[ecis2016.org] A K-shaped recovery could mean that strong players will be able to weather the storm caused by the Coronavirus pandemic, while the smaller and weaker players will be forced to exit the real estate market

While economists and analysts are unanimous in their opinion that the recovery of the real estate sector is inevitable, what is being debated, is the time that it would take, for things would get back to normal. What is even more important, is to assess what would be the shape of the recovery. In classical economics, three shapes are commonly used to denote recovery – ‘V’, ‘U’ and ‘L’. A V-shaped recovery indicates a strong bounce back after a downturn. A U-shaped graph indicates a slow and long-drawn recovery, while an L-shaped recovery is one where the earlier peak is yet to be reached.

You are reading: K-shaped recovery on the cards for Indian real estate

What is a K-shaped recovery?

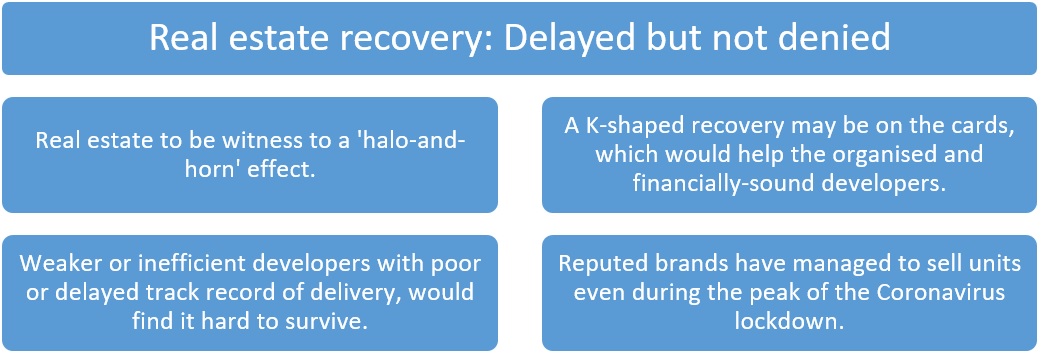

The market dynamics, however, point to a new type of recovery for real estate – a K-shaped recovery. What it actually means, is that the bigger, stronger, organised and listed players would recover faster and more than expected, while the weaker developers could see the end of the road, leading to their exit.

The argument has its share of merits. After all, the market slowdown, muted sales velocity of under-construction projects and the liquidity crunch, had already stressed the weaker players quite a bit, even before the Coronavirus’ impact on real estate. Hence, analysts are forecasting the ‘halo-and-horn effect’ over the business. The halo-and-horn effect is a cognitive bias that causes one trait, either good or bad, to overshadow other traits, behaviours, actions or beliefs.

When will real estate recover from the COVID-19 pandemic?

Read also : Residential property sales fall to lowest in 5 years: Knight Frank report

Amit Modi, director of ABA Corp, seems to agree with the assumption that the future will belong to strong players, when he says that sales are weak but strong players are selling. While they may not be selling 20 units in a month, it may be seven to eight units during the unlock phase. Revenue is coming from the projects that are in the advanced stages of construction, he says. “Even if we are meeting 40% of our target after the Coronavirus pandemic, we should not be pessimistic. What will accelerate the pace of recovery, will be the trust factor towards the developer, as well as the ready-to-move-in inventory. Location and product are the key and the buyer today is also very conscious of the fund position of developers,” adds Modi.

JC Sharma, VC and MD of Sobha Limited, sounds more optimistic about a post-COVID-19 recovery, when he says that June 2020 itself was a month of revival. However, since Coronavirus cases are increasing significantly, the fear factor may again have an adverse impact. Till you return to normalcy, you will have challenges. Once normalcy returns to the Indian economy, not just in terms of the stock market but actual visibility of on-ground activities, when there is no lockdown, when the workers start coming back and there are no restrictions over free movement, then, the steps that we have taken during this period will help us grow faster than the overall market, he maintains.

“Of course, there exists opportunistic buying, because prices are at rock bottom. We have about 20 million sq ft of approved ongoing projects, about 40 million sq ft of projects in the pipeline and some projects at the design stage. So, we are constantly creating a lot of opportunities during this phase. We are creating opportunities now without investing, through a hybrid model. In this scenario, we have to be open to emerging market opportunities,” Sharma explains.

According to Deepak Goradia, vice-chairman and managing director of Dosti Realty, the duration and the extent of the pandemic, will determine whether property prices will decrease, as the holding cost for developers will increase, resulting in pressure to liquidate unsold inventory. Considering the current scenario, the housing sector, hopefully, should see a gradual increase in the next quarter as consumer’s utmost priority presently is health and preservation of income. “The sector will start to revive in times to come, with an increase in housing sales, owing to the initiatives taken by the government. For example, steps such as the extension in project completion dates by six months beyond the lockdown period, reductions in interest rates and easing of credit conditions by banks and financial institutions, will help put the Indian economy back on track and real estate stakeholders are also anticipating some positivity in the industry,” says Goradia.

[ecis2016.org] Impact of Coronavirus on property prices

Read also : China’s Evergrande Group crisis: A learning and a potential disruption for Indian real estate

Property sales data from across the markets after every crisis, clearly show how some of the better-run companies consistently grow faster than the overall industry. The reputed players also end up earning market share from their smaller, weaker or inefficient counterparts. Some of the key enablers supporting this trend are brand equity, execution track record, economies of scale and fiscal depth.

For example, following the demonetisation exercise of 2016 and the impact of the GST on real estate, which was rolled out in 2017, the market witnessed a trend from the ‘unorganised’ to the ‘organised’. Many small developers had to exit the market, while this helped the organised and listed developers to grow their market size. The top- listed and/or organised real estate companies could not only adapt to the ‘new normal’ soon but have also been able to garner a greater market share.

Similarly, regulations like the Real Estate (Regulation and Development) Act (RERA) and disruptions like the NBFC crisis, led to risk-aversion in lending by banks, thereby, further denting the prospects of smaller developers, as access to capital for smaller and inefficient players became a challenge. Now, the COVID-19 pandemic has further restricted the ability of weaker developers to compete effectively with large and listed companies that continue to have access to capital at healthy rates or have enough internal accruals to fund their Capex and working capital needs. A K-shaped recovery is, hence, predicted as a logical conclusion.

(The writer is CEO, Track2Realty)

FAQ

What is a K-shaped recovery?

A K-shaped recovery indicates that stronger businesses will recover quickly while smaller businesses could be forced to shut.

What is a V-shaped recovery?

This indicates a sharp slowdown, followed by an equally strong recovery.

What is a U-shaped recovery?

This indicates a prolonged and slow recovery after a slowdown.

- Mumbai’s emerging commercial-cum-residential destinations

- Transform Bengaluru into a true global city: Former Infosys CFO, to Karnataka government

- Jinnah House row: Bombay HC allows Nusli Wadia to replace his mother as petitioner

- Mumbai Metro moves HC, for urgent hearing on Parsi community plea

- Need to reduce waste at household level, to minimise burden: Environment experts

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle