[ecis2016.org] Explained in detail in this article, is the way IGRS Jharkhand supports stamp duty and property registration efficiently

While investing in any property in India, it is mandatory to pay stamp duty and registration charges, so that the immovable property can be legally registered in the buyer’s name. The Inspector-General of Registration and Stamps (IGRS) Jharkhand is responsible for services towards stamp duty and property registration and this task is performed through the e-Nibandhan web portal. According to Section 25 of the Registration Act, 1908, one has to mandatorily submit documents associated with registration of deeds, within four months from its execution date, failing which it will attract a heavy fine.

You are reading: All about IGRS Jharkhand and the e-Nibandhan website

[ecis2016]: All about Jharbhoomi

e-Nibandhan: Information on stamp duty and registration charges

Stamp duty and registration charges differ across the various states in India. In Ranchi, the current stamp duty rate is 4% of the property cost and the registration cost is 3% of the property cost for both, men and women.

[ecis2016.org] Stamp duty and registration charges in Ranchi

All about IGRS Jharkhand: List of documents for property registration

Below mentioned are the documents that you have to submit, along with your registration form, to register a property in Jharkhand:

- Proof of identity like Aadhaar card/voter card/PAN card/passport/driving licence, etc., of both, the buyer/s and the seller/s.

- The slip that mentions the market value of the property and the chargeable stamp duty and registration fees.

- Filled Form 60 or PAN card, with proof of identity and address of both parties.

- Principal property documents.

- Passport size photographs of both the parties.

[ecis2016.org] All about Bihar bhumi

e-Nibandhan IGRS Jharkhand: Various services provided

[ecis2016.org] All about IGRS Rajasthan

Read also : Mumbai Trans Harbour Link: All about the Sewri – Navi Mumbai sea link

The e-Nibandhan IGRS Jharkhand portal supports a number of property-related activities including:

- Fee calculation or payment, society / firm registration.

- Ease of doing business(EODB).

- Online registration.

- Downloading of the various forms including input form, society registration form, marriage registration form, etc.

- Searching deeds / non-encumbrance.

[ecis2016.org] All about Khasra number

e-Nibandhan IGRS Jharkhand: Calculating the stamp duty of property

On the e-Nibandhan web portal’s home page at http://regd.jharkhand.gov.in/jars/website/ you will see a ‘Stamp Calculator’ tab on the right side of the screen. Clicking on this will take you to the stamp duty calculation page as seen in the screenshot above. Enter the district name and select the deed type, after which you will have to fill in details including anchal name, mauza name, land type, valuation, selling rate, area and unit. Click on ‘Add’ and you will be helped with the minimum stamp value in rupees.

After this, you can get an e-stamp for registration by doing an online payment.

[ecis2016.org] All about IGRS Andhra Pradesh

IGRS Jharkhand: Stamp duty and registration fee payment

You can pay the stamp duty online by clicking on the tab ‘Fee Calculation/Payment’ on the homepage of the e-Nibandhan portal and clicking on ‘e-Stamp Online Payment’.

- RERA warranty clause: Will it protect home buyers?

- Maharashtra cabinet approves two more metro rail projects for Mumbai

- New IT and Electronics Policy to drive West Bengal housing demand: Report

- Maharashtra changed Mumbai Development Plan for metro car shed: HC informed

- Two-member judicial panel to hear Mumbai Metro works’ noise pollution case

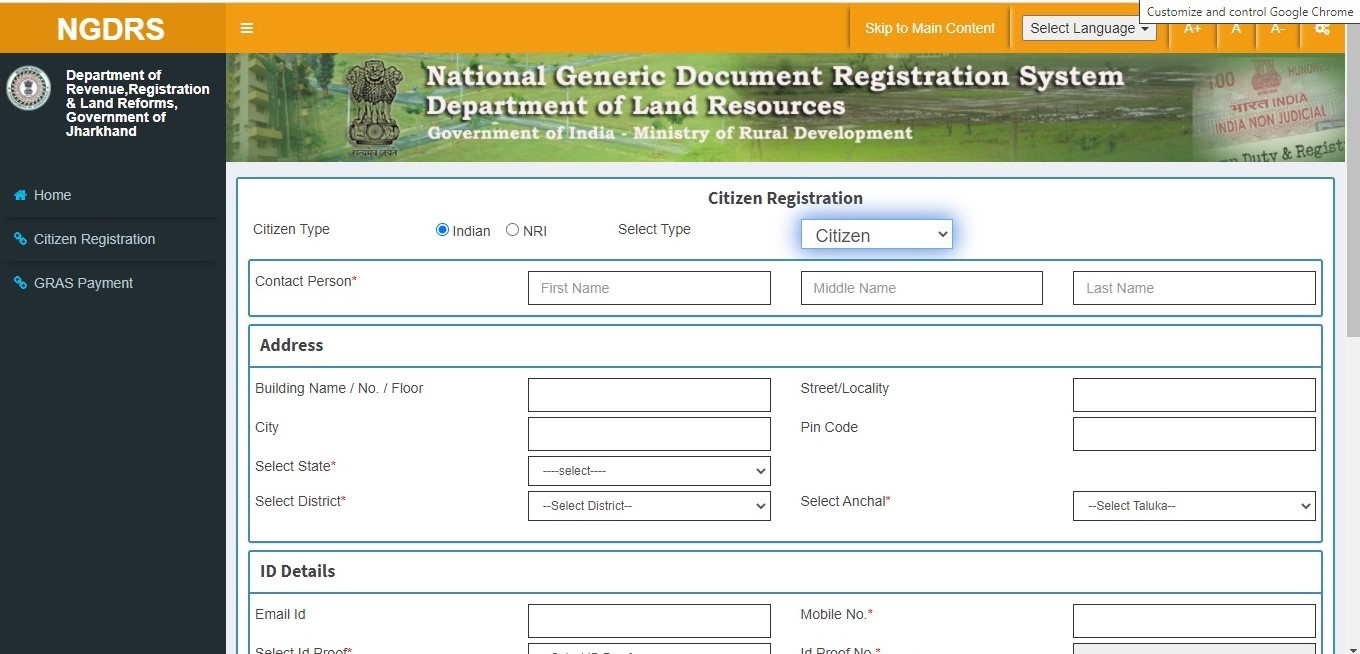

You will be directed to https://jharnibandhan.gov.in/. This page is the document entry for registration. The registration form looks like the below picture. Fill in the details like citizen type, name, address, identity proof details, user name, password and security question. If you have already registered you can enter the site using the user name, password, captcha and OTP.

Read also : Three Largest Commercial Projects in Noida

Once you log in, you will find the payment services tab that will have the ‘purchase e-stamp paper’ option. You will be directed to the payment page where you will have to enter details including purpose of payment (registration deed), district, article, first party name, second party name, stamp duty paid by and purpose of stamp, PAN number, mobile number, amount in rupees and then, proceed to pay.

[ecis2016.org] All about IGR Odisha

Once paid, you can print the online e-stamp certificate by downloading the deed through digi locker.

The next step is the registration charges payment. On the e-Nibandhan portal’s home page you will see the online registration tab. Under it, click on the ‘Pre-registration’ tab as seen in the picture below.

You will be directed to https://jharnibandhan.gov.in, where you have to log in with the username and password created and pay the registration fee, for which you will get a receipt. Next, in the same portal, take an appointment with the SRO to complete the process of stamp duty and registration. You can view the appointment and also your property-related activities in the dashboard present on the website.

[ecis2016.org] All about land record terms

FAQs

What is IGRS Jharkhand?

IGRS Jharkhand is officially responsible for the stamp and registration of property. Services for the same are offered to citizens through the e-Nibandhan web portal.

What documents are required to register property in Jharkhand?

Documents that are mandatory for property registration in Jharkhand include identity proof, address proof and property-related documents.

How do I calculate the stamp duty to be paid in Jharkhand?

One can calculate the stamp duty to be paid by using the stamp duty calculator available on http://regd.jharkhand.gov.in/jars/website/.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle