[ecis2016.org] We examine how long it may take for the real estate sector to recover from the COVID-19 pandemic and which segments are likely to witness the first signs of recovery

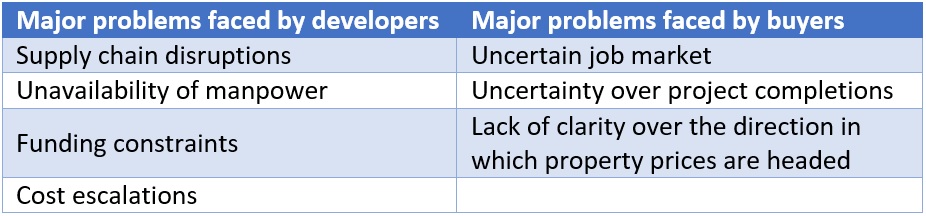

Across the Indian real estate sector, the two questions that seem to be on top of everyone’s mind are: ‘When will the real estate segment recover?’ and ‘Which would be the segment to recover first?’ While the developers are calculating their financial closure and execution bandwidth, lenders are busy in their own cost and benefit analysis from an altogether different perspective of opportunity cost. Amid the confusion, home buyers are wondering whether the prices have bottomed-out or whether there would be better opportunities for buying, in the days to come.

You are reading: Which segment will lead real estate recovery post-COVID-19 and how long will it take?

A closer look at the market fundamentals, suggest that the recovery timelines and the catalysts would not be uniform across the sector. Even in the same city or the same micro-market, the turnaround may be subject to key fundamentals, ranging from the product and pricing, economic revival and job certainty in the market and stage of construction, to policy direction in terms of the government’s infrastructure spending.

Nevertheless, all stakeholders are unanimous that the broken supply chain has adversely affected the execution capability of the developers. Even projects with positive cash flow are today reeling with supply chain hurdles. The availability of man and machinery too, is as much a challenge as the availability of money.

Read also : Delhi: I-T raids on farm house, land developers unearth Rs 215 crores black money

[ecis2016.org] Impact of Coronavirus on real estate

KPMG, in its assessment, has said that the ongoing COVID-19 pandemic is expected to keep Indian real estate subdued over the next six to 12 months, forcing sector entities to contract operations, revisit planned developments, expansions and investments. Notwithstanding the KPMG assessment, the leading players are optimistic. They are nevertheless bothered with challenges at multiple levels – ranging from the cartelisation of inputs to the slowdown in the economy and government impetus to states’ spending on infrastructure.

Amit Modi, director of ABA Corp, admits that their earlier calculation with respect to the developers’ better bargaining power with suppliers, has been off target. It has, hence, led to cost escalations, as well. “We thought that we would have greater room to negotiate with the suppliers of steel and cement, with ready stock and less demand. This could have offset our increased cost on manpower. However, it has been the other way round, with cost escalation posing a major challenge,” says Modi.

JC Sharma, MD and VC of Sobha Limited, points out that “Supply chain is a systemic problem for the sector. However, I believe that nature does not leave room for a vacuum. Right now, there is demand contraction and supply is not that great, as well but with the revival of demand, things will improve. It will take another two to three months, since Indian entrepreneurs are very capable.”

[ecis2016.org] ‘Real estate revival crucial for economic recovery post-COVID-19’

Deepak Goradia, vice-chairman and managing director of Dosti Realty also agrees that the COVID-19 pandemic has marginally impacted the smooth trading process and functioning of industries, and the domain of real estate is no exception. The global impact could lead to delayed decision making and capital expenditures by credible home buyers and investors. Although the instabilities in business cycles have a possibility of affecting the demand for commercial, as well as housing space, in the Indian property market, the sector is taking measures to revive from the crisis, he says. “It will take a while for the market to get back to its usual momentum. Even during the lockdown period there was still decent demand, especially in the affordable and MIG housing segment. While most of the demand was largely end-user-driven, there was also a lot of interest from the investor segment, given the volatility of the stock market. This is just a temporary phase and Indian realty must remain positive and recover successfully, as it has done in the past,” says Goradia.

Which real estate segment will revive fastest after COVID-19?

Read also : Building homes, the natural way

There are two aspects that could lead to the revival of any given segment – one is the availability of funds and the other is the demand dynamics. Logistics and warehousing has the best chance of revival, whereas office spaces would be muted for some time. In the housing market, demand seems to be better at the top end and the bottom end of the pyramid. Most of the developers privately admit that luxury housing has seen better traction, in recent times. The reasons are obvious: luxury buyers have more disposable money and they are making use of the situation for opportunistic buying. Moreover, the developers in this segment also have greater room for renegotiation, since the profit margins are on the higher side.

[ecis2016.org] COVID-19 and recovery of warehousing in India

The concept of wellness will also gain ground moving forward. Serviced apartments in the top cities will be witness to more in demand. Similarly, the demand for compact housing within the affordable budget has increased. Most of the buyers in the mid-segment have learnt an important lesson out of the COVID-19 experience: It is better to go for a smaller house within one’s means than to be over-leveraged in an age of economic and job uncertainties. It makes more sense to buy an 800-sq ft apartment with 50% borrowed money than a 1,200-sq ft apartment with 80% borrowed money.

Nevertheless, the opinion seems to be that the revival could be delayed but not denied. The Coronavirus pandemic has taught builders and buyers to be realistic, to understand the difference between wants and needs and be wary of over-leveraging. The market may be on a recovery path, for those who are learning the lessons. For the rest, it may be time to exit.

(The writer is CEO, Track2Realty)

FAQ

Which residential real estate segment is likely to recover fastest from COVID-19?

The luxury and affordable housing segments are likely to recover the fastest after the COVID-19 pandemic, because of demand.

- Mumbai is India’s most expensive city for expatriates: Survey

- Agra Lucknow Expressway: All you need to know

- HC vacates previous order, allows Thane, Pune civic bodies to issue OC for new constructions

- SC strikes down West Bengal’s real estate law, HIRA

- Key differences between a property broker and a brokerage firm

Which commercial real estate segment is likely to recover fastest from COVID-19?

The warehousing and logistics segment could be the one to recover earliest.

How long will it take for real estate to recover from the Coronavirus pandemic?

According to KPMG, the Indian real estate sector could remain subdued for another six to 12 months.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle