[ecis2016.org] To provide a more user-friendly interface to taxpayers in India, the Income Tax Department, on June 7, 2021, launched the Income Tax new portal, also known as E filing 2.0. Know all about its features and services in this guide.

With an aim to provide taxpayers in India a more user-friendly interface, the Income Tax (I-T) Department, on June 7, 2021, launched the income tax new portal or E filing 2.0.

You are reading: E filing 2.0: All about income tax new portal

It is a more modern and seamless version of the previous one. The latest version of the e-filing portal can be reached at www.incometax.gov.in. The older version of the efiling portal was www.incometaxindiaefiling.gov.in.

Following the shift, all I-T related tasks should be carried out on the new income tax portal.

[ecis2016.org] Know more about taxation of cooperative housing society

Income tax new portal: Objectives

- Fast and accurate outcomes for taxpayers.

- First-time right approach.

- Enhance user experience at all stages.

- Improve taxpayers’ awareness and education through continuous engagement.

- Promoting voluntary tax compliance.

- Managing outstanding demand.

[ecis2016.org] All about e tax payment

E Filing 2.0 features

E Filing 2.0 has the following new features:

One-stop solution: All interactions, uploads or pending actions will be displayed on a single dashboard, for follow-up actions by taxpayers.

Faster refunds: Integrated with immediate processing of the Income Tax Returns (ITRs), to issue quick refunds to taxpayers.

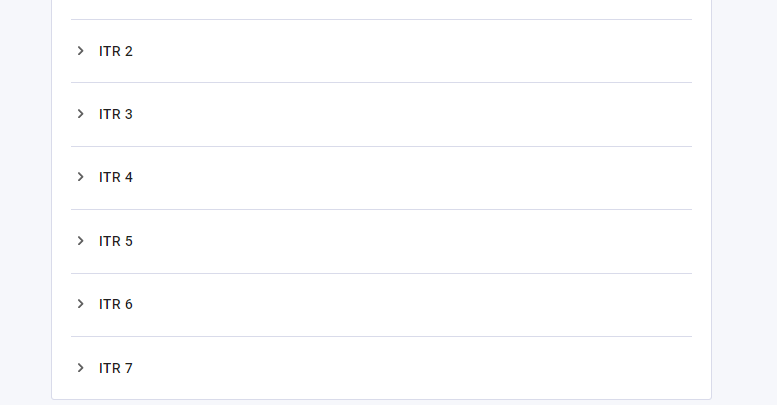

Cost-free ITR preparation: A free ITR preparation software with interactive questions, has been made available. This will help taxpayers in submitting ITRs 1, 4 (online and offline) and ITR 2 (offline). The facility for preparing ITRs 3, 5, 6 and 7, will also be made available later.

Pre-filled ITR forms: Pre-filled ITRs, with salary income, interest, dividend and capital gains, will be available after TDS and SFT statements are uploaded. Taxpayers will be able to update their profile and provide certain income details, including those from salary, house property, business/profession, which will then be used in to pre-fill their ITRs.

Call centre: New call centre for taxpayers’ assistance, for prompt response to queries.

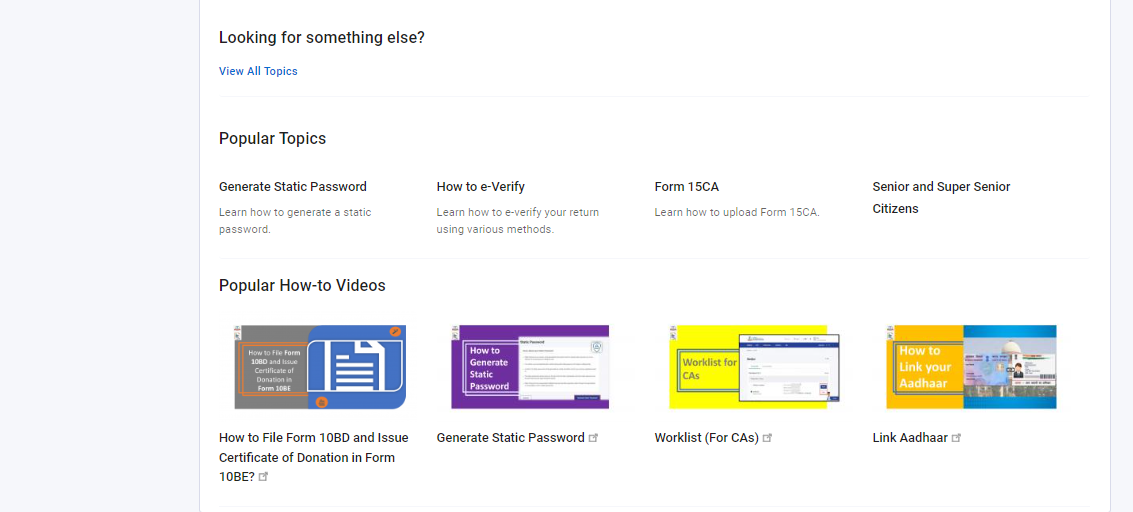

User tutorials: Detailed FAQs, user manuals, videos, and chatbot/live agent.

New functions: Functionalities for filing I-T forms, adding tax professionals, submitting responses to notices in faceless scrutiny or appeals are made available.

Increased payment options: e filing 2.0 enables tax payments through RTGS/NEFT, credit card, UPI and net-banking.

[ecis2016.org] Your guide to advance tax payment online

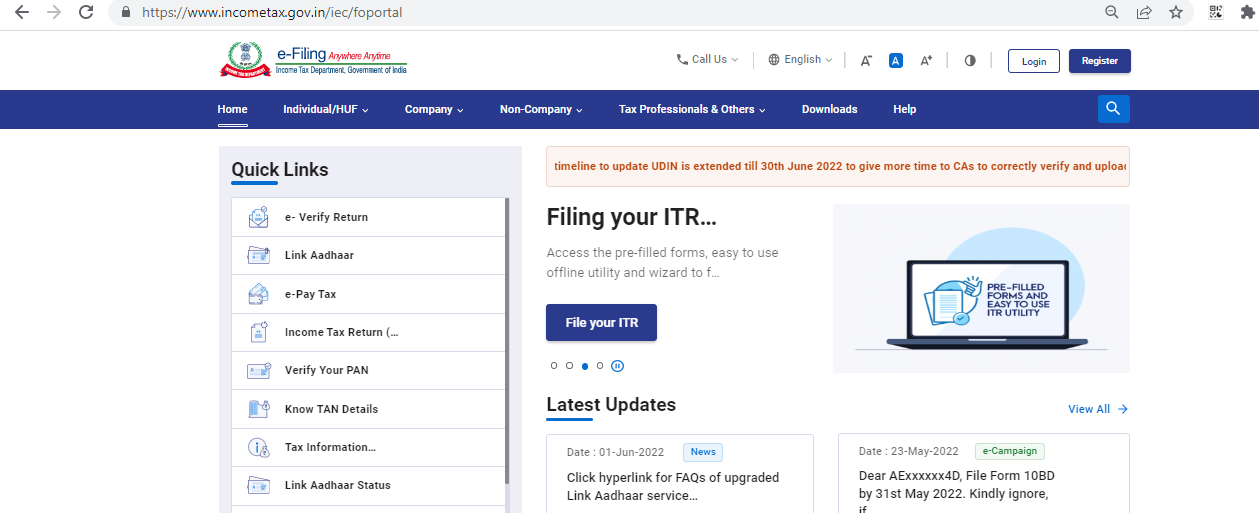

E filing 2.0 home page

Read also : All about property mutation in Bihar

[ecis2016.org] A guide to ITR login and registration

Income tax new portal: Quick links for taxpayers

- e-Verify return

- Link Aadhaar

- e-Pay tax

- Income tax return

- Verify your PAN

- Know TAN details

- Tax information and services

- Link Aadhaar status

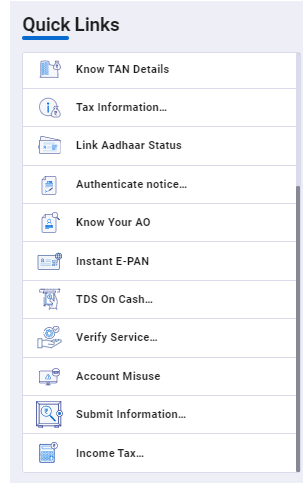

- Authenticate notice/order issued by ITD

- Know your AO

- Instant E-PAN

- TDS on cash withdrawal

- Verify service request

- Account misuse

- Submit information on tax evasion or benami property

- Income tax calculator

[ecis2016.org] All about e PAN card download

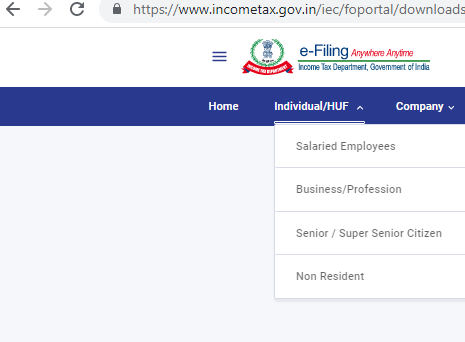

Income tax new portal: Services for individuals and HUFs

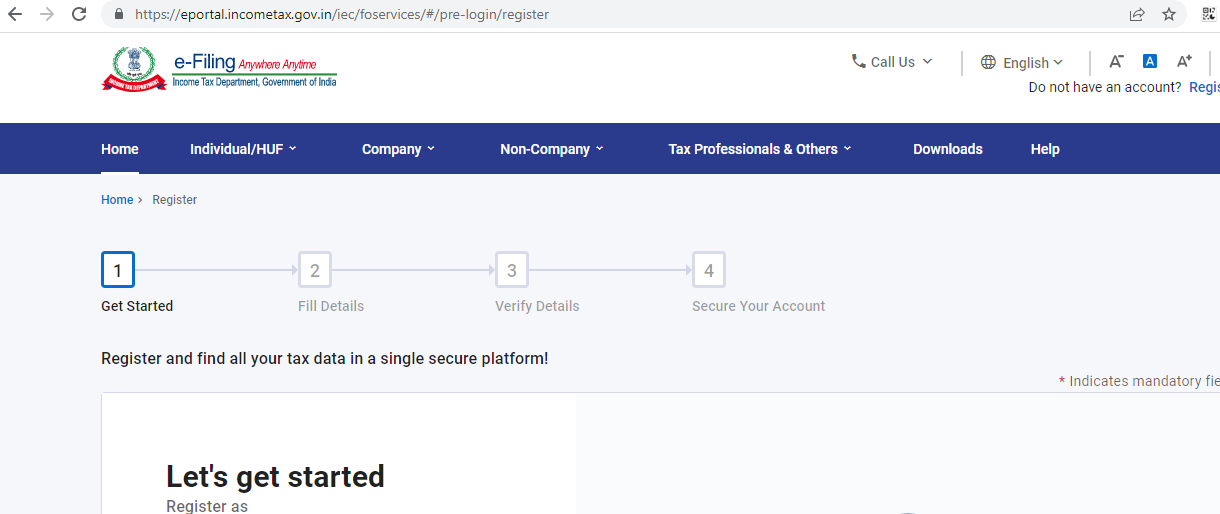

efiling 2.0: Registration

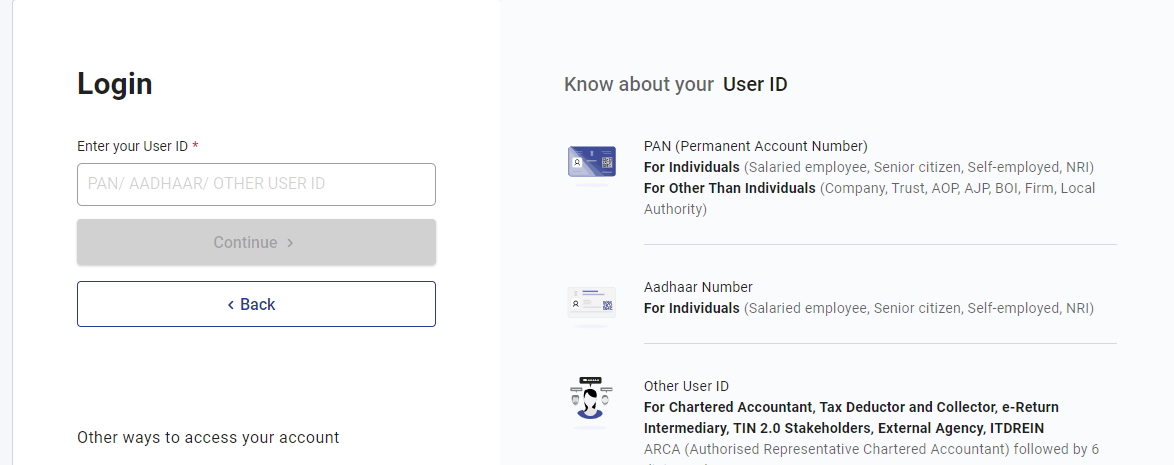

Income tax login 2.0

[ecis2016.org] How to check income tax refund status

Income tax 2.0: Tutorials

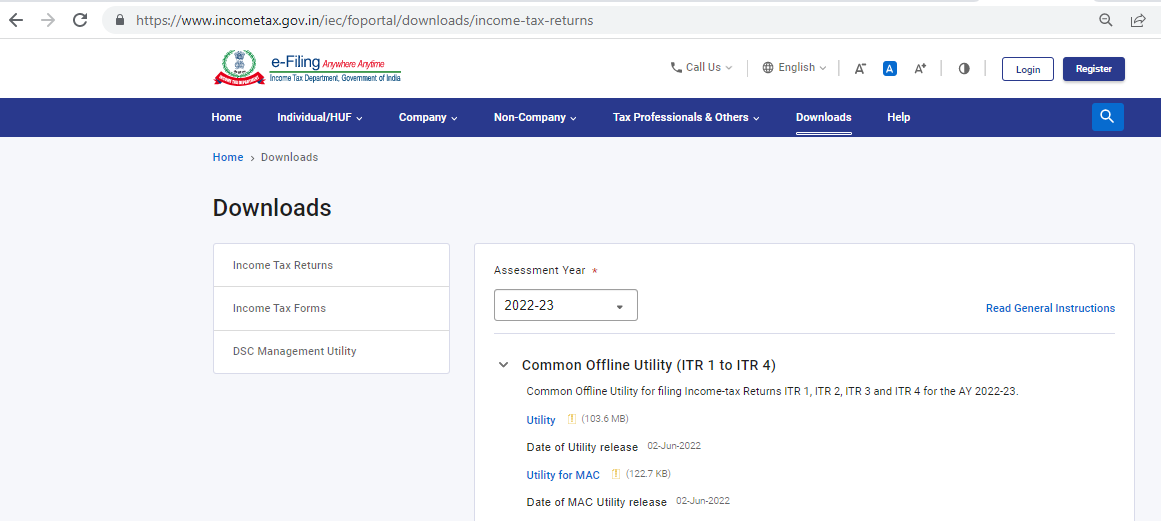

Efiling 2.0 downloads

E filing: Helpline numbers

General queries related to income tax

Timing: From 8 AM to 10 PM (Monday to Saturday)

Phone: 1800 180 1961

e-filing and Centralized Processing Center

Queries on e-filing of ITRs or forms and other value-added services and intimation, rectification, refund, and other I-T processing related queries.

Timing: From 8 AM to 10 PM (Monday to Friday)

Read also : All about small scale industries

From 9 AM to 6 PM (On Saturday)

Phone:

1800 103 0025

1800 419 0025

+91-80-61464700

+91-80-46122000

TRACES – TDS Reconciliation Analysis and Correction Enabling System

Form 16, Tax Credit (Form 26AS), queries related to TDS statement and Form 15CA processing.

Timing: 10 AM to 6 PM (Monday to Saturday)

Phone:

+91-120-4814600

1800 103 0344

Tax Information Network – NSDL

Queries related to application for issuance / update of PAN and TAN through NSDL.

Timing: 7 AM to 11 PM (All Days)

Phone: +91-20-27218080

e-filing unit, Centralized Processing Centre (CPC), Income Tax Department, Bengaluru 560500

Queries related to income tax return (For ITR 1 to ITR 7): ITR.helpdesk@incometax.gov.in

Queries related to tax audit report (Form 3CA-3CD and 3CB-3CD): TAR.helpdesk@incometax.gov.in

Queries related to any other issue: efilingwebmanager@incometax.gov.in

FAQs

When was efiling 2.0 launched?

Efiling 2.0 was launched on June 7, 2021.

What is the address of the income tax new portal?

The address of the income tax new portal is www.incometax.gov.in

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Must Knows