[ecis2016.org] With occupiers increasingly opting for modern office spaces, we look at the prospects of the erstwhile CBDs and how the ‘future-proofing’ of these ageing buildings can help urban planning, as well as the owners of such properties

Indian commercial real estate developers have been gradually aligning themselves, to meet the increasing demand for Grade A properties. In the top 7 real estate markets in India, including Delhi-NCR, Mumbai city and Bengaluru, more than 30 million sq ft of new commercial Grade A office supply is being added every year. This trend suggests that the supply of new office space, is only going to increase in the coming years across the country. Increasing levels of transparency, the Real Estate (Regulation and Development) Act (RERA) and policy reforms such as the implementation of real estate investment trusts (REITs), have infused greater investor confidence in the Indian market in general and firms involved in the development of commercial assets in particular.

You are reading: Can retrofitting help the erstwhile CBDs’ marquee commercial buildings survive in a new market?

However, the current rate of office supply is creating another dilemma for the industry: as new stock is added, old stock is being pushed to the brink of being redundant. The redundancy is being reflected in the average rentals across the central and suburbs, vacancies and the preferences of occupiers/tenants. Mumbai and Delhi-NCR collectively have more than 50% of the old office stock in the country, according to a JLL Research on commercial building supply. This provides us with a tremendous opportunity to refurbish, upgrade and future-proof the ageing assets with modern amenities and look and feel, to appeal to the new age workforce.

Office spaces: Inventory and age of buildings

Earlier, a commercial building was designed and built with an average life span of three to four decades. However, given India’s new age workforce and various macro trends, a building’s lifecycle, in terms of remaining relevant, has reduced to merely a decade.

This means that most buildings in the country that were constructed and delivered around 10 years back, are different in terms of structure and aesthetics. The ongoing trends suggest that they are getting older and are not able to meet the requirements of a large section of the workforce that is young and agile and often prefers working in an environment that is safe, healthy and offers modern amenities.

Read also : Call for new container terminal in Howrah to reduce pollution and decongest Kolkata

There is an abundance of the old stock, especially in the traditional central business districts (CBDs). In Mumbai, the quantum of existing Grade A office stock that was completed 10 years ago (before 2008), stands at 28.8 million sq ft. This is 25% of the current office stock universe in India. In terms of the number of buildings, this universe is a whopping 40% of the total stock in Mumbai. Delhi-NCR has, until now, witnessed a similar trend.

| Commercial Office | Mumbai | Delhi-NCR | ||

| Completion year | Stock

(in million sq ft) |

No of buildings | Stock

(in million sq ft) |

No of buildings |

| Before 2008 | 28.82 (24%) | 169 | 29.96 (29%) | 123 |

| After 2008 | 89.77 (76%) | 267 | 73.84 (71%) | 237 |

Source: JLL Research

[ecis2016.org] Commercial real estate in India: Adapting to the changing trends and preferences

CBD versus SBDs in metro cities: Demand analysis

Read also : RBI notifies revised framework to deal with bad loans

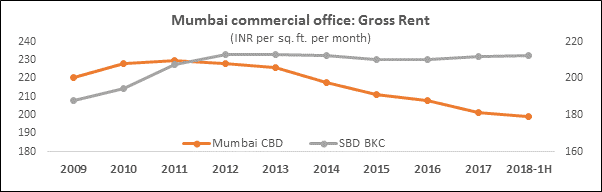

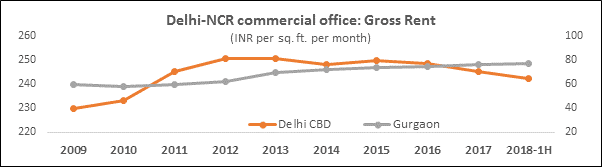

The trend has already been impacting key micro-markets. The impact on the CBDs is clearly reflected through falling rentals and gradually rising vacancies. Across Mumbai and Delhi, the erstwhile prime CBDs such as Nariman Point and Connaught Place (CP), respectively, have lost their sheen to relatively new and vibrant secondary business districts (SBDs) of Bandra-Kurla Complex (BKC) and Gurugram, respectively. The trend, however, is more visible in Mumbai than Delhi.

A number of occupiers, over time, have decided to shift their offices from the old CBDs to BKC and Gurugram, which have become the de-facto CBDs of today. While the relatively lower rentals were an attractive proposition initially, the primary driver of this shift was the need for better amenities and space. Energy efficiency and sustainability have also become key factors for occupiers. The newer buildings in the SBDs have been developed with greater FSI and subsequently, smarter planning and execution of work spaces. This has given occupiers greater flexibility and ease of planning for the workforce.

Market opportunity for the transformation of old buildings

There is a huge market opportunity in building lifecycle management that involves building upgradation, based on users’ preferences and the infusion of technology. Such upgradation will help asset owners to maximise yields and keep the commercial assets relevant. It also gives urban planners a chance to re-plan public spaces around the CBDs. However, this requires a collaborative effort from all stakeholders, right from the planning stage to approvals and successful implementation. Another important consideration, would be the funding of these transformation projects, where old buildings would be made smarter and better. In the current scenario, where the availability of adequate funding has become a challenge, there is room for innovative ways to infuse liquidity in such projects.

(The writer is managing director, project and development services, JLL India)

- RICS working on draft standard, to help property firms to address risks of financial crimes

- Thakur Complex property market: An overview

- Government allocates Rs 5.97 lakh crores for infra spending in 2018-19

- PM Kisan next installment: 12th installment may be released by September 1

- Delayed possession: No data about completion status of housing projects, says government

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle