[ecis2016.org] Permanent Account Number (PAN) is a 10-digit alphanumeric number that acts as an identifier of the tax payer in the eyes of the Income Tax (I-T) Department.

As quoting your Permanent Account Number (PAN) is a must for most of the communications with the I-T Department, keeping a copy of this document is always necessary. The PAN card download process enables you to keep a copy of this document with you. This guide will help you understand the various ways in which you can conduct e PAN card download.

You are reading: PAN card download: A quick guide on e PAN card download process

Read also : Chennai Metro: All you need to know about the CMRL network

What is ePAN?

An e-PAN is a digitally signed PAN card, issued in electronic format based on e-KYC data of Aadhaar.

PAN card download

To get an e-PAN card, you can apply on the NSDL or UTIITSL portals. You can also opt for instant PAN card download, using your Aadhaar card.

[ecis2016.org] Is PAN card mandatory for property registration

e PAN card download on e-filing website

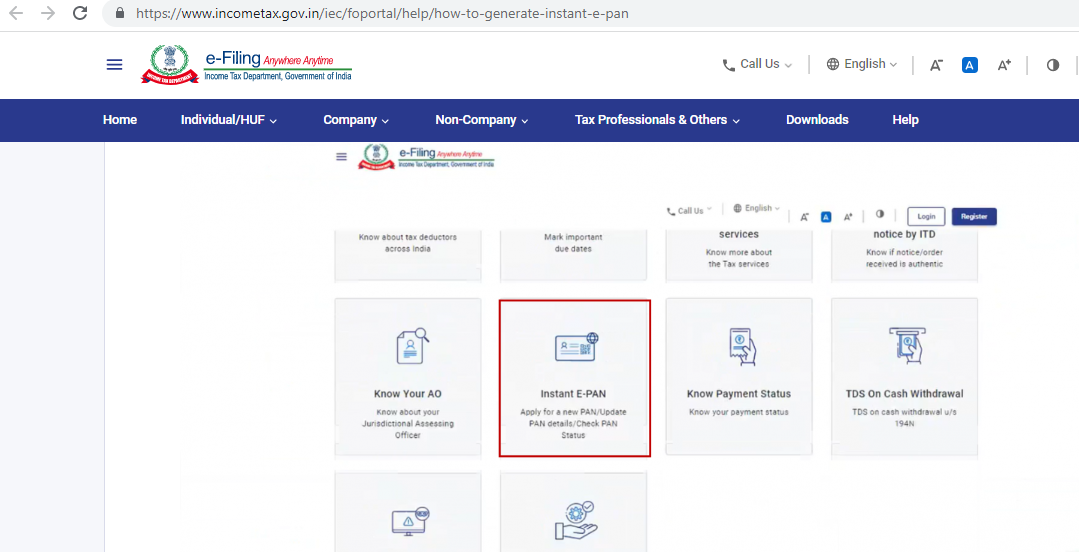

Step 1: Go to the official e-filing website, and select ‘Instant e-PAN’ option under the ‘Quick Links’ tab.

Read also : Chennai Metro: All you need to know about the CMRL network

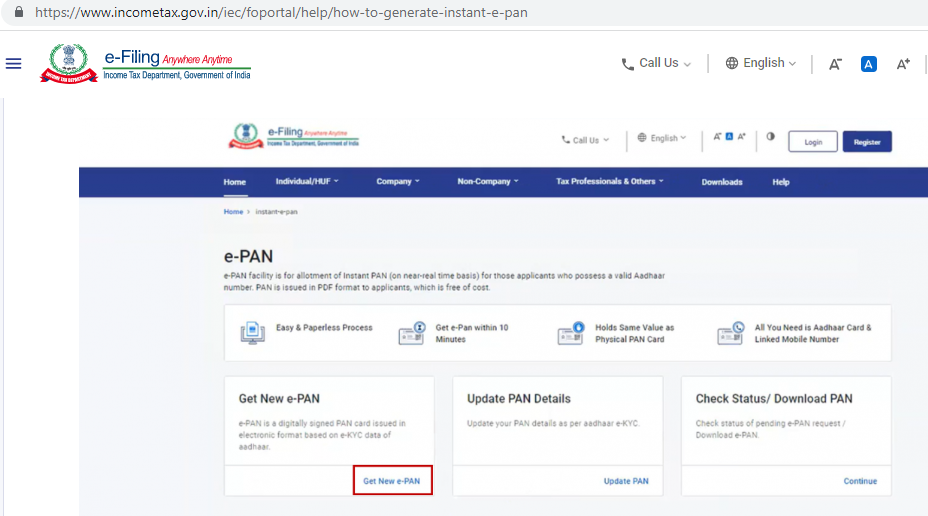

Step 2: Click on ‘Get New e-PAN’.

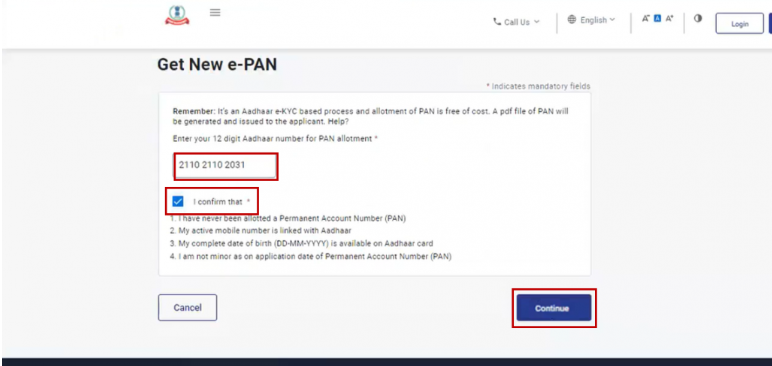

Step 3: Input your Aadhaar number and Captcha code and click ‘Confirm’.

Read also : Chennai Metro: All you need to know about the CMRL network

Note: If your Aadhaar is already linked to your PAN, the following message will be displayed – Entered Aadhaar Number is already linked to a PAN.

- All you need to know about Madhya Pradesh property tax

- Magenta Line Delhi Metro route, stations, and latest updates

- Zojila Tunnel: Project details, length map and latest news about Asia’s longest bi-directional tunnel

- All about forced appreciation

- ecis2016.org ties up with proptech startup Homzhub, to offer residential property management

If your Aadhaar is not linked to any mobile number, the following message will be displayed – Entered Aadhaar Number is not linked to any active mobile number.

[ecis2016.org] All about Aadhar card

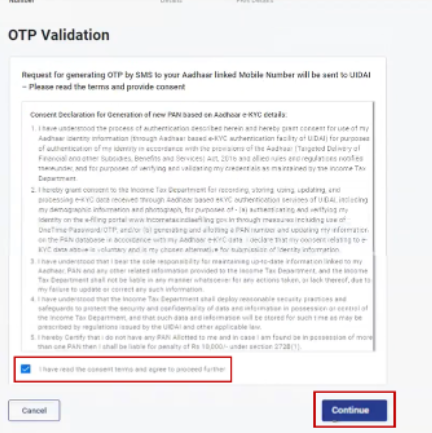

Step 4: On the OTP validation page, check on ‘I have read the consent terms and agree to proceed further’ option and click on ‘Continue’.

Read also : Chennai Metro: All you need to know about the CMRL network

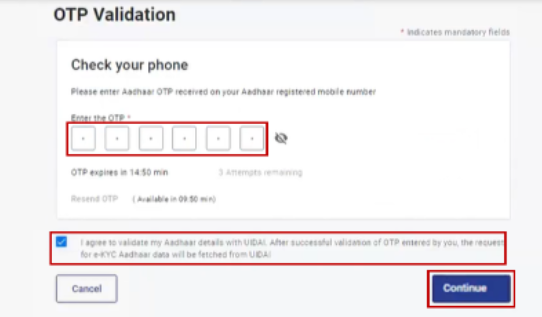

Step 5: On the next page, enter the six-digit OTP received on the mobile number linked to Aadhaar, select the checkbox to validate the Aadhaar details with UIDAI and click on ‘Continue’.

Read also : Chennai Metro: All you need to know about the CMRL network

Read also : Chennai Metro: All you need to know about the CMRL network

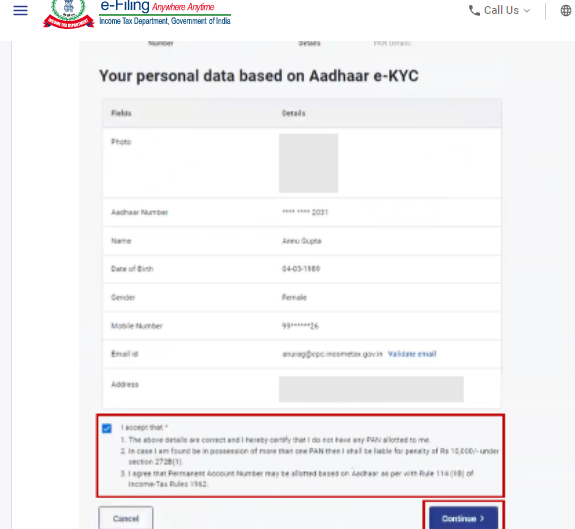

Step 6: The next page will display your personal data, where you should select the ‘I Accept’ checkbox and click on ‘Continue’.

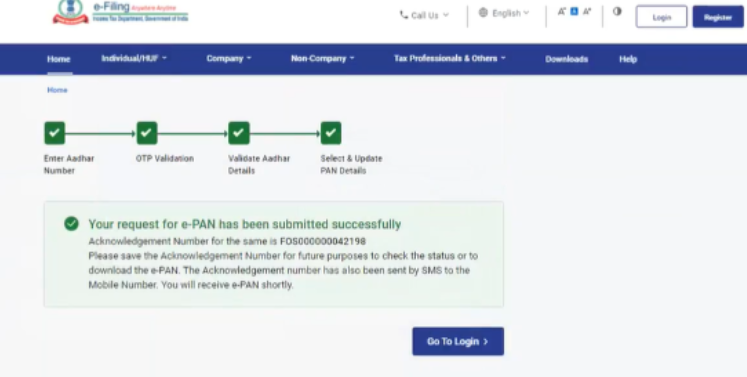

Step 7: A message will be displayed on the screen with an acknowledgement number that you can use for future reference. Additionally, you will receive a confirmation message on your mobile.

Read also : Chennai Metro: All you need to know about the CMRL network

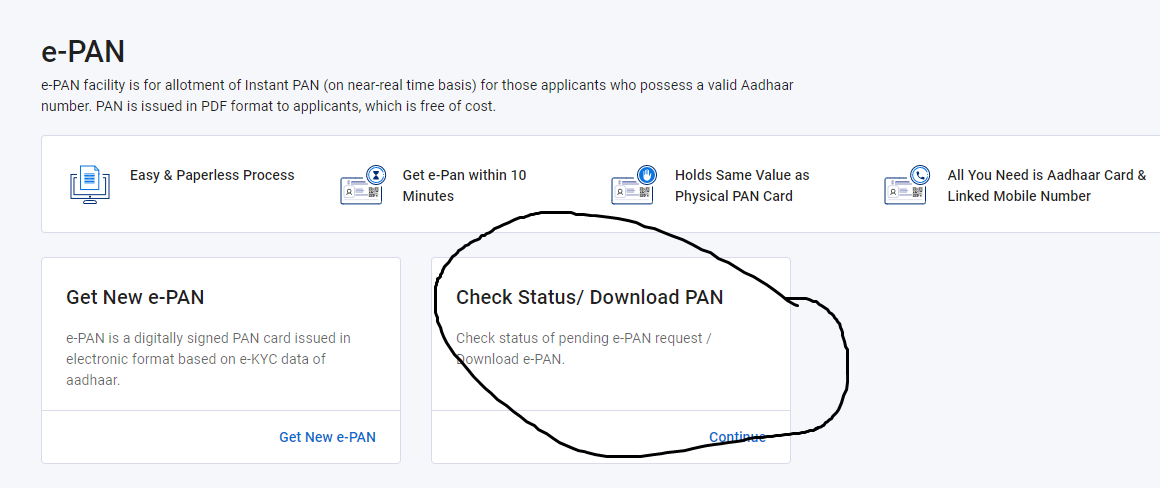

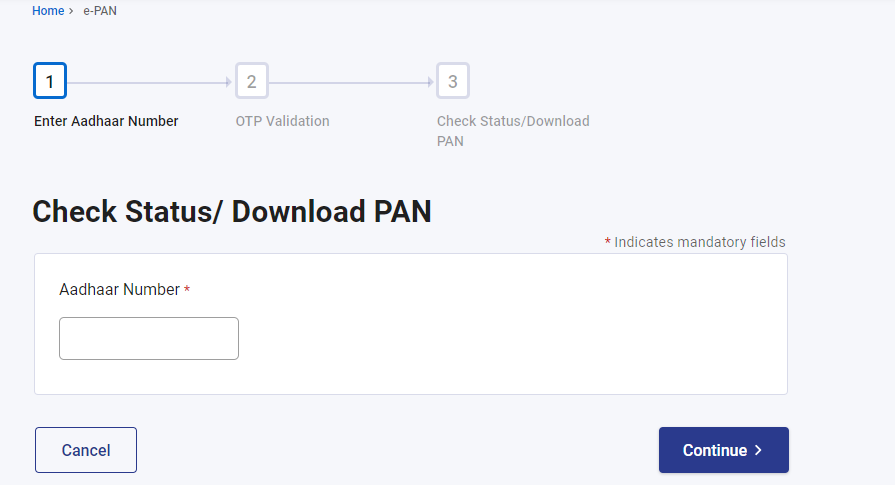

Step 8: Once your e-PAN card is allocated, you will be able to conduct PAN card download on the e-filing portal. This option is available on ‘Check Status/Download PAN’ option.

Read also : Chennai Metro: All you need to know about the CMRL network

Read also : Chennai Metro: All you need to know about the CMRL network

Step 9: Input your Aadhaar number in the requested field and click on ‘Continue’.

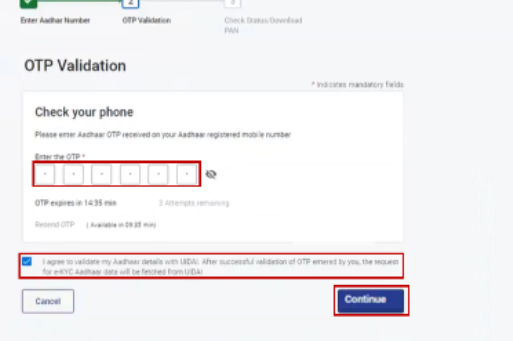

Step 10: On the OTP Validation page, enter the six-digit OTP received on your mobile number and click on ‘Continue’.

Read also : Chennai Metro: All you need to know about the CMRL network

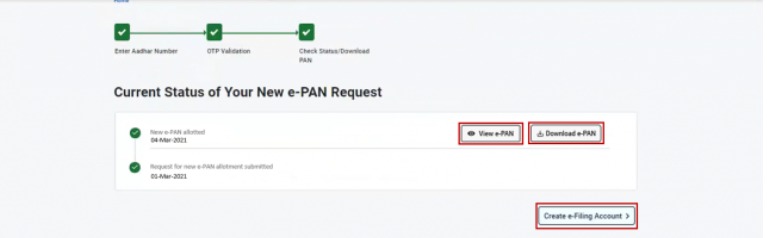

Step 11: The next page will display the current status of your new e-PAN request. If the new e-PAN has been generated and allotted, click on ‘View e-PAN’ to view the same, or click on ‘Download e-PAN’ to download a copy.

Read also : Chennai Metro: All you need to know about the CMRL network

[ecis2016.org] All about Udyam Aadhar

NSDL PAN card download

If you have applied for a PAN card through the NSDL portal, you are eligible for e PAN card download on this website.

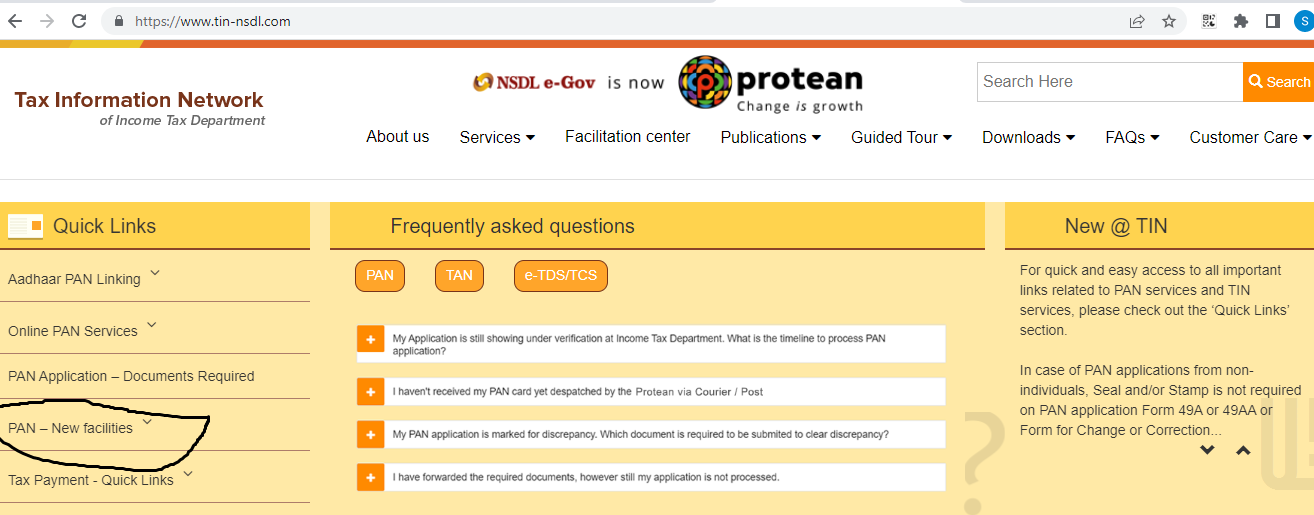

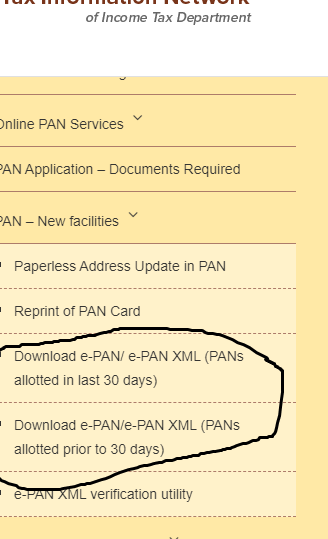

Step 1: Visit the official website of TIN-NSDL. Under the ‘Quick Links’ tab, select ‘PAN-New facilities’.

Read also : Chennai Metro: All you need to know about the CMRL network

Read also : Chennai Metro: All you need to know about the CMRL network

Step 2: Select either of the two options from the drop-down menu:

‘Download e-PAN/e-PAN XML (PANs allotted in last 30 days)’

‘Download e-PAN/e-PAN XML (PANs allotted prior to 30 days)’

You will then be redirected to a new page.

Read also : Chennai Metro: All you need to know about the CMRL network

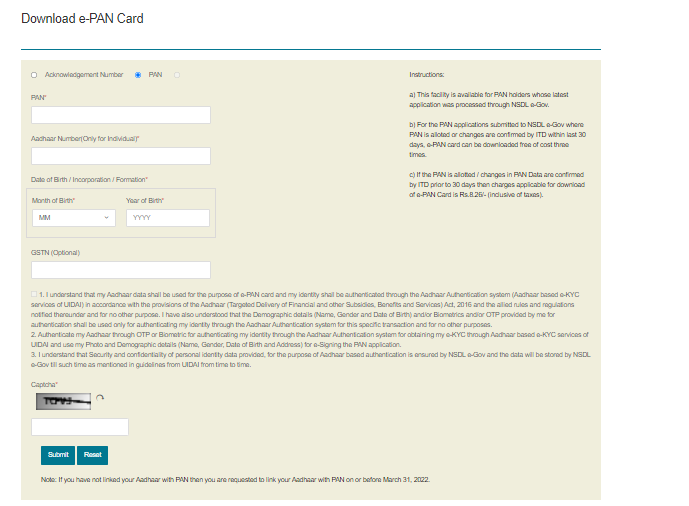

Step 3: On the page that appears, enter your PAN number/or acknowledgement number, Aadhaar number, date of birth/incorporation and GSTN (optional). Next, read and check the terms and conditions, enter the Captcha code and click on ‘Submit’.

Read also : Chennai Metro: All you need to know about the CMRL network

Step 4: You will get the option to send an OTP to your registered mobile number and email ID. Choose one of these two options and click on ‘Generate OTP’.

Step 5: Input the OTP and click on ‘Validate’. You can now click on ‘Download PDF’.

[ecis2016.org] How to get PVC Aadhar card

UTI PAN download

Read also : Market value Telangana: All about property value of flats and plots in Telangana

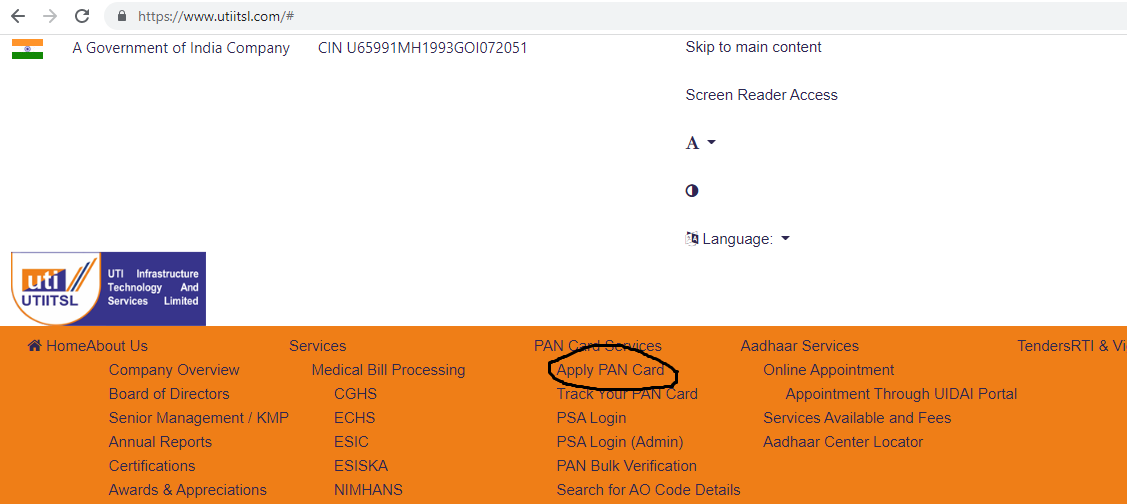

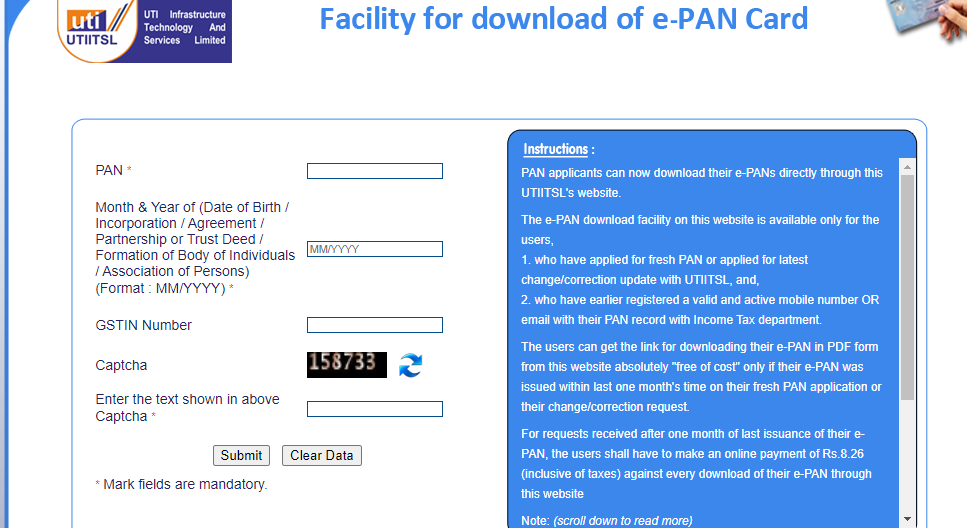

In case, you have applied for your PAN through the UTIITSL portal, go to its official site to download e-PAN.

Step 1: On the home page, under ‘PAN Card Services’ tab, select the ‘Apply PAN Card’ option.

Read also : Chennai Metro: All you need to know about the CMRL network

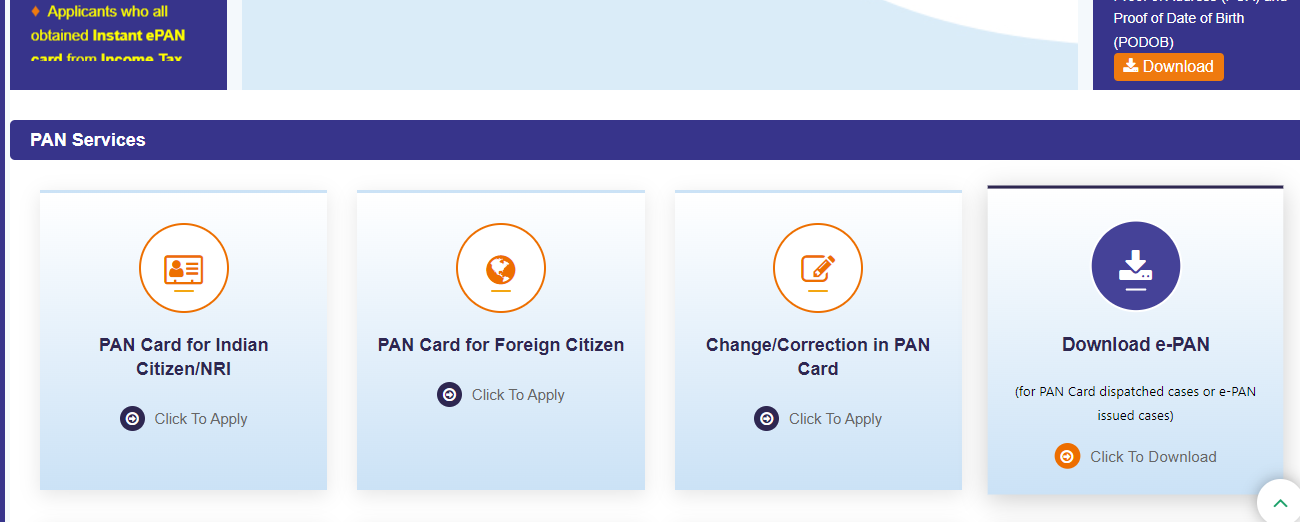

Step 2: You will be redirected to a new page. Click on ‘Download e-PAN’ and then ‘Click to Download’ option.

Read also : Chennai Metro: All you need to know about the CMRL network

Step 3: For UTI PAN card download, input your PAN, date of birth, GSTIN number, etc., before filling in Captcha code. Once done, click ‘Submit’.

Step 4: A link will be sent to your registered mobile number and email ID. By clicking on this link, you can conduct an e PAN card download.

[ecis2016.org] What is UAN and all about UAN login

E PAN card download: Key facts

Details in e-PAN card

- Permanent Account Number

- Name

- Gender

- Date of birth

- Father’s name

- Photograph

- Signature

- QR code

Read also : Chennai Metro: All you need to know about the CMRL network

Who can apply for an e-PAN card?

You need to meet the following conditions to apply for e-PAN card:

- You must be an Indian citizen.

- You must be an individual taxpayer.

- Your should have linked your mobile number to your Aadhaar card.

Read also : Chennai Metro: All you need to know about the CMRL network

I have a PAN but I have lost it. Can I get a new e-PAN through Aadhaar?

No. This service can be used, only if you do not have a PAN number but you have a valid Aadhaar and have updated your KYC details.

Read also : Chennai Metro: All you need to know about the CMRL network

What documents do I require to get a new e-PAN?

You only require an Aadhaar number with KYC details updated and a valid mobile number linked to your Aadhaar.

Who can apply for instant e-PAN through Aadhaar?

PAN card applicants, who have an Aadhaar number and have linked their mobile numbers to Aadhaar, can apply for instant e-PAN.

What should I do if my Aadhaar authentication gets rejected during e-KYC?

Aadhaar authentication may get rejected if one enters the wrong OTP. It can be resolved by entering the correct OTP. If it still gets rejected, you need to contact UIDAI.

Do I need to do in-person verification for e-PAN?

No, the process is completely online. You do not need to visit any centre.

Read also : Chennai Metro: All you need to know about the CMRL network

PAN card customer care numbers

If you need any assistance related to your PAN card download or e PAN card download or if you have any other doubt, you can call the following numbers:

Income Tax Department: 0124-2438000, 18001801961

Income Tax Department toll-free number: 18001801961

UTIITSL: 022-67931300, +91(33) 40802999, Mumbai Fax: (022) 67931399

NSDL: 020-27218080, (022) 2499 4200

Protean eGov Technologies toll-free number: 1800 222 990

Email IDs

tininfo@nsdl.co.in/ info@nsdl.co.in

utiitsl.gsd@utiitsl.com

Read also : Chennai Metro: All you need to know about the CMRL network

PAN card download FAQs

What is a PAN?

Permanent Account Number (PAN) is a 10-digit alphanumeric number, issued by the I-T Department, to any person applying for the same. The department may also allot the number without an application. For a PAN holder, his card is the identifier for the Tax Department. The PAN enables the I-T Department to link all transactions, including tax payments, TDS/TCS credits, income tax returns, specified transactions, correspondence, etc., pertaining to the PAN card holder.

Is it necessary to have a PAN?

It is mandatory to provide the PAN while filing return of income and for correspondence with any income tax authority. Since January 1, 2005, it is also mandatory to quote PAN on challans for any payment due to the I-T Department.

What is an e-PAN card?

An e-PAN card is the online copy of a taxpayer’s PAN card. Used for e-verification, your e-PAN can be saved in your mobile phones and computers.

Does an e-PAN have the same validity as physical PAN cards?

An e-PAN has the same validity as the physical PAN card.

Can I apply for a PAN if my Aadhaar card is inactive?

Your Aadhaar card should be active to apply for a PAN card.

What is the fee to apply for online PAN card?

There is no fee to apply for online PAN cards.

What is the last date to link Aadhaar with PAN?

The last date to link PAN card with Aadhaar is March 31, 2023.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle