[ecis2016.org] We look at some of the common mistakes that first-time buyers are prone to making and what they should do, to avoid future complications

For most people, the purchase of a home is often the biggest investment of their lives. Between the euphoria of buying a property and the stress of its financial implication, a first-time buyer often becomes susceptible to making errors. Here, we list nine common mistakes that first-time buyers are prone to making and how to avoid it.

You are reading: Nine mistakes that first-time home buyers should avoid

Believing that you can get a home loan easily

Buyers may sometimes believe that one can apply for any loan amount and the bank would approve the application and disburse the credit within days. This is not true. Banks grant you a housing loan, depending on your personal eligibility. They then assess the property you intend to buy and decide the loan amount that they would be willing to lend for that property. This will not be more than 90% of its overall worth.

[ecis2016.org] How to repay your home loan faster

Not checking one’s loan eligibility

Most people buy homes with the help of housing finance. The logical thing for such home buyers, is to first find out what kind of home loan they are eligible for. Depending on your credit-worthiness and savings, estimate a budget and stick to it. You may like a particular house but it is no good, if you cannot afford it without taking a huge debt.

[ecis2016.org] Nine assumptions that will harm a home buyer’s credit score

Over-borrowing to buy an unaffordable property

Read also : Are legal advisors ready to handle RERA cases?

In their over-enthusiasm, first-time home buyers often make the mistake of opting for homes that are beyond their monetary capacity. For this, they tend to borrow excessively and invariably regret this decision afterwards. As your house will not be your only liability in future, over-committing to it would not only be financially stressful but also mentally stressing. Home purchases are long-term commitments and any effects (good or bad), would be felt for a long time.

[ecis2016.org] Which EMI method suits you under a home loan?

Not factoring in the miscellaneous expenses

Property investments include a lot of additional expenses. You will have to pay stamp duty and registration charge for registering the property in your name. If it is a resale property, you may have to spend money to carry out some repair work. Having a prior estimate of these expenses would be helpful.

[ecis2016.org] 11 things buyers should know about stamp duty

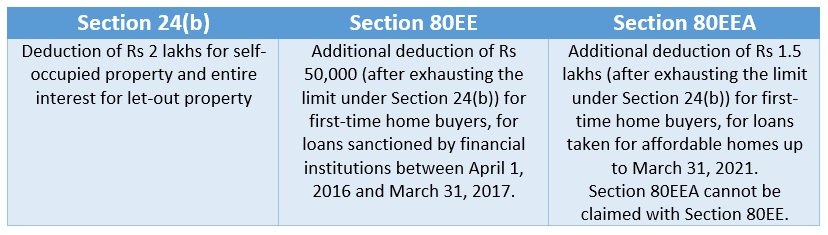

Ignorance about tax benefits

Not many people are well-versed about the taxes that they have to pay upon buying a house and the rebates that they can claim under various sections of the Income Tax Act. Not paying the taxes on your home purchase would amount to tax evasion, while not properly claiming the rebate would mean financial losses. In India, special tax breaks are allowed to first-time home buyers under Section 80EE and Section 80EEA and buyers should take advantage of these provisions.

You may like to read: All about home loan benefits

Joint home loans are good

Read also : Customer conversion rates for real estate improve, post-COVID-19

Taking a joint home loan with your spouse, may increase your loan eligibility and help you purchase a better property but doing so also has several implications. Your spouse will be liable to pay the loan if you are unable to. In case of default, both the co-borrowers’ credit scores will be impacted. Moreover, getting out of a joint loan is not easy. In case of a dispute, the distribution of the property also becomes complicated.

You may like to read: Should you opt for a joint home loan?

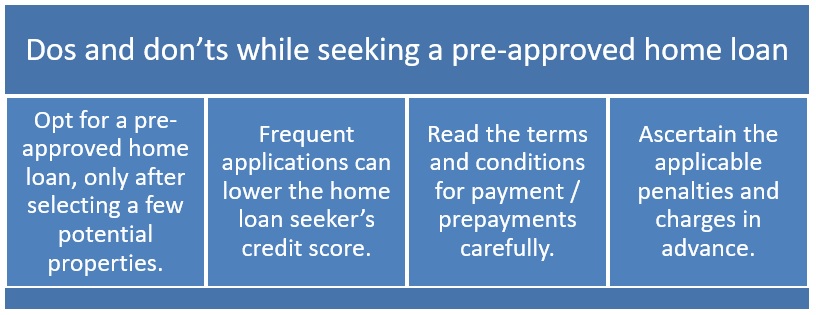

Not researching about home loans

The interest rate is the key determinant while you pick your lender. However, there are several other aspects involved in this too. Considering that you will spend a large part of your working life in paying off this debt, a home loan product must be picked after doing a thorough research and putting in due diligence. Pick a reliable lender, preferably a bank and not a housing finance company. Opt for a product that suits your needs.

- HC seeks government’s stand, on PIL for changing Muslim inheritance law

- Airoli property market: An overview

- ‘Real estate revival crucial for economic recovery post-COVID-19’

- World water day: Can India keep its taps running, amid a spike in demand?

- How to apply for new electricity connection in Tamil Nadu?

Choosing the wrong home

Thanks to housing finance, we can buy properties right at the initial stage of our working lives. Many buyers do not consider old age, disabilities and sickness, while selecting their first home. Consequently, such buyers are often forced to sell their first property towards the middle part of their lives, to buy a more appropriate home, suitable for that age. For example, the absence of an elevator in an apartment building may not bother you, as long as you are young and able to swiftly walk up and down the flight of stairs. However, the same may not be true at age 50.

[ecis2016.org] Coronavirus impact: What type of housing projects will buyers seek?

Trying to do everything on your own

Home buying is a lengthy process, involving legal and financial aspects. Hence, it may be advisable to specialists, to perform tasks where complex legal or financial knowledge is involved. Hiring a property brokerage to help you find a home within your budget, would save you time and effort. Similarly, hiring a lawyer would help take care of all the legal aspects. Recruiting a chartered accountant might be necessary afterwards, so that you are able to file your taxes and claim the rebates available to you to the fullest.

Also see: Dos and don’ts for paying token money for a property purchase

FAQs

Who is eligible to claim tax benefit under Section 80EE?

Only first-time buyers of flats and apartments, whose loan of up to Rs 35 lakhs was sanctioned by a bank or a housing finance company, between April 2016 and March 2017, for a property not worth more than Rs 50 lakhs, can claim deductions under Section 80EE.

What should be the value of the flat to avail of benefits under Section 80EEA?

The stamp duty value of the property should not exceed Rs 45 lakhs.

Can I claim deductions under Section 80EE and Section 80EEA together?

The law clearly states that those claiming benefits under Section 80EE cannot claim rebate under Section 80EEA.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle