[ecis2016.org] The drastic increase in the number of new Coronavirus cases in India in 2021, could adversely affect the demand for residential real estate in India, which was just beginning to show signs of recovery

With the adverse impact of the Coronavirus pandemic gradually easing, things are once again looking up for India’s real estate sector in 2022. This is reflected in growth numbers for the January-March period.

You are reading: Impact of Coronavirus on Indian real estate

According to Real Insight Residential – January-March 2022, 70,623 units were sold in Q1 2022 as compared to 66,176 units sold in Q1 2021, showing 7% annual growth. On the supply side, a total of 79,532 units were launched in Q1 2022 as compared to 53,037 units in 2021, showcasing YoY growth of 50%.

House prices get a boot, too

After a long period of muted growth, rates of apartments in India’s mega cities have also started to show more intense growth. The report shows that all the eight markets covered in the analysis underwent an upwards movement in average rates of new properties.

| City-wise price card | ||

| City | Price range in Rs per sq ft as on March 2022* | YoY % growth |

| Ahmedabad | 3,500-3,700 | 8% |

| Bangalore | 5,600-5,800 | 6% |

| Chennai | 5,700-5,900 | 9% |

| Delhi NCR | 4,500-4,700 | 4% |

| Hyderabad | 6,000-6,200 | 7% |

| Kolkata | 4,300-4,500 | 5% |

| Mumbai | 9,800-10,000 | 4% |

| Pune | 5,400-5,600 | 8% |

| India | 6,600 – 6,700 | 7% |

Source: Real Insight Residential – January-March 2022, PropTiger Research

*Weighted average prices as per new supply and inventory

***

Even though India’s real estate sector was emerging out of a highly dull phase after two waves of the Coronavirus pandemic, the new variant of the virus, Omicron, is fast becoming a cause of concern for the government in general and the real estate sector in particular.

If the situation were to get as adverse as it did during the first or the second outbreak, it would negatively impact the real estate sector, which has been able to make progress after undergoing dramatic changes during the two outbreaks. According to Real Insight: Q3 2021, a quarterly report by REA India-owned real estate company PropTiger.com, home sales and new launches have, both, shown significant improvement in the period between July and September 2021, indicating that a turnaround for the real estate sector might be around the corner.

The rising cases of the new variant, however, do not bode well for the sector.

As on December 5, 2021, India reported 21 cases of the Omicron variant of the Coronavirus, which has been labelled a ‘variant of concern’ by the World Health Organization. Most of these cases were reported in states like Maharashtra, Delhi, Rajasthan and Karnataka. Even though states in India have stepped up their inoculation programme and put safety measures in place to curb the spread of the Omicron variant, the fact that the government has yet to restrict international travel movement remains a cause of concern – dozens of countries have put travel restrictions in place on the southern African nations, since the mutation was first reported in South Africa.

According to Tedros Adhanom Ghebreyesus, director-general of the WHO, the new Omicron Coronavirus variant has been confirmed in more than 25 countries and this number is expected to rise.

***

Rates of property firming up in eight residential markets

The average values of properties in India’s eight prime residential markets have shown a marginal increase during the April-June period of 2021, show data available with PropTiger.com. While cities like Hyderabad and Ahmedabad have recorded an increase in rates of new apartments by 5% when compared to the prices in the same period in 2020, other cities have seen much lower growth. Barring the Mumbai Metropolitan Region, prices have moved upwards, albeit marginally, during a time when the second wave of the Coronavirus pandemic affected the economy badly.

Price growth: City-wise break-up

| City | Average price as on June 30, 2021 (in Rs per sq ft) | Annual growth in % |

| Ahmedabad | 3,251 | 5 |

| Bangalore | 5,495 | 4 |

| Chennai | 5,308 | 3 |

| Hyderabad | 5,790 | 5 |

| Kolkata | 4,251 | 2 |

| MMR | 9,475 | No change |

| NCR | 4,337 | 2 |

| Pune | 5,083 | 3 |

| National average | 6,234 | 3 |

Source: Real Insight: Q2-2021

“Demand and supply, both remained largely hit during the first two months of Q2 CY 2021 when most states put in place fragmented lockdowns to the curb the spread of the virus. However, some ground on both the indicators were covered during the June month, when states started to open up. The same is reflected in Q2 demand and supply numbers. We expect some improvement on both these indicators of real estate heath in the upcoming quarters, since India’s inoculation programme is likely to cover a large part of its population,” said Dhruv Agarwala, group CEO, Elara Technologies.

***

Surge in Covid-19 cases may derail real estate from recovery path

Amid a dramatic spike in the number of new Coronavirus cases in India, the demand for residential real estate in India might be thrown off track, says head of industry body CREDAI.

- Affordable housing: The pros and cons

- Haryana extends last date for payment of property tax, to March 31, 2017

- SC asks Unitech to give list of assets, says would auction them to pay home buyers

- 3 top measures that can boost transparency and confidence in the property market

- 6 emerging trends in residential real estate, in the post-COVID-19 era

As on date, India’s share of global active Coronavirus cases stood at 13.08%. It is the second most-affected country by active cases, at present. On June 2, 2021, India’s total caseload stood at to 2,83,07,832 while total fatalities from the virus reached 3,35,102.

The surge in cases during the COVID-19 second wave, has resulted in large parts of India, especially in Delhi, Maharashtra, Rajasthan, Odisha and Gujarat, now being under restrictions which include partial lockdowns, weekend lockdowns, night curfews, etc.

“We are worried about the second wave of the COVID-19 pandemic. If logistics and supply chain support are available and migrant labour is on sites, I do not think there will be a problem. In case of a complete lockdown or loss, the (buyer) sentiment may get impacted. COVID-19 may turn out to be a short-term dampener,” said CREDAI national president Harsh Vardhan Patodia, at a virtual press conference.

The demand for housing in India might also impact amid a change in stance in the banking system.

According to a recent report by QuantEco Research, the second wave of COVID-19 would hit the Indian economy by prompting people to save, rather than spend. This is in contrast with the first wave in 2020, when the contraction in economic growth was driven primarily by supply disruptions due to a prolonged nation-wide lockdown. This would particularly impact home purchases in the country that require big-ticket investments.

“Expectation of consumption snag looks more palpable now than last year. In contrast to a V-shaped recovery, consumption redux could look more U-shaped this year,” said QuantEco Research economist Yuvika Singhal, while downgrading India’s FY 2022 growth forecast by 150 basis points to 10%.

Unless the government decides to lower the tax burden on home buyers, the demand for residential spaces might take a severe hit, despite the consumers’ positive outlook towards this asset class in the aftermath of the pandemic.

According to Niranjan Hiranandani, national president, NAREDCO and founder and MD of Hiranandani Group, the demand for real estate had always been huge, the short-term disruptions caused by the Coronavirus pandemic notwithstanding.

“It is the huge costs involved in the purchase process that discouraged buyers from investing. One has to keep in mind that buyers end up paying 33% of the total purchase value in various government taxes. So, it might be wrong to point out that there is any deceleration as far as the demand is concerned,” he said.

The stakeholders just have to gauge where the demand actually is and supply accordingly, while the onus is on the government to lower the burden on home buyers by offering stamp duty waivers, says Hiranandani.

Meanwhile, the impact of the monumental surge in the number of Coronavirus cases has become visible on India’s office markets, as well. Reports by two global property brokerage firms, show that net leasing activity during the January-March period of 2021 showed a decline, because of the prevailing situation. While a report by Cushman and Wakefield showed that the net leasing of office spaces across seven major cities reported a 48% annual decline in this period, another research report by JLL India said a 36% decline was witnessed in net leasing activity during the quarter in these markets.

***

Housing affordability seen increasing

As India continues with its Coronavirus vaccination drive, the positive impact of the inoculation programme will also be seen in the country’s real estate segment.

If the improving housing affordability is any cue, India’s residential real estate sector is likely to witness better sales and supply in the January-March period of 2021, the lingering impact of the Coronavirus pandemic on the sector notwithstanding.

Amid the RBI continuing to keep the repo rate unchanged at 4%, home buyers can currently get home loans for as low as 6.65% annual interest. This is in contrast with the average home loan interest rate of 8% seen in January 2020. Price growth in the housing segment has also been under pressure in the past one year, due to the impact on demand.

In a report titled ‘India Real Estate Outlook – A new growth cycle’, property brokerage firm JLL India has also indicated that new housing supply in 2021 would continue to be in the affordable and mid-segment, with developers attempting to reap the benefits of strong pent-up demand.

With most rating agencies making an upward revision in India’s growth forecast, the recovery in the country’s housing sector may also be better and earlier than expected.

Read also : DLF New Town Heights at Gurgaon – Project Overview

On March 24, 2021, Fitch Ratings revised India’s growth estimate for fiscal 2021-22 to to 12.8%, from its previous estimate of 11%, saying that ‘a stronger carryover effect, a looser fiscal stance and better virus containment’ have led to the upgrade in growth projection. Many other rating agencies and global think-tanks, including Moody’s Analytics and the Organisation for Economic Co-operation and Development (OECD), have also made upwards revisions in India’s growth forecasts, amid the domestic inoculation programme against the virus picking up pace.

With the economy picking up and employment witnessing stability, the existing momentum in housing sales could sustain in the year 2021, the brokerage firm opined.

***

Vaccine rollout to restore normalcy in India’s Corona-hit housing segment

Pune-based Serum Institute of India Ltd, the world’s largest vaccine manufacturer by volume, which has been enlisted by the government in India to manufacture a billion doses of AstraZeneca’s Coronavirus vaccine, started distribution across locations on January 12, 2021.

As India kicks off the race to vaccinate its over 1.3 billion people in mid-January, the positive impact of what could be termed as one of the world’s biggest inoculation programmes, will also be seen in the country’s residential real estate segment, the sector that employs the largest number of unskilled workers.

With a massive vaccination drive underway, risks to the recovery may abate and economic activity is expected to gain momentum in the second half of 2021, India’s banking regulator, RBI said, while announcing its monetary policy statement on February 4, 2021. “Financial markets remain buoyant, supported by easy monetary conditions, abundant liquidity and optimism from the vaccine rollout. Growth is recovering and the outlook has improved significantly, with the rollout of the vaccine programme in the country,” RBI governor Shaktikanta Das said.

Amid expectations of the launch of the inoculation programme, green shoots of revival have, in fact, already become visible, with this same being reflected in the quarterly housing sales and new supply numbers.

After touching a record low during the previous two quarters amid a dramatic rise in the number of infections – as on January 12, 2020, India has reported nearly 10.5 million COVID-positive cases and 1,51,000 deaths due to the virus infection – home sales in India’s eight prime residential markets touched 58,914 units in the October-December period of 2020, showing a 68% quarterly increase, according to a recent report by property brokerage firm by PropTiger.com. New supply numbers also showed a significant uptick, registering a 173% quarter-on-quarter (Q0Q) growth.

“All factors considered, the sector has shown remarkable tenacity in 2020, against unprecedented odds that have caused the economy to contract and impacted consumer spending. The fact that housing sales in India’s key markets have started to bounce back, in spite of the general gloom caused by the pandemic, shows the immense potential of the real estate sector, which employs the highest number of unskilled workers in the country,” said Dhruv Agarwala, group CEO, ecis2016.org, Makaan.com and PropTiger.com. The sector’s performance seems particularly impressive, says Agarwala, considering that the pandemic has impacted the income-generating capacity of a large number of people.

While this could be seen as the start of a full-fledged and slow yet steady recovery process, a lot will depend on how efficiently Asia’s third-largest economy, with its limited heath and transport infrastructure, manages the daunting task of making available the vaccine to its large number of people amid supply-side concerns. The same factor would have an impact on the overall economic recovery scenario, which, in turn, would be instrumental in shaping the future for India’s residential realty segment. So, India’s economy is far from being out of the woods.

Even in the best-case scenario, India’s gross domestic product growth, according to government projections, is estimated to contract by a record 7.7% during 2020-21 with the pandemic severely affecting the manufacturing and services segments.

In contrast, global agencies and think-tanks have forecast a much steeper contraction. In fact, the International Monetary Fund (IMF) in its World Economic Outlook released on January 26, 2021, predicted India’s economy to contract at 8% in the current financial year, higher than the 7.7% decline projected by the government’s advance estimates. The IMF has, however, pegged expects the economy to grow at 11.5% rate in the next financial year before slowing to 6.8% in 2022-23. This means India would continue to be the fastest-growing large economy in the world in the two years. The international agency also stated that it was surprised by India’s second quarter growth numbers. As against the predictions of a double-digit contraction, India’s GDP growth contracted by 7.5% in the quarter.

According to the World Bank Global Economic Prospects estimates, India’s economy will contract by 9.6% in FY 2021, amid a drastic decline in household spending and private investment. Growth is expected to recover to 5.4% in 2021. The International Monetary Fund has also projected India’s economy to contract by 10.3% in FY 2021, forecasting an expansion of 8.8% next year.

***

Indian housing market’s initial reaction to COVID-19

Much has changed with the Coronavirus hit the world in December 2019. Amid countries applying extreme measures to contain the pandemic, businesses came to a grinding halt across the world, forcing monetary agencies to slash growth forecasts for the global economy, India included.

In its World Economic Outlook October 2020 report titled, ‘A Long and Difficult Ascent’, the International Monetary Fund (IMF) has said that the Indian economy would grow at a -10.3% rate in 2020 – a downgrade of -5.8 percentage points from the agency’s June estimate.

After the gross domestic product (GDP) numbers for the first quarter of FY21 showed a decline of 23.9% over the same quarter last fiscal earlier, global rating agencies S&P, Moody’s and Fitch also projected Indian economy to contract by 11.5% and 10.5%, respectively, in the current fiscal.

S&P Global Ratings, on September 14, 2020, cut its FY21 growth forecast for India to -9% against -5% estimated earlier, as the number of infections in the country touch record levels. “One factor holding back private economic activity, is the continued escalation of the COVID-19,” S&P Global Ratings Asia-Pacific economist, Vishrut Rana said.

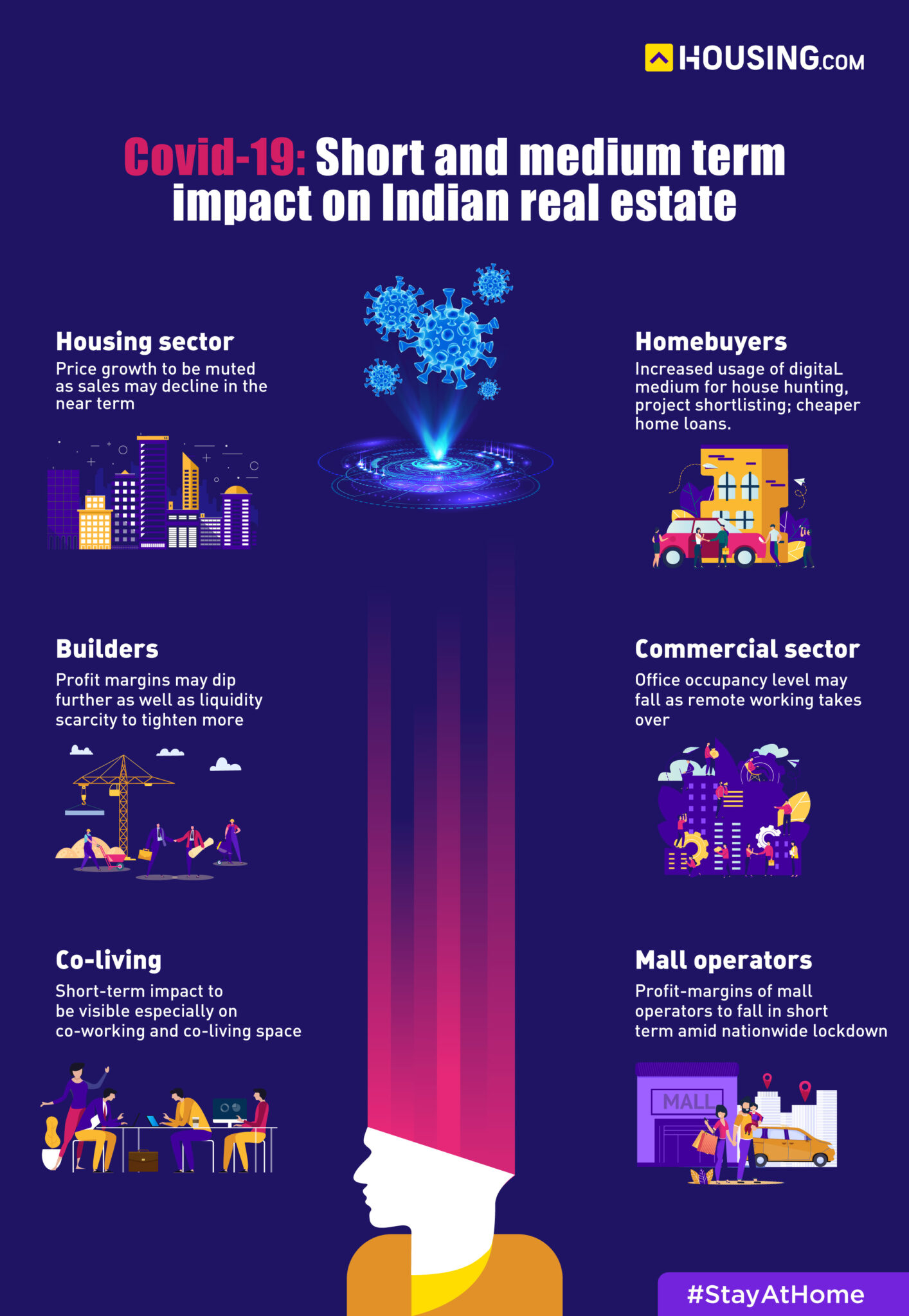

While the adverse effects of the pandemic are already being felt across the world, varying opinions are emerging on COVID-19’s impact on the real estate sector, a health emergency that force-launched the biggest ever work-from-home experiment globally, putting a question mark on the relevance of workspaces in a post-Coronavirus world.

In India, where the economic contraction indicates towards a delayed start of the long-arduous road to recovery, a prolonged lockdown — which started from from March 25, 2020, and was eventually extended till June 7, 2020, amid a dramatic rise in the number of infections — worsened the situation in Asia’s third-largest economy.

As is evident, research agencies are predicting a near-term halt in growth of real estate in India. PropTiger.com data show housing sales in India’s eight major cities declined by 66% in the period between July-September 2020.

“While the Chinese economy has been reeling under the impact of the Coronavirus contagion since December 2019, the situation started to get worrisome in India only in March 2020. The lockdown, which virtually brought to a standstill most economic activity in the country, has hurt all sectors, including real estate. The adverse impact of the Coronavirus is visible on housing sales in the last quarter of the last fiscal because March is usually one of the biggest month for sales,” says Dhruv Agarwala, group CEO, ecis2016.org, Makaan.com and PropTiger.com.

“With several macro-economic indicators showing a positive trend in September, we may well be on the road to a more sustained recovery and the upcoming festival season will be critical, in determining the growth trajectory in the sector over the next twelve months,” he adds.

Although deal volumes in office space in India increased 27% year-on-year in 2019, to an all-time high of over 60 million sq ft, the growth momentum in India’s commercial segment is also likely to get derailed due to the virus attack.

Any positive predictions about its growth made before the sudden outbreak of the global calamity stand retracted, as the government gets busy devising plans to stop businesses in general and the economy in particular from sinking deeper into a slump, amid impending fears of the rupee declining to a low of Rs 78 against the US dollar.

While the real extent of the damage is hard to grasp in a scenario where every day is making a great difference, one thing is for certain – India’s real estate sector will suffer short-term shocks on account of the contagion.

Do you think property prices will fall post Covid-19?

View Results

Loading …

Loading …

Housing market in India’s top 8 cities (April-June 2020)

| Sales | Down 79% |

| Project launches | Down 81% |

| Inventory | 738,335 units |

Source: PropTiger DataLabs

COVID-19 impact on Indian housing market

The Coronavirus spread has further delayed a recovery that might have seemed possible, because of various government measures to revive demand, even though, right now, it does not seem like prices will go down immediately.

Niranjan Hiranandani, national president, NAREDCO, states that “Salvaging Indian realty, the second-largest employment generator is critical, not only from the GDP growth perspective but also for employment generation, since the sector has a multiplier effect on 250-plus allied industries.”

The centre in the recent past had announced higher tax breaks and lower interest rates on home loans to make purchases more lucrative, apart from setting up an Rs 25,000-crore stress fund for stuck projects.

The demand slowdown in the residential segment has already curtailed housing sales, project launches and price growth in India’s residential realty sector, which has been reeling under the pressure caused by mega regulatory changes, such as the Real Estate Regulatory Authority (RERA), the Goods and Services Tax (GST), demonetisation and the benami property law.

According to rating agency ICRA, the pandemic, if not contained soon, would not only significantly impact the economy but also adversely hit developers’ cash flows and project delivery capabilities.

“In case of a longer outbreak though, the impact on overall economic activity is likely to be deeper and more sustained, which would result in a more significant impact on developer cash flows and project execution abilities, giving rise to wider credit-negative implications,” ICRA said in a recent note while also adding that the three-month moratorium announced by the RBI on March 28 on loans will provide some comfort to builders. This loan moratorium, which was subsequently extended by the RBI, on May 22, 2020, till August 31, 2020, may see further extension as the economic situation is seen deteriorating.

“The injected liquidity of Rs 3.74 lakh crore (by the RBI) along with the moratorium on all term loans by financial institutions will alleviate short-term liquidity concerns and help developers, as well as home buyers . It is a big relief for developers and buyers to help them mitigate the challenges faced by them currently,” says Ramesh Nair, CEO & Country Head of JLL India.

Read also : Top 5 localities for buying plots in Hyderabad

Expecting delays in project completion and extending support to the builder community, the the government has also said developers could get project deadlines extended by six months through the RERA citing the force majeure clause.

You may like to read: What is force majeure and how it works in real estate?

“Due to the lockdown announced on account of the COVID-19 outbreak, both, construction and sales activity, have come to a complete halt across the entire real estate sector. On several sites, construction workers, too, have gone back to their home towns. Even after the lockdown, activity will only recommence gradually, which will cause project delays of anywhere between 4 to 6 months at the least,” said Sharad Mittal, CEO and head, Motilal Oswal Real Estate Funds.

“Delivery of existing projects may get pushed back, depending on how quickly the input supply-chain and labour availability are restored. So, the fall in new supply may continue for the next few quarters, as developers wait for demand revival,” says, Mani Rangarajan, Group COO, Elara Technologies.

COVID-19 impact on home buyers in India

If low interest rates (home loan interest rates are at below 7% now) and high tax exemption (rebate against home loan interest payment is as high as Rs 3.50 lakhs per annum) were going to make a change in the consumer behavior, the Coronavirus outbreak is likely to halt that shift, at least in the near to medium term.

With property seekers unwilling or unable to undertake site visits, this could result in the postponing of purchase decisions. “With the Coronavirus pandemic impacting all sectors of the economy, the troubles have compounded for India’s realty sector, which has been dealing with a ‘challenging scenario’ since the economic and policy reforms were introduced. The slowdown since February-end is apparent and while site visits are almost non-existent, the decision-making process is hugely delayed,” says Hiranandani.

Are you ready to buy property in the next six months?

View Results

Loading …

Loading …

The fact that businesses would scale down their workforce would also force many prospective buyers to wait for clarity on their job security, before making a final decision on property purchase.

Even though the RBI has announced several rate cuts, bringing the repo rate down to 4%, any positive effect of the move on buyer sentiment would be seen only in the medium to long term. The step, however, would come as a major support for existing buyers, who might struggle to pay EMIs in the short-term or medium-term, because of the lockdown or in the event of job loss.

However, the pandemic has also made buyers realise the value of home ownership, thus, giving a sold sentiment boost to residential real estate.

In a survey conducted by ecis2016.org in collaboration with NARECCO, 53% respondents said they have put their plans to buy a property on hold only for six months and plan to return to the market after that. Nearly 33% respondents in the survey also said they would have to upgrade their homes, in order to work from home. In a renters’ survey, 47% respondents said they would like to invest in property if it was rightly priced.

“We are seeing increasing digitisation of real estate with significant growth in online demand, as developers and buyers adopt products such as virtual tours, drone shoots, video calls and online booking platforms. We may be seeing a shift in the real-estate sector, where technology will play a significant role in property renting and buying and property registration may move online in some states. While physical site visits will remain important, buyers will use technology to discover new homes with some buyers booking online and buyers will likely make fewer site visits than before,” says Rangarajan.

[ecis2016.org] What will buyers expect in a post-COVID-19 world?

COVID-19 impact on builders in India

Slump-hit builders were pinning their hopes on government support to shed the increasing unsold stock even as an ongoing crisis in the country’s non-banking finance sector, a key source for housing sector funding, made borrowing extremely difficult, jeopardising their plans to deliver projects within the promised timeline.

Developers were sitting on an unsold stock worth approximately Rs 6 lakh crores, as of September 2020, show PropTiger.com data. A near-halt situation on construction activity amid a lockdown in India to contain the virus and delay in supply of manufacturing material and equipment from China, will further push delivery timelines of ongoing projects, consequently increasing the overall cost for developers. Through furious efforts, China, the country where the virus originated, has been able to rein-in the pandemic, with workers returning to offices. However, amid tension between the two neighnours, builders here will be forced to postpone orders.

Several measures announced by the government in its Coronavirus-specific stimulus package and the EMI holiday for developers during the crucial period are some steps that might offer some relief to the builder community.

“The pandemic menace has hit at a particularly sensitive time. Across realty companies, this is the time when statutory payouts and streamlining of balance sheets happens,” Hiranandani added.

What’s stopping you from buying a new home?

View Results

Loading …

Loading …

COVID-19 impact on office space in India

Even though people are gradually coming back to work in sectors where working from home is not an option, remote working continues to be the main way of functioning for companies as of now.

“During the lockdown, India coped very well with the shift in workplace and has continued to do so with limited re-opening. We do believe that going forward, the workplace will no longer be a single location but an ecosystem driven by locations and experiences, to support convenience, functionality and wellbeing,” says Anshul Jain, MD – India and SE Asia, Cushman & Wakefield.

Earlier, as infections increased drastically, companies worldwide announced remote working for employees to contain the virus spread, triggering a debate if work-from-home could replace office spaces in future. While the answer to that question depends on the ultimate level of success achieved by businesses through remote working, a near-term jolt to the commercial real estate segment in India is unavoidable.

Even though developers in this segment remain optimistic, because of better access to liquidity and lower risk of defaults, the impact of the virus is visible on the office space, too. According to international property brokerage JLL, net leasing of office space fell by 50% in the quarter of July to September 2020, across seven major cities to 5.4 million sq ft as corporates and co-working players continued to defer their expansion plans following the pandemic. The net absorption of office space stood at 10.9 million sq ft in the year-ago period across seven cities, including Delhi-NCR, Mumbai, Kolkata, Chennai, Pune, Hyderabad and Bengaluru. During the January-September period of 2020, the net office space leasing fell by 47% to 17.3 million sq ft from 32.7 million sq ft in the same period in 2019. The remote working concept contributed to the fall in demand for office space, JLL said. “Increased office space consolidation and optimisation strategies of corporate occupiers, resulted in subdued net absorption levels, which could not keep pace with new completions. This resulted in overall vacancy increasing from 13.1% in Q2 2020 to 13.5% in Q3 2020,” JLL said in a statement.

Experts, however, expect the pre-COVID-19 growth momentum in this segment to get restored eventually.

According to a report by global property brokerage Knight Frank, in fact, of the total private equity investment of USD 2.31 billion across 11 deals in the first nine months of 2020, the office sector claimed 81% share, followed by warehousing at 10% and residential with 9%. “Private equity investors have taken advantage of this period of economic slowdown to scout for Grade A assets with strong growth potential, for investments. As a result, assets in the office segment saw positive investment activities. The average deal size for office investments was also seen to be remarkably higher in 2020 so far, as compared to full year 2019,” said Shishir Baijal, CMD, Knight Frank India. While stating that the sector continues to attract investors, because of its strong fundamentals, the report also pointed out that investment in this asset class will remain positive in the medium-to-long term.

While stating that the work-from-home run was a reaction to the nationwide lockdown to contain the Coronavirus outbreak and it is unlikely to become a permanent concept in real estate strategies, Anshuman Magazine, chairman and CEO, India, south-east Asia, middle east and Africa, CBRE, says the demand for commercial real estate will remain robust. “This is due to challenges such as psychological impact on employees, data security and monitoring productivity,” Magazine was quoted in the media as saying.

According to numbers available with CBRE, gross office space absorption touched a historic high of 63.5 million sq ft in 2019, nearly 30% higher than 2018. Office stock across seven leading cities is expected to cross 660 million sq ft by the end of 2020.

[ecis2016.org] How to prepare for the reopening of your office

COVID-19 impact on mall developers in India

A total of 54 malls were expected to be launched across India in 2020. These projections were, however, made before the Coronavirus pandemic struck. As a result, only five news malls started operations in some of the leading cities of the country, including Gurugram, Delhi, Bengaluru and Lucknow. This also reflects the state of crisis in India’s retail segment.

The anxiety surrounding the virus spread resulted in footfall in malls in India reducing by half before the government ordered a complete lockdown. This segment continues to suffer even though the government has lifted restrictions, allowing malls to operate, albeit by following strict rules. A survey by the Retailers Association of India (RAI) showed that lockdown relaxations did not benefit retailers as business remained lacklustre.

“Low footfalls and subsequent closure of malls will impact developers’ debt servicing against the project. Even a relaxation from banks for the short-to-medium term should not have a big impact. However, if the virus scare continues beyond one to two quarters, debt servicing challenges may last for a longer period,” points out Rohan Sharma, research head, Cushman and Wakefield.

“Eventually, footfalls will limp back to normalcy as people will take time to regain confidence to throng public places in large numbers. This will also bring a fundamental shift in how mall owners will now look at their properties. An increased focus on air quality, improving hygiene and sanitisation and awareness is what will bring back people to their malls,” Sharma adds.

“The impact of COVID-19 in the form of shutdown of retail outlets and malls as also entertainment and fitness centers has put commercial real estate deals on a wait-and-watch mode,” points out Hiranandani.

According to Nair, mall operators have been the most affected, and they would have to act reasonable to tide over the crisis amid projects of rising vacancies in shopping malls.

COVID-19 impact on warehousing in India

On the assumption that e-commerce will grow significantly in the post-COVID-19 world, there have been projections that the warehousing sector in India would stand to gain immensely. More importantly, this growth will not be limited only to the big cities but it will be spread across smaller cities, as well.

According to property consulting firm Savills India, the supply of new warehousing space in 2020 could be only 12 million sq ft as against the earlier projection of 45 million sq ft. However, as the demand grows in

the long term, a significant capacity increase could be expected in 30-35 new tier-2 and tier-3 cities.

[ecis2016.org] Coronavirus impact on warehousing in India

Indian real estate after Coronavirus: Top 11 projections

|

Outlook for Indian real estate in 2021

Even though the pandemic drastically impacted the sector in 2020, better days are expected in 2021. Amid growing importance of home ownership among buyers and investors, the demand for residential real estate would be high in the coming year.

“In these extraordinary times, stakeholders across sectors have an opportunity to structurally re-imagine their strategies, to ensure sustained recovery. Doing so, would require shifting from traditional approaches and embracing new, transformational methods — which would be accelerated by widespread tech adoption, sustained policy impetus and accelerated investor interest in India,” says Anshuman Magazine, chairman and CEO, India, South East Asia, Middle East and Africa, CBRE.

FAQs

Will COVID-19 impact home sales?

Housing sales might see a drop in the aftermath of the virus outbreak as businesses might cut jobs to offset losses.

Will COVID-19 impact property prices?

Prices might not undergo any significant change as the overall cost of projects is likely to increase.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Lifestyle