[ecis2016.org] While the concept of senior living communities is slowly catching up, we look at what potential residents should consider, to get the best pick for themselves

For 76-year-old SC Krishnan, who retired as the MD of Bharat Aluminium Company, senior living homes are truly a blessing. A resident of Serene Urbana by Columbia Pacific Communities in Bengaluru, Krishnan is happy that he invested in a senior living home. “The stigma that people used to have regarding retirement homes, is now fading away slowly. Others see us enjoying our retirement, leading healthy lives and being involved in many activities and understand that this is a much better place to be in. Some of my family members too, have now started investing in senior homes,” Krishnan says. Mohit Nirula, CEO of Columbia Pacific Communities, points out that seniors of a particular demographic – those who have fulfilled their responsibilities to their parents, their children, their organisations, to society and to the nation – are truly independent and can focus on themselves. For them, senior living communities is a solution for their physical, mental, intellectual and social engagement needs and one that allows them to live life to the fullest. “It is a concept, whose time has come,” Nirula emphasises.

You are reading: Senior housing: What should one look for, before investing in a project?

The market for senior homes in India

Nirula blames the negative perception associated with senior living communities for the lack of growth in the segment. In the past, most residents of old age homes were deemed to have been forsaken by their children. With an increasing number of nuclear families, children moving away from their home city/country in pursuit of their careers and the increasing life span of people, the number of seniors staying alone is only increasing. As seniors become more aware of senior living communities where the product, facilities, services and care are designed to meet their needs, we could see more takers for such communities. After his retirement, Krishnan, who has been living in a senior community for over five years, still practices as a consultant. Previously, he and his wife were in Serene Senior Living in Coimbatore but moved to Bengaluru, when their son insisted. “The joint family system is dissolving now, because of professional commitments and we chose senior living, because it rids us of day-to-day cares of what to cook or having to do things by ourselves when the domestic help is on leave. Our son is happy too, to see us happy and taken care of,” Krishnan elaborates. While senior homes have entered the southern market with Coimbatore being the cradle for retirees, in the Delhi NCR market, Ashiana’s Bhiwadi-based project has received considerable attention. Atul Kumar Singh who manages sales for the developer firm, says that the firm looks after all the requirements of the residents but unlike the practice prevalent in south India, Ashiana manages the services itself.

Prices of senior citizen homes

Senior living homes have units on rent, as well as for sale. Prices vary across units, cities and the quality of the developer and the service provider. In the two-and-a-half years that Krishnan has spent at Serene Urbana, he says that he has not felt the pinch of inflation. Krishnan owns a 3BHK unit spread over 1,500 sq ft and pays a maintenance fee of Rs 7 per sq ft. Singh says that going by prevalent rates, a senior-living is approximately 10% costlier than a regular project, owing to the services provided. Therefore, one should plan early and invest before retirement. “Most senior home buyers who come to us, come late. An ideal senior home purchase, should happen early in your life. Use it as a second home or an investment till you are 55 and then, you can move into the senior home,” Singh advises.

[ecis2016.org] Will the government’s model guidelines for retirement homes help senior citizens?

Factors to consider, before investing in a senior citizen home

Read also : West Bengal metro rail projects to be completed by 2022

People investing in senior living projects, should primarily look at it from the perspective of ‘service and care’ offered by the project and not as a regular property investment. The project should be designed to adapt to and meet the needs and expectations of the residents, as these change over time, explains Nirula. Krishnan concurs that when planning to invest in a senior home, one must think of how good the facilities are. Factors such as flexibility of food arrangement, a helpdesk to assist with concierge services, provision for indoor games, cultural programmes, security, availability of assistance and medical attention, are all important. “One should ascertain the professionalism of the company managing the senior living project. Some private companies may just wind up the business overnight and go away. These cannot be reliable,” cautions Krishnan. As units are available on rent, as well, one can opt for such a unit and analyse the experience, before purchasing such a property, he advises. “If it is good, you can invest but if it is not you could always go back,” adds Krishnan. Nirula maintains that a senior living home buyer is not actually buying a home. They are buying into the service, care and promise of well-being. Hence, their decision should be based less on the quality of the physical product and more on the facilities, services, passion and wellness-providing capabilities of the service provider, he says.

Inheritance of senior living properties

Senior living communities are exclusively for the retirement community, although you can buy it at a young age, if you have planned early. After the death of a resident, the property is bequeathed to the rightful heir and he/she can generally start living in this property, only upon attaining the age of 55. However, the rules may vary from project to project. Children who come visiting their parents can also live with them but the time period is usually restricted for example, 30-90 days in a year if their stay includes nights. However, if they visit in the morning and leave by night, there may not be any restriction.

How much should you save for your retirement?

Finance and wealth managers say that it is wise to account for an inflation of 6% per annum. One should also know how much a senior living property may cost you. Cost of living will also vary, depending upon the lifestyle that you have. The price range of senior living projects as per market rates is given below.

| Cost of senior living projects | Rental value | Other charges | Costs that come up | Costs that you do not have to worry about |

| Rs 30-70 lakhs (approximate value of 1-3BHK units) | Rs 7,000 per month and onwards | Maintenance, GST | Hike in charges due to inflation, spending on clothes, medicines, food, travel, spending on dependent children | Children’s education if they are independent, fuel cost owing to job-related commute, formal clothing for office |

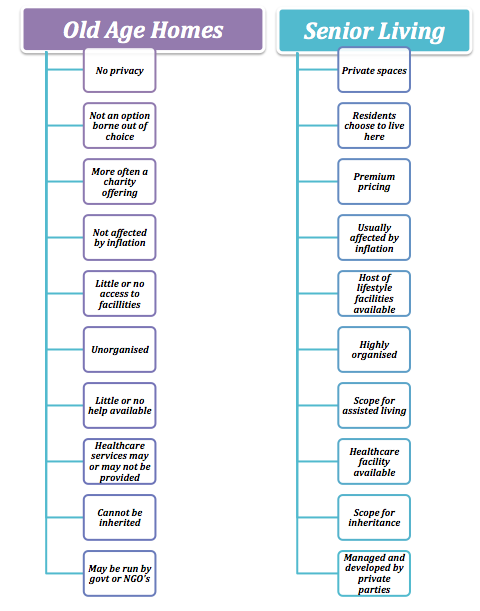

Difference between a senior home and old age home

Senior living or retirement living is often confused with old age homes and hence, for many, this remains a taboo. MK Sachdev, who recently moved from his Chandigarh home to a senior living in Bengaluru says, “Even though such properties are coming up, the awareness is little and the older generation thinks that society frown upon their choice. Initially, my extended family shared the same thought. We are looking at comfort, customisation and are paying for the services we need. How is it similar to being pushed into an old age home with no power to command?” Sachdev asks.

Read also : Impact of artificial intelligence on home automation

Other amenities, like assisted living, counselling, anger management, and care for depression, could be some focus areas for those building for and servicing seniors. A potential resident should consider all these and more. The requirements of seniors may not be the same and not all projects provide the same facilities, concludes Krishnan.

Old Age Home vs Senior Living

FAQ

Why are senior citizen homes so expensive?

Senior citizen-friendly projects are slightly more expensive than regular projects because a lot of care is put into such properties so that they are just right for the lifestyle of the elderly. Anti-skif tiles, dedicated staff, medical facility, concierge services etc make such properties expensive.

Can my son inherit my property that is in a senior-citizen project?

Yes, legal heirs can inherit such a property.

What is the difference between old age homes and senior citizen projects?

Old age homes are mostly provided aid by authorities or run by charity and trusts. Senior citizen projects are well-maintained and cater to the educated class of people who can spend enough to buy such a property.

Is there a defined age when a person can live in a senior citizen project?

Yes, depending upon developer to developer, such projects for sale are usually inhabited by the retired community, that is age 58 and above.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle