[ecis2016.org] We discuss various factors that make the present scenario an ideal time for property investments in India

After India started a phased reopening of businesses, in the aftermath of the Coronavirus pandemic, activity in the housing market is seen resuming with support of online channels. This is reflected in a surge in property searches on real estate portals like ecis2016.org. Several real estate players have also claimed doing good business during their marketing webinars. While we may still be far from normal, India’s realty sector is inching towards normalcy.

You are reading: Why is this the perfect opportunity for property investment in India?

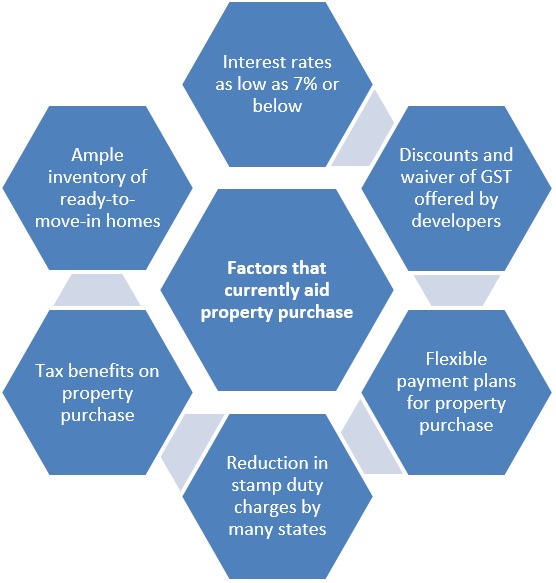

Home purchase activity is likely to see a spurt, during the upcoming festive season – a time considered auspicious for making investments in India, big or small. The pandemic has also led to the creation of never-seen-before opportunity for buyers who have the initial capital to make an investment.

Discounts on property purchase

Much before the Coronavirus crisis emerged, developers were struggling with a prolonged demand slowdown, following large-scale project delays, muted buyer sentiments and prohibitively expensive prices in most markets. Since the opportunities for securing funding from financial institutions are far and few amid an economic crisis, builders have been forced to rationalise prices, to weather the storm brought forth by the biggest health emergency in modern times.

Developers have devised numerous innovative ways to bring down the purchase cost for end-users. While some are waiving the Goods and Services Tax (GST), others are attracting buyers by offering to pay the stamp duty and registration charges.

While buyers have to pay 8% of the property cost as GST for under-construction properties, another 6%-8% of the value has to be spent in paying stamp duty and registration charges. Stamp duty charges vary across states while GST is uniform across the country.

Some developers are allowing buyers to book homes, with negligible investment. Typically, buyers have to pay at least 20% of the house cost as the upfront amount at the time of the signing of the builder-buyer agreement. Now, developers are allowing buyers to book homes by paying 1% or less. The remaining amount could be paid at later stages, when it is more convenient for the buyer to pay. Builders are going the extra mile and offering bespoke payment plans, to make the purchase more convenient for the buyer.

[ecis2016.org] All you need to know about possession-linked payment plans

Read also : L&T, RInfra, Tatas, 15 others, bid for Nagpur-Mumbai Expressway project

“Developers are increasingly offering schemes such as flexible payment plans, selective discounts and price protection plans to attract buyers,” says, Mani Rangarajan, group COO, ecis2016.org, Makaan.com and PropTiger.com.

Home loan interest rates at a 15-year low

For a majority of buyers, home purchases are made at the start of their working lives, because of the availability of housing finance. With interest rates coming down to a 15- year low right now, there is greater incentive to avail of housing loans.

All leading banks in the country, including SBI, PNB, ICICI Bank, etc., are currently offering housing loans at below 7% annual interest, after the RBI reduced the repo rate to 4% through consecutive cuts. If a borrower were to choose a fixed rate option while borrowing right now, they will eventually save on the overall purchase price.

Availability of ready homes

If home buyers in India were wary of purchases despite the fact that real estate remains the most favoured asset class in the country, much of it had to do with project delays. Consequently, buyers are more likely to invest in ready-to-move-in homes now, although the initial capital needed for this purchase will be higher. What often deters buyers from the secondary market, is that they are not eager to purchase an old property at higher rates.

Today, they have the option to book a brand new, ready-to-move-in property from developers. ecis2016.org data show there are over 7.38 lakh unsold housing units in India. A majority of these are ready homes.

Stamp duty reduction by states

While some developers are offering zero stamp duty packages, some states have also announced reductions in this tax, to lower the cost for the buyer. From September 1, 2020, buyers in Mumbai have to pay only 2% of the stated property value as stamp duty. From January 1, 2021 till March 31, 2021, the charges would increase to 3%. From then on, buyers will be paying the charges prevalent before the waiver was announced – i.e., 5% stamp duty. Karnataka, too, has lowered the stamp duty charge to 3% on property transactions valued between Rs 21 lakhs and Rs 35 lakhs.

As a complete lull in the property markets have left the coffers of the state revenue departments extremely depleted, more states are expected to follow Maharashtra and Karnataka’s moves, to woo buyers.

Property price correction after COVID-19

Even though the scope for price reduction has remained limited for builders, offering a haircut on prices, has not actually been a choice, in the aftermath of the COVID-19 pandemic. Consequently, property values across prime residential markets have undergone some correction.

Average property prices in top cities

- Home Utsav 2018: An opportunity to make the most of the real estate revival

- Objection from religious institution not grounds for registration refusal: Madras HC

- Piramal Housing Finance enters Pune, to add 4-5 cities in six months

- SC dismisses RLDA plea against arbitral award of Rs 1,034 crores to Parsvnath Ltd

- Lotus Arena at Noida – Project Overview

| City | Weighted average price per sq ft |

| Ahmedabad | Rs 3,104 |

| Bengaluru | Rs 5,299 |

| Chennai | Rs 5,138 |

| Hyderabad | Rs 5,505 |

| Kolkata | Rs 4,178 |

| MMR | Rs 9,490 |

| NCR | Rs 4,293 |

| Pune | Rs 4,951 |

Data as on June 30, 2020

Read also : Noida’s Sector 121 emerges as home buyers’ preferred destination

Source: Real Insight: Q2, 2020

In the quarters to come, prices will continue to show deceleration, because of the overall economic stress.

Tax savings and subsidy under the PMAY

Salaried individuals can claim various deductions under various sections of the income tax law, when applying for a home loan. Aside from the benefits they enjoy under Section 80C and Section 24(b), first-time home buyers can also increase the deduction limit on the interest component to Rs 3.50 lakhs per year, under Section 80EEA of the Income Tax Act. “Interest paid on housing loan is allowed as a deduction to the extent of Rs 2 lakhs in respect of self-occupied property. In order to provide further benefit, I propose to allow an additional deduction of Rs 1.5 lakhs, for interest paid on loans taken up to March 31, 2020, for a purchasing an affordable house of up to Rs 45 lakhs in value. Therefore, a person purchasing an affordable house now will get an enhanced interest deduction of up to Rs 3.5 lakhs,” finance minister Nirmala Sitharaman said, in her 2019 budget speech. In the budget presented in February 2020, the government has increased the time limit to avail of the benefits under this section for another year.

Cost benefits could be much higher for buyers who could apply for the credit-linked interest subsidy under the centre’s flagship Pradhan Mantri Awas Yojana (PMAY). Under the scheme, an interest subsidy up to Rs 2.67 lakhs is available to the buyer. Those who can apply for the interest subsidy must fall within the below mentioned salary brackets, to be eligible for the programme:

EWS household annual income: Up to Rs 3 lakhs

LIG household annual income: Between Rs 3 lakhs and Rs 6 lakhs.

MIG-I household annual income: Between Rs 6 lakhs and Rs 12 lakhs.

MIG-II household annual income: Between Rs 12 lakhs and Rs 18 lakhs.

Scope for negotiation

All sector stakeholders are currently busy announcing measures that would prompt the end-user to make investments. This provides buyers with a great opportunity to negotiate a favourable deal, making it a buyer’s market. This remains true for loans, as well, as financial institutions are also open to discussions to offer buyers bespoke deals.

FAQs

What is the interest deduction on home loans?

Home loan borrowers can avail deductions of up to Rs 3.5 lakhs, subject to certain conditions.

What are the offers being given by builders post-COVID-19?

Besides offering discounts and freebies, several developers are also offering to bear the cost of Goods and Services Tax (GST), or pay the stamp duty and registration charges.

How much money buyers have to pay to book a property?

Buyers have to typically pay 1% booking amount. However, they have to pay 20% of the cost by time a builder-buyer agreement is signed.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle