[ecis2016.org] Know about Telangana land registration details, the documents required for registering a sale deed and how to access Telangana land registration documents online.

Telangana land registration details

Property buyers in Telangana have to register the sale with the Telangana Registration and Stamp Department. A buyer, along with the seller and witnesses, needs to visit the sub-registrar’s office, nearest to the location of the property, to pay the stamp duty and registration charges as applicable in Telangana state. A part of the Telangana property and land registration can be done online, where you have to upload all the documents online.

You are reading: Telangana land and property registration: All you need to know

Note that there is an increase in market values of agricultural lands, open plots and flats in Telangana by 50 %, 35 % and 25 % respectively. The new rates came into effect from February 1, 2022. Changes have been made in the software of the official website of IGRS Telangana to reflect the revised rates. The market value charges were revised after the Commissioner and Inspector General of Registration and Stamps (IGRS Telangana) completed it with various committees constituted under Telangana Revision of Market Value Guidelines Rules-1998 for revision of market values.

[ecis2016.org] All about land record terms

Telangana land registration details: Fees

| Document | Stamp duty | Transfer duty | Registration fee |

| Sale of apartment/flat (semi-furnished) | 4% | 1.5% | 0.5% |

| Sale agreement with possession | 4% | 0 | 0.5% (minimum Rs 5,000, maximum Rs 20,0000) |

| Sale agreement without possession | 0.5% | 0 | 0.5% (minimum Rs 5,000, maximum Rs 20,0000) |

| Sale agreement-cum-GPA | 5% | 0 | Rs 2,000 |

| Will | 0 | 0 | Rs 1,000 |

Telangana land registration details: Timelines

| Service | Time frame | Officer responsible |

| Document registration including sale deed, lease deed, agreement, etc. | 24 hours (After registration, the document will be scanned, certified and returned to the parties). | Sub-registrar |

| Issue of encumbrance certificate | 1 hour (After conducting a search of the computer records, a certificate in a fixed format is issued to parties). | Junior/senior assistant |

| Issue of market value | 1 hour (On application by the party, a computer-generated value slip is issued) | Junior/senior assistant |

[ecis2016.org] All about gift deed stamp duty in Maharashtra

The property owner will be required to pay stamp duty, registration fee and transfer duty, during the Telangana land registration as mentioned above.

[ecis2016.org] A guide to calculating and paying property tax online in Hyderabad

House registration process in Telangana: Documents required for land registration

The buyer has to upload all the documents online on the portal, before visiting the sub-registrar’s office for sale deed registration. The documents required as per new registration rules in Telangana 2020 are:

- Original documents, with the signature of all parties.

- Encumbrance certificate.

- Demand draft/bank challan of payment of full stamp duty.

- Property card

- Section 32A photo form of executants and witnesses.

- Identity proof of the buyer, seller and witnesses.

- PAN card.

- Power of attorney.

- Aadhaar card.

- Address proof of the buyer and seller.

- Photograph of the property’s exterior.

- Pattadar passbook for agricultural land.

[ecis2016.org] Hyderabad master plan 2031

House registration process in Telangana: How to calculate stamp duty and registration charges?

Property buyers can easily calculate stamp duty and registration charges on land using following steps:

Step 1: Visit the Registration and Stamp Department portal of Telangana at http://registration.telangana.gov.in/TGMV_Client/NonAgri.htm

Step 2: Enter deed details Telangana like nature of deed, nature of sub-deed from the drop-down menu and enter the consideration value. Select the property type from the drop-down box. Next, fill in all the information about the property and the structure details and press on calculate. Do note that all the boxes with a red* have to be necessarily filled. Once done, click on calculate, to see the market value assistance (duty and fee calculator) showing the values.

Step 3: The calculation clearly shows the market value derived by adding land cost and structure cost. The duty fees calculated by adding stamp duty, transfer duty and registration fee, shows the total payable amount.

[ecis2016.org] All about IGRMaharashtra

Checklist for creating sale deed in Telangana

A property owner should get the sale deed drafted by the legal draftsman on a non-judicial stamp paper of the requisite value. The parties should use five non-judicial stamp papers, while the remaining amount has to be paid through the challan system or any other medium, as mentioned by the state government. The sale deed should have following clauses:

- Home buyers demand basic practices before best practices

- Kolkata sees 54 per cent jump in new home launches in Jan-Mar 2017

- Sobha and Godrej emerge as top choices of HNI and NRI buyers: Track2Realty Report

- Real estate set for strong recovery in 2021, says report

- A Guide to Cap Rate and Valuation Of Property

Name of the deed: The document should clearly mention which type of deed it is. The parties could decide on the basis of mutual consent, what type of deed will be prepared for the document for property transfer.

Parties to sale deed: The sale deed should have the names, age and addresses of parties involved in the transaction. The deed should be duly signed by all the parties.

Description of the property in context: The property in content should be clearly mentioned in the sale deed. It should have the full description of the property, including the identification number, plot area, location, etc.

Sale consideration clause: A sale deed must have all the information related to the sale amount as mutually decided by the seller and the buyer. It should clearly mention the amount paid for transferring the property rights from one party to another.

Mode of payment and advance payment: A sale deed should also have clear information about how a buyer is going to pay the sale amount and the amount of token, if paid as an advance.

Possession status and date: The deed should also mention when the immovable property will be transferred to the seller. There should be a mention of the actual date of possession.

Read also : Salarpuria Sattva Altana at Vijayanagar, Bangalore

Indemnity clause: The sale deed should have an indemnity clause, which means the seller is liable to bear all the statutory charges including property tax, electricity charges, water bill and all other charges in relation to the property, before the sale deed is executed.

Check out property prices in Hyderabad

House registration process in Telangana: Steps to follow

Here is a step-by-step process to be followed for house registration process in Telangana and land registration process in Telangana as per new registration rules in Telangana 2021:

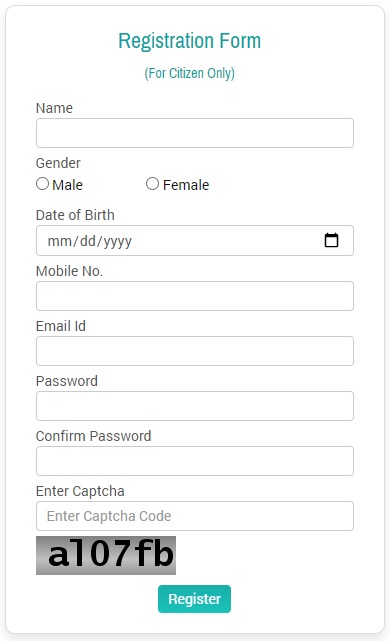

Step 1: Visit the Telangana Property Registration portal and create your login ID.

Step 2: Upload all the documents required for land registration in Telangana and pay the stamp duty and registration fee.

Step 3: Book the time slot for visiting the sub-registrar’s office (SRO).

Step 4: Visit the SRO.

- Get your check slip prepared by the officer at the SRO, based on the deed details Telangana provided during document upload, making necessary changes if required.

- After the generation of the check slip, an E-KYC is conducted, where fingerprints of the registering parties are collected and are verified against the Aadhaar database.

- After successful verification via Aadhaar, the payment of stamp duty, registration fees and other requisite fees will be verified through the challan provided.

- After successful verification of payment, endorsements are printed on the document being registered.

Step 5: The Telangana land registration documents will then be registered by the sub-registrar, by providing a document number and the thumb impression of the parties is collected.

Step 6: Then the Telangana land registration document will be scanned and uploaded on the portal, which the user can download from the portal.

Step 7: In case of verification being unsuccessful, the applicant will be directed to make necessary changes and re-submit the application.

Check out properties for sale in Hyderabad

How to pay stamp duty on property purchase in Telangana?

Property buyers can pay stamp duty and registration charges online for property registration purpose. Here is a step-by-step guide to making the payment in a hassle-free way.

Step 1: Visit the Telangana Registration and Stamps department portal and search for ‘E-payments’ under the ‘Online Services’ column.

Step 2: You will be redirected to a new page https://registration.telangana.gov.in/estamps.htm where you will see three options where you will see three options:

- Document registration e-challan

- Non-registration e-challan

- Franking services e-challan

For property registration, click the first option and register the documents by entering the details, including remitter details, party details, document information and details of the amount remitted and press on the ‘register’ button.

Step 3: Register your profile after which you will get an SMS that will have a 12-digit challan number and five-digit passcode. Save these details for later use.

Step 4: After registering, proceed to the payment option form, where you can print the challan number and passcode details.

Step 5: You will be then redirected to a disclaimer page, after agreeing to it the user is directed to SBI ePay, where the user can choose to pay the charges either online or offline.

Step 6: For online payments, select Debit/Credit card, Net banking or NEFT.

Step 7: After entering the payment credentials and submitting the necessary details, the user gets a ‘successful’ status message. Then, the challan in duplicate is generated by the system, which will have the SBIePay confirmation reference number. The user needs to print the challan and submit the SRO copy of it, along with the documents to the sub-registrar, during the property registration.

Do note that the Registration & Stamps Department does not license any intermediary for carrying out stamp duty and registration -related transactions. You will have to directly pay the duties and the fees associated with the property only to the SRO.

Read also : Deposit Rs 10 crores, to refund the investors: SC to Supertech

[ecis2016.org] All about e swathu login

How to search prohibited properties in Telangana before buying

Property buyers in Telangana should check the list of prohibited properties, before signing or making any payment to the seller. The list can be searched on the Telangana Registration Department portal, by following these steps:

Step 1: Visit the Telangana Property Registration Department and select the Prohibited Property option.

Step 2: Select the district, mandal, village and criteria to search for the list. The criteria could be:

- Ward number/block number

- Town survey number

- Revenue survey number

- Survey number

- Ward-wise details

- Survey number-wise details

Step 3: Submit the details. The list will be displayed on your screen.

How to check the market value of land in Telangana using Dharani Portal?

At present, the facility is available only for agricultural land. To check the market value of the land parcels, follow the procedure step-by-step:

Step 1: Visit the Dharani portal (click here) and click on ‘Agriculture’.

Step 2: Click on ‘View Market Value of Lands for Stamp Duty’. You will be redirected to a new page.

Step 3: Choose the district, mandal, village, town and survey number from the drop-down menu and click ‘Fetch’.

Step 4: The market value will be displayed on the screen.

[ecis2016.org] All about village land records in Karnataka

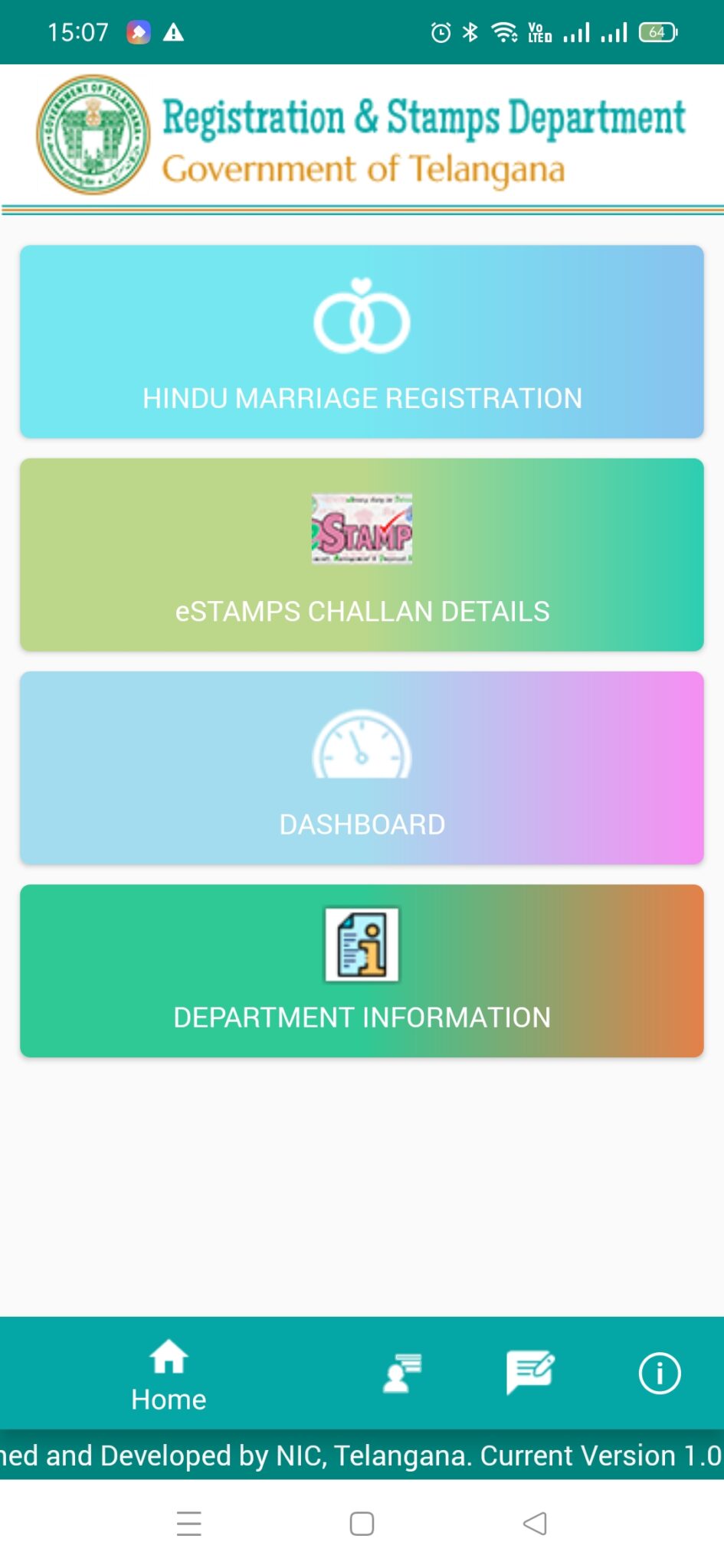

Telangana land registration: Mobile app

You can download the Telangana land and property registration mobile app, ‘T-registration’, from the Google Play store. First, you have to register yourself and you will get an m-pin number. Once you login with your m-pin number, you will see a page like the one below, where you can enter the details.

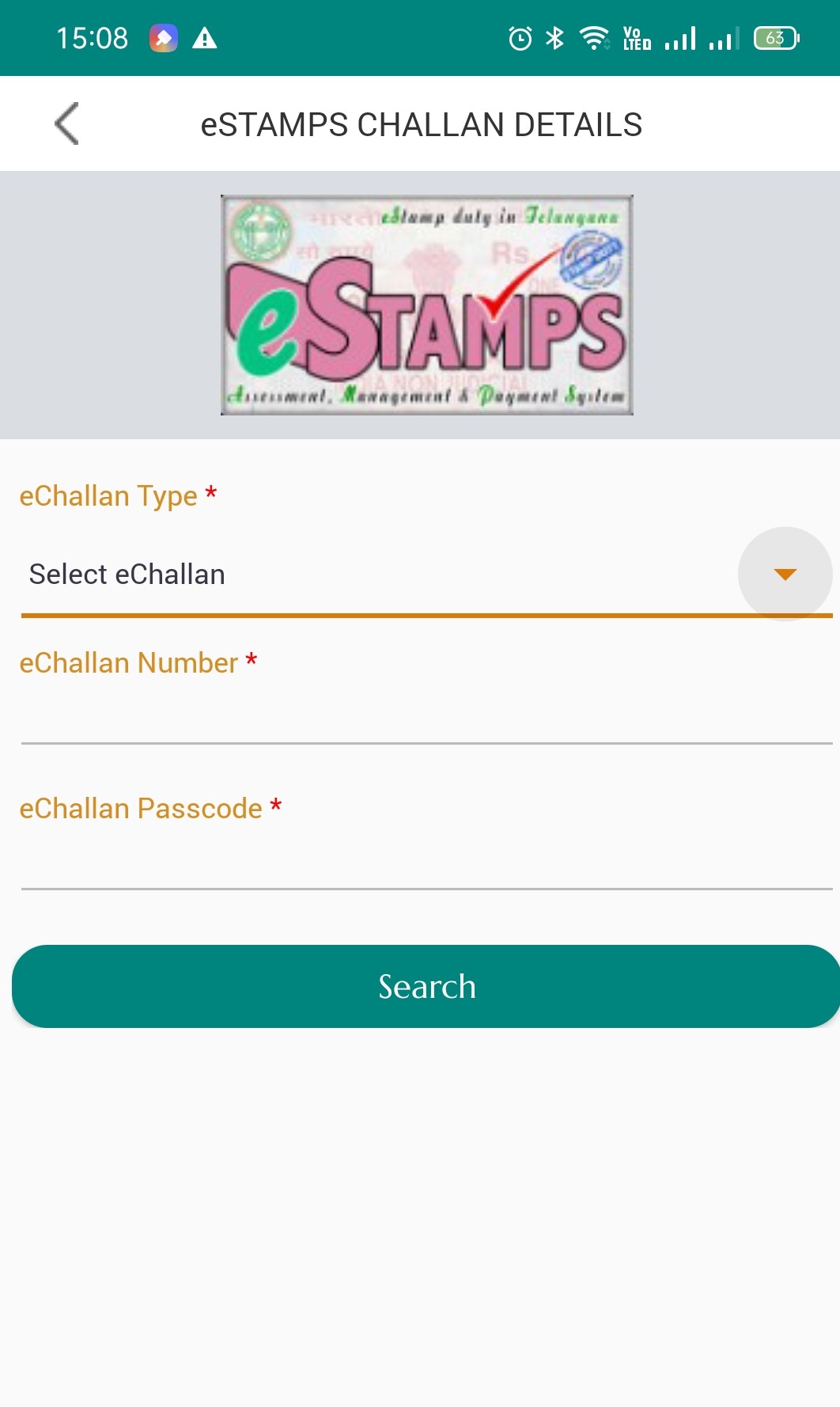

Click on ‘eStamps Challan’ details to proceed with finding details about Telangana land and property registration.

Select eChallan type from the drop-down box and then enter the eChallan number and the eChallan passcode and press ‘search’.

For feedback on the Telangana land and property registration mobile app, you can email on nic-ts@igrs.telangana.gov.in.

Telangana land registration: Should you compulsorily get inherited property documents registered in the SRO for Patta/Khata transfer (mutation)?

It is not compulsory to get the document registered. After the death of the property owner his legal heir/heirs can produce his death certificate to the mentioned officers and get the Patta /Khata transferred. For transfer of agricultural land, they have to produce documents to the Mandal Revenue Officer ( under Andhra Pradesh Land Revenue Act). If the property is a vacant land other than agricultural land, or a property, he should visit offices of Corporation-Municipality, Panchayat or City survey if such office exists.

Telangana land registration: Contact information

For any query on Telangana land and property registration contact:

Toll free number: 1800 599 4788

email id: grievance-igrs@igrs.telangana.gov.in

New WhatAapp No: 91212 20272

Telangana land and property registration: Latest news

Feb 2, 2022:

Telangana hikes property market values

Market values of agricultural lands, open plots and flats are increased by by 50 %, 35 % and 25 % respectively in Telangana. The new rates came into effect from February 1, 2022. Changes have been made in the software of the official website of IGRS Telangana to reflect the revised rates. The market value charges were revised after the Commissioner and Inspector General of Registration and Stamps (IGRS Telangana) completed it with various committees constituted under Telangana Revision of Market Value Guidelines Rules-1998 for revision of market values.

FAQs

Is there an online facility for Telangana property registration?

Home buyers can visit the Telangana property portal at https://registration.telangana.gov.in/index.htm to upload documents and fix an appointment for appearing at the sub-registrar’s office.

What are the fees for registering a will in Telangana?

A flat fee of Rs 1,000 is charged for registration of wills.

What is the stamp duty for sale of property in Telangana?

Stamp duty of 4% of the transaction value is applicable on sale of property in Telangana.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle