[ecis2016.org] Learn the process to check EPFO claim status on the official portal, mobile app and through a missed call.

You can utilise your pension fund, which gets saved in your EPFO account, in case of emergencies. Apart from applying for it on the official website, you can also check your EPFO claim status online by following some simple steps. This guide will help you with the step-wise process to check your EPF claim status online, as well as offline.

You are reading: EPFO claim status: 5 ways to conduct a check for EPF claim status

EPFO claim status: Step-wise checking process

Once you have raised a request to withdraw funds from your PF account (read our guide on PF withdrawal to understand the process), you can track your PF claim status on the following platforms:

- EPFO member portal

- UMANG mobile app

- Through SMS

- Through missed call

- Through EPFO toll-free number

Check our guide to conduct PF balance check

EPFO claim status: How to check on the EPFO portal?

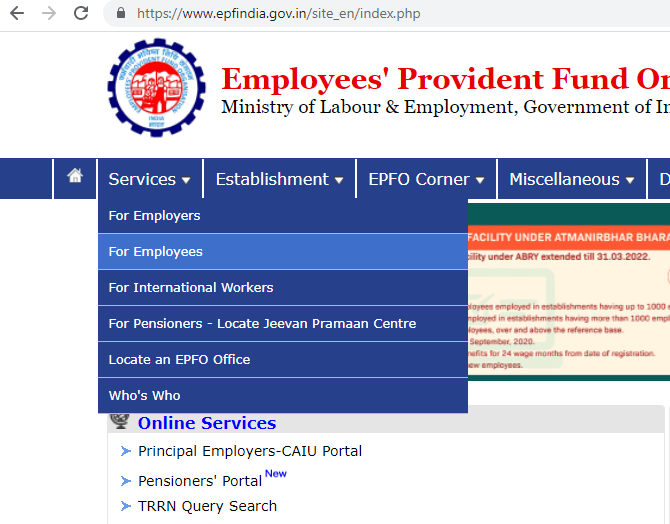

Step 1: Go to the official EPFO website and click on the ‘Services’ option. Select ‘For Employees’ from the available options.

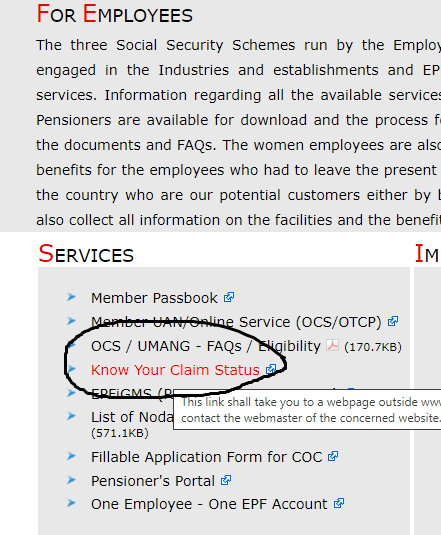

Step 2: On the next page, select ‘Know Your Claim Status’ under the ‘Services’ section.

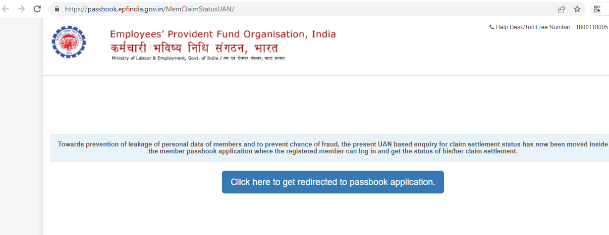

Step 3: Choose ‘Click here to get redirected to passbook application’ on the next page.

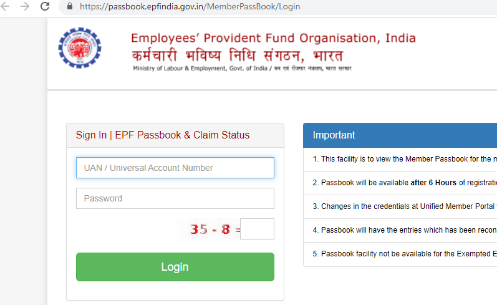

Step 4: Log in using your UAN, password and Captcha code. (To know all about the login process, read our guide on UAN login.)

Read also : All about Maa Bhoomi Telangana 2022

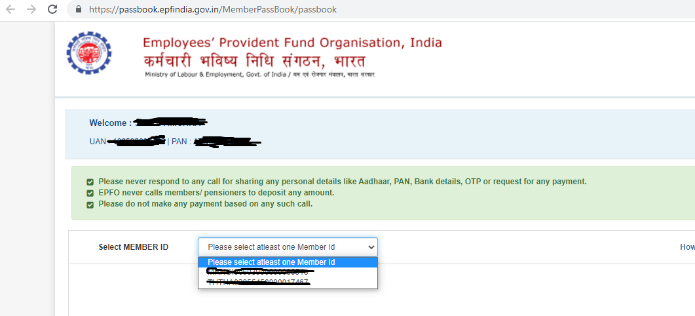

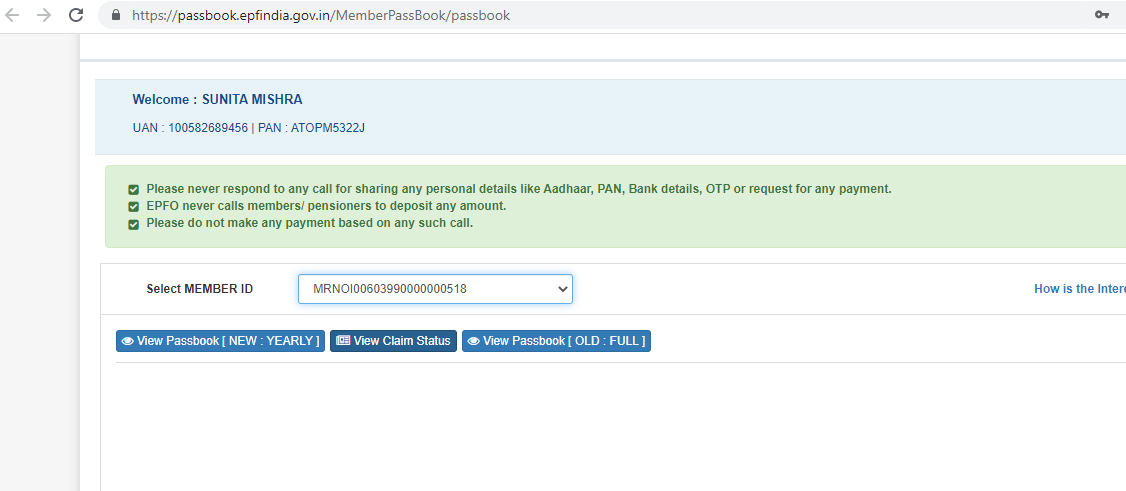

Step 5: Once you are logged in, the home page will show you your member IDs. Select the member ID for which you have raised a settlement request.

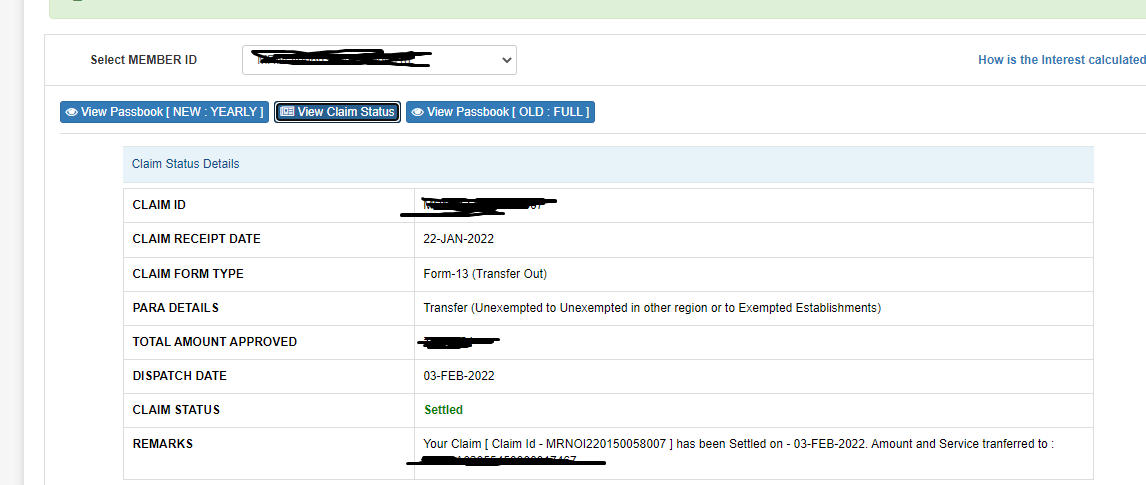

Step 6: After selecting the member ID, click on ‘View Claim Status’ option.

Step 7: The status of your EPFO claim request will be reflected on the screen, along with the other details of your PF account.

[ecis2016.org] How to check EPF passbook?

EPF claim status check through missed call

You can also check your EPF claim status by giving a missed call on 011-22901406.

- For this, your mobile number must be registered with the EPFO.

- Your UAN must be activated and linked with your number.

- Your Permanent Account Number (PAN), Aadhaar number and bank account information should be updated on the UAN portal.

Note that you will receive an answer to your missed call through an SMS and not through a call-back. Your call would get disconnected automatically after two rings.

[ecis2016.org] Rules for PF withdrawal for house purchase

PF claim status check on EPFO toll-free number

You can also check your PF claim status by calling on the EPFO toll-free number 1800 118 005.

[ecis2016.org] All about EPFO e nomination

EPFO claim status check through SMS

Read also : Bank Reconciliation Statement: Need, procedure and benefits

After you raise a request for PF withdrawal, the EPFO intimates you through an SMS on your registered mobile number. You will get to know your PF claim status, as soon as the pension fund body decides about your request. It will send you an SMS, informing you whether your EPF claim has been approved or rejected.

In case your UAN is activated and your mobile number is registered with the EPFO, you can check your PF claim status by sending a text message. PF account holders have to send EPFOHO UAN ENG message to 7738299899. The abbreviation ENG here means that the user wants the information in the English language. In case you prefer the information to reach you in, say, Hindi language, just replace ENG with HIN. You have to use different codes for different languages:

| Language | Code |

| English | ENG |

| Hindi | HIN |

| Punjabi | PUN |

| Marathi | MAR |

| Tamil | TAM |

| Telugu | TEL |

| Malayalam | MAL |

| Kannada | KAN |

| Gujarati | GUJ |

Note that your UAN must be linked with a bank account, your Aadhaar number and your PAN for you to be able to check your EPF claim status through the SMS facility.

[ecis2016.org] All about Employees’ Provident Fund (EPF) housing scheme

EPFO status claim check through the UMANG app

After logging in, select ‘Employee Centric Services’. Select ‘Track Claim’. You will be redirected to a page where you can view your claim status.

Details needed to check PF claim status

To check the status of their EPFO status claim, you will require the following details:

- Employer’s details

- Details of your EPF regional office

- Universal Account Number

- Active mobile number

- Extension code

EPFO claim status stage

There are 4 stages of EPFO claim status:

- Payment under process

- Settled

- Rejected

- Not available

How much time does it take for EPFO claim status to get settled?

Once the withdrawal is initiated using one of the five platforms discussed in this guide, your PF claim would be settled within 5-10 days.

[ecis2016.org] How to raise your EPF grievance?

EPFO claim status FAQs

In case the PF claim status is not settled within 20 days, where do I complain?

You can approach the regional PF commissioner in charge of grievances. You can also file a complaint on the website using the EPFiGMS feature in the ‘For Employees’ section. You can also appear before the commissioner in the ‘Nidhi Apke Nikat’ programme conducted on the 10th of every month.

Is there any time limit for withdrawal of provident fund dues?

A member has to wait for two months for withdrawal of the PF amount, in the case of resignation from service (not superannuation).

When the employer is not attesting to the claim form, how to apply for withdrawal of provident fund?

The employer must attest the PF withdrawal application form. In case of any dispute, the member can obtain an attestation, preferably from the bank in which he has maintained his account and submit the same to the regional PF commissioner, giving reasons for not obtaining the signature of the employer. The commissioner will then pursue the matter with the employer, if necessary. If the member has activated his UAN (Universal Account Number) and linked his bank account and Aadhaar, he can submit a composite claim (Aadhaar), which only requires the signature of the member.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Must Knows