[ecis2016.org] More than tax reforms and the much-awaited GST, home buyers want the union budget to make a clear distinction between end-users and the retail investors, as they feel that the wealthy investors, are the biggest roadblocks in the goal of achieving ‘Housing for All’

The Indian home buyers are quite convinced that whatever incentives are given to them in the union budget, will never reach them. The reason: Investors and middlemen in the Indian housing market, will absorb the benefits given in the budget, they feel. Hence, they would like to see a combination of incentives and penalties, to ensure that the government’s commitment towards ‘Housing for All’ becomes a reality.

You are reading: Home buyers’ wish-list for Budget 2017: Remove investors, encourage end-users

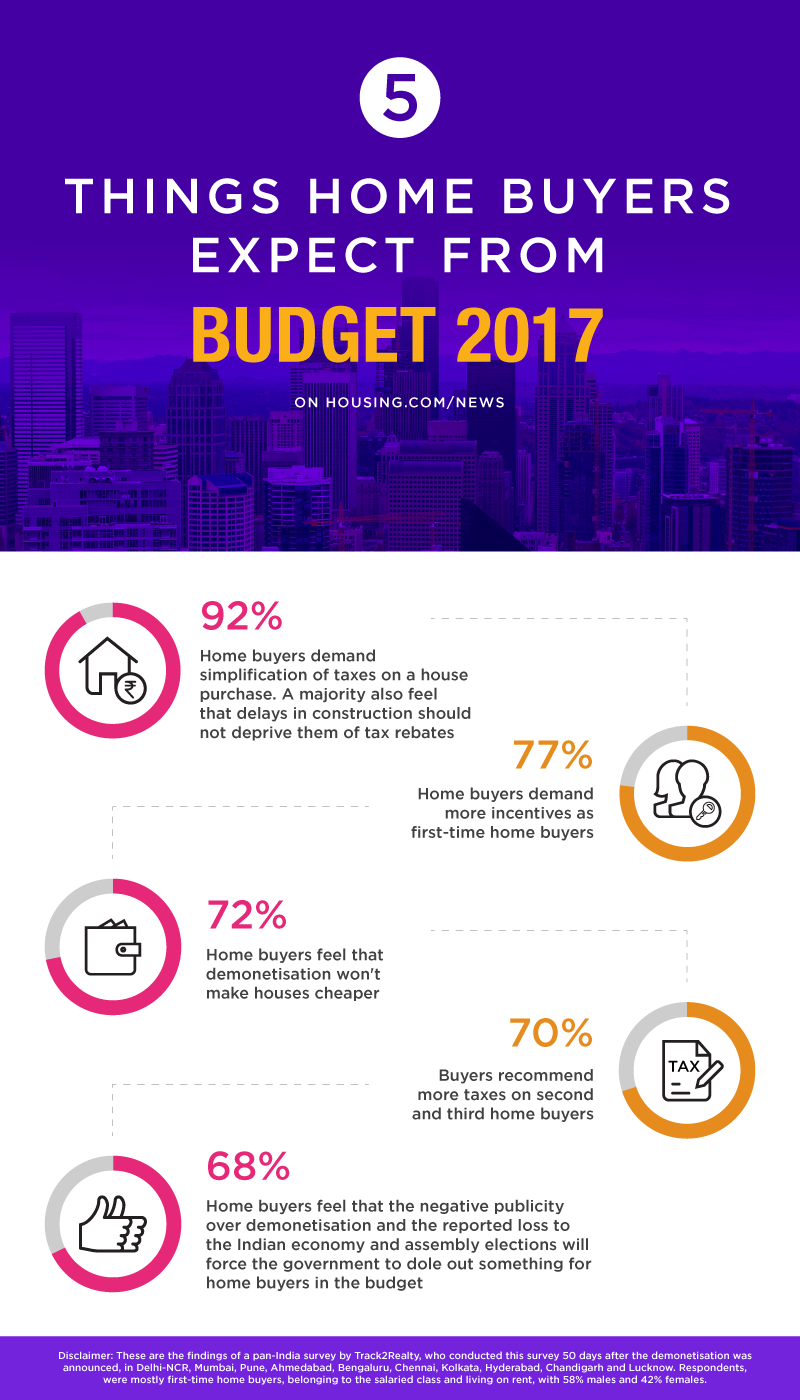

Nearly eight out of 10 (77%) demand more incentives for first-time buyers. They assert that the incentive should not be passed on to the second-time buyers or repeat buyers. This is one way to ensure that end-users are incentivised, while the investors are kept at bay. A substantial number of home buyers (as many as 70%), even recommend more taxes on repeat buyers.

Home buyers across the country also feel that the budget should encourage rental housing in the major cities of India. Nearly two-thirds (62%) feel that this can keep the housing crisis in check. They even suggest that heavy penalties (at least up to the renal value of the apartment) be levied on the scores of purchased and locked houses in the cities.

These are the findings of a pan-India survey by Track2Realty, a real estate think-tank group. Track2Realty conducted this survey 50 days after the demonetisation was announced, in Delhi-NCR, Mumbai, Pune, Ahmedabad, Bengaluru, Chennai, Kolkata, Hyderabad, Chandigarh and Lucknow. A mix of open-ended and closed-ended questions were given to the respondents, who were mostly first-time home buyers, belonging to the salaried class and living on rent. The representative set had 58% males and 42% females.

Read also : From dawdlers to front runners: Tier 2 cities on their way to lead the next growth wave

Discourage ownership of multiple houses, say buyers

“As of now, the policies do not differentiate between the actual end-user and the wealthy persons, who are retail investors with four or five houses. It seems like the policy makers only understand who the organised investors are. However, the tax benefits should be clear and encourage one house per person. No one should be encouraged to have more than one house at the cost of needy home seekers,” says Abvhinav Shukla in Mumbai.

“If the government is sincere about its ‘Housing for All’, then, the union budget should clearly announce all incentives and tax exemptions, only for first home buyers. People having more than 2-3 houses, should be levied additional taxes and stamp duties, as a deterrent for investment,” opines Swati Chandra from Mumbai.

[ecis2016.org] What do home buyers want in 2017?

Nikhil Hawelia, managing director of the Hawelia Group, maintains that if the union budget announces incentives for first-time home buyers, then, developers will only benefit, rather than business getting affected.

“We are already complying with all the mandatory provisions. Contrary to the perception that housing sales will be slow if investors are discouraged, I feel that if end-users are encouraged, then, the housing market in general will be benefitted,” says Hawelia.

Tax sops that home buyers want, in Budget 2017

Read also : Budget 2017 expectations: How do we fuel consumption of real estate?

Nearly all the home buyers (92%) want simpler taxation on house purchase, where delays in construction do not deprive them of tax rebates.

More than half of the respondents (54%), felt that the additional tax incentive of Rs 50,000 for houses up to Rs 50 lakhs, announced in the last budget, was not enough in most of the metro cities and should be increased to houses worth Rs 1 crore.

Nearly three-fourths of the respondents (72%), do not think that the demonetisation drive will benefit them. However, 68% felt that the negative publicity over demonetisation and the reported loss to the Indian economy on the eve of the elections in five states, will force the government to dole out something for the home buyers in the upcoming budget.

Finally, the home buyers also want the finance minister to provide greater clarity on the Goods and Services Tax (GST), with 58% saying that they do not understand what the tax burden will be, after the GST.

Home buyers’ wish-list for Budget 2017

- 77% home buyers demand more incentives for first-time buyers.

- 70% buyers recommend more taxes on second and third home buyers.

- 62% feel that tax incentives for first-time buyers and additional taxes on repeat buyers, will deter retail investors.

- 92% demand simplification of taxes on house purchase and feel that delays in construction should not deprive them of tax rebates.

- 54% buyers feel that the additional tax incentive of Rs 50,000 for houses up to Rs 50 lakhs, announced in the last budget, is not enough for metro cities and demand that this incentive be extended to houses worth Rs 1 crore.

- 72% feel demonetisation won’t make houses cheaper.

- 68% feel that the negative publicity over demonetisation, the reported loss to the Indian economy and assembly elections, will force the government to dole out something for home buyers in the budget.

- 58% home buyers want greater clarity on taxes post GST.

(The writer is CEO, Track2Realty)

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle