[ecis2016.org] Across Asia-Pacific, India shows maximum improvement in the Global Real Estate Transparency Index 2022

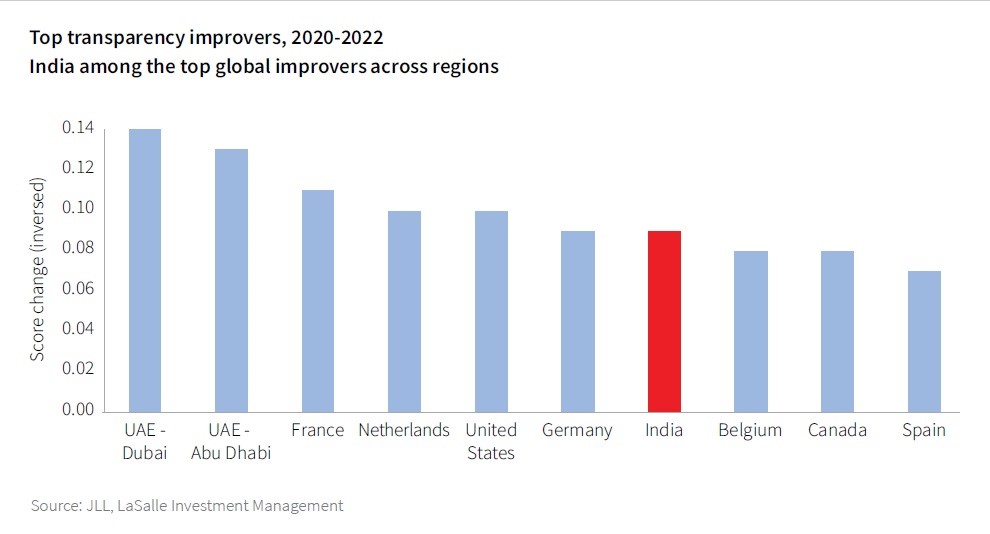

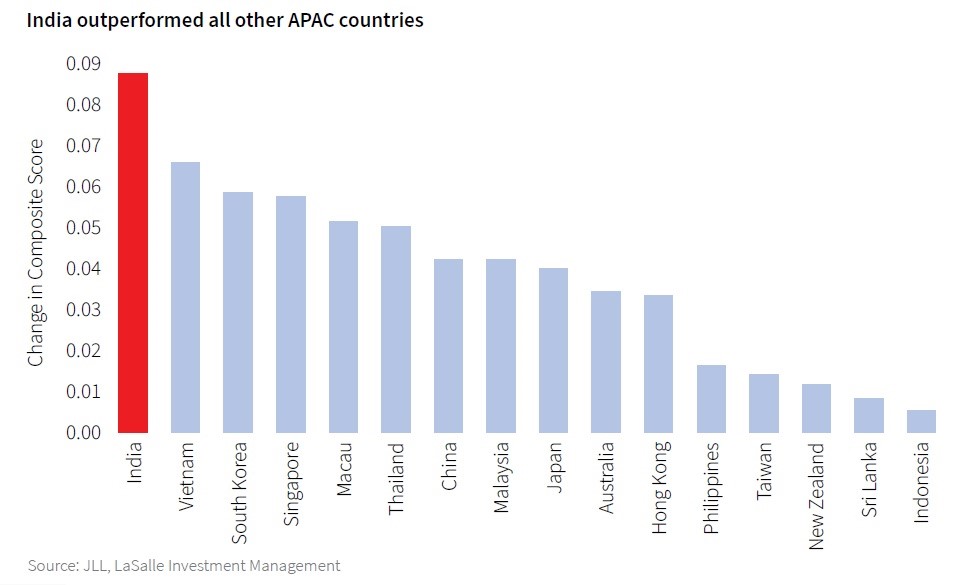

India’s real estate market transparency is amongst the top 10 most improved markets globally, according to JLL’s 2022 Global Real Estate Transparency Index (GRETI). The report, release on July 5, 2022, said that India’s improvement in transparency score between 2020 and 2022 (from 2.82 to 2.73) was higher than some of the highly transparent markets, due to digitisation and data availability for transaction processes, in addition to overall market fundamentals.

You are reading: Indian real estate among top 10 most improved markets, vis-à-vis transparency

|

|

According to JLL, India’s improvement in transparency is reinforced by increased institutional investment and the growing numbers of real estate investment trusts (REITs) helping to broaden market data and bring more professionalisation to the sector to complement regulatory initiatives like the Model Tenancy Act, and digitisation of land registries and market data, such as through the Dharani and Maha RERA platforms.

“The move towards greater transparency in India will intensify investor interest and bolster occupier confidence. As a result, we will see more capital deployment into the country as it demonstrates consistent efforts to make accurate data available, enforce legal protections for property ownership, and enhance the regulatory environment to facilitate the transactions. Regulatory changes in the Indian real estate sectors like RERA and digitisation in all transaction processes have led to a more sanitised and transparent data availability helping the country make tremendous progress in the index,” said Radha Dhir, CEO and country head, India, JLL.

“Sustainability continues to be the key focus for the world going ahead. We have seen India take great strides in sustainability in the past years, however, there is a need for a more concerted and congruent thought process and action plan to bring sustainability into the main,” she added.

Read also : Maharashtra to set up infrastructure SPV to raise Rs 1 lakh crore

Sustainability needs sustained thinking

To be able to move to the coveted Transparent list, from the present Semi-Transparent list, the country needs to improve sustainability tracking. Sustainability has not been one of the major areas for change over the last couple of years for India, but investors and occupiers are driving this change. Several initiatives are underway at either the national or local level including the National Guidelines on Responsible Business Conduct from 2021, with reporting for the largest 1,000 companies by market cap to be compulsory from 2022-23, and local plans such as Mumbai’s Climate Action Plan, released in 2022, which is expected to establish a system to conduct regular energy performance benchmarking of buildings by 2025, and mandate a building energy management system in all new buildings.

Making green certifications/ratings and adherence to ECBC a mandate would give a greater push to sustainability. The regulatory impetus for mandatory tracking and reporting is still lacking but should get a major push following India’s call for Net Zero by 2070.

Sustainability has been the biggest driver of transparency improvements across markets according to JLL’s 2022 index. With increasing numbers of countries and cities setting mandatory energy efficiency and emissions standards for buildings and the more widespread adoption of green and healthy building certifications. However, sustainability measures remain among the least transparent globally, and the fractured regulatory landscape – with different standards being set at the municipal, state, region, and country levels, and a proliferating array of sustainability credentials, benchmarks, and standards – is making it increasingly difficult for investors and companies to navigate and understand their responsibilities.

[ecis2016.org] Why realty players should focus on green buildings

Improvement in transaction process

This was the parameter on which India’s score improvement was the highest in GRETI 2022. Given the regulatory initiatives, and better and deeper data availability, access to asset information has improved to a great extent. With reforms also creating the push for better professional standards for property agents and an environment for weeding out illicit finance through stringent anti-money laundering regulations, the transaction process in India has become more transparent and meaningful.

Read also : Gurgaon Sector 37 property market: An overview

India’s improvement in this parameter was just behind Vietnam and Malaysia among other APAC countries.

“India’s investment performance parameter has held steady with a conducive investment environment in place and healthy opportunities for investors. The last two years have also been marked by upheaval and a reset in investor strategies. Some countries have found increased favour from investors and have moved up the rankings. India has kept its ranking steady, though it has improved its composite score in this parameter,” said Samantak Das, chief economist and head of research, REIS, India JLL. “JLL’s GRETI is one of the leading indices that offers a deeper understanding of the transparency spectrum across real estate parameters which is most useful for real estate investors globally. It offers countries a window of opportunity to identify lagging indicators and make a concerted push to improve global investment flows,” he added.

Interest in alternative real estate assets

Diversification remains a core theme for many investors in the Asia Pacific. Institutional capital, such as that controlled by asset managers, pension funds, and sovereign wealth funds, is active in alternative real estate sectors in nearly two-thirds of the markets tracked. That means expectations for transparency across niche property types like lab space, data centers, or student housing have grown.

India has made rapid strides in the availability of high-frequency data across its big cities and core asset classes through the intervention of tech platforms and regulatory reforms. It needs to replicate for other cities and alternative sectors with the work already underway through a mix of both private sector participation and government push towards digitisation of land and property records. As market transparency improves through access to data, better corporate governance practices, and more publicly listed REITs creating more publicly available datasets, the sustainability agenda needs a greater push for India to rapidly ascend to the Transparent tier.

[ecis2016.org] All you need to know about investing in REITs in India

- Green Court at Sector 90, Gurugram – Project Overview

- Property rates & trends in Talegaon Dabhade, Pune

- Piramal Enterprises partners with Ivanhoé Cambridge, to invest in residential projects

- Congress alleges irregularities in publication of Thane Urban Renewal Plans

- Delhi to become a ‘solar city’, incentives for ‘green’ homes

Looking ahead

Transparency and sustainability are now colliding to create new, insightful, and game-changing trends for the real estate industry. Standardised sustainability measurement metrics will make it easier to benchmark assets globally. Making such data reporting mandatory will be key to the built environment decarbonisation and climate risk mitigation across countries. The increasing diffusion of technology is creating the push toward tracking and aggregating granular and high-frequency data. While this works best in countries with digitised data sources and governance, advanced infrastructure, and deeper capital markets, the converse of transparency improvement by the proliferation of such data aggregators who build market data from scattered sources also holds true. The road from regulations to putting them into practice – across financial regulations, land-use planning, taxation, anti-money laundering and eminent domain – will be necessary to increase transparency levels and match heightened expectations.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle