[ecis2016.org] Here’s everything you need to know about stamp duty and registration charges on property purchases in Gurgaon

Gurgaon (now known as Gurugram) is among the most expensive property markets in India currently. In spite of some correction in the past few years, the average property rates in the Millennium City currently stand at over Rs 5,000 per sq ft. Additionally, there are various other expenses that property buyers have to bear, to legally transfer the asset in their name. The Registration Act, 1908, makes it mandatory for the buyer to register a property, for which property buyers in this region have to pay the Gurgaon stamp duty and registration charges. Since these two levies considerably increase the overall cost of purchase, buyers need to know the expenses they would have to bear for this legal formality.

You are reading: Stamp duty and registration charges in Gurgaon

[ecis2016.org] FAQs on property registration in India

Stamp duty in Gurgaon as percentage of the property cost

In Gurgaon, buyers have to pay stamp duty, depending on their gender and property location. Stamp duty charges are higher for men and higher for areas falling within the municipal limits. For properties for sale in Gurgaon in areas that fall within the municipal limits, men and women have to pay 7% and 5% stamp duty, respectively. In areas that fall outside the municipal limits, men and women have to pay 5% and 3% stamp duty, respectively.

Stamp duty in Gurgaon

| Area | Men | Women | Joint |

| Under municipal ambit | 7% | 5% | 6% |

| Outside municipal ambit | 5% | 3% | 4% |

Even though there has been intense pressure from the industry, to reduce the stamp duty and registration charges in Haryana to make property purchases more lucrative, at a time when the Coronavirus pandemic has ushered in an era of demand slowdown, the state government has decided to maintain a status quo on these levies. Much to the dismay of the industry, in fact, the state government also recently hiked circle rates in key housing markets, including Gurgaon.

Registration charges in Gurgaon

Under the provisions of the Registration Act, buyers have to get the transaction registered within four months of the purchase. Unlike most states where the buyer has to pay 1% of the property value as the registration charge, Haryana charges a flat fee, based on the property’s worth.

[ecis2016.org] All about circle rate in Gurgaon

Property registration charges in Gurgaon

| Property value | Registration charge |

| Up to Rs 50,000 | Rs 100 |

| From Rs 50,001 to Rs 5 lakhs | Rs 1,000 |

| Above Rs 5 lakhs up to Rs 10 lakhs | Rs 5,000 |

| Above Rs 10 lakhs up to Rs 20 lakhs | Rs 10,000 |

| Above Rs 20 lakhs up to Rs 25 lakhs | Rs 12,500 |

| Over Rs 25 lakhs | Rs 15,000 |

How to calculate property value in Gurgaon

Read also : Maharashtra to amend laws, to expedite sale of property in fraud cases

Stamp duty payable by a buyer can be calculated, by factoring in the unit area and the prevalent circle rate in the area. Buyers can arrive at the duty, by first calculating the property value. This can be done by following the formula mentioned below:

| Property type | Method to calculate stamp duty

|

| Plot | Plot area in sq yards x circle rate per sq yard |

| Independent homes built on plot | Plot area in sq yards x circle rate per sq yard + carpet area per sq ft x minimum construction cost per sq ft |

| Apartments, flats, units in housing societies, builder floor | Carpet area x circle rate per sq ft |

Check out price trends in Gurgaon

Stamp duty calculation example

Depending on the property value you arrive at, you have to calculate the stamp duty, by taking the percentage applicable on you.

If the property value is Rs 50 lakhs, for example and it falls within the municipal limits and is being registered in the name of a male, the applicable stamp duty would be 7% of Rs 50 lakhs. Thus, the buyer will have to pay Rs 3.50 lakhs as stamp duty. Since the transaction value is over Rs 25 lakhs, the buyer will have to pay an additional Rs 15,000 as the registration charges.

If the same property fell outside the municipal limit and was being registered in a woman’s name, the applicable stamp duty would be 3%. Then, the buyer would have to pay Rs 1.50 lakhs as stamp duty. Since the transaction value is over Rs 25 lakhs, the registration charge will be the same.

[ecis2016.org] All about Haryana’s Jamabandi website and services

Online payment of stamp duty in Gurgaon

Buyers have to first pay the stamp duty online, before they can book an online appointment for property registration at the sub-registrar’s office. You can make this payment by following the steps mentioned below.

Read also : Telangana Builders Federation wants buildings under RERA to be exempted from mortgage

- A guide to choose the best insurance policy for your commercial property

- Godrej Meridien at Sector 106, Gurugram – Project Overview

- What should buyers do when a distressed project gets a new builder?

- Committee on Land Bill gets extension, as report still not finalised

- NGT issues interim stay on Pune Metro construction

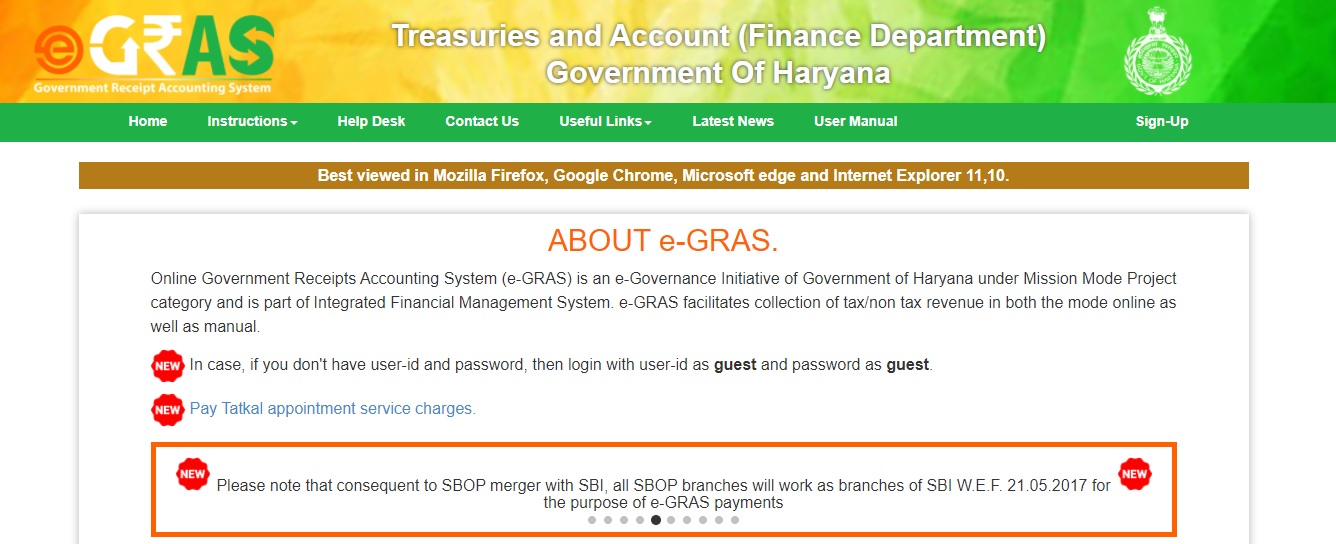

Step 1: Log on to the official portal, egrashry.nic.in.

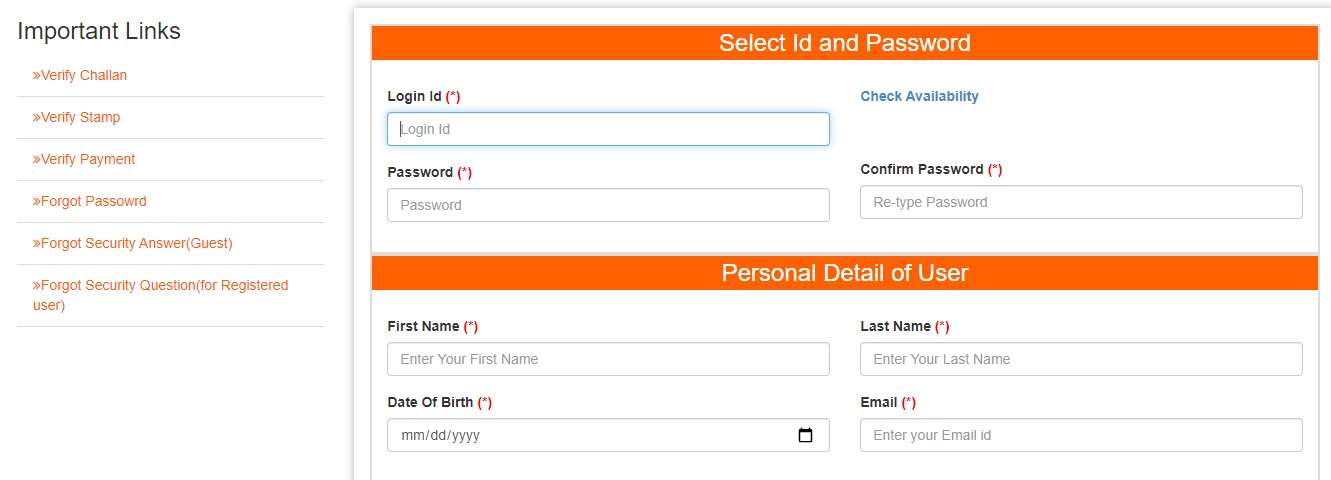

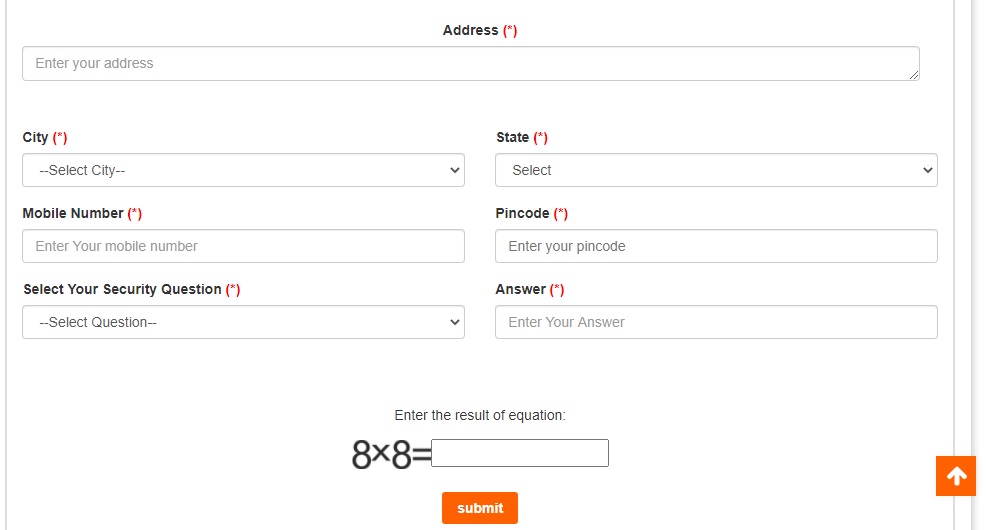

Step 2: Create an account, after which you can login, using your username and password.

Step 3: You could then start the process by keying in all the property’s details and then make the payment through internet banking.

Step 4: After the successful payment, an e-receipt would be generated. At the time of the registration, the buyer has to carry a copy of this receipt along with other documents.

FAQs

What is the circle rate in Gurugram?

Circle rates in the city vary across areas.

Can I pay stamp duty online in Gurugram?

Yes, you can pay the stamp duty through the egrashry.nic.in portal in Gurugram.

What is property registration charge in Gurugram?

Buyers have to pay registration charges depending on the transaction value. For deals of over Rs 25 lakhs for example, the buyer has to pay Rs 15,000 as the registration charge.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle