[ecis2016.org] Know more about the additional cost that property buyers have to bear as stamp duty registry charges in MP 2021

In a move to promote property ownership in the state, the Madhya Pradesh government, on September 7, 2020, announced a reduction in stamp duty charges for registration of properties, by 2%. With the reduction, the stamp duty rate in MP was 10.50% (stamp duty of 7.5% and a registration fee of 3%) from the previous 12.50% (stamp duty of 9.5% and registration charges of 3%).

You are reading: Stamp duty and registration charges in Madhya Pradesh

The reduction in rates was expected to boost property sales within the municipal areas. Despite a high volume of inventory, active sales have plummeted due to the COVID-19 pandemic. The stamp duty rationalisation may bring back some much-need vigour to the property market in Madhya Pradesh.

[ecis2016.org] All about laws of property registration in India

Stamp Duty in Madhya Pradesh

| Stamp duty in MP | |

| Male | 7.5% |

| Female | 7.5% |

| Joint | 7.5% |

Registry charges in MP 2021

| MP Registry charges | |

| Male | 3% |

| Female | 3% |

| Joint | 3% |

[ecis2016.org] How to do Khasra number check MP

How much money can you save on property in MP?

There is a sizable savings if you are looking to buy a property soon. Let us look at an example. Prior to September 2020, if you bought a property, you would have to pay Rs 12.50 lakhs towards stamp duty charges, on a property worth Rs 1 crore.

Cost of property: Rs 10,000,000

Previous stamp duty rate: Rs 12.50%

Stamp duty charges: Rs 1,250,000

Under the current scenario:

Cost of property: Rs 10,000,000

Read also : Sentiments indicate real estate industry positive about recovery

Current stamp duty rate: Rs 10.50%

Stamp duty charges: Rs 1,050,000

Hence, you would save Rs 2 lakhs. Note that there are no concessions for female home buyers and the stamp duty in MP on property is the same for both, men and women, in Madhya Pradesh.

Do stamp duty cuts really help?

You can see through the example cited above that stamp duty cuts will definitely help improve buyer sentiments. However, buyers will find it a big relief, if the circle rates are also slashed, especially in places where there is a larger gap between the actual market value and the circle rate, that is, where the circle rate is much higher.

Demands of real estate industry in MP

Industry bodies are urging the authorities to consider a reduction in registration fees as well, by 2%. If this happens, the overall burden would be 8.5% which will augur well for the property market.

How to pay stamp duty in MP ?

You can choose to pay the stamp duty, either by going to the sub-registrar’s office and directly paying it in person, or via e-stamping or franking.

E-stamping in Madhya Pradesh

In MP, you can pay the stamp and registration charges online through the dedicated portal – Stamps and Management of Property and Documents Application (SAMPADA). Prior to SAMPADA, stamping and related work was very strenuous for a layman and it took days to deliver the certified documents. Now, it is faster and much easier to access and also save these documents for future reference.

- Delhi land pooling policy: Public feedback to be put before board on July 2-3, 2018

- Can’t afford the high rental deposit? Opt for a rental deposit loan

- COVID-19 impact on global property markets: Why are housing prices rising in the west?

- What can you do if your project gets excessively delayed?

- What is the importance of a credit score or CIBIL score in getting a home loan?

Follow the steps to pay stamp duty online in MP:

Step 1: Login to the official website of registration and stamps, commercial tax department, government of Madhya Pradesh, or click here for MP registry.

Step 2: Login to ‘Estamp Verify’ and proceed with paying the requisite charges.

Read also : Turnkey project: What is turnkey contract and examples

[ecis2016.org] All about MP bhu naksha

What to note when opting for e-stamping?

As per directions from the authorities, online payments may work only if you have chosen English as the language on the login page. Details fed by you should also be in English. Also note that digital signatures are mandatory. Be careful not to hit the refresh or back button until the payment is complete.

[ecis2016.org] Land and property registration online: Process and charges in India explained

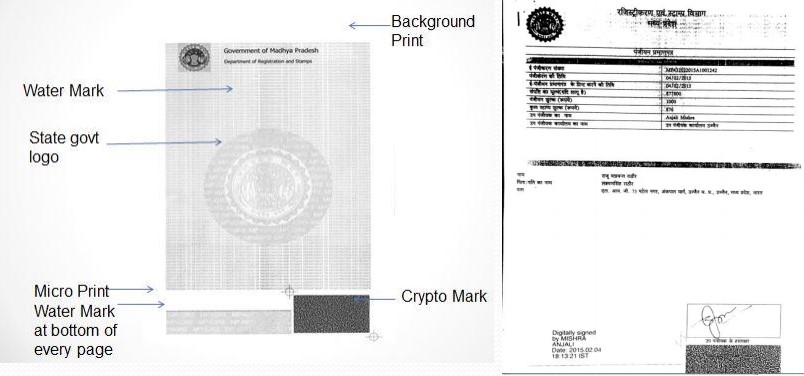

What does an e-stamped document look like?

Details on an e-stamp will include the following:

- Serial number or a unique identification number.

- Date and time of issuance.

- Amount of stamp duty paid (in words and figures).

- Name of the purchaser and the other party.

- Address of purchaser and other party.

- Description of the property or subject.

- User ID.

- Code of service provider.

- Digital signature, authorised barcode.

- Security features.

E-stamped document

Stamp duty in MP using Franking

You can also pay the stamp duty charges through the banks and post offices, approved and designated by the MP government.

[ecis2016.org] What is Franking charges?

Stamp duty in MP: Tax Benefits

Under section 80 C of the IT Act, one can get benefits of upto Rs 1.50 lakh on paying stamp duty in MP. A person can avail this benefit while filing his IT returns. However, note that this deduction can be availed only in the year of property purchase.

In spite of the pandemic, property registrations in Madhya Pradesh have increased. In fiscal 2020-21, about 1,07,000 properties were registered, bringing in a revenue of Rs 1,325 crores, which was 8% more than the previous fiscal, official data showed. Properties registered during the COVID period were also much higher than what was targeted by the department, with a considerable jump in demand for plots and affordable homes, especially from first-time home buyers.

[ecis2016.org] Stamp duty in Pune

FAQs

Who can give licence to service providers for e-stamping service?

The senior district registrar or district registrar of the district in Madhya Pradesh, has the power to give licences to service providers.

Is e-stamping valid in MP?

Yes, after e-stamping you can also view information regarding the amount paid, party details, particulars of the transaction, etc.

Can I pay stamp duty and registration fee through challan in MP?

Yes, you can pay stamp duty and registration fee through challan, online payment and by using the credit limit of service providers in MP.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle