[ecis2016.org] Here’s all you need to know about the stamp duty and registration charges on property purchases in Patna

Buyers of property in Bihar’s capital Patna have to pay stamp duty and registration charges at the time of property registration, under the provisions of several laws including the Registration Act, 1908. The stamp duty and registration charges in Patna can significantly increase the cost of buying a property in the state capital, where property rates are comparatively higher than any other city in the northern state. This is why buyers must factor in these two expenses, before purchasing land or property in Bihar’s capital.

You are reading: Stamp duty and property registration charges in Patna

Stamp duty in Patna

Unlike other states where women pay less, buyers have to pay 6% of the property value as stamp duty in Patna.

| Stamp duty as percentage of the property’s cost | Registration under |

| 6% | Male name |

| 6% | Female name |

| 6% | Joint |

Discounts are offered to women buyers, depending on who the parties involved in the transaction are. For example, if a man sells his property to a woman, the woman buyer gets a rebate of 0.40% on stamp duty. This means if, say, Lakhan sells his land to Lata, the latter will pay only 5.60% as stamp duty.

However, in the opposite scenario, the buyer will have to pay 0.40% additional stamp duty. This means if a man buys a property from a woman, the former will pay 6.40% of the property cost as stamp duty.

In case both the parties are women, the standard stamp duty charge will be levied.

Read also : Better financial profiles of infra companies hints at revival of sector: ICRA

Check out price trends in Patna

Property/land registration charge in Patna

Unlike most states where buyers pay 1% of the transaction value as the registration charge, buyers have to pay 2% duty for property and land registration in Bihar. This is applicable, irrespective of the gender of the person registering the property.

Registration charge in Patna as percentage of the deal value

| Registration under | Registration charge |

| Male name | 2% |

| Female name | 2% |

| Joint | 2% |

This means, buyers have to pay at least 8% of the property cost as stamp duty and registration charge in Patna. This calculation is done, based on the prevalent circle rates in the area. Recall here that circle rate is the government-determined value below which a property cannot be registered.

[ecis2016.org] All about Bihar bhu naksha

Can I register property online in Patna?

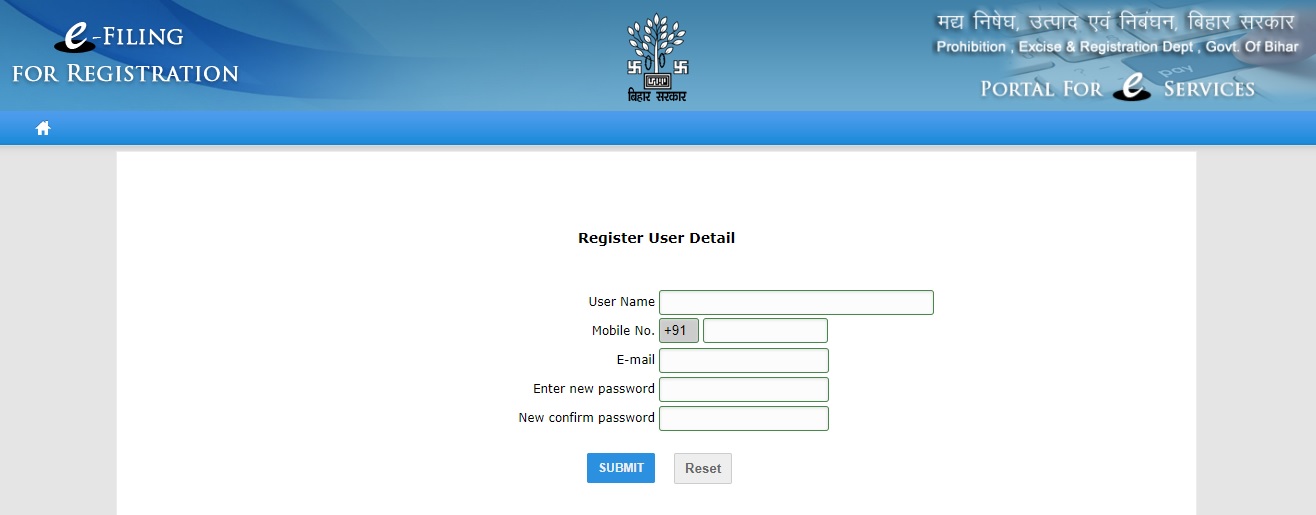

Buyers can complete a certain part of the property registration process online, by visiting the official website http://registration.bih.nic.in/.

Read also : RBI keeps lending rate unchanged at 6.25%

Buyers will have to register themselves on the portal, to complete the process.

Additionally, buyers can also go to a bank and use franking to pay stamp duty. Alternatively, they can also buy non-judicial stamp of the same worth and pay the duty.

Check out properties to buy in Patna

FAQs

What is the stamp duty rate in Patna?

Property buyers in Patna have to pay 6% of the property’s value towards stamp duty. Discounts are available, depending on the parties involved in the transaction.

Can I pay stamp duty online in Patna?

Yes, buyers can pay stamp duty online in Patna, by visiting and registering on the official website http://registration.bih.nic.in/

What is the land registration charge in Patna?

Buyers pay 2% of the plot cost as the registration charge.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle