[ecis2016.org] With women becoming more active in real estate purchase decisions, we look at the factors they consider and the incentives on offer for women home buyers

Women have mastered the art and science of making a home out of a house or an apartment. It is something that comes naturally to them. What is interesting though, is that women have further enhanced their home making skills and are leveraging it for home buying, as well. In fact, as per industry estimates approximately 74% of all the residential real estate buying decisions are influenced by women and/or women members of the family.

You are reading: What do women real estate buyers want?

In today’s day and age, women are actively involved in the home buying procedure. They ensure complete know-how of the varied legalities involved in the process and acquire knowledge on compliance aspects to due diligence. Women are not only calculative about the tax benefits but also check clauses in agreement of sales, registration of property formalities, rules guiding formation of societies and also rights and duties of flat allottees.

The changing socio-economic environment has increased women’s participation in areas of education, employment, entrepreneurship and business. This has played a catalyst’s role for the Indian real estate sector that is witnessing increased traction from women home buyers. Accordingly, realtors have started planning their residential developments, keeping their preferences in mind.

Also, with financial independence among women gaining momentum coupled with informed risk taking appetite, a major shift is happening in their approach to ownership of various asset classes. This is very evident from the fact that women are increasingly diversifying their portfolio comprising of fixed deposits, precious metals and stones and adding real estate for their own use, as well as long-term investment.

Where do women homebuyers invest?

Read also : Industrial township proposed for Sonepat, could generate 34,000 jobs

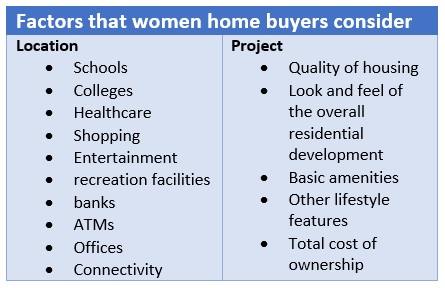

So, what are the various factors that women home buyers consider, before making up their mind to acquire a residential real estate? Women look at a host of things before zeroing in on the locations of their choice. A combination of factors like schools, colleges, healthcare, shopping, entertainment and recreation facilities, in addition to banks, ATMs, offices and connectivity, form a part of the detailed study that influences their decision-making process. Neighbourhoods that score high on these parameters definitely make the cut, particularly for women with families.

Thereafter, elements like quality of housing, look and feel of the overall residential development, basic amenities, other lifestyle features and total cost of ownership come into play at the time of finalising the property.

Single women homeowners

As for single women, the residential location’s proximity to the work area is a very crucial factor. In fact, there are women who prefer to reside in neighbourhoods that are located within a certain radius of their work area, mainly due to ease of access, thereby, reducing travel time. Just to illustrate, a prominent voice-over artist in my known circles relocated to the Andheri-Goregaon area from her parental house in the extended suburbs of Thane. The decision to move to this locality helped her to significantly cut travel time, optimise work schedule and be in the radar of media and entertainment companies, advertising agencies, studios and production houses. Moving closer to the source market has allowed her to take up more projects. This has significantly enhanced visibility, earnings and improved her ability to comfortably service the home loan taken for purchasing the apartment.

This is where ready-to-move-in apartments/ residential developments enjoy an upper hand, as compared to under-construction projects. Ready-to-move-in houses give an opportunity to the women home buyers to actually touch, feel and experience the place, something that is not possible in the case of under-construction developments.

Other benefits of buying ready-to-move-in properties:

| No Goods and Services Tax (GST), resulting in direct savings of 5%. |

| Various tax deductions against principal and interest payments of Rs 1.5 lakhs and Rs 2 lakhs respectively, every year under Sections 24 and 80C of the Income Tax Act. |

| An additional deduction of Rs 1.5 lakhs on interest payment can also be availed under Section 80EEA. |

Special schemes for women home buyers

Read also : How will the NPA law impact the realty sector?

As far as benefits and advantages that women enjoy when buying residential real estate are concerned, there are plenty. The central government, as well as various state governments, have taken note of this buying behaviour and introduced schemes, thereby, encouraging women to look at buying residential real estate.

Women homebuyers get preference under PMAY

The Pradhan Mantri Awas Yojana (PMAY) under the ‘Housing for All by 2022’ mission, for instance, was introduced to encourage and mandate women participation as a co-owners, when considering to own a residential unit in the rural and urban areas. Targeting the first-time home buyers, this scheme allowed for subsidies to the tune of Rs 2.35 lakhs and Rs 2.30 lakhs to eligible applicants, depending on their annual income bracket. Offered under the Credit-Linked Subsidy Scheme (CLSS), this can be availed by households in the middle income group (MIG) having an annual income of between Rs 6 lakhs and Rs 18 lakhs. The buyer also gets to avail a PMAY-linked home loan and benefit from the tax concessions that come along.

Stamp duty waiver for women in real estate

Additionally, various Indian states like Punjab, Haryana, National Capital Territory of Delhi, Uttar Pradesh, Jharkhand and Rajasthan, allow partial waiver of 1% to 2% in stamp duty for women home buyers and properties registered in a women’s names. Collectively, this results in significant savings for a woman home buyer at the time of purchasing a residential unit.

Home loan interest rates for women

On their part, public and private sector banks, as well as non-banking financial companies (NBFCs), have come up with specially-designed home loans and financing schemes that are primarily targeted at women raising debt for their home buys. Women home buyers are offered concessions on home loan interest rates of up to 1%, depending on the policies of the lending institution, as compared to their male counterparts.

(The writer is an investment specialist at Simple Solution 4U)

- Kerala gives final nod for Embassy Taurus World Technology Centre, in Trivandrum

- Indian realty sector’s future sentiments plummet to 39-month low

- Developers need to speed-up construction, to meet housing demand: Rohit Poddar, MD, Poddar Housing

- Residential real estate growth momentum continues in Q1 2022: PropTiger.com report

- Mumbai coastal road project gets final green nod, says CM

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle