[ecis2016.org] District Level Committee (DLC) rate, is the minimum value of property at which the registration of sale of a plot, apartment, house or land takes place. Know more about DLC rate and how/where to find these rates

If you purchased a property in Rajasthan, the next step would be to get the sale deed registered. For this, you will need to pay the stamp duty to the government. Should you pay stamp duty on the actual sale price of the property or the DLC rate, which is the government’s valuation of the property you have bought?

You are reading: DLC rate: All about District Level Committee rate or DLC rate in Rajasthan

DLC rate full form and meaning

DLC rate stands for District Level Committee rate. It is the minimum rate at which the stamp duty is calculated. Let us see this through an example:

Case 1: When DLC is lower than the actual sale price

Suppose Aarti Khandelwal buys a residential property worth Rs 50 lakhs. The DLC rate of this property is Rs 40 lakhs. However, Khandelwal will need to pay stamp duty on the higher value, which is on Rs 50 lakhs.

Case 2: When DLC is higher than actual sale price

Suppose N Sundarajan buys a property worth Rs 60 lakhs and the DLC rate for this property is Rs 65 lakhs. Therefore, Sundarajan will have to pay stamp duty on the higher of the two, which is at Rs 65 lakhs.

DLC rates: Where to find it?

To get the correct DLC rate, you will have to check the government websites. These are revised and updated from time to time, so, make sure that you are referring to the current DLC rates.

DLC rate: Other names by which it is known in India

While DLC rate is a term largely used in Rajasthan, it is known by other names in the rest of the country.

| State | Term |

| Rajasthan | DLC rate |

| Maharashtra | Ready reckoner rate |

| Delhi, Uttar Pradesh, Uttarakhand | Circle rate |

| Haryana, Punjab | Collector rate |

| Karnataka | Guidance value |

| Tamil Nadu | Guideline value |

| Telangana | Unit rate |

| Chhattisgarh, Madhya Pradesh | Market value guideline |

[ecis2016.org] All about IGRS Rajasthan and the Epanjiyan website

DLC rates classification

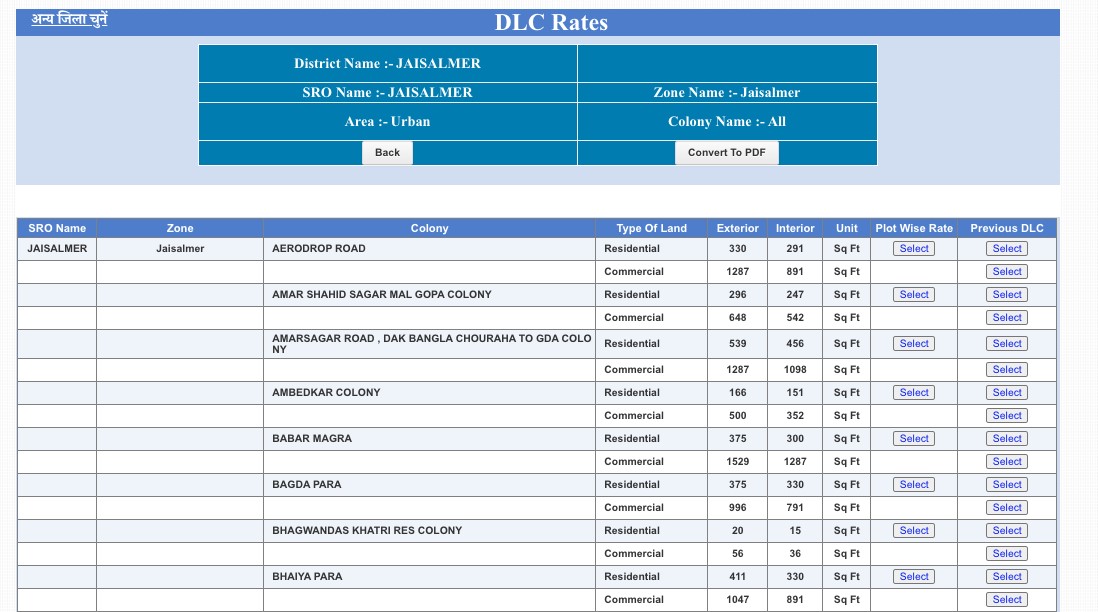

The DLC rates can be classified into four different broad heads. These are: residential, commercial, institutional and industrial. The residential and commercial categories can further be sub-divided into the exterior and the interior. The DLC rates are defined and formulated by the authorities, accordingly.

What entails the categorisations for DLC rates?

Read also : What is a partnership deed?

Residential land or property can be categorised as premises that are meant for residential usages only. This can include farmhouses and flats. At the same time, residential premises that are rented or guest houses are also a part of this category.

Commercial land or property can be categorised as premises that are meant for commercial purposes. Showrooms, retail shops, eateries, godowns gardens, multiplexes, cinema halls and restaurants, cafes and banquets outside the hotel premises, are taken as commercial properties.

Institutions include all educational, medical, government and community centres. This is a huge list that entails yoga centres, gas stations, stations, booking stations, etc.

Industrial land and property are premises that are meant for industrial purposes and are registered under the Industrial Department of the government of Rajasthan. Examples of such properties are canteens and small cafetaria in the factories and industrial workplaces that are meant for industrial workers.

What is exterior and interior DLC rate?

The DLC rate can be easily divided into two categories, the DLC exterior and the interior. These are categorised and defined by their proximity to the road. If the property or land is deemed to be beside the main road, the DLC exterior is applicable. However, if the property or land is not beside the main road, the DLC interior is applicable on it. These categories apply to both, residential and commercial categories.

DLC rate Rajasthan: How to find DLC rate on epanjiyan?

Given that the term DLC rate is used widely across Rajasthan, we will show you how to find the DLC rate for properties in the state. You can view these rates on the IGRS website or through the epanjiyan website.

Step 1: Log on to the IGRS Rajasthan website or epanjiyan or simply click here.

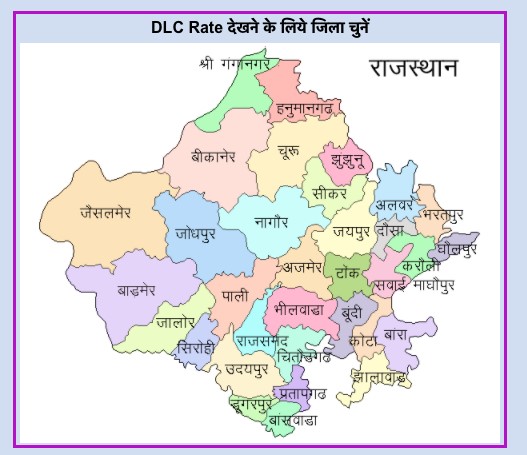

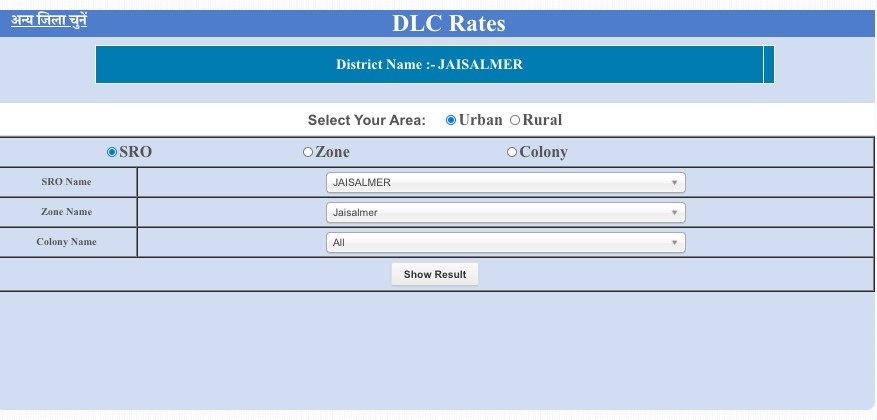

Step 2: On your left-hand side, you will see a ‘DLC information option’. Click on it to proceed. You will be directed to the following map.

Step 3: Click on the district to view the DLC rates. Both, the old and new rates will be available.

DLC rate Rajasthan: How to find DLC rate on IGRS Rajasthan website?

Read also : Aadhaar card verification online procedure: Everything you need to know

You can check the DLC rate on the IGRS Rajasthan website.

Step 1: Log on to the IGRS website or click here.

Step 2: On the homepage, go to the ‘E-citizen’ tab and then go to ‘DLC Rate’. You will be able to check both, old and new, DLC rates in Rajasthan. You can check the old rates within the IGRS Rajasthan website. If you wish to know the new rates, on clicking it, you will be directed to the epanjiyan website.

[ecis2016.org] Stamp duty and registration charges in Rajasthan

DLC rate latest updates

Developers demand lower DLC rate, Rajasthan state budget slashes rate

Developers in Rajasthan have demanded that the district level committee (DLC) rates should be lowered by 30%. In 2017, the DLC rate for residential properties was raised to 17%, up from 10%. This, the developers allege, was done without adequate consultation with the public representatives and has led to an imbalance in the property market. Normally, the DLC rate is decided by the committee which includes the MLA and the district collector.

According to the builders, the state government should revise the rates, keeping in view the fact that the market value is far lesser than the fixed value. The DLC rate of commercial properties should not be substantially higher than the residential properties either, they say.

The Rajasthan Budget 2021-22 did seem to accommodate the plea to an extent. While presenting the state budget in the assembly, chief minister Ashok Gehlot slashed the DLC rates by 10% and reduced the registry rates for flats priced up to Rs 50 lakhs to 4% from the existing 6%.

While agriculture, health and education were the priority sectors, no new taxes were imposed on the public.

DLC rates and the revival of the realty sector

The reduction in the DLC rates and stamp duty, as decided by the state government, is expected to boost the real estate market. This reduction is expected to increase the demand for housing, providing additional benefits to home buyers. The stamp duty was reduced from 6% to 4% in 2021, to cope up with the economic downfall in the real estate sector. The outbreak of the Coronavirus pandemic and the subsequent lockdown across the country had adversely affected the sector. However, the reduction in DLC rates has provided significant opportunities in the sector once again. It is expected that with a decreased DLC rate, there would be greater demand for housing units across all sections, thereby, increasing the opportunities for both, sellers and buyers.

DLC rate Jaipur

The DLC rate in Jaipur is decided by the Jaipur Nagar Nigam (Jaipur Municipal Corporation). It refers to the minimum rate notified by the state government through the registrar/ sub-registrar’s office of Jaipur, for the registration of property transactions. The stamp duty will be paid on the higher of the declared transaction value and the value computed on the basis of the circle rate chart applicable for an area/sector in the city.

FAQs

What is the full form of DLC?

DLC rate stands for district-level committee rate.

What is the stamp duty in Jaipur?

For men in Rajasthan, stamp duty is 6%, while women enjoy a lower stamp duty at 5%.

Where to check DLC rate in Rajasthan?

You can check the DLC rate on the IGRS Rajasthan website or through the epanjiyan website.

Is there an app for DLC rate calculation?

There is a DLC rates app on the Google Play store that provides DLC rates of Hanumangarh and Ganganagar. The app is completely free of cost and helps individuals in assessing the DLC rates.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Must Knows