[ecis2016.org] Advance tax payment can be made online or offline with Challan 280.

Advance tax payment is a monetary liability that individuals and companies in India, that earn a specific type of income, must fulfil. This guide explains advance tax and related aspects. We also discuss the online advance tax payment process.

You are reading: Advance tax payment: Your guide to advance tax and advance tax payment online

What is advance tax?

The name is self-explanatory. That tax, which an individual or company pays to the government in advance, is called advance tax. The income tax, in this case, is paid during the financial year and not at the end of it. Working on a pay-as-you-earn concept, advance tax is paid in instalments throughout a financial year. However, advance tax payments cannot be made as and when a taxpayer wishes. The government notifies taxpayers about advance tax payment dates through the year.

Since the tax must be paid in advance, the individual liable to make advance tax payment needs to estimate his income for the entire year and pay the tax, based on this estimate.

The advance tax is paid by individuals who earn an income in India from various sources. These sources include salary, fixed deposits, capital gains from shares, rent, income earned from house property and lottery winnings, among others. Advance tax must be paid by people whose income tax liability exceeds Rs 10,000 after TDS deduction, as prescribed under Section 208 of the Income Tax Act 1961. NRIs, whose income in India exceeds Rs 1 lakh, are also liable to pay advance tax.

[ecis2016.org] ITR login: A guide to Income-tax E filing login and registration

Advance tax payment

While companies are liable to make advance tax payment online only, individuals can pay advance tax online or offline, by depositing Challan 280 at their bank branch.

While you need to visit an authorised bank branch to make the tax payment offline, advance tax payment online can be made on the official website https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

The prescribed form for advance tax payment is Challan 280.

Advance tax payment online

Step 1: Visit the official site of the Income Tax Department – http://www.tin-nsdl.com. Under the ‘Services’ tab, click on the ‘e-payment-Pay Taxes Online’ option.

Read also : HDFC credit card net banking: Registrations, benefits and features

Step 2: Since Challan 280 is the prescribed form for advance tax payment online, click on the ‘ITNS 280 option.

Step 3: Challan 280 will appear on your screen. Enter all the required details for advance tax payment online. These details include tax applicable, type of tax, mode of payment, PAN/TAN, assessment year, address, email ID, mobile number, etc.

Step 4: On successful submission of the details, you will be directed to your net banking site. Login with your credentials, to make the advance tax payment.

Step 5: On successful payment, a challan counterfoil will be displayed, containing the CIN, payment details and bank name through which the e-payment was made. This counterfoil is proof of advance tax payment. Save a copy for future reference.

[ecis2016.org] Which ITR to file?

How to download advance income tax payment receipt?

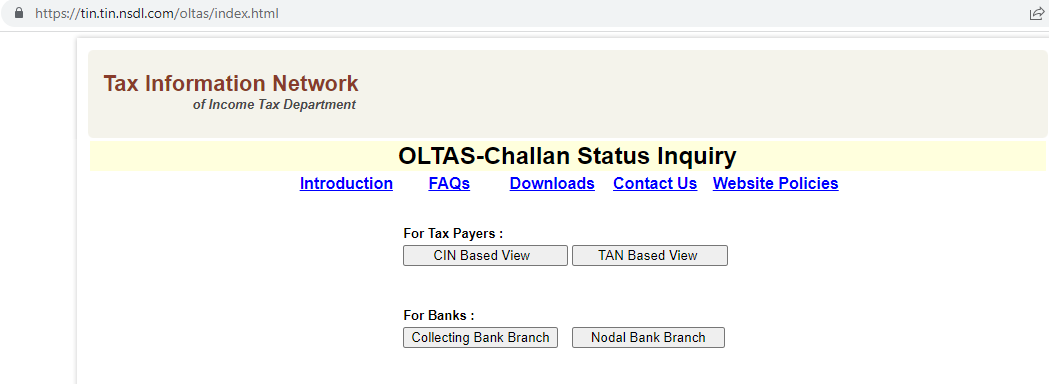

Step 1: Visit the official site, https://tin.tin.nsdl.com/oltas/index.html. Select the ‘CIN-based View’ option.

Step 2: Input the required details and click on ‘View’.

Read also : How to get the best home loan deal right now?

How to calculate advance tax?

You can calculate advance tax on the Income Tax Department’s official website, https://www.incometaxindia.gov.in/pages/tools/advance-tax-calculator.aspx,by providing specific details.

[ecis2016.org] Income tax calculator: Know how to calculate income tax for the financial year

Advance tax payment due dates |

| 15%: Before June 15 of the financial year (FY)

45%: On or before September 15 75%: On or before December 15 100%: On or before March 15 |

| Note 1: Taxpayers opting for presumptive taxation scheme under Section 44AD or Section 44ADA can pay the entire advance tax by March 15.

Note 2: Any tax paid till March 31 will be treated as advance tax payment. Note 3: Individuals/companies missing these deadlines are liable to pay interest as a penalty under Section 234B and Section 234C. |

Who is liable to make advance tax payment? |

| According to Section 208, every person whose estimated annual tax liability is Rs 10,000 or more, must pay advance tax. However, senior citizens are not liable to pay advance tax if they do not have any income from business or profession. |

FAQs

What if excess advance tax is paid?

Those who have made excess advance tax payment, receive a refund with 6% annual interest on the excess amount if the additional money is more than 10% of the tax liability.

What if there is a shortfall in advance tax payment?

In case of a shortfall in advance tax payment, the pending payment can be made before March 31.

Which form is used for advance tax payment?

Challan 280 is used to pay advance tax.

What is Challan 280?

Challan 280 is a form that can be used to deposit advance tax, self-assessment tax and regular assessment tax online and offline.

Source: https://ecis2016.org/.

Copyright belongs to: ecis2016.org

Source: https://ecis2016.org

Category: Must Knows