[ecis2016.org] Here we will discuss the procedure for paying property tax in Warangal via the official website of Greater Warangal Municipal Corporation (GWMC)

Citizens of Warangal in Telangana are required to pay GWMC house tax every year to the Greater Warangal Municipal Corporation if they own a property in the city. The GWMC is the civic body responsible for the administration of the city. Property owners in Warangal can pay their GWMC house tax online as the civic body has made the process completely hassle-free through its website. Here is how you can pay the property tax Warangal.

You are reading: GWMC House Tax: Know all about paying property tax in Warangal

How to pay GWMC house tax online in Warangal?

Home owners can choose the online mode for GWMC house tax payment in Warangal, by following the steps mentioned below:

Step 1: Visit the GWMC website. Click on the tab ‘Pay Property Tax’ under EDOB services.

Step 2: On the next page, enter details such as house number or the assessment number to know the property tax-related details.

Read also : Dharani portal: All about Telangana’s integrated land records management system

Step 3: The next page will display the payment status. Click on the appropriate link to make an online payment.

Step 4: It will then direct you to a page that displays property tax details. Verify the details and proceed.

Step 5: Select your preferred payment mode such as credit or debit card, net banking, NEFT/RTGS, etc. and click on the tab ‘make payment’.

How to calculate property tax Warangal?

The GWMC website also provides its citizens the facility to calculate the GWMC property tax online.

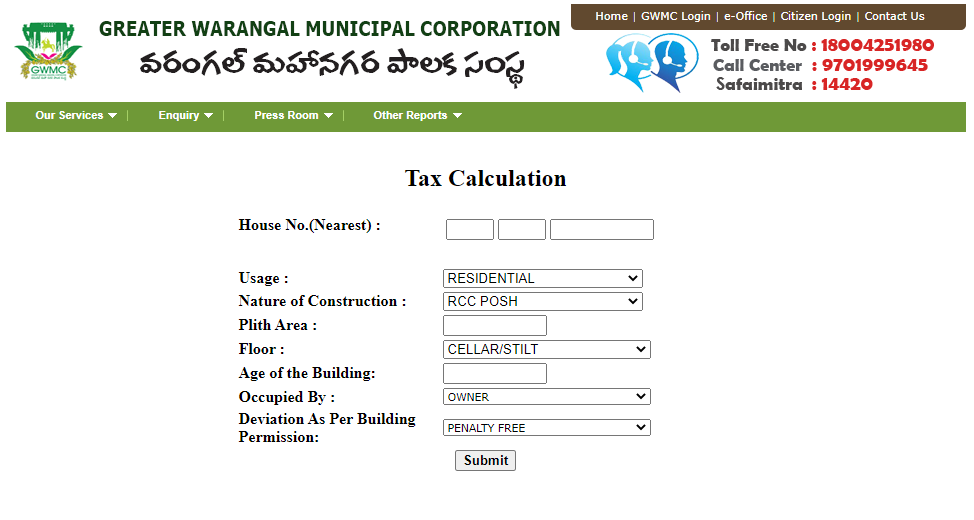

Step 1: Visit the GWMC website home page and go to Our Services > Property Tax > Calculate Your Property Tax.

Read also : AAI to transfer 40-acre land to MMRDA for metro car shed

Step 2: On the next page, enter details such as house number, usage (e.g., residential), nature of construction, plinth area, floor, age of the building, occupied by (owner/tenant/government), deviation as per building permission. Click on ‘Submit’.

- CREDAI launches first all-women masons’ batch in Chhattisgarh

- Low-cost, pure drinking water project launched around West Bengal’s Shantiniketan

- GIC to pick up minority stake in Prestige’s Exora Business Park

- Budget 2021: Six benefits for the real estate sector and buyers

- Small is big, as micro homes gain traction in metro cities

Self-assessment of house tax Warangal

Citizens in Warangal can also apply for self-assessment of GWMC house tax online by clicking on ‘Online Self-Assessment Application’ tab on the home page of the GWMC website.

They should provide their mobile number, on which they will receive a One Time Password (OTP), and proceed to apply for self-assessment of their GWMC house tax.

[ecis2016.org] Telangana CDMA launches dedicated WhatsApp channel for property tax

FAQs

How can I check my GWMC house tax in Warangal?

If you own a house in Warangal, you can check the status of your GWMC house tax on the GWMC website by clicking on ‘Pay Property Tax’ tab and provide the necessary details.

How do I get house tax Warangal payment receipt?

You can download the property tax Warangal payment receipt from the GWMC website after paying the property tax dues.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle