[ecis2016.org] Investments in built real estate properties in India stood at Rs 18,600 crores in H1 2021, increasing by 52% YoY, with the office sector accounting for almost 35% of the total investment, according to a report

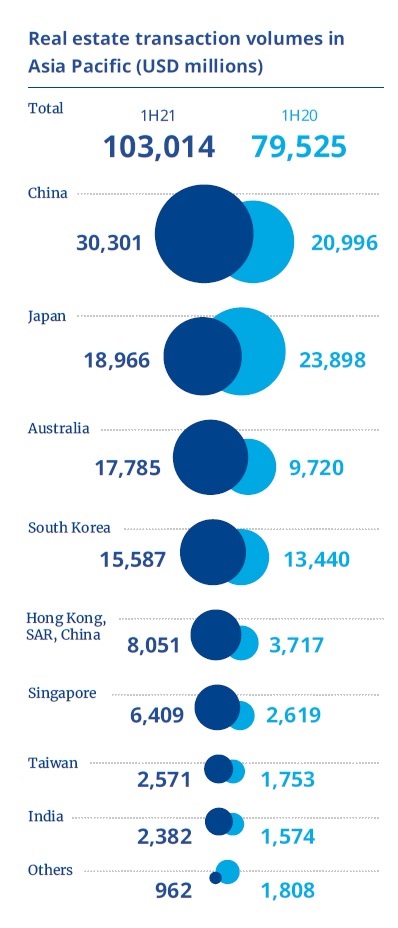

Investments in built real estate properties in India stood at USD 2.4 billion (Rs 18,600 crores) in H1 2021, as per Colliers’ latest report, ‘A Brave New World: Investing Beyond the Momentary Squall’. This represents a 52% increase from inflows in built assets in H1 2020. During H1 2021, China garnered the highest inflows in the Asia-Pacific region, followed by Japan and Australia.

You are reading: India witnessed USD 2.4 billion inflows into built realty assets in H1 2021, up 52% YoY

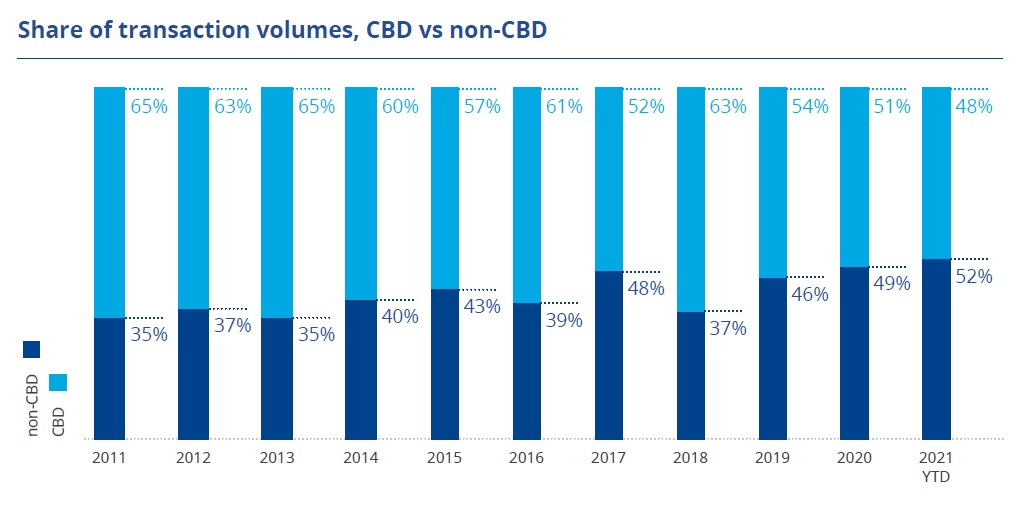

Interestingly, across Asia Pacific, roughly half of all office investments were seen in non-CBD assets in 2020 and early 2021. This was partly driven by the increasing supply pipelines and larger assets being developed in these areas, as well as more life sciences and business park-type of demand from the end-users. In India, while the majority of the office investments have been in non-CBD locations across cities for some years now, investors are now scouting for office assets, either in land or in the under-construction stage. In India, office sector investments accounted for almost 35% of the total investments in the first half of 2021, indicating a firm belief in the long-term resilience of the sector, even as many firms look to pivot to a hybrid work model.

Read also : Union Budget 2022: Are there any long-term benefits for home buyers and developers?

[ecis2016.org] 74% of Indian workers keen on flexible, remote working options

“There is a huge potential for global funds in India. Office assets will continue to gain fervor from investors, due to the steady returns from the asset class and the opportunity to bundle the assets under a REIT. Global funds are also looking to form investment platforms with developers, as they look to build their capabilities in sectors such as industrial and warehousing, buoyed by the growth in e-commerce and the need for same-day delivery,” said Ramesh Nair, chief executive officer, India and managing director, market development, Asia, at Colliers.

Industrial and warehousing the fastest recovering sector

The industrial and warehousing sector garnered the second-highest inflows, with a share of 27% in total inflows in India during H1 2021. The increased demand from e-commerce companies for logistics space has, in turn, resulted in continued interest from institutional investors with inflows of about USD 775 million (Rs 5,657 crores) in H1 2021. Investors are forming joint ventures with local developers, to build mega-portfolios.

Read also : Tamil Nadu government proposes new housing policy

“The global capital flows in Asian and other emerging markets specifically like India, with a stable policy regime, have witnessed robust inflow of investments. The investors are pragmatic in emerging investment themes, across private and public markets. Apart from the traditional real estate asset classes like office, residential, industrial and logistics, newer themes on digital storage, shared spaces, public equities and greenfield, have seen significant traction,” said Piyush Gupta, managing director, capital markets and investment services (India), at Colliers.

[ecis2016.org] Warehousing sector leads Rs 10,200-crore investment into commercial real estate during Q2 2021

Alternate assets gaining ground in Asia-Pacific

Investment volumes of alternative assets now account for 8.5% of all real estate assets in the Asia-Pacific region – more than double of their market share in the period 2014 to 2019. This is primarily driven by technology economy sectors like data centres, R&D centres, cold chain and life sciences. Given the growing focus on these emerging asset classes, there is more room for more specialised investors to enter this space, particularly in the data centre and cold chain space. In India, H1 2021, data centres saw investments of about USD 161 million (Rs 1,175 crores), with corporates tying up with global data centre providers.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle