[ecis2016.org] Mentioned in this article is everything that you should know about Madurai Corporation property tax regulations and payment

Property owners in south India’s temple town – Madurai – have to pay Madurai Corporation property tax on their residential properties to the Madurai Municipal Corporation or the Madurai corporation every year. The revenue generated by the Madurai Corporation from the collection of the Madurai corporation property tax is substantial and contributes to the town’s development. Spread across a total of 148 sq kms, Madurai Municipal Corporation has a total of 100 wards and is divided into four zones. Zone 1 of Madurai Corporation covers wards 1 to 23, Zone 2 of Madurai Corporation covers wards 24 to 49, Zone 3 of Madurai Corporation covers wards 50 to 74 and Zone 4 of Madurai Corporation covers wards 75 to 100. It is the responsibility of each property owner to pay the Madurai Corporation property tax so that the citizens can benefit from all the facilities and critical services provided by the Madurai Municipal Corporation.

You are reading: Madurai Corporation property tax: All you should know

[ecis2016.org] Everything about PCMC property tax bill 2021-22

This article outlines the process of paying the Madurai Corporation property tax. While both, online and offline methods, are available for paying the Madurai Corporation property tax, it is advisable to use the online way, especially during this pandemic.

[ecis2016.org] How to use Chennai property tax calculator

Madurai Corporation property tax calculator

Individuals can calculate the Madurai Corporation property tax based on factors including whether the property is residential or commercial, the built-up area of the property, base value of the property, age of the property and the type of construction – single or multi-floored and occupancy. The Madurai Corporation property tax calculator is available on the property tax Madurai website where citizens can self-assess and pay the property tax.

[ecis2016.org] Everything about building tax Kerala

Property tax online payment Madurai

To pay the property tax online payment Madurai, citizens have to visit the website https://tnurbanepay.tn.gov.in/.

Read also : Sela Pass: All you need to know about the Sela Tunnel project

For house tax online payment Madurai, registered users can log in on the property tax Madurai website with their mobile number or email ID and password. First-time users will need to register themselves with the Madurai Municipal Corporation. Alternatively, to proceed with the property tax online payment Madurai without registration on the website, use the ‘Quick Pay’ option that will lead https://tnurbanepay.tn.gov.in/IntegratedPaymentNew1.aspx.

[ecis2016.org] Know how to pay property tax GVMC

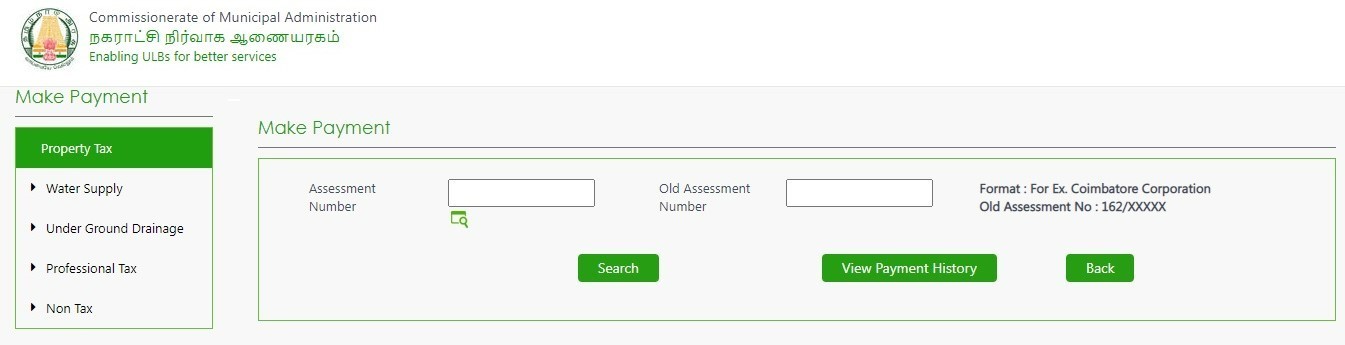

For house tax online payment Madurai, on the new page, click on ‘Property Tax’ and enter the assessment number, old assessment number and click on search. The page will populate all the Madurai Corporation property tax payment details related to the entered Madurai corporation property tax assessment number. Once assured that the correct details of the property tax online Madurai are being shown, click on ‘View Payment History’ to proceed with the payment.

On the next page, click on the ‘My Properties’ section to check the property list, add assessment and delete properties. Click on the ‘My Tax’ section to calculate the property tax Madurai for your properties by using the ‘Tax Calculator’ option and filling in the required details. Make the property tax online payment Madurai in the ‘Make Payment’ section through one of the available online payment options. Payments can be made through NEFT, net banking, UPI and cards. In case of any query, click on the ‘My Grievances’ section to register a complaint regarding their property tax Madurai. The ‘My Request’ section is for those who want to raise a service request or check the status of previous requests. Visitors can also check their Madurai property tax dues in this section.

[ecis2016.org] Everything about GVMC water tax online

[ecis2016.org] All about property tax in Chennai

- CTS number in Mumbai: Everything you need to know

- e-Panchayat Telangana: All you need to know

- Indian homebuyers are looking for ready-to-move-in (RTMI) properties: ecis2016.org and NAREDCO survey

- All about Bihar Urban Infrastructure Development Corporation Limited or BUIDCO

- All about HIG flats in India

Madurai Corporation property tax contact information

For any queries related to Madurai Corporation property tax, contact:

Commissioner Madurai Corporation

Phone No: 0452253521

WhatsApp number: 8428425000

Email id: commr.madurai@tn.gov.in

[ecis2016.org] All about GHMC property tax

FAQs

What are the other taxes that can be paid on the Madurai Municipal Corporation website?

In addition to the Madurai Corporation property tax, you can pay water supply bills, underground drainage, professional tax and non-tax revenues on the website.

Why is online payment for property tax recommended?

The online payment service is recommended as it is an end-to-end online service with no physical touchpoint required. It saves time and removes the need to stand in queues.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle