we have mentioned here.

You are reading: 5 financial moves that will help first-time home buyers to tide over any crisis

1. Maintain a good credit score

“Maintain a good credit score. Ensure that you pay your bills on time and in full. There will be a certain amount of credit tightening and a good credit score, can go a long way in ensuring that you get a good deal on your loan,” suggests Adhil Shetty, CEO of BankBazaar.com. A high credit score can also help a borrower to get the home loan at the lowest interest rate. The borrower should ensure timely repayment of existing loan EMIs, to maintain a good credit score.

2. Boost your emergency fund

Read also : How to buy a home in your 20s

Experts suggest that prospective buyers should increase the reserve/emergency fund held by them, so that it covers a salary of six months to one year, as security. This will ensure you have more funds at hand, in case of an emergency. This also gives you sufficient time to get another job, in case of a job loss.

3. Opt for a longer loan tenure

By taking a loan for a longer tenure, the buyer can reduce the monthly cash outflow towards the EMI, thereby, reducing the stress on other monthly expenses. However, the overall interest cost will increase, as the buyer will be paying more interest over a longer duration.

Shetty further advises: “You can start putting together a small fund towards your home loan, which you can prepay from time to time. This will reduce the impact of a longer tenure home loan. For example, assume a loan of Rs 40 lakhs at 8% interest. For a 20-year loan, you will be paying an interest of Rs 40.3 lakhs. For the same loan, you will have to pay an interest of Rs 65.7 lakhs if the tenure is 30 years. However, a prepayment of Rs 5 lakhs at the end of the third year, will bring down the interest payable to Rs 41 lakhs. Calculate how you can prepay your loan, to get maximum benefits.”

4. Opt for a smaller house with minimum amenities

A bigger house requires a larger down payment, to be able to avail of a loan than a small house, as well as higher maintenance costs. By downsizing the home, you can easily reduce the loan EMI. It is easier to borrow a smaller amount than a bigger loan. Also, avoid properties with unnecessary amenities. For example, you can consider a project without a clubhouse, gymnasium, swimming pool, etc., if you are not going to use these facilities. Unnecessary amenities not only increase the property’s price but also increase the regular maintenance cost. In the future, when you have requirements and adequate income, you may plan to buy a bigger home.

5. Buy a home in a developing location

Read also : Belarus shows interest in modernising Calcutta Tramways

Properties in developed locations are often expensive, in comparison to upcoming locations. Post-COVID-19, social distancing is going to be an essential aspect that no home buyer can ignore. Emerging locations are usually less crowded than developed ones and are also affordable. So, you may prefer buying your first home at an emerging location. While buying a home in an upcoming location, ensure the availability of good social and physical infrastructure and amenities around the project.

Things to keep in mind

“Post-COVID-19, prospective buyers should adopt a cautious approach in finalising their homes and not fall prey to attractive offers/discounts being offered by developers. They should perform their due diligence towards a particular project and assess the developer’s capacity, in completing and delivering the same. They should also evaluate their financial obligations arising from buying a property, such as the down payment, EMI, maintenance costs, etc., without their savings being affected and above all, job security,” opines Amit Goenka, MD and CEO at Nisus Finance.

Buying a home is as much an emotional decision, as it is a financial one. So, there is no one-size-fits-all solution. Depending on your situation, you should be open to exploring other options, as well.

FAQs

What factors should one consider, when exploring a location for buying a home?

Buyers should select the location for their home, based on their income, family size, loan repayment capacity and availability of social and physical infrastructure in the area.

What are the factors that home buyers will consider when buying a home after COVID-19?

Post-COVID-19, home buyers may prefer homes which are located in areas that are less prone to the spread of contagious diseases, where it is possible to practice social distancing and basic infrastructure is in place for work-from-home (WFH) purposes.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle