[ecis2016.org] In the capacity of the banking regulator, the RBI has the power to address the concerns of consumers against banks, HFCs and NBFCs. In this article, we look at how to go about filing a complaint with the RBI

What if you feel your concern has not been addressed properly by a bank, housing finance company or a non-banking finance company? Worse still, what if the bank has ignored your complaint? Does a banking customer have remedies other than the bank’s routine channels and internal ombudsman scheme introduced in 2018? The answer is, yes.

You are reading: RBI complaint: Process to file a complaint with RBI banking ombudsman

RBI complaint: legal framework

Since the buck stops with the Reserve Bank of India in the capacity of being the banking regulator, that is where you can proceed, to raise your grievance. The RBI banking ombudsman would resolve your complaint under the Reserve Bank – Integrated Ombudsman Scheme, 2021 , which was launched on November 12, 2021.

[ecis2016.org] All about RBI guidelines for home loan

RBI ombudsman meaning

RBI banking ombudsman refers to senior officials appointed by the banking regulator, to address RBI complaint from customers pertaining to deficiency in banking services covered under the grounds of complaints specified under Clause 8 of the Banking Ombudsman Scheme 2006.

Also read all about the Consumer Protection Act 2019

RBI complaint email IDs, phone numbers

| City | RBI complaint address | Area of operation |

| Ahmedabad | N Sara Rajendra Kumar

C/o Reserve Bank of India 5th Floor, Nr. Income Tax, Ashram Road Ahmedabad-380 009 STD Code: 079 Tel. No. 26582357 Email: cms.boahmedabad@rbi.org.in |

Gujarat, Union Territories of Dadra and Nagar Haveli, Daman and Diu |

| Bangalore | Saraswathi Shyamprasad

C/o Reserve Bank of India 10/3/8, Nrupathunga Road Bengaluru -560 001 STD Code: 080 Related read:

Tel. No. 22277660/22180221 Fax No. 22276114 Email: cms.bobengaluru@rbi.org.in |

Karnataka |

| Bhopal | Hemant Kumar Soni

C/o Reserve Bank of India Hoshangabad Road Post Box No. 32, Bhopal-462 011 STD Code: 0755 Tel. No. 2573772 2573776 2573779 Email: cms.bobhopal@rbi.org.in |

Madhya Pradesh |

| Bhubaneswar | Biswajit Sarangi

C/o Reserve Bank of India Pt. Jawaharlal Nehru Marg Bhubaneswar-751 001 STD Code: 0674 Tel. No. 2396207 Fax No. 2393906 Email: cms.bobhubaneswar@rbi.org.in |

Odisha |

| Chandigarh | MK Mall

C/o Reserve Bank of India 4th Floor, Sector 17 Chandigarh Tel. No. 0172 – 2703937 Fax No. 0172 – 2721880 Email: cms.bochandigarh@rbi.org.in |

Himachal Pradesh, Punjab, Union Territory of Chandigarh and Panchkula, Yamuna Nagar and Ambala Districts of Haryana |

| Chennai | Balu K

C/o Reserve Bank of India Fort Glacis, Chennai 600 001 STD Code: 044 Tel No. 25395964 Fax No. 25395488 Email: cms.bochennai@rbi.org.in |

Tamil Nadu, UT of Puducherry (except Mahe Region) and Andaman and Nicobar Islands |

| Dehradun | Arun Bhagoliwal

C/o Reserve Bank of India 74/1 G.M.V.N. Building, 1st floor, Rajpur Road, Dehradun – 248 001 STD Code : 0135 Telephone : 2742001 Fax : 2742001 Email: cms.bodehradun@rbi.org.in |

Uttarakhand and seven districts of Uttar Pradesh viz., Saharanpur, Shamli (Prabudh Nagar), Muzaffarnagar, Baghpat, Meerut, Bijnor and Amroha (Jyotiba Phule Nagar) |

| Guwahati | Thotngam Jamang

C/o Reserve Bank of India Station Road, Pan Bazar Guwahati-781 001 STD Code: 0361 Tel.No. 2734219/ 2512929 Email: cms.boguwahati@rbi.org.in |

Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland and Tripura |

| Hyderabad | T Srinivasa Rao

C/o Reserve Bank of India 6-1-56, Secretariat Road Read also : Stamp duty and registration charges in Bhopal Saifabad, Hyderabad-500 004 STD Code: 040 Tel. No. 23210013 Fax No. 23210014 Email: cms.bohyderabad@rbi.org.in |

Andhra Pradesh and Telangana |

| Jaipur | Rekha Chandanaveli

C/o Reserve Bank of India, 4th floor Rambagh Circle, Tonk Road, Jaipur – 302 004 STD Code: 0141 Tel. No. 2577931 Email: cms.bojaipur@rbi.org.in |

Rajasthan |

| Jammu | Ramesh Chand

C/o Reserve Bank of India, Rail Head Complex, Jammu- 180012 STD Code : 0191 Telephone: 2477905 Fax : 2477219 Email: cms.bojammu@rbi.org.in |

UTs of J&K and Ladakh |

| Kanpur | PK Nayak

C/o Reserve Bank of India M. G. Road, Post Box No. 82 Kanpur-208 001 STD Code: 0512 Tel. No. 2305174/ 2303004 Email: cms.bokanpur@rbi.org.in |

Uttar Pradesh (excluding Districts of Ghaziabad, Gautam Buddha Nagar, Saharanpur, Shamli (Prabudh Nagar), Muzaffarnagar, Baghpat, Meerut, Bijnor and Amroha (Jyotiba Phule Nagar) |

| Kolkata | Rabindra Kishore Panda

C/o Reserve Bank of India 15, Netaji Subhash Road Kolkata-700 001 STD Code: 033 Tel. No. 22310217 Fax No. 22305899 Email: cms.bokolkata@rbi.org.in |

West Bengal and Sikkim |

| Mumbai-I | Neena Rohit Jain

C/o Reserve Bank of India 4th Floor, RBI Byculla Office Building, Opp. Mumbai Central Railway Station, Byculla, Mumbai-400 008 STD Code: 022 Tel No. 23022028 Fax : 23022024 Email: cms.bomumbai1@rbi.org.in |

Districts of Mumbai, Mumbai Suburban and Thane |

| Mumbai-II | SK Kar

C/o Reserve Bank of India, 4th Floor, RBI Byculla Office Building, Opp. Mumbai Central Railway Station, Byculla, Mumbai-400 008 STD Code: 022 Telephone: 23001280/23001483 Fax : 23022024 Email: cms.bomumbai2@rbi.org.in |

Goa and Maharashtra, (except the districts of Mumbai, Mumbai Suburban and Thane) |

| Patna | Rajesh Jai Kanth

C/o Reserve Bank of India Patna-800 001 STD Code: 0612 Tel. No. 2322569/2323734 Fax No. 2320407 Email: cms.bopatna@rbi.org.in |

Bihar |

| New Delhi-I | RK Moolchandani

C/o Reserve Bank of India, Sansad Marg, New Delhi STD Code: 011 Tel. No. 23725445 Fax No. 23725218 Email: cms.bonewdelhi1@rbi.org.in |

North, North-West, West, South-West, New Delhi and South districts of Delhi |

| New Delhi-II | Ruchi ASH

C/o Reserve Bank of India Sansad Marg, New Delhi STD Code: 011 Read also : Green cover in the NCR drops by 1% between 1999 and 2012 Tel. No. 23724856 Email: cms.bonewdelhi2@rbi.org.in |

Haryana (except Panchkula, Yamuna Nagar and Ambala Districts) and Ghaziabad and Gautam Budh Nagar districts of Uttar Pradesh |

| Raipur | JP Tirkey

C/o Reserve Bank of India 54/949, Shubhashish Parisar, Satya Prem Vihar Mahadev Ghat Road, Sundar Nagar, Raipur- 492013 STD Code : 0771 Telephone: 2244246 Email: cms.boraipur@rbi.org.in |

Chhattisgarh |

| Ranchi | Chandana Dasgupta

C/o Reserve Bank of India 4th Floor, Pragati Sadan, RRDA Building, Kutchery Road, Ranchi Jharkhand 834001 STD Code : 0651 Telephone : 8521346222/9771863111/ 7542975444 Fax : 2210511 Email: cms.boranchi@rbi.org.in |

Jharkhand |

| Thiruvananthapuram | G Ramesh

C/o Reserve Bank of India Bakery Junction Thiruvananthapuram-695 033 STD Code: 0471 Tel. No. 2332723/2323959 Fax No. 2321625 Email: cms.botrivandrum@rbi.org.in |

Kerala, UT of Lakshadweep and UT of Puducherry (only Mahe Region). |

Source: RBI

[ecis2016.org] Best bank for home loan

What kind of RBI complaints can you file with the banking ombudsman?

You can approach the RBI ombudsman, the authority that will address your concerns on behalf of the RBI, for all sorts of bank-related grievances, as mentioned in the list below.

If you think, for example, that a bank has rejected your home loan request, because of some bias or is avoiding to pass on the benefits of a low interest rate regime, you can approach the banking ombudsman. If there are any monetary wrongdoings on part of the bank with respect to your account, you can also approach the RBI.

Type of RBI complaints you can lodge with the banking ombudsman

For issuing unsolicited credit cards

The RBI has asked credit card companies neither to issue nor upgrade credit cards without the explicit consent of the customer. Without obtaining prior approval from the Reserve Bank, NBFCs should not issue debit cards, credit cards, charge cards, or similar product,s virtually or physically, it said

If they fail to do so, they will have to pay double the billed amount as penalty, the RBI said, in April 2022. “The person in whose name the card is issued can approach the RBI ombudsman who would determine the amount of compensation payable to the card issuer for loss of the complainant’s time, expenses incurred, harassment and mental anguish suffered by him,” it said.

The banking ombudsman can receive and consider any complaint relating to the following deficiency in banking services:

- Non-payment or inordinate delay in the payment or collection of cheques, drafts, or bills.

- Non-acceptance, without sufficient cause, of small denomination notes tendered for any purpose and for charging of commission.

- Non-acceptance, without sufficient cause, of coins tendered and for charging of commission in respect thereof.

- Non-payment or delay in payment of inward remittances.

- Failure to issue or delay in issue of drafts, pay orders or bankers’ cheques.

- Non-adherence to prescribed working hours.

- Failure to provide or delay in providing a banking facility (other than loans and advances) promised in writing by a bank or its direct selling agents.

- Delays, non-credit of proceeds to parties’ accounts, non-payment of deposit or non-observance of the Reserve Bank of India directives, if any, applicable to rate of interest on deposits in any savings, current or other account maintained with a bank.

- Complaints from non-resident Indians (NRIs) having accounts in India in relation to their remittances from abroad, deposits and other bank-related matters.

- Refusal to open deposit accounts without any valid reason for refusal.

- Levying of charges without adequate prior notice to the customer.

- Non-adherence to the instructions of the Reserve Bank of India on ATM / debit card and prepaid card operations in India, by the bank or its subsidiaries.

- Non-adherence by the bank or its subsidiaries to the instructions of the Reserve Bank of India on credit card operations.

- Non-adherence to the instructions of the Reserve Bank of India, with respect to mobile banking / electronic banking services in India by the bank.

- Non-disbursement or delay in disbursement of pension (to the extent the grievance can be attributed to the action on the part of the bank concerned but not with regard to its employees).

- Refusal to accept or delay in accepting payment towards taxes.

- Refusal to issue or delay in issuing, or failure to service or delay in servicing or redemption of government securities.

- Forced closure of deposit accounts without due notice or without sufficient reason.

- Refusal to close or delay in closing the accounts.

- Non-adherence to the fair practices code as adopted by the bank.

- Non-adherence to the provisions of the Code of Bank’s Commitments to Customers issued by Banking Codes and Standards Board of India and as adopted by the bank.

- Non-observance of Reserve Bank of India guidelines on engagement of recovery agents by banks.

- Non-adherence to RBI guidelines on para-banking activities like sale of insurance / mutual fund / other third-party investment products by banks.

- Any other matter relating to the violation of the directives issued by the RBI in relation to banking or other services.

[ecis2016.org] All about CERSAI

Can a home buyer lodge an RBI complaint against a bank?

A home buyer can lodge an RBI complaint against a bank with the RBI ombudsman in the following cases:

- Non-observance of RBI directives on interest rates.

- Delays in sanction, disbursement or non-observance of prescribed time schedule for disposal of loan applications.

- Non-acceptance of application for loans without furnishing valid reasons to the applicant.

- Non-adherence to the provisions of the fair practices code for lenders as adopted by the bank or Code of Bank’s Commitment to Customers.

- Non-observance of any other direction or instruction of the Reserve Bank of India, as may be specified by the Reserve Bank of India for this purpose, from time to time.

[ecis2016.org] Home loan interest rates and EMI in top 15 banks

Can you file RBI complaint directly with the RBI banking ombudsman?

There are certain procedures that you have to follow, before you approach the ombudsman to lodge your RBI complaint. You have to first raise the issue with your bank, which is obligated to close your complaint within 30 days. If the bank fails to address your concerns or if you are not satisfied with the outcome of the proceeding, then, you can approach the RBI ombudsman.

Before you approach the RBI banking ombudsman, also note that ‘complaints pending in any other judicial forum will not be entertained by the banking ombudsman’.

[ecis2016.org] All about Section 80EEA

Where to file RBI complaint?

You may lodge your RBI complaint at the office of the Banking Ombudsman under whose jurisdiction the bank branch is situated (the information about the office has already been mentioned earlier in this article). For RBI complaints relating to credit cards and other types of services with centralised operations, the same may be filed before the banking ombudsman within whose territorial jurisdiction the billing address of the customer is located.

How can I file RBI complaint offline?

You can file RBI complaint in the physical mode at the centralised receipt and processing centre (CRPC) set up at RBI, 4th floor, Sector 17, Chandigarh, 160017.

How to file your RBI complaint?

There are three different ways in which you can lodge your complaint with the RBI:

- You can write to the RBI.

- You can file your complaint on the RBI complaint management system (CMS)

- You can call the office concerned.

1. How to file a complaint by writing to the RBI

Those who are more comfortable in dealing with postal methods, can file a complaint with the RBI ombudsman by writing a letter and sending it to the office of the ombudsman by post or fax or hand delivery. Note here that you have to file this written complaint with the banking ombudsman with supporting documents within a year of the bank having failed to resolve your grievance. Alternatively, you can also file your complaint with the ombudsman by writing an email to—–

How to draft your RBI complaint?

Even though it is not mandatory, it would be ideal to follow the format available on the RBI website while drafting the material for your complaint. The forms for this purpose are also available in all bank branches.

While submitting the complaint you have to mention details, such as your name, address, mobile number and bank account number.

[ecis2016.org] Best banks to get your home loan in 2021

2. How to file a complaint on the RBI complaint management system portal (CMS)?

You can file an RBI complaint online through https://cms.rbi.org.in. RBI’s Complaint Management System is accessible on desktop, as well as on mobile devices. Complaints would be directed to the ombudsman/regional office concerned.

Procedure to file an RBI complaint online

Go to the CMS RBI (cms.rbi.org.in) and click on ‘File a Complaint’.

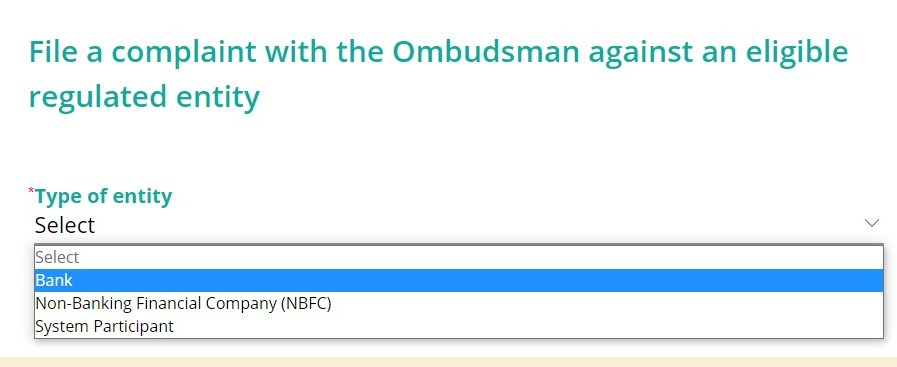

On the top right side of the page, select your preferred language to file the complaint. Also, select the ‘Type of Entity’ form among bank, NBFC or other.

One you select the entity, the page will ask you to provide more information, including your mobile number, area of operation of the bank, state, district, bank name, etc. You will also be asked if your complaint is related to a credit card and you will have to provide your bank name, branch name, your name and your email ID if your answer is ‘yes’.

On the next page, select if the complaint is sub-judice/under arbitration and proceed with filling the details about the complaint. After this, check the declaration and select nomination on whom the complaint is being raised. Also provide attachments, if any. Now, click on ‘submit’ to lodge your complaint.

RBI complaint in case of digital transactions

In case your digital transactions fail and the service provider is not able to address your concern, you can lodge a complaint with the RBI. This complaint could be filed over payment failures related to mobile, electronic fund transfers or prepaid payment instruments. For digital transactions, approach the Ombudsman for Digital Transactions within whose jurisdiction the branch or office of the bank is located.

3. Make a call

As mentioned in the table above, you can also call the office concerned, to raise your complaint. However, you would eventually have to lodge this complaint through a written medium, so that it can be addressed formally.

How to track your RBI complaint status?

For RBI complaint tracking, on the RBI CMS (https://cms.rbi.org.in/), select your language, provide your complaint number and key in the captcha and click on ‘submit’ to get the status.

RBI complaint: What is the fee to file a complaint?

There is no fee to file a complaint with the banking ombudsman. In a circular issued in January 2021, the RBI reiterated that it does not charge any fee to address consumer complaints.

No fee for filing RBI complaint, clarifies banking regulator

The RBI, in March 2022, said it had noticed instances of misinformation being spread through certain sections of the social media about the Reserve Bank – Integrated Ombudsman Scheme 2021.

“These messages (on social media) are conveying to public at large to lodge their complaints against entities regulated by the RBI through third parties for a charge/fee or otherwise, for early redress of grievances,” the RBI said, clarifying that it does not have arrangements with any entity for redress of grievances against the regulated entities nor does it charge any fee for this. “The RBI has laid down a cost-free grievance redress mechanism under the RB-IOS, which does not involve payment of fees or charges in any form or manner,” the RBI said.

What happens after you file a complaint with the RBI?

After filing your complaint, you will be provided with a unique identification number (UID) for tracking the progress of your case. There are two things that will happen as the ombudsman pursues this case – it will either help you and your bank reach an amicable solution or an order will be passed.

How much time will the RBI take to resolve the complaint?

The banking ombudsman will take between six to eight weeks to resolve the issue. In this period, representatives from the RBI office might also contact you, to confirm the details of your complaint.

How much compensation can I get from the RBI?

In case the bank is ordered to make monetary compensation, because of a dispute over money, the refund will be Rs 20 lakhs or the amount arising directly out of the act or omission or commission of the service provider, whichever is lower. This compensation will be over and above the disputed amount. In addition to this, you may also be awarded a compensation not exceeding Rs 1 lakh for the mental agony and harassment, factoring in the loss of time and money.

What if you are not happy with the banking ombudsman’s decision?

There is a provision for you to go further in case you are not happy with the banking ombudsman’s decision. You can now approach the Appellate Authority in the RBI, to get your grievance addressed. In case you are not satisfied with the decision of the Appellate Authority also, you can write to the RBI deputy governor. Ultimately, you may have to approach the consumer courts if all else fails.

FAQs

How to track RBI ombudsman complaint?

To track RBI ombudsman complaints, enter your complaint number on the RBI complaint portal (https://cms.rbi.org.in/), to get the status.

Banking ombudsman scheme was introduced by RBI in which year?

The banking ombudsman scheme was first introduced by the RBI in 1995.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle