[ecis2016.org] While the real estate industry may have been expecting more from Budget 2021, stakeholders have, nevertheless, welcomed the finance minister’s various announcements, terming it as a pragmatic budget

The market has welcomed the host of announcements in Budget 2021 that are being seen as a measure to revive the economy. From health to infrastructure, finance minister Nirmala Sitharaman’s third Budget speech tackled the wishlist of various industries and consumers that were impacted by the COVID-19 pandemic. Here are some of the key highlights of the Union Budget 2021-22.

You are reading: Budget 2021: Industry welcomes expansionary budget, hails pragmatic approach

Check out our Union Budget 2021 Latest updates

Affordable housing benefits extended

The finance minister has announced the extension of the time limit to avail of benefits on purchase of affordable housing by one more year, to March 31, 2022. This means, the deduction benefit of Rs 1.5 lakhs under Section 80EEA will now be available for buyers who invest in an affordable housing project before March 2022. This provides relief for buyers who were seeking investment opportunities in a market where new launches have fallen, due to the COVID-19 pandemic and developers are focussing on clearing their existing stock. The government’s push towards Housing for All under the Pradhan Mantri Awas Yojana (PMAY) will only revive the real estate sector, which has witnessed a slowdown due to large-scale policy changes such as demonetisation, GST and the RERA.

Moreover, with the FM announcing the extension of tax holiday for affordable housing projects by one more year, there is likely to be more supply in the market, with new launches gaining pace once again. The FM has also allowed tax exemption for notified affordable rental housing projects, which could further boost the prospects of this sector.

“It is a pragmatic and forward-looking budget. The estimated, gradual reduction in the fiscal deficit from 9.5% to under 4.5% by 2024-25 will help boost consumption in the economy. The government’s decision to extend the tax holiday for affordable housing projects by another year is a step in the right direction, to realise the PM’s dream of ‘Housing For All by 2022’,” says Kaushal Agarwal, chairman, The Guardians Real Estate Advisory.

[ecis2016.org] Budget 2021: Additional tax benefits for affordable housing to continue

“The government has continued on its stated path of doing away with sector-specific sops and in light of this, the extension of the interest rate deduction for home buyers, as well as extension of tax holiday for affordable projects by one more year, is welcome. Simplification of processes and rules for the SME segment will help ease the cost and efforts of compliance which is very good for the SME sector,” says Rohit Gera, managing director, Gera Developments.

Budget 2021 allocation for highways and metros

In what could be seen as providing a big boost for employment generation, the FM said that the contracts for building around 8,500 kms of highways will be awarded by March 2022. Poll-bound states such as West Bengal will get to witness highway projects worth Rs 25,000 crores. To fund infrastructure projects, the government will also be launching a Development Financial Institution and will provide Rs 20,000 crores to capitalise the institution, with an aim to create a lending portfolio of Rs 5 lakh crores, in next three years.

| State | Investment announced |

| Tamil Nadu | 3,500 kms at Rs 1.03 lakh crores |

| Kerala | 1,100 kms at Rs 65,000 crores |

| West Bengal | 675 kms at Rs 25,000 crores |

| Assam | 1,300 kms at Rs 34,000 crores |

The FM also announced funding for expansion of metro routes in Kochi, Chennai, Bengaluru, Nagpur and Nashik. Two new technologies, ‘MetroLite’ and ‘MetroNeo’ will be deployed in tier-2 cities and the peripheral areas of tier-1 cities, to boost connectivity.

For rail and airport connectivity, the FM announced that Indian Railways is working on the ‘National Rail for 2020’, which will make the entire system future-ready. Sitharaman also announced the privatisation of airports in tier-2 and tier-3 cities. In addition to this, the FM has allocated Rs 1.18 lakh crores to the Ministry of Road and Transport.

“The focus of the Union Budget 2021-22 is to improve economic efficiency and infrastructure growth. Increased focus on infrastructure growth and capital expenditure, will impact the overall growth of the real estate sector too. Good infrastructure could propel the development of real estate, both, commercial and housing, along the transit corridors, highways and newly-proposed airports,” said Ankush Kaul, president – sales and marketing, Ambience Group.

“The government has put its best efforts to put the economy back on track after the adverse effects of the COVID-19 pandemic that the entire country went through. It has focussed a lot on infrastructure in this budget. This will indirectly help boost the housing demand, especially in the Tier II & Tier III cities,” says Ashok Mohanani, president, NAREDCO Maharashtra.

No changes in direct tax

While the government left the direct taxes unchanged, senior citizens of age 75 and above are now exempted from filing income tax returns, if their income source is solely pension and interest earned from their savings. Apart from this, the FM emphasised on reducing compliance and making the system faceless, to improve efficiency and accountability. Small tax payers, which means anyone with a taxable income of up to Rs 50 lakhs and disputed income of up to Rs 10 lakhs, can approach the dispute resolution committee which will be formed for the same. In addition to this, the FM announced that the pre-filled tax forms will now include details of investments made in financial securities.

[ecis2016.org] Budget 2021: Government extends affordable housing tax holiday, deductions under Section 80EEA for another year

Flexibility to REITs and InvITs

The finance minister, in her Budget presentation, announced that the debt financing of Real Estate Investment Trust (REITs) and Infrastructure Investment Trusts (InvITs) will be enabled by making suitable amendments. This has elated the market experts as now, it will become easier for such trusts to raise funds for acquiring infrastructure and real estate assets, thus, solving the cash flow issues in the sector. This will also bring in additional cash from global institutional investors and sponsors, who have been seeking the push from the government to enable REIT and InvITs debt-raising from cash-rich companies. The FM has further announced that the dividend payment will be exempted from the TDS.

“The proposed easing of InvITs/REITs will be massively positive in getting new REITs going and attracting fresh investments in real estate,” maintains Gagan Randev, national director, capital markets and investment services, Colliers International.

Social security for construction workers

The finance minister, in her speech, also said that the social security benefits will now be extended to construction workers and minimum wages will apply to all categories. In addition to this, a portal will be launched that will collect the relevant information on building and construction workers, which will help the government to formulate health, housing, skill, insurance and food schemes, for migrant workers. At the same time, compliance burden on employers will be reduced, with single registration and licensing and online returns. The FM also said that women will be allowed to work in all categories and also in night-shifts, with adequate protection.

“Social security framework has been extended to construction labour. The social security under BOCW cess is already existing. Implementation in most states was done by having a proper framework. This new announcement of including construction workers under the welfare extended to migrant labours, needs to be studied further, on how different it is from the existing scheme,” says Jatin Shah, national director at Colliers International India.

“Given the challenged scenario, the proposed annual budget has been largely positive, no major taxation enhancement is something that is welcome. As the Prime Minister pointed out last year saw mini budgets across the pandemic impacted time frame; the unsaid thing for most industries across the economy is that similar steps may happen with more positives in the offing. Continued focus on ‘Minimum Government, Maximum Governance’ will enhance ‘ease of doing business’, this government spending will provide stimulus for GDP growth, and is laudable,” said Dr Niranjan Hiranandani -National President – NAREDCO and MD – Hiranandani Group

Budget 2021: Real estate industry seeks tax rationalisation to boost demand

We look at what the real estate industry is expecting from the Union Budget 2021, which is due to be announced on February 1, 2021

January 31, 2021: With finance minister Nirmala Sitharaman likely to present the Union Budget 2021 on February 1, 2021, the real estate sector is hoping for announcements that could alter the future of real estate in India. Even though a number of announcements were made in the past six months, such as the revision of the differential between the circle rate and agreement value and major funding for the Pradhan Mantri Awas Yojana (PMAY), which have boosted the sentiments of buyers, stakeholders are still hoping for a bonanza for first-time home buyers and real estate investors.

Will income tax slabs be revised in Budget 2021?

Like every year, the developer community is hoping for more cash in the hands of home buyers, to make property investment more probable and easier for them. In the previous budget, the taxation regime was simplified. This year, it is more about greater liquidity for the tax payer, which will also boost consumption and kick-start the economy once again.

“According to Section 24 of the Income Tax Act, home owners can get a rebate of up to Rs 2 lakhs on the home loan interest, if the owners reside in the property. The government should raise this ceiling to Rs 5 lakhs, to attract more customers,” says Arun Malhotra, CEO, AM Estate Developers.

Nitesh Kumar, MD and CEO of Emami Realty, adds that “For the first-time buyers, the existing cap on property value is Rs 50 lakhs for a loan amount of Rs 35 lakhs, under Section 80EEA. The industry wants it to be increased to Rs 75 lakhs and Rs 60 lakhs, respectively. The tax exemption under Section 80C should also be increased from the current Rs 1.5 lakhs.”

GST discount for developers and home buyers

With the dwindling demand for under-construction properties new project launches coming to a standstill following the Coronavirus pandemic, developers are seeking a Goods and Services Tax (GST) cut for a limited period of time, as they feel that this could help them to speed up construction and make the inventory more attractive to the home buyers.

“The real estate sector contributes 8% to India’s GDP. Even if the government introduces a limited-period GST cut, it would still boost the demand for under-construction properties. The capital influx from the buyers, would allow builders to finish their projects faster, as well,” adds Malhotra.

Budget 2021 will be a crucial one for the real estate sector, maintains Chintan Sheth, director, Ashwin Sheth Group. “So far, the recovery has been a positive one, with profitable sales growth in the residential segment, due to the festive season, attractive schemes and the consumers’ assertive outlook to restart looking for homes. We wish the budget will address some of the critical issues, including GST waiver on under-construction residential developments,” says Sheth.

The present GST rate on under-construction properties is 5% minus the input tax credit benefit for premium homes (valued above Rs 45 lakhs) and 1% for affordable homes (valued under Rs 45 lakhs), points out Ankush Kaul, president, sales and marketing, Ambience Group. “A waiver on GST will reduce the overall burden on developers and make property prices competitive,” he elaborates.

Measures to improve liquidity

Liquidity has remained a concern for developers, since the demonetisation move of 2016. With COVID-19 further worsening the situation, developers are hoping that the FM will announce measures to ease borrowing for them.

“The revival of the real estate sector is imperative for GDP growth, additional employment generation and for drawing investment from domestic and global investors. As the pandemic has brought forth numerous challenges, one of our major budget expectations is the introduction of innovative liquidity measures and improving ease of doing business in the legal and regulatory framework,” says Niranjan Hiranandani, president, NAREDCO.

“Government reforms like the reduction in stamp duty, extension of the project completion deadlines and the RBI’s decision to extend the co-lending scheme for NBFCs and HFCs, led the industry on the path of recovery and boosted market sentiment further. At this point in time, we need easy cash flow and capital generation options that will support the developers to complete the construction on time,” explains Sheth.

More encouragement to affordable housing

To prevent the Housing for All scheme from getting derailed, it is important for developers to have enough incentives and margins. While the PMAY mission has received fresh funds from the government in November 2020, private developers are still struggling to complete and deliver projects on time.

“We expect more incentives for private sector investments in affordable housing. Even though affordable housing is an important segment, the profit margins still remain low and therefore, a stimulus from the government is direly needed,” concludes Malhotra.

FAQs

What date is the budget 2021?

The Union Budget 2021 will be announced on February 1, 2021.

From when is the new budget applicable?

The new budget will be applicable from April 1, 2021.

Budget 2020: What did the real estate sector gain?

By: Amit Sethi

ecis2016.org News speaks to some real estate experts and developers, to understand their views on the Budget 2020 and how it will impact the residential realty sector

February 1, 2020: Budget 2020 has come up with several surprises for the real estate sector, as well as the common man. There are several demands, which the realty sector was expecting to get addressed in the budget 2020, but only a few got the attention of the finance minister. Let us look at some of the key announcements made in the budget and its impact on the realty sector.

What are the new income tax slabs proposed in Budget 2020?

Read also : SC favours setting up of portal to address Supertech home buyers’ grievances

The government has proposed a dual tax slab option to the individual tax payers. The tax payers can select between the new and the existing tax slab option. The FM has proposed to abolish 70 types of tax exemptions out of 100.

The new tax slab format is as mentioned below:

Farshid Cooper, MD, Spenta Corporation says, “The most telling thing to come out of Budget 2020 is the tax relief to individuals. The amended tax slabs will ensure more disposable income in the hands of the middle class. This could lead to reviving the consumption cycle in the realty sector and kick-starting the economy. Further, with additional savings, individual investments in housing, especially affordable housing could see an uptick in the near future.”

Some experts have contrary views as they believe that the non-applicability of the deduction on housing loans under the new optional individual tax structure, can act as a significant deterrent for those contemplating availing of housing loans.

The guarantee scheme for NBFCs and HFCs

The liquidity crisis faced by the NBFCs/HFCs in 2019 is still not completely over. The Budget 2020 proposal to further enhance the credit guarantee scheme for NBFCs and HFCs, is expected to provide some respite to market. “The government’s decision to further bolster the guarantee scheme for NBFCs and HFCs and offer subordinate debt to MSMEs, will to a certain extent, help bring liquidity in the market alongside the abolition of DDT,” opines, Kaushal Agarwal, chairman, The Guardians Real Estate Advisory.

[ecis2016.org] Budget 2020: Tax benefits for home buyers

Boost to infrastructure in Budget 2020

The finance minister announced several steps to boost the infrastructure growth. Several schemes were announced and huge funds have been allocated for industry and commerce. Rahul Grover-CEO, SECCPL, points out: “This year, the budget has revealed the government’s intentions towards bettering infrastructure. The National Infrastructure Pipeline includes 6,500 projects across the country and finance minister Sitharaman has also announced the allocation of Rs 27,300 crores for industry and commerce in FY21. Along with this, plans for developing strategic national highways have also been announced, which can help bring about developmental changes in the real estate sector as well.”

What were the announcements for affordable housing in Budget 2020?

In the Budget 2019, the government had introduced tax benefit for affordable home buyers under section 80EEA, for deduction up to Rs 1.5 lakhs against interest payment. However, the deadline was March 31, 2020. In the Budget 2020, the FM has announced an extension of the benefit under section 80EEA till March 31, 2021.

“The Union Budget 2020-21 continued the government’s focus on the affordable housing sector, by extending the permitted additional deduction of up to Rs 1.5 lakhs for interest paid on loans borrowed for the purchase of an affordable house valued up to Rs 45 lakhs, by one year, i.e., up to March 31, 2021. Thus, the total tax deduction available on such interest paid stays at Rs 3.5 lakhs for one more year, which is expected to positively impact demand in the affordable housing segment. Moreover, segmental supply is also expected to be favourably impacted by the one-year extension in the tax holiday currently available to developers of affordable housing,” says Shubham Jain, group head and senior vice-president, corporate ratings, ICRA Ltd.

What did the warehousing segment get in Budget 2020?

According to Ramesh Nair CEO and country head, JLL India, “The National Logistics Policy and viability gap fund for development of warehouses, would provide impetus for increasing warehousing supply which is expected to rise from 211 million sq ft in 2019 to 379 million sq ft in 2023. Net absorption of 36 million sq ft in 2019 will get a further boost and single-window clearance will expedite supply, as approval time is expected to reduce by six months.”

Other key announcements in Budget 2020

The FM also announced to set up 5 new smart cities under the PPP model. 100 new airports are proposed across the country. The government has also proposed to enhance the guarantee on the bank FDs from Rs 1 lakhs to Rs 5 lakhs. “Declaration to build 100 airports will be a massive infrastructure initiative to integrate all cities and foster growth. The potential of smaller growth centres can now possibly be exploited better,” says Indranil Basu, director, project management (south) at Colliers International India.

|

FAQs

What are the income tax slabs proposed in Budget 2020 for individual tax payers?

The finance minister has proposed two tax slabs for individual tax payers in Budget 2020. Under the existing tax slabs, individual tax payers can avail of tax exemptions, while under the new tax slab, tax payers will have to forego tax exemptions. Tax payers will have the option to choose between the two slabs.

What is the existing tax slab for individual tax payers?

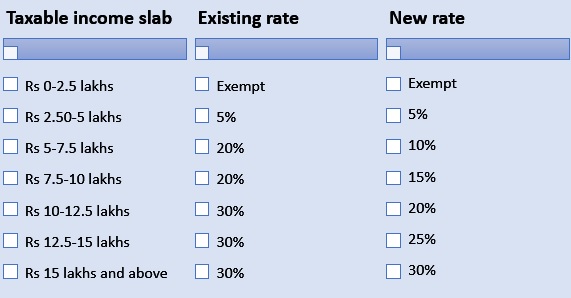

Taxable income slab – Existing rate || Rs 0-2.5 lakhs – Exempt || Rs 2.50-5 lakhs – 5% || Rs 5-7.5 lakhs – 20% || Rs 7.5-10 lakhs – 20% || Rs 10-12.5 lakhs – 30% || Rs 12.5-15 lakhs – 30% || Rs 15 lakhs and above – 30%

What is the new alternative tax slab for individual tax payers in Budget 2020?

Taxable income slab – New rate || Rs 0-2.5 lakhs – Exempt || Rs 2.50-5 lakhs – 5% || Rs 5-7.5 lakhs – 10% || Rs 7.5-10 lakhs – 15% || Rs 10-12.5 lakhs – 20% || Rs 12.5-15 lakhs – 25% || Rs 15 lakhs and above – 30%

What is the deadline for availing of the additional deduction on home loan interest?

The Union Budget 2020-21 has extended the deadline for availing of the additional tax benefit of Rs 1.5 lakhs on interest payment, on the purchase of affordable homes (priced up to Rs 45 lakhs) under section 80EEA, to March 31, 2021.

Budget 2020: What does the Indian real estate sector want from the FM?

By: Amit Sethi

We examine the key demands of the real estate sector from finance minister Nirmala Sitharaman’s Union Budget for 2020-21

January 21, 2020: The real estate sector is the top non-farm employment-generator in the country in the post-liberalisation era. While it contributes a significant share to the country’s GDP, it is presently in the midst of a slowdown in growth. With Budget 2020 expected to be announced on February 1, 2020, we list the sector’s demands for its revival and to overcome growth obstacles.

Increase in tax benefits

Satish Magar, president of CREDAI (National), points out that an individual is allowed to avail of an additional deduction of interest on the loan for the acquisition of a first house. However, this deduction is allowed only on loans sanctioned between April 1, 2016 and March 31, 2017, with the loan amount not exceeding Rs 35 lakhs and the property value not exceeding Rs 50 lakhs. Magar suggests the following, to boost demand in the realty sector:

- “The timeline for such loans should be extended to March 31, 2022, in line with the ‘Housing for All by 2022’ mission.

- In the case of individuals, 100% interest on home loan should be allowed, as a deduction for the first home.

- To boost rental housing, 100% interest on home loans should be allowed as a deduction, for the second and third home, provided that except for the self-occupied home, others are rented for a period of nine months during the year.

- The benefit under Section 80IBA should be extended to all affordable housing projects, as long as the size of the residential units satisfy the limits on carpet area at 30 sq metres (for projects located within the cities of Chennai, Delhi, Kolkata or Mumbai) or 60 sq metres (for projects located in any other place).”

Amendment or removal of Sec 43 CA

Magar further adds that Section 43 CA of the Income Tax Act, is a barrier to natural price correction and the stalled project has a cascading effect on home buyers, banks and other stakeholders. Hence, this section needs to be removed or amended, to exempt primary sales or at least allow sales at 30% below the circle rate.

[ecis2016.org] Budget 2020: Changes in income tax laws that can help home buyers

GST relaxation

Several real estate players have also demand that the benefit of input tax credit (ITC) be reinstated and GST be charged at 12% along with an allowance for land cost at 33%, at par with the current rate of works contract services for government projects. Stamp duty should be subsumed into the Goods and Services Tax (GST) and the government should consult with states in this direction, they maintain.

Relaxation in stamp duty

According to Niranjan Hiranandani, national president, NAREDCO, “A reduction in stamp duty by 50%, for all real estate transactions registered on or before March 31, 2020, shall induce the fence-sitters to turn into the actual home buyers, thereby, spurring demand and consumption.”

Support for rental housing

Rental housing has often not received proper attention in previous budgets. Tax benefits, easy funding mechanisms, availability of loans at lower interest rates and policies aimed at the growth of rental housing, can boost the segment and play a big role in achieving the vision of ‘Housing for All by 2022’.

“To meet the urban housing requirements, the government should consider promoting the development of an institutional rental market, by providing incentives. The proposed Model Tenancy Law is a step in the right direction. While progress on the draft guidelines is expected, the government also needs to align with changing consumption patterns, as trends like co-living are already gaining ground.

“On an individual basis, higher House Rent Allowance (HRA) or related benefits, can be extended to such rental housing avenues, to help consumers opt for it along with the associated tax benefits. On an institutional basis, fiscal measures like tax breaks/tax holidays to rental housing, will definitely give a fillip to this segment,” explains Shishir Baijal, chairman and managing director, Knight Frank India.

Resolution of the liquidity crisis

Over the past few years, the crisis in the non-banking financial company (NBFC) sector and high non-performing assets (NPAs) of banks, resulted in a liquidity crunch for several realty projects. Thus, many developers either defaulted on their loans, or slowed down the launch of their new projects. To ease this crisis, several developers and organisations are demanding relaxations, such as loan restructuring and a one-time loan roll-over. On the whole, the real estate sector is hoping that the government will unveil reforms for the development of the realty and infrastructure sector. A concrete roadmap for the development of the realty sector, according to the real estate fraternity, will infuse positive sentiment and give direction to sustained growth in the long-term.

Budget 2020: Demands of realty sector

|

Union Budget 2019: What did the real estate sector gain

By: Amit Sethi

July 5, 2019: While the real estate sector had a list of demands, vis-à-vis the Union Budget 2019-20, we look at what the finance minister, Nirmala Sitharaman, managed to give the sector and the demands that went unheeded

Additional tax benefit of Rs 1.5 lakhs for affordable home buyers

In terms of taxes, the government has increased the tax deduction benefit against interest on home loans for affordable housing, with a value of up to Rs 45 lakhs. “Interest deduction up to Rs 3.5 lakhs for affordable housing, as against Rs 2 lakhs earlier, is available for loans taken till March 31, 2020. This is expected to drive sales and bring fence-sitters back into the market, within this financial year,” says Aashish Agarwal, senior director, valuation and advisory services, at Colliers International India. The budget, however, had no mention of subsuming stamp duty within the ambit of the GST.

Resolving NBFCs’ woes will help solve funding crisis in real estate

Several measures were announced for the revival of non-banking financial companies (NBFCs) from the ongoing debt crisis and liquidity crunch. The government announced a one-time, six-month credit guarantee for the purchase of pooled assets, of highly rated NBFCs up to Rs 1 lakh crore. Experts believe that risk-averse banks needed this nudge from the government, to ensure the revival of lending activity and sustained flow of capital, for sustainable and well-performing NBFCs. The government has also allowed the FIIs and FPIs to invest in debt papers of NBFCs. This will give a boost to the much-needed liquidity of NBFCs.

Financial support and initiatives towards skill development

The realty sector expected support on skill development initiatives, as it requires skilled workers to handle technology and new-age tools. The government has announced several measures to widen the skill development program under ‘Pradhan Mantri Kaushal Vikas Yojana’. The government has a vision to train 10 million youth to take up industry oriented training and acquire various skillsets in AI, big data, VR, 3-D printing, etc.

[ecis2016.org] Budget 2019: What did the home buyers and home owners get

More focus on affordable housing to achieve ‘Housing for All by 2022’

The government aims to achieve its target of ‘Housing for All by 2022’, through the Pradhan Mantri Awas Yojana (PMAY). It has sanctioned over 81 lakh houses under the PMAY-Urban scheme and an additional 1.95 crore houses have been proposed to be provided under the PMAY-Rural. “The government has been consistent, with its efforts towards boosting affordable housing, in the form of granting infrastructure status to this segment in the previous budget and also by providing exemption of Rs 1.5 lakhs in income tax, on home loans under affordable housing in this budget. This is a big move, as it will benefit a broader segment of home buyers and increase demand,” maintains Navin Makhija, managing director of the Wadhwa Group.

Read also : Delinquencies in the loan against property market to rise: CRISIL

Read the important highlights of Union Budget 2019 here.

Reducing corporate tax

There was an expectation from all sectors that the government should reduce the corporate tax. Heeding to this demand, the government has allowed companies having a turnover up to Rs 400 crores, to pay a lower tax of 25%.

Boost to infrastructure development

The government has said that it is committed to boosting infrastructure across the country. In the Union Budget 2019-20, the FM spoke about improving road; suburban railways and Metro connectivity; creating an expansive water management system; investing Rs 100 lakh crores in infrastructure over the next 5 years The finance minister also emphasised on transit-oriented developments (TODs) across the country and proposed a ‘One Nation One Grid’ initiative.

Enacting a Model Tenancy Law

The current rental law is archaic and it hurts the interests of lessor, as well as lessees. The finance minister said that several reforms have been proposed under the Model Tenancy Law, to replace the current rental law. This move is expected to boost rental housing and increase the interest of investors, who are looking for rental income. “Rental housing is a critical piece for the ‘Housing for All’ objective. It is imperative to develop strong rental housing markets, which starts with creating a modern, uniform tenancy law, with corresponding tax incentives. The budget’s focus on this segment, will encourage active engagement by developers and financial institutions, to consider this space as a profitable and investable asset class, as the laws and tax codes develop around it,” explains Amit Goenka, MD and CEO at Nisus Finance.

Demands that were not met in Budget 2019, again

The government did not address concerns pertaining to banks not passing on the benefit of interest rate cuts by the RBI, to home loan borrowers. The long-standing demand of a single-window clearance for the real estate sector and granting of industry status to sector, etc., also remained unaddressed. However, this being the second budget (i.e., after the interim budget) in a year, there was little scope to make a big move. The government has presented its vision for the next five years, in line with becoming a USD 5 trillion economy, in the near future.

Additional inputs from PTI:

To widen the tax net, the government has proposed to introduce 5% TDS on all payments made by individuals to contractors or professionals, in excess of Rs 50 lakhs a year. Currently, there is no requirement for an individual or Hindu Undivided Family (HUF) to deduct tax at source, on payments made to a resident contractor or professional when it is for personal use, or if the individual or HUF is not subjected to audit for his business or profession. “It is proposed to insert a new provision, making it obligatory for such individual or HUF to deduct tax at source, at the rate of 5%, if the annual payment made to a contractor or professional exceeds Rs 50 lakhs,” said the Budget document. The budget also proposed to tax gifts, in the form of money or property situated in India, by residents to non-residents. Sitharaman proposed to tax such gifts from on or after July 5, 2019.

Budget 2019: Top 5 expectations of the real estate sector

By: Amit Sethi

With the real estate sector facing a liquidity crunch and multiple taxes adding to the burden on home buyers amidst a slowing economy, we look at the expectations of the real estate fraternity, from the first budget of Modi Sarkar 2.0

July 4, 2019: The aam aadmi always hopes that the union budget will have announcements that will impact their lives positively – for example, by improving their income and helping them to get jobs. Similarly, the real estate sector too hopes that the budget will alleviate their major problems and boost growth in the industry.

1. Solution to funding issues

The real estate sector has been facing a significant funding crunch, which was aggravated by the distress in the NBFC (non-banking financial company) sector. “The realty sector is expecting the government to ease ECB (External Commercial Borrowing) norms, to ensure steady inflow of capital from foreign investors. Similarly, the introduction of housing bonds, granting of special status to HFCs (housing finance companies), at par with the banking sector, will further help in providing the much-needed fillip to the housing segment, across all markets and geographies. For ambitious government welfare schemes, such as the ‘Housing for All’ initiative to be a reality, such reforms are prerequisites,” asserts Anshuman Magazine, chairman and CEO – India, Southeast Asia, Middle-East and Africa, CBRE.

2. Support for affordable housing

While the government has taken several initiatives to boost affordable housing in the country, experts maintain that there is room for more steps. According to Nimish Gupta, MD south Asia, RICS, investments in infrastructure development are likely to have a substantial share. This should help in increasing developers’ access to funds, for the development of affordable housing projects, in addition to initiating rental housing, he adds. “Highest levels of compliances and adoption of business best practices will, therefore, need to overlap with advancements in technology and delivery mechanisms, for the affordable housing scheme,” says Gupta.

3. Tax rationalisation

The real estate sector is also expecting further relaxation in the GST rates. Recommendations, to cut the corporate tax and extend the SEZ program, have also been put forth. There is fear that if the tax incentive for SEZs is withdrawn, it could severely hit the job creation ability of the sector. Praveen Dhabhai, COO, Payworld, points out, “We expect Modi 2.0 to think towards the reduction in GST, for remittances where the margin is wafer thin. The current GST rate is levying a huge burden on the end consumers.”

[ecis2016.org] Budget 2019: What do home buyers need from the finance minister?

4. Cross purchasing of residential and commercial properties, from sales proceeds

At present, there are restrictions on tax benefits, if the seller of a residential property uses the sales proceeds, for buying a commercial property, or vice-versa. Analysts are hoping that the government will take the initiative, to allow the use of sale proceeds of residential property to purchase commercial property and vice-versa.

5. Infrastructure development

The union budget should focus on a holistic plan for infrastructure and housing development, in the peripheral locations and tier-2 and tier-3 cities, says Magazine. A boost for infrastructure, will not only benefit the realty sector but also help other industries and create large scale employment in the economy. “For the creation of large-scale housing developments, tax benefits under Section 80-IA and Section 35AD (deductions to encourage private sector participation within the infrastructure sector) should be extended to integrated township projects, by including the same within the definition of infrastructure facility,” Magazine concludes.

Key expectations of the realty sector from Budget 2019

|

5 expectations that Interim Budget 2019 must address, to uplift the real estate sector’s sentiment

By: Amit Sethi

With the real estate sector facing the problem of high inventory, low liquidity and high input cost, we look at some of the top issues that one hopes the interim budget will address, for a revival of the sector

Update on February 1, 2019:

Tax exemptions proposed in Interim Budget 2019

- As a once in a lifetime benefit, the of rollover of capital tax gains is proposed to be increased from investment in one residential house to that in two residential houses, for a tax payer having capital gains of up to Rs 2 crores.

- Exemption on notional rent on unsold inventory increased from 1 to 2 years – i.e., notional rent wil lbe levied only after 2 years.

- Affordable housing – Section 80IBA – benefits extended by another year if registered by 2020.

- TDS exemption on rental income increased from Rs 1.8 lakhs to Rs 2.40 lakhs.

- TDS threshold on interest earned from banks, FDs, etc. – raised from Rs 10,000 to Rs 40,000.

- Notional rent to be exempt on second self-occupied house.

- Standard deduction raised from Rs 40,000 to Rs 50,000 for salaried classs.

- Individual tax payers with annual income of up to Rs 5 lakhs to get full tax rebate. Those with gross income of Rs 6.5 lakhs may not be required to pay tax, if they do investments in specified savings like VPF, etc.

Aashish Agarwal

Head – consulting services at Colliers International India

With exemption on notional rent for self-occupied second homes, the Government has addressed a significant pain point for the middle class, particularly migrants with dependant parents. Along with capital gains exemption for up to two houses, this will allow people to have a diversified portfolio for real estate investment – which will spur demand across the country, including Tier 2 and Tier 3 cities.

Joe Verghese

Managing Director (south), Colliers International India

Review of “GST impact on homebuyers” by group of ministers is a positive step, but it is disappointing to note there is no timeline around the changes to be introduced and implemented. It’s will be a wait and watch on this front unfortunately.

The Indian economy is expected to remain one of the fastest growing economies in the world. This is possible, only if India’s realty sector performs well, as it contributes a significant portion to the GDP. Hence, there are hopes that the government will address several challenges faced by the sector, in the interim budget 2019. Some of these pertain to taxes, funding and liquidity, rental housing and project approvals. Experts also maintain that while the affordable housing segment has been granted infrastructure status, it would help if this was extended to other segments of residential housing, as well.

5 concerns that require attention in the interim budget 2019

According to Niranjan Hiranandani, co-founder and MD of the Hiranandani Group, the government should focus on the following concerns, in the interim budget 2019:

- “Incentives for rental housing, to meet the acute shortage.

- A clear policy roadmap for the creation of rental housing stock and exemption from the burden of tax on notional rental income.

- Rationalisation of GST in case of under-construction properties – the GST should be pegged at either eight per cent with an input tax credit or five per cent without the input tax credit.

- Focus on financial re-engineering concepts, to overcome the NBFC crisis and the challenge caused by the IL&FS default.

- Incentives for new asset classes in real estate, like affordable housing, warehousing and logistics, co-working spaces, co-living spaces and light industrial spaces.”

Another demand that has been repeated in previous budgets, includes a smooth process for granting permissions and clearances, in a time-bound manner.

[ecis2016.org] Budget 2019 highlights: What did home buyers and the real estate sector gain

While generous funds were allocated for various highways projects in the previous budget, experts maintain that pace of building roads should increase, as improved connectivity is the lifeblood of the real estate industry.

Apart from that, the creation of more employment in the infrastructure sector can redeem the incumbent government’s well-documented shortfall on that front.

The expectation of the real estate sector, from budget 2019

Ashok Mohanani, chairman of Ekta World and vice-president, NAREDCO West, feels that home loan interest rates are the foremost concern of home buyers. “If the tax deduction limit is increased up to Rs five lakhs from the present Rs two lakhs per annum, there will be a positive impact, which will help home buyers to save money on home loans,” he says.

The finance minister also needs to adopt a holistic view, while making proposals for real estate. As per data available from the Ministry of Housing Affairs, the total estimated investment under the Pradhan Mantri Awas Yojana (PMAY), as on January 2019, was Rs 3.87 lakh crores, of which the central government has sanctioned approximately 27 per cent, while only 32 per cent of the sanctioned amount has been released so far. Evidently, despite the government’s concerted efforts towards achieving its objective of ‘Housing for All by 2022’, the deficit is too large to ignore.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle